This guide covers how to cancel PMI on conventional loans for homeowners. Mortgage insurance is required on FHA, USDA, and conforming loans with less than 20% equity. There are two types of mortgage insurance: Upfront mortgage insurance and annual mortgage insurance.

Private Mortgage Insurance (PMI) is typically required for conventional loans when the borrower’s down payment is less than 20% of the home’s purchase price.

Once you’ve reached a certain level of equity in your home, you may be able to cancel PMI. In the following paragraphs we will cover the general steps how to cancel PMI on conventional loans.

Understand the Requirements of Private Mortgage Insurance

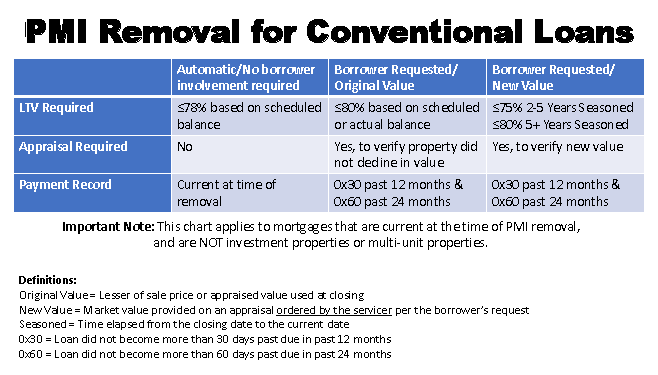

Familiarize yourself with the specific requirements of your loan and the terms of your PMI. Different lenders may have slightly different rules. Federal law mandates that PMI automatically cancels when you reach 78% loan-to-value (LTV) based on the original property value. You can request automatic cancellation once you reach this threshold.

Request Cancellation at 80% LTV

You can request PMI cancellation when you reach 80% LTV. The lender may have specific requirements, such as a good payment history and an appraisal to confirm the current property value. Accelerate your mortgage payments to build equity more quickly. This can help you reach the necessary LTV ratio sooner.

Ensure that you have a good payment history with no late payments. Some lenders may require a clean payment history before considering PMI cancellation.

If you’ve made home improvements that increase the value of your property, consider getting a new appraisal. A higher property value may help you reach the LTV threshold sooner. Keep an eye on the real estate market in your area. If property values have increased significantly, your LTV may naturally decrease, making it easier to reach the cancellation threshold.

Contact Your Lender

Once you believe you’ve met the requirements for PMI cancellation, contact your lender. They will provide you with the specific steps and documentation needed to initiate the cancellation process. If you can’t meet the cancellation requirements through the steps above, consider refinancing your mortgage. With a higher home value or a larger down payment, you may be able to secure a new loan without PMI.

Types of Mortgage Insurance

HUD, the parent of FHA, has both an upfront FHA mortgage insurance premium of 1.75% and an annual FHA MIP of 0.55%. VA does not have an annual mortgage insurance premium. VA does require an upfront VA Funding Fee of 2.15% to 3.3% which can be rolled into the VA loan balance.

USDA lans has a monthly mortgage insurance as well as an upfront mortgage insurance premium called a Guarantee Fee.

Government loans such as FHA and USDA require annual mortgage insurance premium for the life of the term of the loan. Fannie Mae and Freddie Mac allows homeowners to have their annual private mortgage insurance removed once homeowners has more than 20% equity in their homes. There are steps on how to cancel PMI on conforming loans.

What is Private Mortgage Insurance

Homeowners pays for private mortgage insurance. However, private mortgage insurance has no benefits to homeowners. Lenders require for homeowners to pay for mortgage insurance to insure lenders in the event homeowners ever default on their home loans and the property goes into foreclosure. T

he private insurance company will insure the lender on part of their losses due to the home loan default.

Private Mortgage Insurance, often referred to as PMI, is mandatory on all conforming loans with less than 20% equity. Home Buyers who put 20% down payment on a home purchase, lenders do not require private mortgage insurance on conventional loans.

How To Cancel PMI On Conforming Loans

Any home purchase with less than 20% down payment on conventional loans require private mortgage insurance. Good thing about conforming loans is there are ways on how to cancel PMI if homeowners have more than 20% or more equity during the term of their loan.

Homebuyers who are conventional mortgage borrowers can avoid annual private mortgage insurance by going with Lender Paid Mortgage Insurance (LPMI) in lieu of higher rates.

However, the higher rates in lieu of Lender Paid Mortgage Insurance may not be a wise choice for borrowers with lower credit scores. There is another conventional loan program on how to cancel PMI on a home purchase and avoiding annual mortgage insurance. There is upfront private mortgage insurance where by paying a large one time upfront private mortgage insurance, there is no monthly mortgage insurance and the mortgage rates do not need to be higher.

Strategies on How To Cancel PMI For Homebuyers

Gustan Cho Associates Mortgage Group are experts in finding unique creative strategies how to cancel PMI for homebuyers. Fannie Mae and Freddie Mac does not require private mortgage insurance on conforming loans as long as homebuyers can put 20% down payment. There is 80/10/10 Piggyback Mortgages offered at Gustan Cho Associates

Using creative strategies on how To cancel PMI for homeowners can benefit home buyers in saving thousands of dollars

The way this works is getting a first mortgage at 80% loan to value, put 10% down payment, and get a second mortgage/HELOC for the difference. This way, homeowners get to avoid paying private mortgage insurance on conforming loans.. Once the property value increases, homeowners can do a 80% LTV refinance and pay off the second mortgage.

How Much Is Private Mortgage Insurance

Government loans have fixed set mortgage insurance premium. However, with conventional mortgages, private mortgage insurance varies depending on borrowers credit/income profile and types of property. The way private mortgage insurance companies quote PMI is based on borrowers and property risk factors. The lower borrowers credit scores, the lower the down payment the higher the private mortgage insurance premiums will be.

3% Down Payment Conventional Loan Programs

Fannie Mae and Freddie Mac offers 3% down payment conventional loans. However, not too many private mortgage insurance companies will insure borrowers with 620 credit scores on 97% LTV Conventional Loans.

The more safer and secure the private mortgage company feels about a borrower, the lower private mortgage insurance premiums will be.

On a $300,000 home purchase with a 740 credit borrower, PMI on 3% down payment can be $200.00 per month. However, if the same borrower were to put 5% down payment, PMI will drastically get reduced to $90.00 per month. The extra 2% down payment greatly reduces the risk factors for the lender and it is reflected on the lower PMI premiums.

Private Mortgage Insurance Versus High DTI

On another note with conforming loans, Automated Underwriting System will render an approve/eligible per AUS Findings on conventional loans up to 50% debt to income ratios.

Most private mortgage companies will not insure any borrowers with credit scores under 700.

Higher credit score borrowers with higher debt to income ratios would need 700 credit scores to qualify for conforming loans if they are putting down less than 20% down payment.

Cases Where Homebuyers Choose Conforming Versus FHA Loans

There are instances where home buyers need to go with conforming versus FHA loans. If consumer had a prior mortgage included in Chapter 7 Bankruptcy, there is a four year waiting period after discharged date of Chapter 7

The foreclosure, deed in lieu, short sale (housing event date) can be finalized after the discharged date and that date does not matter with Conventional and VA Loans

However, with FHA loans, there is a three year waiting period after the recorded housing event date and the discharged date of the Chapter 7 Bankruptcy does not matter. The housing event needs to be finalized and the mortgage included in the bankruptcy cannot be reaffirmed. This is a case where conventional and not FHA will work for the home buyer. There cannot be any late payments after bankruptcy or housing event dates.

Conventional Versus FHA Guidelines On Deferred Student Loans

Deferred student loans is used to be one of the largest obstacles when qualify for home loans. FHA and USDA does not exempt deferred student loans when underwriters calculate debt to income ratios. Both FHA and USDA require mortgage underwriters to take 1.0% of the outstanding student loan balance. Now, HUD and USDA updated student loan guidelines where 0.50% of the outstanding loan balance is used as borrowers hypothetical monthly debt.

This can become a big hurdle with professionals like doctors, dentists, lawyers, and educators who have six figure student loan balances

The U.S. Department of Veterans Affairs does allow deferred student loans that has been deferred for longer than 12 months to be exempt from DTI calculations. VA requires underwriters to take 5% of the outstanding student loan balance and divide that figure by 12 months. That yielding figure is to be used as veterans hypothetical monthly debts when underwriters are calculating DTI on borrowers. Income Based Repayment (IBR) can be used for conventional loans as long as the IBR payments is reflecting on borrowers credit reports.

Rising Home Prices Forces FHFA And HUD To Increase Loan Limits

Both the Federal Housing Finance Agency (FHFA) and the U.S. Department of Housing and Urban Development (HUD), the parent of FHA has increased loan limits for two years in a row. This is due to rising home prices. Mortgage rates are at a 10 year all time high and is expected to increase two more times this year. However, history proves that rising home prices yields slower home buying stats. Not on this case. Even though mortgage rates are high and continue to be high, there is no slowdown in home buying. There is more demand for homes than inventory.

Home values in many parts of the country has experienced double digit grow year after year starting in mid 2012 with no signs of a correction.

Many homeowners, especially California homeowners, are sitting in homes with a lot of equity with FHA loans. This may be the time on how to cancel pmi and refinance their FHA Loans into Conventional loans. Homeowners with 20% equity with their FHA loans can easily eliminate their high annual FHA MIP by refinancing with conforming loans. This is one great way on how to cancel pmi.

Ways and Advice How To Cancel PMI on Conforming Loans

Lenders will automatically remove private mortgage insurance on conventional loans when the homeowners loan to value gets down to 78% LTV of their scheduled amortization. However, it cannot be forced down to 78% LTV to expedite the 78% LTV sooner than the scheduled amortization period.

How To Cancel PMI On Conventional Loans

Homeowners can request cancellation of private mortgage insurance to their lender and PMI company cases where the property did not appreciate. This can be done if homeowners can pay down the loan balance to 78% of the original value at closing.

Requesting PMI Cancellation and How To Cancel PMI

If homeowners property has appreciated, borrowers can request the removal of their private mortgage insurance based on the appreciated value. A new home appraisal needs to be ordered and the loan had to be active for at least 24 months.

The lender or mortgage servicer needs to order the appraisal and not the homeowner. Remember that the rules regarding PMI cancellation may vary.

It’s essential to check with your lender and review your loan documents for specific information. Additionally, this information is based on the situation as of my last update in January 2022, so there may have been changes in regulations or lender policies since then.