In this blog, we will cover the role of mortgage underwriter during the mortgage process. The role of mortgage underwriter is to underwrite the borrower’s file and make sure they qualify for a home mortgage. The mortgage underwriter is hands down the most important person during the mortgage process.

The mortgage underwriter determines whether or not a borrower is approved for a mortgage loan. The mortgage underwriter decides whether or not a borrower qualifies and meets the lending guidelines.

It is the mortgage underwriter’s role to determine whether the borrower has qualified income and the ability to repay their new housing payment. The underwriter will determine the assets, liabilities, income, credit, derogatory credit tradelines, and other important factors before issuing a conditional home loan approval. There are many other stages of the mortgage process before the file gets to the mortgage underwriter. The mortgage underwriter is the person that will issue the clear to close on a file. In the following sections of this article, we will cover the role of mortgage underwriter during the mortgage process.

Role of Mortgage Underwriting During Steps in The Mortgage Process

The mortgage approval process has multiple steps. There are many mortgage professionals involved in the mortgage approval process. The first point of contact for borrowers deals with our loan officers. Mortgage Loan Officers are the mortgage professionals who initially qualify borrowers.

Loan officers will interview borrowers, take their mortgage loan applications, run credit, collect mortgage documents, review docs, and run Automated Underwriting System Findings.

Once the loan officer feels that the borrower qualifies for a home loan, the loan officer will issue a pre-approval letter. With a solid pre-approval letter, the borrower can shop for a home and enter into a real estate purchase contract. Once the borrower enters into a real estate purchase contract, the mortgage approval process starts. The homebuyers are assigned to a mortgage processor. Talk to us about Qualify for mortgage underwriting during steps in mortgage process

What is the Role of Mortgage Underwriter in the Home Loan Process

A mortgage underwriter plays a crucial role in the mortgage loan approval process. Their primary responsibility is to evaluate the risk associated with a loan application by analyzing various factors related to the borrower’s creditworthiness and the financed property. Here are some key roles and responsibilities of a mortgage underwriter.

Role of Mortgage Underwriter: Evaluate Credit and Income Documentation

Underwriters review and verify the borrower’s credit reports, employment history, income sources, and other financial documentation to ensure they meet the lender’s guidelines and regulatory requirements.

Role of Mortgage Underwriter to Assess Borrower’s Ability to Repay

Underwriters calculate the borrower’s debt-to-income ratio (DTI) and ensure that their income is sufficient and stable enough to make the monthly mortgage payments and other existing debt obligations.

Analyze Property Value and Collateral

Underwriters review the property appraisal report to ensure that the property’s value is accurately represented and that the loan amount does not exceed the lender’s loan-to-value (LTV) requirements.

Role of Mortgage Underwriter to Review Title and Ownership

Underwriters examine the title report to verify clear ownership of the property and identify any potential liens or encumbrances that could impact the lender’s security interest.

Role of Mortgage Underwriter To Ensure Compliance with Guidelines

Underwriters ensure that the loan application and supporting documentation comply with the lender’s internal guidelines, as well as any applicable state and federal regulations, such as those set by Fannie Mae, Freddie Mac, FHA, or VA.

Role of Mortgage Underwriters To Identify and Mitigate Risk

Underwriters assess the overall risk associated with the loan, considering factors like credit scores, employment history, property type, and loan program. They may request additional documentation or conditions to mitigate identified risks.

Role of Mortgage Underwriter to Make Final Loan Decision

After thorough analysis, underwriters decide to approve, suspend, or deny the loan application based on their assessment of the borrower’s creditworthiness and the loan’s adherence to guidelines. Mortgage underwriters play a critical role in protecting the lender’s interests while ensuring that borrowers are not taking on more debt than they can reasonably afford. Their diligence and attention to detail help maintain the integrity and stability of the mortgage lending process.

The Importance of Preparing Documents Required For Underwriting

The mortgage processor works closely with the loan officer to prepare the borrower for processing and prepare the file for underwriting. An experienced processor will be detailed and thorough when reviewing the documents. An experienced veteran mortgage processor will not submit any documents and paperwork with missing pages or documents that are not legible to underwriting. Incomplete and not legible documents submitted to underwriting are one of the biggest reasons why files get kicked back by the mortgage underwriter and delay the mortgage process and closing. This article will discuss the role of mortgage underwriter during the mortgage process.

Role of Mortgage Underwriter During Mortgage Approval Process

Borrowers first deal with the mortgage loan originator. Below are the steps loan officers take in the qualification and pre-approval mortgage process. The loan officer first qualifies the client. The loan officer will complete a full four-page 1003 mortgage loan application. The loan officer will run credit and go over the line item of the credit report with the borrower.

Once qualified, the loan officer will issue a pre-approval letter. The borrower will shop for a home. Once the borrower enters into a real estate purchase contract, the mortgage process will start.

Documents such as tax returns, W2s, most recent paycheck stubs, and 60 days of bank statements will be requested and reviewed. The borrower is assigned to a mortgage processor. The mortgage processor starts processing the loan file. Once the mortgage loan originator runs credit and reviews the credit report and Automated Underwriting System AUS Findings, borrowers request documents. The mortgage loan processor then reviews all data collected by the mortgage loan originator and prepares the mortgage package for the underwriter. Speak with us about mortgage underwriter during mortgage approval process

Role of The Mortgage Processor

The role of the mortgage processor is to prepare the mortgage file for a mortgage underwriter to review. If anything is missing, the mortgage processor contacts borrowers. The mortgage processor’s job is to get everything ready to submit to underwriters. The underwriter is the most important person in the mortgage loan approval process. Underwriters make sure whether or not borrowers qualify for a mortgage. Mortgage underwriters decide whether borrowers get approved. Underwriters are the mortgage professionals who issue the clear to close. A clear-to-lose is the clearance to fund the mortgage loan. Borrowers never have contact with the mortgage loan underwriter. A mortgage underwriter has much power and discretion over the borrower’s files. It will be the underwriter’s discretion whether a borderline loan gets approved.

Role of Mortgage Underwriter During Qualification of Loan Applicant

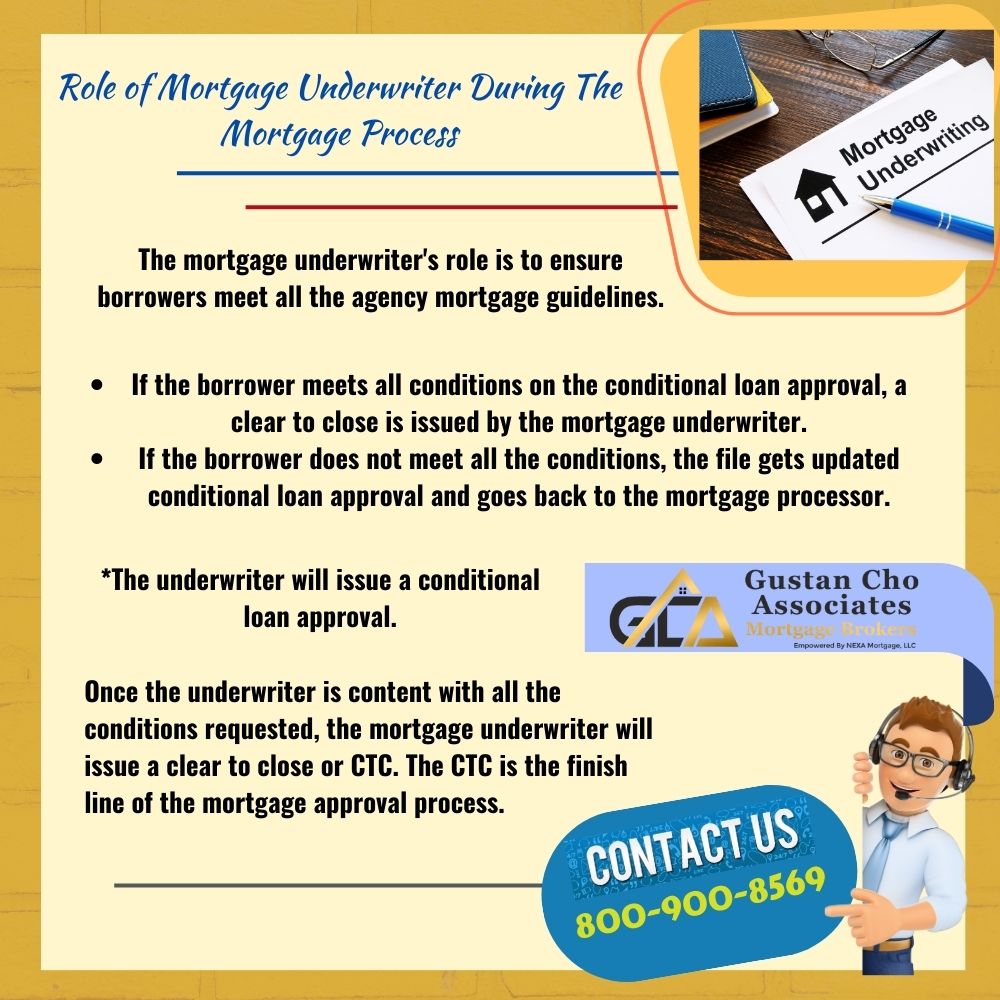

The mortgage underwriter’s role is to ensure borrowers meet all the agency mortgage guidelines. If the lender has lender overlays, it is the mortgage underwriter’s responsibility to ensure the lender’s overlays and guidelines are followed. If it is an FHA loan, the role of mortgage underwriter is to make sure that borrowers meet all HUD agency mortgage guidelines.

Not only does the borrower need to meet HUD guidelines, but the mortgage underwriter’s role is to ensure that borrowers meet the lender’s overlays.

Mortgage lender overlays are lending requirements that are above and beyond those of minimum mortgage lending guidelines. Once the mortgage underwriter feels that borrowers meet all the agency mortgage guidelines and overlays of the particular lender, the underwriter will issue a conditional loan approval.

Clear To Close During The Mortgage Process

Once a conditional mortgage approval is issued, the file returns to the mortgage processor. It is the processors’ job to gather all conditions on a conditional mortgage approval. Once the processor gathers all the conditions, the processor submits all conditions for a clear to close. The same underwriter who issued the conditional mortgage approval gets the file back. The underwriter will thoroughly review all conditions. Two things will happen at this time. If the borrower meets all conditions on the conditional loan approval, a clear to close is issued by the mortgage underwriter. If the borrower does not meet all the conditions, the file gets updated conditional loan approval and goes back to the mortgage processor.

Clearing Conditions and The Clear To Close

Mortgage underwriters can issue additional conditions, not on the initial conditional loan approval. The process of the mortgage processor gathering conditions and resubmitting to the mortgage underwriter can go back and forth a few times. There are instances where the mortgage underwriter can add new conditions not listed on a previous conditional loan approval on updated conditional loan approval.

Once the underwriter is content with all the conditions requested, the mortgage underwriter will issue a clear to close or CTC. The CTC is the finish line of the mortgage approval process.

The CTC is issued when the lender is ready to prepare the closing docs and is ready to fund the loan. Once the final CTC is issued, the mortgage processor will coordinate the home closing with the closing department of the lender and the title company. The closing date and time are scheduled, and the closing takes place at that time. The closing is where ownership changes hands, the title is transferred to the homebuyers, the mortgage closing docs are signed, the lender wires the funds, and the homebuyer gets the keys to their new home.

We can help. Please reach out to me at gcho@gustancho.com. There are several loan programs I have in mind that can benefit you.