Non-QM (Non-Qualified Mortgage) loans are alternative home loans for borrowers who don’t meet the requirements of FHA, VA, USDA, or conventional “agency” programs—often because of self-employment income, recent credit events, high loan amounts, complex income, or non-traditional documentation.

Unlike government and conventional loans, Non-QM guidelines are not uniform. Each wholesale Non-QM investor sets its own rules for:

- credit score and housing history requirements

- down payment / LTV limits

- reserves (months of payments kept in the bank)

- income documentation methods (bank statements, 1099s, P&L, asset depletion, DSCR, etc.)

- waiting periods after bankruptcy/foreclosure (if any)

- pricing adjustments based on risk

Last updated for 2026: This version removes outdated COVID-era language and replaces it with current, evergreen Non-QM rules, including what lenders commonly require today and what typically affects approval.

What’s Different About Non-QM Guidelines in 2026

In 2026, Non-QM is widely available again, but approvals are more risk-based than “one-size-fits-all.” Here’s what borrowers should expect:

- Documentation is flexible, but not “no-doc.” Lenders still verify your ability to repay—just with alternative methods.

- Loan limits aren’t “agency-limited,” but every lender has its own maximum loan amount and exposure limits.

- Mortgage insurance is usually not required (no monthly PMI), but pricing is adjusted based on risk through rate/points.

- Down payments and reserves matter more than with many agency loans, especially for recent credit events, higher DTIs, or higher loan amounts.

- Guidelines can shift with the market, so the best approach is matching your scenario to the right investor/program.

What Non-QM Loans Are

A Non-QM mortgage is a home loan that doesn’t have to follow Fannie Mae/Freddie Mac (conventional) or HUD/VA/USDA (government) underwriting rules. Because these loans are funded by private investors, they can offer options that standard programs don’t—such as:

- Bank statement loans for self-employed borrowers

- 1099-only income programs for contractors

- Asset depletion for retirees or high-asset borrowers with low taxable income

- DSCR loans for investment properties (qualify based on rental income, not personal income)

- Expanded credit-event flexibility (case-by-case, depending on lender)

Non-QM is not “bad credit lending.” Many Non-QM borrowers have strong credit and assets but don’t fit traditional documentation rules.

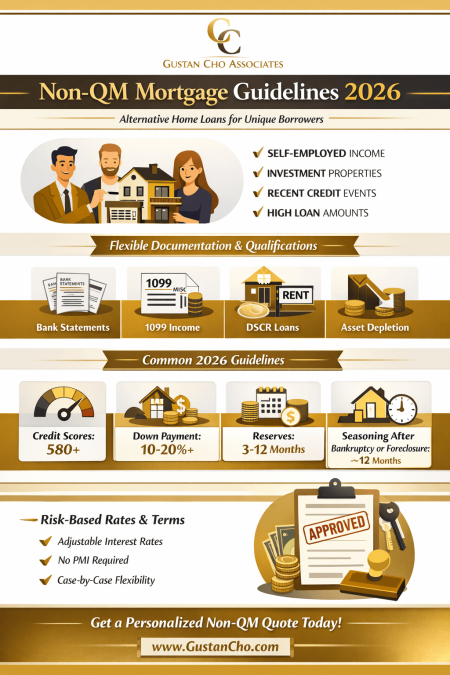

Common 2026 Non-QM Guidelines

Because every investor is different, think in common ranges instead of hard rules:

Credit scores:

- Many programs start around the mid-500s to 600+, with stronger terms at higher scores.

- Some lenders advertise lower minimums, but down payment, reserves, and housing history become more important.

Down payment / LTV:

- Primary residences: often around 80–90% LTV depending on program, credit, and documentation

- Second homes & investment properties: often lower LTV than primary residences

- Recent credit events or layered risk usually require more down payment and/or more reserves

Reserves:

- Often, 3–12 months of reserves, depending on loan size, property type, credit profile, and documentation type

- Higher loan amounts may require higher reserves

Debt-to-income (DTI):

- DTI flexibility varies widely by lender and documentation type

- Many lenders allow higher DTIs with compensating factors (strong reserves, higher credit, lower LTV)

Important: These are market-common ranges, not universal rules. Your exact approval depends on the investor and the program.

Bank Statement Mortgage Programs (2026 Update)

Bank statement loans are super popular for self-employed folks since they let you qualify based on 12 to 24 months of bank deposits instead of using tax returns.

How lenders typically calculate income:

- Business bank statements: lenders apply an expense factor (varies by business type and investor) to estimate usable income

- Personal bank statements: lenders typically count eligible deposits that can be sourced and supported

- Some programs allow a CPA/Tax Preparer letter or a profit-and-loss statement to support the income story.

Don’t Wait—Start Your Non-QM Mortgage Journey

Every borrower’s story is different. With Non-QM loans, your unique situation can still lead to approval.

Who Benefits from Non-QM Loans?

Self-Employed Borrowers

Non-QM (Non-Qualified Mortgage) loans were built for the self-employed, the gradual-commission crowd, and the flexible gig economy worker. They let entrepreneurs, freelancers, and part-time business owners document income that tax write-offs often mask.

Borrowers with Credit Challenges

Non-QM programs also welcome individuals with credit blemishes. Bankruptcies, foreclosures, or short sales that happened a year or three back will still enter the picture, allowing a sensible second chance and the chance to own again.

Unique Financial Situations

The final category deserves the broadest gaze. Whether retirees relying on managed-income portfolios, part-time property owners filing 1099s, or any shopping-pattern person under a standard-1099 structure, Non-QM loans account for income your standard mortgage calculator will miss.

Key Considerations on Non-QM Loans

Non-QM loans are marketed as flexible, but the upside comes with some strings attached. They cater to home buyers who don’t check every box on a conventional lender’s list. In return, buyers might face a bigger down payment and a higher interest rate. Dale Elenteny, a senior mortgage loan originator at Gustan Cho Associates says the following about the relaxed non-QM guidelines:

The relaxed non-QM guidelines allow freelancers, gig-workers, and those with less-documented incomes to prove creditworthiness and secure the keys to a new home.

Recent updates to Non-QM guidelines show lenders are shifting gears, broadening the definition of creditworthy in a way that mirrors the gig and self-employed economy. Home buyers with pay stubs, tips, commissions, crypto gains, or variable incomes now find more pathways to mortgage approval, reflecting a cultural and economic change: lenders are meeting prosperous, but unconventional, financial profiles where they are.

Non-QM Waiting Periods: What’s True in 2026 (And Why It Varies)

Non-QM waiting periods after bankruptcy, foreclosure, deed-in-lieu, or short sale are not the same across lenders because Non-QM is funded by private investors with different risk rules.

To avoid confusion, here’s the most straightforward way to think about it:

Before COVID:

Some Non-QM investors offered little to no seasoning after certain credit events—sometimes 0–1 day in minimal cases. These programs were rare, priced for risk, and not available from every lender.

Common Now (2026 market reality):

Today, many Non-QM lenders typically wait around 12 months after a bankruptcy or major housing event before offering their best options. Some investors may allow less time with stronger compensating factors, while others require more seasoning depending on the file.

What Impacts the Waiting Period and Loan Terms

Even when a lender allows a shorter waiting period, the approval and pricing usually depend on the overall risk profile, including:

- Credit score and recent late payments (especially housing lates)

- Loan-to-value (LTV) / down payment size

- Cash reserves (months of payments in verified assets)

- Type of event (Chapter 7 vs Chapter 13, foreclosure vs short sale, etc.)

- Housing history since the event (rent verification, on-time housing payments)

- Compensating factors (strong assets, stable deposits, low DTI, strong equity position)

Bottom line: Non-QM can be more flexible than agency loans, but “no waiting period” is not a universal rule in 2026. The best approach is matching your timeline and profile to the right Non-QM investor and program.

Non-QM Guidelines After Bankruptcy and Foreclosure

If you’ve recently filed for bankruptcy, you might again wonder if you’ll ever be able to get a loan. The amazing news is that getting approved for a mortgage after bankruptcy or a housing event is not impossible.

Since non-QM mortgages are portfolio loans, each lender has its own guidelines. Most lenders will negotiate or make exceptions on a case-by-case basis. Lenders can and are willing to make exceptions if the deal makes sense.

Here are some solid tips on improving your chances of getting approved. One of the best ways to increase your odds of getting approved for a mortgage after bankruptcy is to meet the minimum waiting period requirements of the government or conventional loans. Or find someone without a prior bankruptcy or foreclosure to be on the loan, and you will be on title together with the main borrower.

Traditional versus Non-QM Guidelines on Waiting Period After Bankruptcy and Foreclosure

FHA, VA, USDA, and conventional loans require a two—to four-year waiting period after bankruptcy. Non-QM loans allow borrowers one year out of bankruptcy or foreclosure to qualify for them. Dale Elenteny, a senior mortgage loan originator

Many lenders no longer offer non-QM loans one day after bankruptcy and foreclosure. The longer the bankruptcy discharge date or the longer the foreclosure recorded date, the lower the rate and risk tolerance for the wholesale non-QM lenders.

The one-day waiting period after bankruptcy and foreclosure has been changed to a one-year waiting period after bankruptcy or foreclosure on non-QM loans, explains John Strange of Gustan Cho Associates. The updated non-QM guidelines post-COVID-19 ERA changed for the worse, especially for non-QM loans one day after bankruptcy and foreclosure.

The Latest Updates on Non-QM Guidelines

The no-waiting period after bankruptcy and foreclosure non-QM guidelines have been changed to one year after bankruptcy and foreclosure by most non-QM wholesale mortgage lenders. The updated non-QM guidelines on non-QM loans after bankruptcy or a housing event may return someday with no waiting period. However, most wholesale lenders now have a one-year waiting period after bankruptcy or a housing event. A housing event is a foreclosure, a deed-in-lieu of foreclosure, or a short sale.

Open Doors With Non-QM Loans

Don’t let strict conventional guidelines stop you. Our Non-QM programs make homeownership possible for more buyers.

Non-QM Mortgage Post Coronavirus Pandemic

The coronavirus pandemic has devastated the mortgage markets. At least temporarily. Non-QM mortgages have been halted until further notice by all lenders. Many borrowers who locked their non-QM mortgage rates and were set to close have seen their dream of homeownership halted until further notice. John Strange, a senior loan officer at Gustan Cho Associates, shares his thoughts about the updated non-QM guidelines on non-prime loans after the coronavirus outbreak and scare as follows:

The team at Gustan Cho Associates had over 40% of its pipeline canceled due to the coronavirus pandemic crisis. A handful of non-QM lenders either closed their doors or went bankrupt.

The future of alternative financing seemed gloomy and not too promising. As time passed, the good news is that non-QM lending returned. Lending guidelines have been easing up as time has passed. If the deal makes sense, non-QM lenders are willing to make an exception to make the deal work. Gustan Cho Associates is an aggressive mortgage broker of non-traditional mortgages. Gustan Cho Associates has recently launched home mortgages with one day out of bankruptcy or foreclosure.

Best Non-Traditional Lenders With Lenient Non-QM Guidelines

Over 80% of our borrowers at Gustan Cho Associates could not qualify at other lenders due to their lender overlays. Gustan Cho Associates has no lender overlays on government and conventional loans. We are also experts in originating and funding non-QM mortgages and alternative portfolio lenders.

Non-QM lenders anticipated skyrocketing growth in the years to come. However, the COVID-19 pandemic completely shut down the mortgage markets for non-QM and alternative portfolio financing.

The great news is that non-QM loans have been making a resurgence in the past couple of months. To qualify for a mortgage with a lender with no lender overlays and experts in alternative financing, please contact us at Gustan Cho Associates at 800-900-8569, text us for a faster response, or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays.

Non-QM Mortgage Experts: Gustan Cho Associates

Gustan Cho Associates are experts in NON-QM mortgage lending.

- We have numerous investors who offer different programs for these types of loans

- In this blog, we will detail what a NON-QM mortgage is and how to apply for one

- You will also update you on some recent document changes to NON-QM lending after the COVID-19 Coronavirus outbreak

Non-QM Mortgage Guidelines UPDATE: Non-QM Loans Defined

A NON-QM mortgage loan is a special mortgage product that does not follow federal lending guidelines by Fannie Mae, Freddie Mac, and HUD.

- Non-QM wholesale mortgage lenders are private investors who can lend their own money, allowing them to create their own mortgage products and guidelines.

- QM stands for qualified mortgage.

- NON-QM means non-qualified mortgage.

- Since they do not follow the federal guidelines, thousands of Americans can buy or refinance homes with these products.

- At the beginning of the COVID-19 coronavirus outbreak, NON-QM mortgage products disappeared.

- Investors were not honoring their loan products due to uncertainty in the market.

- However, non-QM loans have returned and are one of the most popular mortgage loan options today for homebuyers.

Even individuals already in the loan process were not able to close on their transactions. Recently, NON-QM mortgage lending has made a comeback.

Non-QM Mortgage Guidelines UPDATE On Relaunched Loan Programs

Popular non-QM mortgage products after the COVID-19 coronavirus outbreak

- Bank statement mortgages for self-employed borrowers

- Most self-employed borrowers use tax write-offs to increase take-home pay

- Tax code for self-employed individuals allows for many legitimate write-offs

- These write-offs count against your debt-to-income ratio when you attempt to buy a home

- Federal guidelines outline exactly how mortgage companies can calculate self-employed income

- Many write-offs will count against your qualifications

- If that is your scenario, a bank statement loan may be a great alternative for you

- A bank statement loan will calculate your income based on business-related deposits

- Typically, 50% of your business-related deposits will be counted as qualifying income

Depending on credit score, these mortgages require at least a 15% down payment. Lower credit scores will require a larger down payment.

Asset Depletion Mortgage Loan Programs

Asset depletion mortgages. While Freddie Mac does offer an asset depletion program, it is nowhere near as forgiving as a NON-QM asset depletion loan.

- Many borrowers, especially retired borrowers, may have a large nest egg of liquid assets but low take-home pay

- This mortgage product allows you to use your liquid assets as qualifying income

- You may even count other income, such as pension or Social Security income

- They will take your total assets and divide them by 60 months

That figure will be added as qualifying income to your mortgage file. Adding the assets will dramatically increase a borrower’s purchasing power.

Discover Flexible Non-QM Mortgage Options

If traditional lenders turned you away, Non-QM guidelines may be your path to homeownership. At Gustan Cho Associates, we specialize in these alternative programs with no overlays.

Qualifying For Non-QM Home Mortgages

Applying for a NON-QM mortgage loan with Gustan Cho Associates is similar to applying for a QM mortgage.

- Your first call should be to Alex Carlucci at (800) 900-8569 to discuss your mortgage qualifications. Mike is the NON-QM expert!

- From there, Mike will fit you into the best NON-QM mortgage product available

- You will be paired with a licensed loan officer in your state

- You will complete your application with an online link that will give your loan officer permission to verify your credit report

- Just like a QM mortgage, you will go through the preapproval process

Depending on the loan program, your loan officer will need certain documentation, such as bank statements, pay stubs, tax returns, a driver’s license or state ID, and more. Once you send these items, your loan officer will complete the preapproval process.

Frequently Asked Questions About Non-QM Guidelines:

What is a Non-QM Loan?

A Non-QM (non-qualified mortgage) is a home loan that doesn’t follow standard “agency” underwriting rules used for conventional (Fannie/Freddie) or government loans (FHA/VA/USDA). Non-QM lenders can use alternative documentation—like bank statements, 1099s, or asset depletion—to verify your ability to repay.

Who Qualifies for a Non-QM Mortgage in 2026?

Non-QM loans are commonly used by:

- Self-employed borrowers with heavy write-offs (bank statement loans)

- Gig/commission/1099 workers with fluctuating income

- Real estate investors using the DSCR/rental income qualification

- Borrowers with recent credit events who don’t fit agency waiting periods

- Exact qualifications vary by lender, program, property type, and risk profile.

Are Non-QM Interest Rates Higher Than Conventional Loans?

Often, yes. Non-QM pricing is typically higher than conventional pricing because it’s risk-based and may not include the same consumer protections and standardized underwriting rules. The trade-off is flexibility in how income and credit are evaluated.

How Much Down Payment Do You Need for a Non-QM Loan?

Down payment requirements vary by lender, but Non-QM often requires more down payment than agency loans—especially if you have layered risk (lower credit score, recent credit event, higher loan amount, or limited reserves). Some lenders publish programs that can go lower with strong compensating factors, but the “typical” down payment is scenario-dependent.

How Does a Bank Statement Mortgage Work for Self-Employed Borrowers?

A bank statement loan lets you qualify using 12–24 months of personal or business bank statements instead of tax returns, W-2s, or pay stubs. Lenders review deposits to estimate usable income (often applying an expense factor on business statements). Requirements vary by investor and documentation type.

Can You Get a Non-QM Loan After Bankruptcy or Foreclosure?

Sometimes, yes—Non-QM may allow financing sooner than traditional programs, but waiting periods are not universal. Some lenders may allow shorter seasoning, while many commonly require around 12 months (or more/less, depending on credit score, down payment/LTV, reserves, and housing payment history).

This article about “How Non-QM Guidelines Open Doors For Homebuyers” was updated on February 27th, 2026.