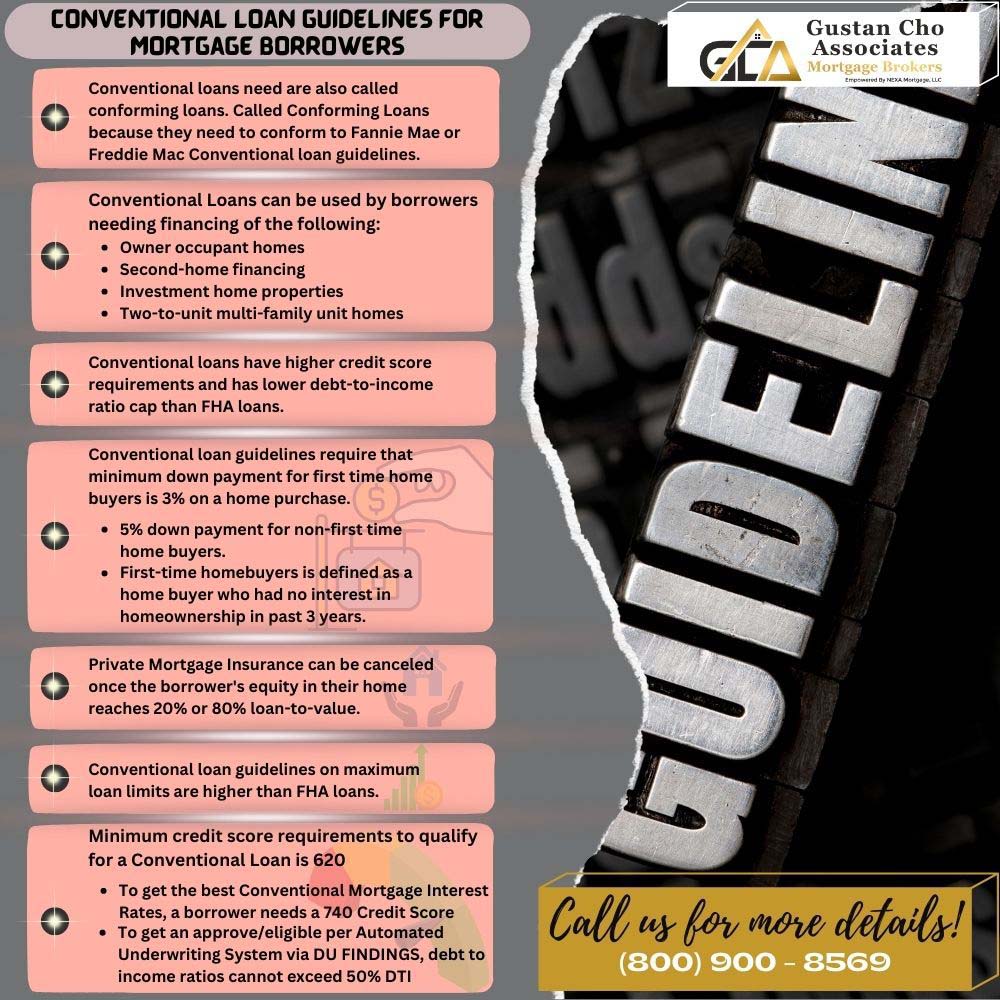

This article will cover the conventional loan guidelines for mortgage borrowers on primary, second, and investment homes. Borrowers needing Conventional loans must meet the minimum Conventional loan guidelines. Conventional loans are called Conforming loans because they must conform to Fannie Mae and Freddie Mac mortgage guidelines. There is no private mortgage insurance on conventional loans if you have less than 80% loan-to-value.

Fannie Mae and Freddie Mac are the two mortgage giants in the United States. Fannie and Freddie are the two government-sponsored enterprises (GSEs) whose primary role is to keep stability and liquidity in the housing markets. Fannie Mae and Freddie Mac are the two largest purchases of mortgages on the secondary market.

Fannie Mae and Freddie Mac are the two mortgage giants that sets Conventional loans guidelines. If a lender wants to sell their funded Conventional loans to Fannie Mae or Freddie Mac, the loan needs to meet the minimum Conventional Loan Guidelines required by Fannie or Freddie. You can finance first homes, second homes, and investment homes with conventional loans. In this article, we will discuss and cover Conventional loan guidelines for mortgage borrowers.

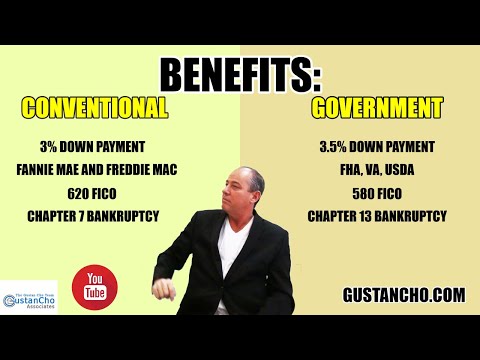

Key Benefits on Conventional Loans

Conventional loans is the most popular loan program in the nation. Unlike government-backed loans, you can finance owner-occupant, second homes, and investment properties with conventional loans. Here are some bullet points of Conventional loans. Conventional Loans can be used by borrowers needing financing of the following:

- Owner occupant homes

- Second-home financing

- Investment home properties

- Two-to-unit multi-family unit homes

Aligned with Conventional loan guidelines, Conventional loans have higher credit score requirements and has lower debt-to-income ratio cap than FHA loans.

Conventional Loan Guidelines on Private Mortgage Insurance

Conventional loans are also called conforming loans because they need to conform to Fannie Mae or Freddie Mac Conventional loan guidelines.

Many homeowners with conventional loans can raise their credit scores and credit profile so they can refinance their FHA loan to a conventional loan once their equity increases to 80% loan-to-value. Refinancing your FHA loan to a conventional loan can eliminate your 0.85% annual mortgage insurance premium and have a substantial lower rate.

Conventional loan guidelines require that the minimum down payment for first time home buyers is 3% down payment on a home purchase. 5% down payment for non-first time home buyers. First-time homebuyers is defined as a home buyer who had no interest in homeownership in past 3 years.

Conventional Loan Guidelines on Rate and Terms

Borrowers have various options of the type of Conventional loans such as 15 to 30 year fixed rate mortgages and adjustable-rate mortgages. Conventional loan guidelines do not require private mortgage insurance (PMI) if borrowers put 20% down payment on a home purchase. Private Mortgage Insurance can be canceled once the borrower’s equity in their home reaches 20% or 80% loan-to-value.

There are several options borrowers can choose private mortgage insurance on conforming loans. There is lender-paid mortgage paid insurance which is a one lump private insurance payment like the one-time upfront mortgage insurance premium. There is the monthly private mortgage insurance which is priced based on the borrowers and property risk factor.

Borrowers with higher credit scores, private mortgage insurance is normally lower than FHA mortgage insurance premium. Benefits of Conventional loans is that private mortgage insurance is not permanent like FHA loans. Again, private mortgage insurance can be canceled once loan-to-value reaches 80% LTV. Minimum credit scores to qualify for Conventional loans is 620. The maximum debt-to-income ratio cap on conventional loans is 50% DTI.

Qualification Requirements on Conventional Loans

Both Fannie Mae and Freddie Mac lowered the minimum down payment requirements to qualify for Conventional loans to 3% for first-time homebuyers. A first-time homebuyer is defined as someone who did not have ownership in a home in the past three years. The 3% down payment on conventional loans are for first time homebuyers.

To compete with FHA loans, Fannie Mae and Freddie Mac reintroduced the 3% down payment homebuyer down payment program on conventional loans. You need private mortgage insurance on conventional loans.

In December 2014 in order to compete with the popular 3.5% down payment requirement on FHA loans, the 3% down payment loan program was launched. Due to this lowering of down payment requirements for first time home buyers on Conventional Loans, more and more borrowers were gearing towards Conventional loans.

The Benefits of Conventional Loans

Conventional loan programs became a stronger competition to FHA mortgage loan options. Due to not just the lower down payment requirements of 3% down payment on a home purchase But also because of qualifying for Conventional Loan after Chapter 7 Bankruptcy when borrowers have mortgage part of bankruptcy. We will discuss more in detail later on this article.

Fannie Mae Versus HUD Mortgage Insurance Guidelines

HUD requires annual FHA mortgage insurance premium on FHA loans for the term of the FHA loan. Homeowners can cancel Private Mortgage Insurance on Conventional loans once you are at 80% loan-to-value. Private mortgage insurance or PMI is mandatory for borrowers who put less than 20% down payment on a home purchase. Conventional loans are very credit-sensitive.

Private mortgage insurance companies are very strict when pricing out private mortgage insurance on borrowers of conventional loans. Not all conforming loan borrowers get a fixed mortgage insurance rate like FHA loans.

Borrowers with lower credit scores will definitely get a negative loan-level pricing adjustments on mortgage rates, which is a pricing hit adjustment. Mortgage interest rates will be higher since Conventional loans are not government loans. Pricing on private mortgage insurance is not fixed like FHA loans. PMI companies will base the pricing on private mortgage insurance based on credit scores, credit profile, and other risk factors.

Private Mortgage Insurance on Conforming Loans

Private Mortgage Insurance is based on the following factors:

- Amount of equity

- Type of property

- Type of loan whether primary residence or investment property

- Most importantly, the borrower’s credit scores

Private mortgage insurance is based on risk. Private mortgage insurance companies judge risk factor on the borrower’s credit scores. The higher the borrower credit scores, the lower the risk factor, thus the lower the private mortgage insurance premium. MGIC, Genworth Financial, RMIC, and Radian are some name brand well known Private Mortgage Insurance companies.

Conventional Loan Guidelines on Loan Limits

Conventional loan guidelines on maximum loan limits are higher than FHA loans. Due to higher loan limits on Conventional loan guidelines, many FHA borrowers need to qualify for Conventional loans but need to meet the Conventional loan guidelines requirements. Here are the Conventional loan guidelines on loan limits:

- Conventional loan limits on a single-family home is generally $726,200

- As per conventional loan guidelines, loan Limits on Conventional loans on two units is $929,850

- Conventional loan limits per on three-unit Conventional loan Guidelines is capped at $1,123,900

- The maximum Conventional loan limit on four-unit properties is capped at $1,386,800

The above is for most areas in the United States.

Loan Limits In High-Cost Areas

There are many areas throughout the country that have areas that are designated high-cost areas. High-Cost Areas have higher loan limits. High-cost areas have higher loan limits per 2023 Conventional loan guidelines. For example, Los Angeles County and many counties in California have loan limits of up to $1,089,300 single-family homes. Hawaii has higher housing costs and a four-unit property in Honolulu, Hawaii and Alaska has loan limits up to $1.3 million.

Credit Score Requirements Per Conventional Loan Guidelines

Here are the credit score requirements to qualify for Conventional loans:

- In line with conventional loan guidelines, the minimum credit score requirements to qualify for a Conventional Loan is 620

- A 620 Credit Score is considered very low for conventional loans

- To get the best Conventional Mortgage Interest Rates, a borrower needs a 740 Credit Score

Loan Level Price Adjustments or LLPA is a pricing adjustment where the lower your credit scores are, there will be a pricing adjustment hit which means higher interest rates.

Debt-To-Income Ratio Requirements on Conventional Loans

Here are Conventional Loan Guidelines on Debt-To-Income Ratios:

- To get an approve/eligible per Automated Underwriting System via DU FINDINGS, debt to income ratios cannot exceed 50% DTI

To get an approve/eligible per Automated Underwriting System via LP FINDINGS, debt to income ratio cannot exceed 50% DTI.

Conventional Loan Guidelines on Condominiums

Homebuyers purchasing a condominium need to consider the condominium complex being HUD-approved. Condo Buyers can only qualify for a FHA loan and want to purchase a condominium, they need to make sure that the condominium complex is FHA Approved.

HUD, the parent of FHA, allows FHA spot loan approval on non-HUD approved condominium complexes. What FHA loan spot approval means is HUD will allow condo units that is not HUD-approved eligible for FHA loan financing is all other HUD warrantable condo standards apply.

Most condominium buyers think that just because the condominium is not FHA Approved that they can automatically qualify to purchase a condominium with a Conventional loan. This is not the case and not true. HUD now allows FHA Spot Approval on non-HUD approved condos. However, the condo complex needs to be a warrantable condo complex.

Conforming Guidelines on Condominiums

Here are the Conventional Loan Guidelines on Condominiums: The common area of the condominium complex needs to be fully complete and owned by the condominium unit owners or the condominium homeowners association. In order to qualify for a Fannie Mae and/or Freddie Mac condominium loan, the condominium complex needs to be classified as a warrantable condominium complex.

There are two different types of condo complexes: Warrantable and non-warrantable condos. Government and conventional loan guidelines only allow warrantable condos. Warrantable condos are when 51% or more of the occupants are owner-occupants. Non-warrantable condos are when the residents are 51% or more of the occupants and are primarily non-owner occupied.

Warrantable condominium complex means that at least 51% of the condominium units needs be owned by primary resident condominium unit owners or second home unit owners and not be owned by investment unit owners where the condominium units are rentals. The condominium complex needs to be in good financial condition with reserves and not negative or in financially in distress. Ninety percent of the condominiums must be sold and owned by condominium unit owners on existing condominium projects. A single enterprise and/or owner cannot be the owner of 10% or more of the condominium units. The condominium complex needs to be fully insured and/or insurable.

Second Home Financing & Investment Home Mortgages

Government loan programs such as FHA, VA, USDA only allow for primary owner occupant home financing. However, Fannie Mae and Freddie Mac allow for second-home and investment home financing with Conventional loans. Here are the requirements to finance second homes and investment properties with Conventional loans:

- 10% down payment is required for second home financing with Conventional Loans

- 15% to 20% down payment is required for investment home financing with Conventional loans

Based on conventional loan guidelines, multiple unit properties will require a 15% down payment on owner occupant two unit multi-family homes. Three to four unit owner-occupant multi-family homes require a 20% down payment. Investment property multi-family homes require a 25% down payment.

Conventional Loan Guidelines After Bankruptcy & Foreclosure

We have no lender overlays on government and conventional loans after bankruptcy and foreclosure: There is a four-year waiting period to qualify for a Conventional loan after a Chapter 7 Bankruptcy.

Gustan Cho Associates are experts in helping borrowers qualify for traditional and non-conforming loans after bankruptcy and foreclosure. We offer non-QM loans one day after bankruptcy and foreclosure with 20% down payment. No waiting period after bankruptcy and foreclosure to qualify for non-QM loans.

There is a four year waiting period after Chapter 11 Bankruptcy from the discharged date of the bankruptcy or dismissal date of their bankruptcy. There is a two-year waiting period to qualify for a Conventional loan two years from the discharged date of the Chapter 13 Bankruptcy or four years from the dismissal date of their Chapter 13 Bankruptcy.

Fannie Mae Mortgage Included in Bankruptcy Waiting Period Guidelines

If you have a mortgage part of your Chapter 7 Bankruptcy and if the mortgage is not reaffirmed, then there is a four-year waiting period to qualify for a Conventional loan from the discharged date of the Chapter 7 Bankruptcy. The foreclosure can happen after the discharged date and has no bearing on the four-year waiting period.

Per Fannie Mae and Freddie Mac agency mortgage guidelines, if you have included a mortgage in your bankruptcy, the waiting period is four years from the discharge date of the bankruptcy to qualify for a conventional loan. The foreclosure date does not matter.

However, the foreclosure needs to happen and cannot be lingering in order for you to qualify. There is a four-year waiting period to qualify for a Conventional loan four years after the date of sale. There is a four-year waiting period to qualify for a Conventional loan after the recorded date of a deed in lieu of foreclosure. There is a seven-year waiting period to qualify for a Conventional Loan after a standard recorded date of foreclosure.

Qualifying For Conventional Loan With Lender With No Overlays

Gustan Cho Associates has no overlays on Conventional loans. Gustan Cho Associates are mortgage brokers licensed in 48 states including Washington, DC, and Puerto Rico. The team at Gustan Cho Associates has a national reputation of being able to do mortgage loans other lenders cannot do.

Gustan Cho Associates has FHA, VA, USDA, Conventional, and non-QM mortgage loan programs for our borrowers. We have a reputation for being a one-stop mortgage shop. Besides traditional mortgage loan options with no overlays, we have hundreds of non-QM loan programs such as no-doc mortgages, Profit and Loss Mortgage Loans, DSCR mortgages, 1099 mortgage loans, and hundreds of non-traditional mortgage loan options.

We have a lending network of over 210 wholesale mortgage lenders including wholesale lenders of government and conventional loans with no overlays. Borrowers who have gotten a last-minute loan denial or are going through a stressful process and their current lender keeps on asking for conditions after conditions and are looking for a lender with no overlays, please contact us at Gustan Cho Associates at 800-900-8569 or text for a faster response. Borrowers can also email us at gcho@gustancho.com. We are available 7 days a week, evenings, weekends, and holidays.

When Will The 3% Down Payment Home Purchase Program Go Into Effect?

Fannie Mae’s 3% down payment home purchase conventional loan program will go into effect immediately. First-time homebuyers who qualify for a conventional loan can now qualify for the 3% down payment home purchase mortgage loan. Homeowners who need to refinance their mortgage loan can also qualify for a 97% refinance mortgage loan. The maximum loan limit on conventional loans is $548,250. Any loans that are higher than $548,250 are non-conforming loans and are referred to as jumbo loans.

Freddie Mac will be starting a more limited conventional mortgage loan program starting in March which will give incentives to low-income home buyers and first-time homebuyers to get housing counseling.

3% Down Payment Conventional Loan Program

The 3% down payment home purchase conventional loan program is not new. Fannie Mae and Freddie Mac offered the 3% down payment home purchase conventional loan program up until November 2013 before it started to increase the down payment requirement in tightening its mortgage underwriting standards. The 3% down payment home purchase conventional loan program was not offered at all in all of 2014 until it was reinstituted in December 2015.

How Do I Qualify For Fannie Mae 3% Down Payment Home Purchase Conventional Loan?

In line with conventional loan guidelines, in order to qualify for Fannie Mae’s 3% down payment home purchase conventional loan, the home buyer need to be a first-time homebuyer or could not have owned a home in the past three years. Freddie Mac’s standards and guidelines to qualify for the 3% down payment home purchase conventional loan are the same as Fannie Mae’s. Freddie Mac requires the home buyer to be a first-time homebuyer. The homebuyer could not previously have owned a home in the past three years. Or home buyers with low to moderate incomes or home buyers who are purchasing a home in underserved areas.

97% LTV Refinance Mortgage

Fannie Mae and Freddie Mac will permit homeowners who currently have mortgage loans backed by Fannie Mae and/or Freddie Mac to do a 97% refinance mortgage. Fannie Mae will allow refinancing mortgage loan borrowers to withdraw cash out for their refinance closing costs. Freddie Mac will not permit refinance mortgage loan borrowers to take cash out for closing costs on a 97% loan to value refinance mortgage loan.

Frequently Asked Questions (FAQs)

1. What is a conventional loan?

A conventional loan is a mortgage that is not insured or guaranteed by a government agency like FHA, VA, or USDA. It is funded by private lenders and typically follows Fannie Mae or Freddie Mac guidelines.

2. What are the credit score requirements for a conventional loan?

Based on conventional loan guidelines, lenders demand a 620 minimum credit score, but a higher score (typically 700+) may be needed for better rates and lower down payment options.

3. How much down payment is required for a conventional loan?

3% for first-time homebuyers and 5% for repeat buyers. A down payment of 20% is required to avoid private mortgage insurance (PMI).

4. What is a conventional loan’s maximum debt-to-income (DTI) ratio?

As per conventional loan guidelines, most lenders allow a DTI ratio of up to 45%, though some borrowers with strong credit and assets may qualify with a DTI of up to 50%.

5. Do conventional loan guidelines require private mortgage insurance (PMI)?

Yes, PMI is required if you put down less than 20%. However, PMI can be removed once you reach 20% equity in the home.

6. Can I use gift funds for my down payment on a conventional loan?

Yes, gift funds from family members are allowed for down payment and closing costs. Still, documentation is required to verify the source.

7. How long after bankruptcy or foreclosure can I qualify for a conventional loan?

- Chapter 7 Bankruptcy: 4 years from discharge

- Chapter 13 Bankruptcy: 2 years from discharge or 4 years from dismissal

- Foreclosure: 7 years from completion date

8. Are there conventional loan options for self-employed borrowers?

Yes, consistent with conventional loan guidelines, self-employed borrowers can qualify with at least two years of tax returns or alternative documentation like bank statement loans (for non-QM conventional loans).

9. What types of properties can I buy with a conventional loan?

Conventional loans can be used for:

- Primary residences

- Second homes

- Investment Properties

For any questions about conventional loan guidelines, or to qualify for a mortgage with a five-star mortgage company licensed in multiple states with no lender overlays, please contact us at Gustan Cho Associates at 800-900-8569. Or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, evenings, weekends, and holidays.

Get Approved for a Conventional Loan with Flexible Guidelines

Apply Online And Get Pre-Approved for a Conventional Loan with No Extra Requirements