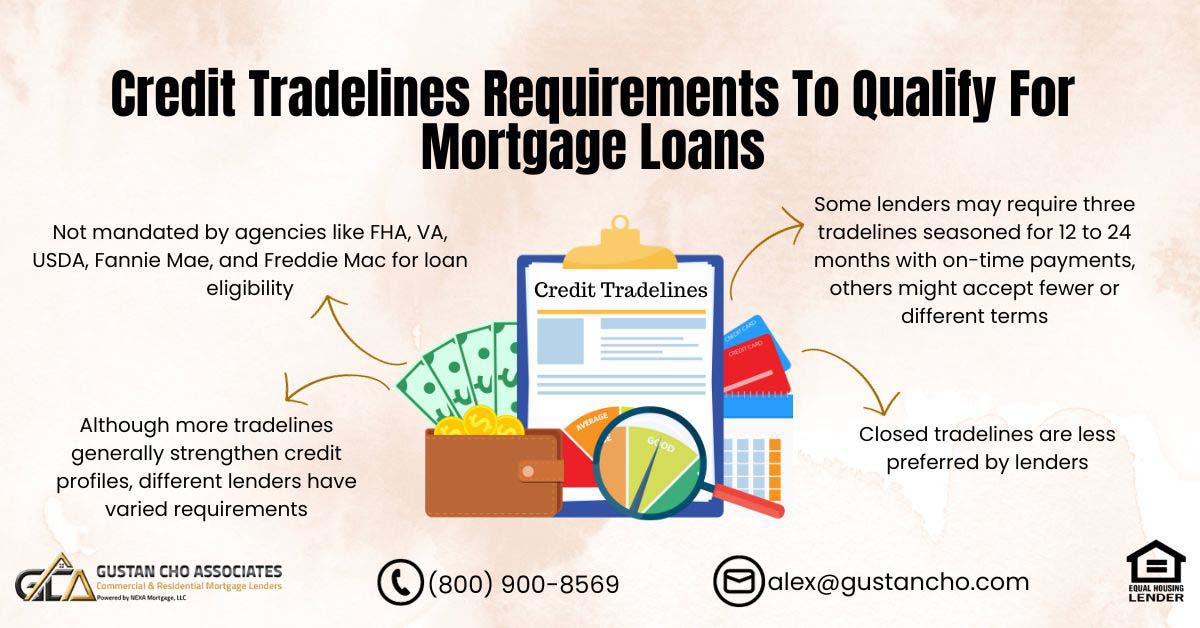

In this article, we will delve into the credit tradelines requirements essential for mortgage loan application eligibility. The credit tradelines requirements on government and individual lenders set conventional loans. It’s crucial to emphasize that agency guidelines do not regulate credit tradelines. Individuals applying for FHA, VA, USDA, Fannie Mae, and Freddie Mac loans are not obligated to possess a specific minimum number of credit tradelines.

Mortgage Guidelines on Credit Tradelines Requirements

Credit tradelines requirements, commonly called lender overlays, represent supplementary lending criteria individual lenders establish. These criteria go beyond the baseline guidelines outlined by agencies such as FHA, VA, USDA, Fannie Mae, and Freddie Mac. It is not uncommon for lenders to enforce more stringent lending standards than those mandated by these agencies. Despite this, borrowers without credit tradelines may still qualify for government or conventional loans, subject to approval or eligibility determined by the automated underwriting system (AUS).

These additional credit tradelines requirements are essentially an extra layer of criteria lenders use to assess a borrower’s creditworthiness. Even if an individual lacks traditional credit tradelines, such as credit cards or loans, they may still secure government or conventional loans if they receive approval or eligibility clearance through the automated underwriting system. While credit tradelines requirements add complexity to the lending process, they only sometimes preclude borrowers with established credit tradelines from accessing various loan options. Prequalify for a mortgage in just five minutes.

How Many Credit Tradelines Requirements To Qualify For Mortgage?

Lenders typically impose specific credit tradelines requirements as part of their criteria for loan approval. Generally, most lenders necessitate three credit tradelines that have a seasoning period of 12 to 24 months, with a crucial emphasis on consistent on-time payments. This requirement is commonly included in lender overlays, serving as a benchmark to evaluate an individual’s creditworthiness.

For non-QM (Non-Qualified Mortgage) lenders, the stipulated credit tradelines requirements may vary slightly. Typically, they may request either two credit tradelines with a longer 24-month seasoning period or three credit tradelines with a shorter 12-month seasoning requirement. These conditions underscore the importance of a borrower’s credit history and payment reliability, shaping the lending landscape for those seeking financing outside the conventional mortgage parameters. Adhering to these credit tradelines prerequisites becomes pivotal for individuals navigating the loan application process.

What Are Closed Credit Tradelines?

A closed credit tradeline denotes a scenario in which a consumer had a credit tradeline that is no longer active due to closure or full repayment, despite its existence in the past, spanning months or even years. Lenders commonly prioritize the examination of active and well-established open credit tradelines. The longevity of a credit tradeline is generally regarded as advantageous, with a preference for those that have maintained activity for a minimum of 12 months.

In credit tradelines requirements, a closed credit tradeline signifies the cessation of activity on a previously held credit account through closure or full repayment, irrespective of its historical presence, extending over several months or years. Lenders typically emphasize the significance of actively maintained and firmly established open credit tradelines when evaluating a consumer’s creditworthiness. A credit tradeline’s duration is commonly acknowledged as a positive factor, and a track record of at least 12 months of consistent activity is generally viewed favorably in this context.

What Are Credit Tradelines Requirements?

Credit tradelines pertain to the credit accounts of consumers reported to credit bureaus. Lenders generally consider a credit tradeline as an account with a minimum of 12 months of activity that is reported to the credit bureaus. To illustrate, if a consumer possesses a Blue Sky Visa-secured credit card, the payment history associated with that card will be documented and displayed on their credit report.

Prequalify for a mortgage in just five minutes.

Notably, most creditors report to the three major credit reporting agencies, namely TransUnion, Experian, and Equifax. These agencies play a crucial role in compiling and maintaining individuals’ credit histories.

What Does Credit Reports Consist Of?

The credit grantor will post the following:

- credit limit

- credit balance

- minimum monthly payment

- date of last activity

- payment history

How Many Active Credit Tradelines Requirements By Mortgage Lenders

Mortgage lenders don’t set specific requirements regarding the number of credit tradelines borrowers must have. Having more credit tradelines generally strengthens a consumer’s credit profile. However, even a single late payment on a tradeline can negatively impact credit scores. Any derogatory report typically stays on a consumer’s credit report for 7 years.

Lender Overlays on Credit Tradelines Requirements

Lenders often have additional requirements known as overlays. While automated underwriting systems may approve borrowers, most lenders still demand three to four credit tradelines that have been established for 12 to 24 months, despite the system’s initial eligibility. However, Gustan Cho Associates stands out by not imposing lender overlays on government or conventional loans. Instead, they rely solely on the automated underwriting system’s findings. In this article, we’ll delve into lenders’ credit tradeline guidelines and overlays.

Do Mortgage Lenders require Minimum Credit Tradelines?

Typically, lenders have their own set of requirements regarding Credit Tradelines. Those without specific requirements don’t necessitate credit tradelines but rely on the Automated Underwriting System (AUS) findings. Applicants needing tradelines but receiving approval through the Automated Underwriting System can potentially qualify with lenders not imposing additional requirements. Gustan Cho Associates, for instance, doesn’t have overlays on government and conventional loans.

Lender Overlays

Certain lenders impose their overlays that include minimum credit tradeline criteria. Typically, most lenders stipulate a minimum of 3 credit tradelines. However, certain lenders may demand 4 established credit tradelines, while others set even higher requirements. Additionally, some lenders mandate a 12-month seasoning for credit tradelines, whereas others insist on a 24-month seasoning period. Click here for no lender overlays

Do Lenders Require Credit Tradelines?

In addition to minimum credit tradeline criteria, lenders often impose credit tradeline seasoning requirements. Most lenders stipulate that mortgage applicants should demonstrate at least one year of consistent credit history for each tradeline. For instance, if a borrower recently obtained a Visa credit card and has held it for only six months, it wouldn’t meet the required credit tradeline duration. Lenders necessitate mortgage applicants to possess credit accounts with a clean payment record for a minimum of one year. Evaluating credit tradelines from the past year is how lenders gauge the risk levels associated with borrowers.

Credit Tradeline That Has Been Seasoned For A Year

For mortgage loan seekers lacking three credit tradelines seasoned for a year, there’s still a chance. Some lenders may consider exceptions given a robust credit profile in other respects, backed by compensating factors. These factors, such as minimal payment shock, reserves, or a secondary job not utilized for income, can play a pivotal role.

Non-Traditional Credit Tradeline

To substitute credit tradeline, we can use rental verification or non-traditional credit tradeline. Examples of non-traditional tradelines are the following:

- Cellular phone bill

- Cable

- Internet Bill

- Utility payment

- Other documented monthly payment bills that have been paid with a check and/or direct deposit for the past 12 months with no late payments

Whenever rental payments are made or other monthly payments, please pay them by check so they can always be tracked and verified. Cash payment is non-existent in the mortgage world. Mortgage lenders will always want to see canceled checks as proof of payment.

To secure a mortgage without lender overlays on government and conventional loans, reach out to Gustan Cho Associates by dialling 1-800-900-8569. For a quicker response, send a text or email us at gcho@gustancho.com. Our team is at your service seven days a week, including evenings, weekends, and holidays.

Frequently Asked Questions (FAQ) About Credit Tradelines Requirements To Qualify For Mortgage Loans

- What are credit tradelines requirements for mortgage loan applications? Credit tradelines requirements, also known as lender overlays, are additional lending criteria individual lenders set beyond the baseline guidelines outlined by government agencies like FHA, VA, USDA, Fannie Mae, and Freddie Mac. These requirements are used to assess a borrower’s creditworthiness. However, government and conventional loans do not have specific minimum requirements for credit tradelines.

- How many credit tradelines do I need to qualify for a mortgage? Lenders typically require three credit tradelines with a seasoning period of 12 to 24 months for loan approval. The emphasis is on consistent on-time payments. Non-QM (Non-Qualified Mortgage) lenders may have slightly different requirements, such as two credit tradelines with a 24-month seasoning period or three tradelines with a 12-month seasoning requirement.

- What are closed credit tradelines? A closed credit tradeline refers to a credit account that is no longer active due to closure or full repayment, even though it existed in the past for several months or years. Lenders prioritize active and well-established open credit tradelines and often prefer those with a minimum of 12 months of consistent activity.

- What do credit reports consist of? Credit reports include information credit grantors provide, such as credit limits, balances, minimum monthly payments, dates of last activity, and payment history. These details help lenders assess a borrower’s creditworthiness.

- How many active credit tradelines are required by mortgage lenders? Mortgage lenders do not set specific requirements for the number of credit tradelines a borrower must have. Having more credit tradelines can strengthen your credit profile, but even a single late payment on a tradeline can negatively impact your credit score. Derogatory reports typically stay on your credit report for seven years.

- Do mortgage lenders require minimum credit tradelines? Lenders have their own requirements for credit tradelines. Some lenders rely solely on the Automated Underwriting System (AUS) findings and do not require specific credit tradelines. Others may have minimum requirements, often ranging from 3 to 4 tradelines with seasoning periods of 12 to 24 months.

- What is the role of lender overlays in credit tradelines requirements? Lender overlays are additional requirements imposed by some lenders, which may include minimum credit tradeline criteria and seasoning requirements. These overlays can vary between lenders, and not all lenders have them. Some lenders, like Gustan Cho Associates, do not impose overlays on government or conventional loans and rely solely on the AUS findings.

- What is credit tradeline seasoning, and why is it important? Credit tradeline seasoning refers to the duration for which a credit account has been open and active. Most lenders require at least one year of consistent credit history for each tradeline. Seasoning helps lenders assess borrowers’ risk and payment habits over time.

- Can I qualify for a mortgage with less than three credit tradelines seasoned for a year? Sometimes, borrowers with less than three credit tradelines seasoned for a year may still qualify for a mortgage. Lenders may consider exceptions if the borrower has a strong credit profile in other aspects and can provide compensating factors, such as minimal payment shock, reserves, or additional income sources.

- What are non-traditional credit tradelines? Non-traditional credit tradelines can be used as substitutes for traditional credit accounts. Examples include rental verification, cellular phone, cable, internet, utility, and other documented monthly bills paid with checks or direct deposits for at least 12 months without late payments. These can help borrowers establish creditworthiness in the absence of traditional credit tradelines.

Related> Non-Traditional Credit Tradelines

This blog about the waiting Credit Tradelines Requirements To Qualify For Mortgage Loans was updated on February 5, 2024.

Cool blog! Is your theme custom made or did you download it from somewhere?

So I’ve been working on my credit I have 2 secured cc’s one non secured they are all under a year so I wouldn’t qualify for a mortgage even with a FICO score of 620 because my tradelines are under 12mnths. I was never told that just to get my score up. Iam so disappointed I wanted to be in a home by the end of the year that ain’t happening now. I wish someone would’ve told me.

Who told you that you need to wait 12 months having new credit cards to qualify for a mortgage. That is absolutely not true. There is no such rule. That rule is probably the lender’s own rule and part of their lender overlays. You definitely qualify. Please reach out to us at gcho@gustancho.com or call/text us at 262-716-8151 or text us for a faster response. Looking forward to working with you. By the way, what state are you in?