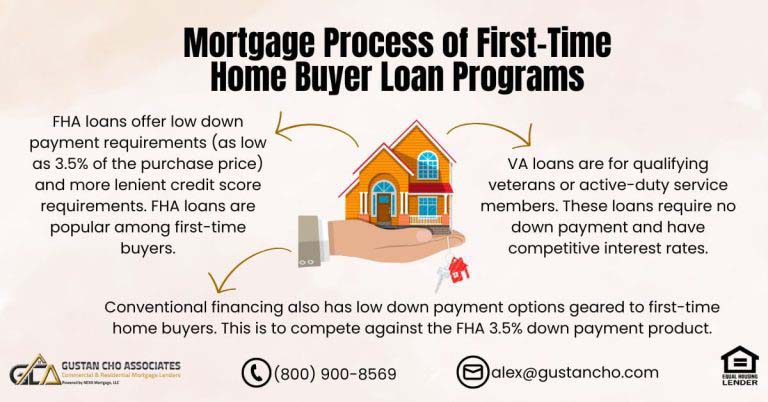

Mortgage Process of First-Time Home Buyer Loan Programs

This guide covers the mortgage process of first-time home buyer loan programs. First-time home buyers have dominated the housing market…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This guide covers the mortgage process of first-time home buyer loan programs. First-time home buyers have dominated the housing market…

Mortgage Underwriters will require one or more compensating factors for borrowers with higher debt to income ratio on manual underwrites to offset the risk of the higher DTI.

This guide covers VA late payment after bankruptcy mortgage guidelines on VA loans. VA loans were created and implemented to…

In this blog, we will cover and discuss the agency mortgage guidelines from the U.S. Department of Veterans Affairs for…

This guide covers the credit scores required for FHA and VA loans. Many borrowers are confused about the credit scores…

This blog covers the best Arizona mortgage lenders for bad credit with low FICO credit scores. It is an important…

This guide covers how the VA mortgage process work for homebuyers. How the VA mortgage process work? VA loans are…

Not all Florida VA lenders have the same lending requirements on VA loans. Not all Florida VA lenders do manual…

This guide covers VA credit score mortgage guidelines on VA home loans. VA mortgages are the best home loan program…

This guide covers disabled Veterans benefits on VA loans. The Department of Veterans Affairs (VA) insures and guarantees VA Loans…

This guide covers the eligibility guidelines for VA Jumbo Home Mortgages. Most veterans know they do not need a down…

Conventional Loans also referred to as Conforming Loans are not guaranteed and/or insured by the federal government. Conventional Loans need to …..

Eligible active duty and retired veterans meeting the minimum Washington VA loan requirements can qualify for VA loans with no…

This BLOG On Houston Housing Market For Veterans Of Our United States Military The Great City of Houston, Texas is…

This ARTICLE Is About VA Loans Alabama Mortgage Guidelines With No Lender Overlays Alabama is on the map. The state…

This ARTICLE On VA Co-Signer Mortgage Guidelines On VA Home Loans Was PUBLISHED On August 25th, 2020 2020 UPDATED VA…

This Article On VA Mortgage Guidelines For Same-Sex Married Couples Was Written By Gustan Cho of Gustan Cho Associates The…

This ARTICLE On Purple Heart Veterans Updated Mortgage Guidelines was PUBLISHED On December 12th, 2019 Many loyal Gustan Cho Associate’s…

This ARTICLE On Sacrifices Versus Benefits By Veterans And Their Families Was PUBLISHED On November 11th, 2019 There are many…