Gustan Cho Associates has over 280 wholesale lending partnerships. Gustan Cho Associates has a national reputation for its no lender overlays on government and conventional loans. We have a reputation for being able to do loans other lenders cannot do.

Gustan Cho Associates are mortgage brokers licensed in 48 states including Washington, DC, and Puerto Rico. The team at Gustan Cho Associates pride itself for having the states, the product, and the best rates for our clients.

Besides FHA, VA, USDA, and conventional loans, the team at Gustan Cho Associates can do non-QM loans, asset-depletion mortgages, bank statement loans, mortgages one day out of bankruptcy and foreclosure, fix and flip loans, and hundreds of other mortgage loan programs.

Types of Mortgage Lenders and Credit Unions

Credit Unions are financial institutions that are exempt from licensing like banks. Borrowers who are members of credit unions and have their checking, savings, and credit accounts there, may want to see if their credit union can qualify them for home loans. Many credit unions take care of their members. Credit Union members may want to see if their credit union will give them favorable rates and terms.

Types of Mortgage Lenders For Prime Borrowers

Borrowers with great credit and are members of a credit union might get the best rates and lower fees from their credit unions. Most credit unions take care of their members. Credit unions, like banks and mortgage bankers, are exempt from disclosing yield spread premiums and other fees and charges, unlike mortgage brokers. However, most credit unions have lender overlays and borrowers with less than perfect credit or higher debt to income ratios may not qualify at credit unions.

Get the Best Rate by Picking the Right Lender

We break down all the lender types so you can make a smart, money-saving choice.Types of Mortgage Lenders For Lowest Rates are Mortgage Brokers

Borrowers can get a wide variety of mortgage loan products. Borrowers can get way better rates with mortgage brokers versus mortgage bankers. Mortgage brokers are not mortgage bankers and do not fund loans. Mortgage Brokers need to get set up with relationships with wholesale mortgage lenders. Mortgage Brokers get paid a commission, also referred to as yield spread premiums, from wholesale mortgage lenders.

How Do Mortgage Lenders Price Rates?

The reason why mortgage brokers can get consumers the lowest rates versus mortgage bankers is that brokers can only get paid a 2.75% yield spread premium. Mortgage bankers normally charge a 7% to 10% yield spread premium. The more a lender makes, the higher the rates to the consumer. Brokers close loans in the name of the wholesale mortgage lender that funds the loans.

Shopping For The Best Mortgage Rates

Borrowers using mortgage brokers often get substantially lower rates than mortgage bankers. Consumers using mortgage brokers will get substantially lower mortgage rates than mortgage bankers and/or correspondent lenders. The maximum a mortgage broker make is 2.75% as a yield spread premium. Mortgage bankers make substantially more than 2.75% and do not have to disclose how much they make.

Using Brokers Versus Mortgage Bankers

There are advantages and disadvantages to working with mortgage brokers versus mortgage bankers. Mortgage brokers can have broker relationships with various different mortgage bankers. Mortgage brokers do not have any of their own liability in the event a loan goes into default. This is because they are not lenders but more of a matchmaker where they refer their borrowers to a wholesale mortgage lender.

The Disadvantage of Using Mortgage Brokers

The disadvantages are that mortgage brokers do not have control over the mortgage process. When mortgage brokers submit a loan to a mortgage banker, the underwriter underwriting the borrower’s file works for the mortgage banker and not the mortgage broker.

The clear to close, closing docs, and funding are at the mercy of the wholesale mortgage lender and not the mortgage broker.

Mortgage brokers do offer a valuable service for borrowers who are having a hard time qualifying for a mortgage due to credit or income issues. Mortgage brokers can have hundreds of wholesale lending partners while mortgage bankers are captive and can only offer their own government and/or conventional loans.

Why Use Mortgage Brokers And Not Mortgage Bankers?

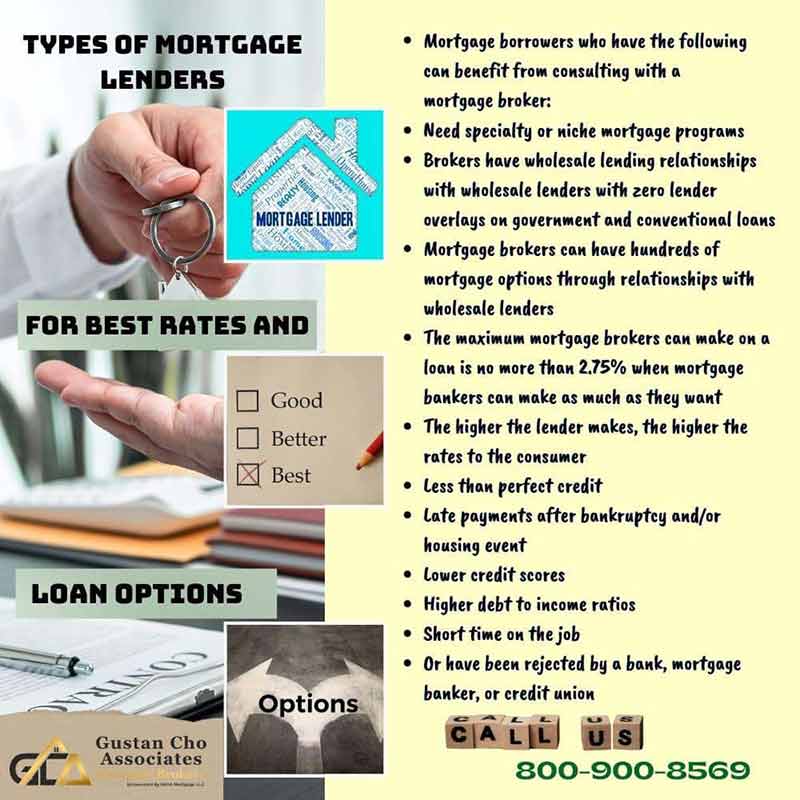

Mortgage borrowers who have the following can benefit from consulting with a mortgage broker:

- Need specialty or niche mortgage programs

- Brokers have wholesale lending relationships with wholesale lenders with zero lender overlays on government and conventional loans

- Mortgage brokers can have hundreds of mortgage options through relationships with wholesale lenders

- The maximum mortgage brokers can make on a loan is no more than 2.75% when mortgage bankers can make as much as they want

- The higher the lender makes, the higher the rates to the consumer

- Less than perfect credit

- Late payments after bankruptcy and/or housing event

- Lower credit scores

- Higher debt to income ratios

- Short time on the job

- Or have been rejected by a bank, mortgage banker, or credit union

Comparing Types of Mortgage Lenders

Mortgage Brokers Offer Wide Range of Loan Products at Lower Rates Than Mortgage Bankers. Choosing a mortgage broker may be a better option in getting a residential mortgage loan. Instead of shopping from lender to lender, borrowers can hire the services of a mortgage broker where the broker can do the shopping for the borrower. Mortgage brokers get paid a commission when borrowers close the loan and not beforehand. Brokers work for a commission called yield spread premium.

Why Using A Mortgage Broker Versus Mortgage Banker Can Save You Thousands of Dollars

Mortgage brokers need to be licensed and regulated. Brokers are not lenders. They need to develop relationships and agreements with mortgage lenders. The advantage of brokers is if a borrower does not qualify with a particular lender, the broker can take it to a different lender. Mortgage brokers cannot make more than 2.75% commission from lenders.

Mortgage bankers, banks, and credit unions do not charge commissions. They get paid on the back end when they resell the loan. Lenders compensate brokers via yield spread premium. The mortgage broker needs to disclose the YSP unlike banks, mortgage banks, and credit unions.

Various Types of Mortgage Lenders and Differences

Bankers, credit unions, and mortgage bankers are direct lenders. Bankers are captive only to their own products and have their own overlays when offering residential mortgage loans. These direct mortgage lenders. Many banks do not provide unbiased recommendations or selection of other mortgage products.

The Important of Customer Service by Loan Officers

Many banks or lenders with overlays will not help borrowers raise their credit scores or work with borrowers who do not yet qualify. Bankers also do not recommend borrowers to other mortgage lenders in the event of borrowers do not qualify for their own products. Borrowers who do not qualify for their own loan products, the borrower is out of luck and left on their own to find another bank or mortgage banker.

Mortgage Shopping Starts With the Right Lender

Whether you need low rates, flexible guidelines, or fast closings—there’s a lender for that.Best Mortgage Lenders With No Overlays With Best Rates

Over 75% of the borrowers of Gustan Cho Associates are folks who have either gotten a last-minute mortgage loan denial or who are stressed with their current lender and mortgage process. There is no reason for any borrower to stress over the mortgage process.

The main and only reason why borrowers get a last-minute loan denial and/or stress during the mortgage process is that they were not properly qualified initially by their loan officer. They were issued a pre-approval letter when they did not qualify.

Mortgage Brokers Versus Mortgage Bankers

On the flip side, mortgage brokers represent dozens of lenders. Many lenders are only captive to their own loan products and do not want to broker loans. There are different types of mortgage lenders with different mortgage requirements. Brokers can be objective. Mortgage brokers can select the appropriate lender that suits the borrowers’ credit and financial criteria.

In lieu of the mortgage brokers’ services, lenders will compensate mortgage brokers a commission called yield spread premium (YSP) which is disclosed on the Closing Disclosure (CD). The yield spread premium paid to the mortgage broker is normally 2.75%

Case Scenario In Using Mortgage Broker Versus Mortgage Banker

For example, if a borrower walks into their local bank where they have a banking relationship and apply for a mortgage loan that does not qualify, the bank can no longer help the borrower.

However, with a mortgage broker, in the event, if the borrowers get denied a mortgage from a particular lender, the broker has the borrower’s files and can resubmit them to another lender. The borrower may have to sign new paperwork of the new lender and start the whole mortgage application again

Types of Mortgage Lenders: Hybrid Model of Being Correspondent Lender and Broker at the Same Time

NEXA Mortgage LLC dba Gustan Cho Associates has a national reputation for its no-lender overlays business model. We are also correspondent lenders and have the ability to broker loans. Borrowers who got denied from a bank, credit union, or other mortgage bankers due to their overlays, you have come to the right place. As long as the borrower has an Automated Underwriting System approval per DU Findings please contact us at gcho@gustancho.com or call us at 800-900-8569. Or text us for a faster response.

The AUS Approval is the final mortgage loan approval. I can also help borrowers after a one-year waiting period after a bankruptcy. No waiting period after foreclosure, deed in lieu of foreclosure, or short sale qualify for a residential mortgage loan with our NON-QM Loan Program. We launched our bank statement mortgage loan program for self-employed borrowers.

Types of Mortgage Lenders With a Reputation of Being Able to Do Loans Other Lenders Cannot Do

In this blog, we will cover and discuss the types of lenders for getting the best mortgage rates and having the most mortgage loan programs options available. There are various types of lenders. Borrowers may benefit from one type of mortgage lender versus a different type.

Mortgage Borrowers should do extensive research on the type of lenders they may benefit from. Not all lenders are the same. You often hear about a mortgage company being a direct lender versus a mortgage broker.

Best Mortgage Calculator with PMI and DTI

Types of Mortgage Lenders For The Best Rates

The key is what types of lenders offer the best rates. The key to getting the lowest rates possible is how much the lender makes on the back end. The more the lender makes on the back end means the higher the mortgage rates to consumers.

Mortgage brokers are capped at how much they can make by law. Mortgage bankers do not have a cap on how much they can make. We will explain the mechanics of mortgage brokers versus mortgage bankers and what types of lenders can yield the best rates and terms for you, the consumer. The best rates are offered by mortgage brokers.

Types of Mortgage Lenders With Most Loan Products

Mortgage brokers can offer hundreds of different types of mortgage options whereas most mortgage bankers are captive and can only offer government and/or conventional loans. Mortgage bankers will only offer FHA, VA, USDA, and conventional loans. However, mortgage bankers can offer wholesale mortgage products such as non-QM and alternative financing loan programs.

Comparing Rates Between Mortgage Bankers Versus Mortgage Brokers

Mortgage bankers will steer their loan officers to just offer their in-house government and conventional loans because they can only make a 2.75% yield spread premium on brokered mortgage products but can make 7% to 9% commission with their in-house banking products. Mortgage brokers can have hundreds of wholesale lending partners. Brokers can offer owner-occupant, second home, investment properties loan programs as well as commercial loans, hard money loans, no-doc loans, asset depletion mortgages, and hundreds of other loan programs in the marketplace.

Types of Mortgage Lenders With Lowest Rates

Mortgage brokers cannot charge more than a 2.75% yield spread premium (broker compensation/commissions) and the yield spread premium needs to be disclosed on the Closing Disclosure. There is no limit on the amount of commission a mortgage banker can charge and they do not need to disclose the commission.

The reason mortgage bankers do not need to disclose how much they make is because they close the loan under their own name using their warehouse line of credit. Most mortgage bankers charge substantially over 2.75%. The higher the lender compensation, the higher the rate to the borrower.

It is not uncommon for mortgage bankers to charge a 7% or higher commission on the back end which is almost triple the yield spread premium mortgage brokers can charge. The more a mortgage company charges on the back end, the higher the mortgage rates for the borrower. It is very important how much you get charged by mortgage bankers.

Where Do I Get More Options of Loan Programs

There are mortgage brokers who are middlemen between borrowers and lenders. There are full eagle mortgage bankers who are the actual lender where they have relationships with other larger mortgage bankers. Correspondent lenders are lenders who use their money from their warehouse lines of credit. Mortgage bankers fund loans with their own money with a partnership of a full eagle lender. Mini-correspondent lending is smaller types of mortgage lenders that originate and fund the loans under their own company name.

What Does High Lender Compensation Mean to Rates

Mortgage bankers have higher mortgage rates than mortgage brokers because they have higher overheads. There is no way mortgage bankers can survive with a 2.75% yield spread premium. Most mortgage bankers charge a 7% to 9% commission on the back end which means higher rates for consumers. We will discuss the types of lenders and how the mortgage process works in this blog.

Calculate Your Debt to Income Ratios

Choose the Right Lender for the Best Deal

Not all lenders are created equal. Learn the differences and find the best rate for your situation.What Types of Mortgage Lenders are Mortgage Brokers

Mortgage Brokers are licensed mortgage professionals. Brokers are licensed professionals who act as a go-between between a wholesale mortgage lender and a borrower. Brokers are not stuck with one particular mortgage lender’s processing and underwriting team. Brokers do have their own mortgage processors who are trained to be familiar with the actual wholesale lenders’ mortgage guidelines and requirements. Mortgage Brokers get paid a commission after the loan closes.

Mortgage Brokers versus Mortgage Bankers Commission

Broker’s commissions are disclosed on the Closing Disclosure as a Yield Spread Premium. One disadvantage of mortgage brokers is they are capped on only making a 2.75% yield spread premium whereas mortgage bankers can make more than 7% to 9% in compensation. However, borrowers benefit greatly from using mortgage brokers versus mortgage bankers because they get the lowest rates in the marketplace. The less the mortgage lender makes, the lower the rates.

Benefits of Using Mortgage Brokers For a Variety of Mortgage Options

Mortgage Brokers may have over a dozen or more lenders they do business with. Mortgage brokers can also have hundreds of wholesale lenders. Gustan Cho Associates empowered by NEXA Mortgage, LLC NMLS 1660690 has over lending associations and partnerships with over 280 wholesale mortgage lenders.

Types of Mortgage Lenders: Banks and Credit Unions

Many banks offer mortgage loans. Banks are FDIC regulated. Credit Unions are exempt from licensing as well. Here is what Investopedia defines a federal credit union as:

Types of Mortgage Lenders: Licensed Loan Officers Versus Non-Licensed Registered Loan Originators

Loan Officers at banks do not have to be licensed. Bank loan officers are exempt from NMLS Licensing. They just need to be registered with the NMLS. Most loan officers who work at banks can do business in all 50 states without being licensed. One disadvantage of working with a loan officer employed by a bank is banks have many overlays. For example, to qualify for an FHA loan with a 3.5% down payment, the minimum credit score required is 580 FICO.

Lender Overlays by Mortgage Bankers

Most banks require 640 FICO even though FHA only requires 580. The higher credit score required by banks is called lender overlays. FHA does not require outstanding collections and charged-off accounts to be paid to qualify for FHA loans. However, most banks require all collection and charged-off accounts to be paid in order to qualify for FHA loans. This is called a lender overlays on collections and charged off account. Borrowers with bad credit and/or lower credit scores will need other lenders with no overlays besides banks to qualify for home loans.

Types of Mortgage Lenders: Mortgage Bankers

Mortgage bankers are companies who use their own money to fund home loans. Mortgage Bankers have warehouse lines of credit they use to originate and fund government and conventional loans.

They tap into their warehouse lines of credit to fund the loan. After the loan funds, the mortgage banker then sells the loan they funded on the secondary market and/or to a larger mortgage banker that pools loans together and sells them to the secondary market.

Lender Compensation Among Types of Mortgage Lenders

Mortgage Bankers are exempt from disclosing how much they make like mortgage brokers. Mortgage brokers cannot make more than a 2.75% yield spread premium. However, mortgage bankers do not have to disclose their compensation on the closing disclosure because the law states if you fund and close the loan in your company name, you are exempt. Mortgage bankers have substantially higher rates than brokers.

How The Mortgage Banking and Warehouse Line of Credit Business Work

Once the loans are sold on the secondary market, the proceeds are used to pay down the warehouse lines of credit. Mortgage Bankers make money from the spread they make between the loans they fund and the sale on the secondary market. The yield spread premium (YSP) is not disclosed on the Closing Disclosure.

Types of Mortgage Lenders: Mortgage Bankers Do Not Have to Disclose Their Compensation

Due to being able to fund with their own money, mortgage bankers have full control over mortgage brokers. Mortgage Brokers are licensed professionals who have lending relationships with wholesale mortgage lenders. Brokers are dependent on lenders for underwriting and funding decisions. If brokers are not happy with a particular underwriter from a wholesale lender, they can always take the file to a different wholesale lender. Some mortgage bankers have the ability to broker loans out.

What Are Correspondent Lenders

Other types of lenders are correspondent lenders. Correspondent Lenders use their own money to originate and fund government and conventional loans. However, they partner up with a full eagle mortgage banker. The mortgage banker will underwrite the file. The correspondent lender will then close the loan under their name. The correspondent lender will prepare closing docs and fund the loan.

The correspondent lender will use their own warehouse line of credit to fund the loan. After the loan funds, the correspondent lender will sell the loan to the mortgage banker who has underwritten the loan. The mortgage banker will pay the correspondent lender. The correspondent lender will then pay down their warehouse lines of credit so they can originate and fund more mortgage loans

NON-QM and Portfolio Lenders

NON-QM Loans are alternative types of lenders that cater to borrowers who cannot qualify for government and/or conventional loans. There are no waiting period requirements after bankruptcy and/or a housing event such as foreclosure, deed in lieu, or short sale with non-QM loans. NON-QM Lenders partner with mortgage bankers and brokers to get business Self-employed borrowers can benefit from non-QM bank statement loans where no income tax returns are required. A large percentage of our business at Gustan Cho Associates are non-QM mortgages.

Which Types of Mortgage Lenders Is Best For Me?

A borrower with 800 FICO, low debt to income ratio, no credit blemishes, the large down payment can choose any types of mortgage lenders and will get approved. However, borrowers with past credit/income issues may need to choose a lender that can cater to their individual needs. Gustan Cho Associates is a mortgage company licensed in 48 states with lending partnerships with over 160 wholesale mortgage lenders.

Our wholesale lenders have no lender overlays on government and conventional loans. We also have the ability to broker non-QM loans as well as specialty loan programs with our many wholesale mortgage lending partners. Please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. We are available 7 days a week, on evenings, weekends, and holidays.

Get the Best Rate by Picking the Right Lender

We break down all the lender types so you can make a smart, money-saving choice.In this blog, we will discuss and cover the types of mortgage lenders homebuyers can consult with to get pre-approved for a home mortgage. There are different types of mortgage lenders. Most people are not familiar with the mortgage process. There are three types of government loans. FHA, VA, and USDA loans. Government-backed loans are the only home loans that offer low down payment requirements. There are government-backed home loans, conventional loans, and non-QM mortgage loans. Government-backed mortgages are for owner-occupant properties only.

You can buy owner-occupant, second homes, and investment properties with conventional loans. Non-QM loans are alternative forms of financing for owner-occupant, second homes, and investment properties.

Fannie Mae and Freddie Mac set the standards of conventional loans. Conventional loans are also referred to as conforming loans. The reason conventional loans are called conforming loans is that conventional loans need to conform to Fannie and Freddie Guidelines. Conventional loans are not backed by any government agencies. Most folks only need to consult lenders at most half a dozen times in their lifetime. This holds true unless they are professional real estate investors. Not all lenders have the same mortgage guidelines.

Types of Mortgage Lenders on Government Versus Conventional Loans

Government loans are backed by the federal government in the event borrowers default on the loan. There are three government-backed loan programs. HUD, the parent of FHA, insures FHA loans. The U.S. Department of Agriculture Rural Development insures USDA loans. The Veterans Administration insures VA loans. Government backed loans are for primary owner-occupant homes only.

Due to the government guarantee, private lenders can offer government-backed mortgage loans with little to no money down at competitive rates. FHA, USDA, and VA loans are the three government-backed mortgage loans.

FHA loans only require a 3.5% down payment on a home purchase. USDA and VA loans does not have a down payment requirement. Gustan Cho Associates, empowered by NEXA Mortgage, LLC, are experts in originating government-backed loans with no lender overlays.

Choose the Right Lender for the Best Deal

Not all lenders are created equal. Learn the differences and find the best rate for your situation.Government-Backed Mortgage Loans

Government loans are guaranteed by the federal government to private lenders. Private lenders originate and fund government-backed loans. Here are the three government-backed mortgage loans.

- FHA loans are guaranteed by the U.S. Department of Housing and Urban Development (HUD)

- VA loans guaranteed by the U.S. Department of Veteran Affairs

- USDA loans guaranteed by the U.S. Department of Agriculture Rural Development

HUD, VA, and USDA do not originate, or fund government-backed loans. Private lenders originate and fund FHA, VA, and USDA loans. The government agencies acts like a mortgage insurer.

Types of Mortgage Lenders: What Are Government Loans

Government loans are owner-occupant home loans originated and funded by private mortgage lenders and banks. The governmental agency insures the individual banks and/or lenders’ losses incurred by lenders in the event the borrower defaults on their government loans.

Government-backed loans has little to no down payment requirements with competitive rates. Homebuyers with prior bad credit and low credit scores are eligible to qualify for government-backed loans. FHA, USDA, and VA loans are the three government-backed loans.

However, in order for the government to guarantee the home loans in default, the lender needs to follow the government mortgage guidelines at the time of originating the loan

What Is The Role of Fannie Mae and Freddie Mac in the Mortgage Industry?

Fannie Mae and Freddie Mac are the two mortgage giants that set mortgage guidelines for Conventional loans. Conventional loans also referred to as Conforming loans, are not guaranteed and backed by the federal government. The role of Fannie Mae and Freddie Mac is to provide liquidity in the housing and mortgage markets.

Fannie Mae and Freddie Mac are the two giant government sponsored enterprises (GSEs) and largest buyers of mortgage loans from lenders. Without Fannie and Freddie, lenders would not be able to sell their warehouse line of credit to make more loans.

How conventional loans work is mortgage lenders need to abide by Fannie Mae and/or Freddie Mac Mortgage Guidelines. This holds true if they want to sell the closed loans on the secondary market to either Fannie and/or Freddie. If closed conventional loans do not conform to Fannie Mae and/or Freddie Mac’s guidelines, these two GSEs will not purchase them. The lender is stuck holding them on their books.

Why Are Conventional Loans Called Conforming Loans

Fannie Mae and Freddie Mac are the two mortgage giants in the nation. This is the reason why mortgage borrowers need to meet Fannie Mae and/or Freddie Mac’s guidelines. Fannie Mae and Freddie Mac are the two largest buyers of mortgages in the secondary market. The role of Fannie Mae and Freddie Mac is to keep liquidity in the housing market by purchasing mortgage loans on the secondary market.

Lenders use their warehouse line of credit to fund loans. Mortgage companies need to sell the loans they fund on the secondary market in order to repeat making loans over and over.

Fannie Mae and Freddie Mac buys loans on the secondary market so lenders can repeat the process. Fannie and Freddie will only purchase home loans that conform to their lending guidelines. No lender wants to keep the mortgage loans they originate in their books. Whether they are government loans or conventional loans, all lenders want to sell the loans they closed on the secondary market.

Researching Types of Mortgage Lenders For Best Rates and Selection of Loan Options

Borrowers have a wide variety of Types of Mortgage Lenders to choose from in applying for a residential mortgage loan. They can go to their local bank, a national bank like Chase, Wells Fargo, Bank of America, Citibank, or any regional bank. They can also choose their local credit union. Or the hundreds of mortgage bankers or mortgage brokers locally or nationally. Not all lenders have the same mortgage rates on government and conventional loans. It is highly advised for homebuyers to shop for rates.

The team at Gustan Cho Associates highly recommend borrowers to shop for rates to get the best rate and term on a home loan.

Borrowers now can apply for a residential mortgage loan in the comfort of their own homes. They can apply via online mortgage applications instead of visiting a lender face to face like they needed to do. Everything in mortgage lending, from the initial application, to submitting documents is all electronic now and done via email and/or fax.

Agency Mortgage Guidelines Versus Lender Overlays

As mentioned earlier, not all mortgage bankers have the same lending guidelines. Most of them have lender overlays. So if a borrower may meet all federal and/or conventional loan guidelines does not necessarily mean that they will qualify with all mortgage lenders and/or banks. Lender overlays are lending requirements set by the individual lender and not by HUD, VA, USDA, Fannie Mae, or Freddie Mac.

Just because one lender denies a borrower a loan does not mean the borrower cannot qualify and get approved for a mortgage loan by a different lender.

Borrowers need to find out what overlays each lender has and whether or not the overlays will affect them in them getting qualified. Gustan Cho Associates is a mortgage company licensed in 48 states with a national reputation for its no overlays on government and conventional loans.

The Right Lender Can Save You Thousands

Banks, brokers, credit unions—each offers something different. Discover which one fits your goals.Choosing The Types of Mortgage Lenders Which Is Best For Me

Certain mortgage lenders are direct mortgage loan lenders such as retail banks and have retail brick and mortar locations. The first thought of most home buyers is to go to their local bank when applying for a home mortgage. In general, mortgage brokers offer the best rates to borrowers. Mortgage brokers are capped at 2.75% yield spread premium, which is the total commission. Mortgage brokers need to disclose the yield spread premium. Mortgage bankers normally charge more than 5.00% compensation on the back end.

The compensation by mortgage bankers do not get to get disclosed like mortgage brokers. The higher the compensation, the higher the rates to the borrower.

However, most banks have lender overlays and are very strict when it comes to credit and debt to income ratio requirements. Banks are a good place to get qualified for borrowers with good credit, low debt to income ratios, and no derogatory credit

Types of Mortgage Lenders: Qualifying For Mortgages With FDIC Banks

Banks normally have higher lending requirements than state-licensed mortgage companies. Many banks’ mortgage rates are generally higher than mortgage bankers. This is due to their higher overhead such as advertising and having retail salaried staff in their residential mortgage lending division. Banks rely on advertising and name recognition. Banks do not have to disclose how much they make in yield spread premium like mortgage brokers do. They are exempt from disclosing many fees. Mortgage brokers need to disclose the yield spread premium on the closing disclosure.

The maximum yield spread premium mortgage brokers can charge is 2.75%. Mortgage bankers do not need to disclose their compensation because they use their own money to fund the loan.

Most mortgage bankers make over 5.00% compensation on the back end. The higher the back end compensation, the higher the mortgage rate to the borrower. This is why mortgage brokers has a lower rate for borrowers. Mortgage brokers do not have that luxury and need to disclose their yield spread premium as well as other fees, unlike banks and mortgage bankers. Loan Officers at banks do not have to be licensed. This is since the federal government exempts any loan officer working at an FDIC Bank from licensing. The advantage of banks is they can do business in all 50 states and not be licensed. Loan officers at banks, and credit unions need to registered and NOT licensed.

Types of Mortgage Lenders With No Overlays are Mortgage Brokers

Gustan Cho Associates has over 280 wholesale lending partnerships. Gustan Cho Associates has a national reputation for its no lender overlays on government and conventional loans. We have a reputation for being able to do loans other lenders cannot do.

Gustan Cho Associates are mortgage brokers licensed in 48 states including Washington, DC, and Puerto Rico. The team at Gustan Cho Associates pride itself for having the states, the product, and the best rates for our clients.

Besides FHA, VA, USDA, and conventional loans, the team at Gustan Cho Associates can do non-QM loans, asset-depletion mortgages, bank statement loans, mortgages one day out of bankruptcy and foreclosure, fix and flip loans, and hundreds of other mortgage loan programs.

Types of Mortgage Lenders and Credit Unions

Credit Unions are financial institutions that are exempt from licensing like banks. Borrowers who are members of credit unions and have their checking, savings, and credit accounts there, may want to see if their credit union can qualify them for home loans. Many credit unions take care of their members. Credit Union members may want to see if their credit union will give them favorable rates and terms.

Types of Mortgage Lenders For Prime Borrowers

Borrowers with great credit and are members of a credit union might get the best rates and lower fees from their credit unions. Most credit unions take care of their members. Credit unions, like banks and mortgage bankers, are exempt from disclosing yield spread premiums and other fees and charges, unlike mortgage brokers. However, most credit unions have lender overlays and borrowers with less than perfect credit or higher debt to income ratios may not qualify at credit unions.

Get the Best Rate by Picking the Right Lender

We break down all the lender types so you can make a smart, money-saving choice.Types of Mortgage Lenders For Lowest Rates are Mortgage Brokers

Borrowers can get a wide variety of mortgage loan products. Borrowers can get way better rates with mortgage brokers versus mortgage bankers. Mortgage brokers are not mortgage bankers and do not fund loans. Mortgage Brokers need to get set up with relationships with wholesale mortgage lenders. Mortgage Brokers get paid a commission, also referred to as yield spread premiums, from wholesale mortgage lenders.

How Do Mortgage Lenders Price Rates?

The reason why mortgage brokers can get consumers the lowest rates versus mortgage bankers is that brokers can only get paid a 2.75% yield spread premium. Mortgage bankers normally charge a 7% to 10% yield spread premium. The more a lender makes, the higher the rates to the consumer. Brokers close loans in the name of the wholesale mortgage lender that funds the loans.

Shopping For The Best Mortgage Rates

Borrowers using mortgage brokers often get substantially lower rates than mortgage bankers. Consumers using mortgage brokers will get substantially lower mortgage rates than mortgage bankers and/or correspondent lenders. The maximum a mortgage broker make is 2.75% as a yield spread premium. Mortgage bankers make substantially more than 2.75% and do not have to disclose how much they make.

Using Brokers Versus Mortgage Bankers

There are advantages and disadvantages to working with mortgage brokers versus mortgage bankers. Mortgage brokers can have broker relationships with various different mortgage bankers. Mortgage brokers do not have any of their own liability in the event a loan goes into default. This is because they are not lenders but more of a matchmaker where they refer their borrowers to a wholesale mortgage lender.

The Disadvantage of Using Mortgage Brokers

The disadvantages are that mortgage brokers do not have control over the mortgage process. When mortgage brokers submit a loan to a mortgage banker, the underwriter underwriting the borrower’s file works for the mortgage banker and not the mortgage broker.

The clear to close, closing docs, and funding are at the mercy of the wholesale mortgage lender and not the mortgage broker.

Mortgage brokers do offer a valuable service for borrowers who are having a hard time qualifying for a mortgage due to credit or income issues. Mortgage brokers can have hundreds of wholesale lending partners while mortgage bankers are captive and can only offer their own government and/or conventional loans.

Why Use Mortgage Brokers And Not Mortgage Bankers?

Mortgage borrowers who have the following can benefit from consulting with a mortgage broker:

- Need specialty or niche mortgage programs

- Brokers have wholesale lending relationships with wholesale lenders with zero lender overlays on government and conventional loans

- Mortgage brokers can have hundreds of mortgage options through relationships with wholesale lenders

- The maximum mortgage brokers can make on a loan is no more than 2.75% when mortgage bankers can make as much as they want

- The higher the lender makes, the higher the rates to the consumer

- Less than perfect credit

- Late payments after bankruptcy and/or housing event

- Lower credit scores

- Higher debt to income ratios

- Short time on the job

- Or have been rejected by a bank, mortgage banker, or credit union

Comparing Types of Mortgage Lenders

Mortgage Brokers Offer Wide Range of Loan Products at Lower Rates Than Mortgage Bankers. Choosing a mortgage broker may be a better option in getting a residential mortgage loan. Instead of shopping from lender to lender, borrowers can hire the services of a mortgage broker where the broker can do the shopping for the borrower. Mortgage brokers get paid a commission when borrowers close the loan and not beforehand. Brokers work for a commission called yield spread premium.

Why Using A Mortgage Broker Versus Mortgage Banker Can Save You Thousands of Dollars

Mortgage brokers need to be licensed and regulated. Brokers are not lenders. They need to develop relationships and agreements with mortgage lenders. The advantage of brokers is if a borrower does not qualify with a particular lender, the broker can take it to a different lender. Mortgage brokers cannot make more than 2.75% commission from lenders.

Mortgage bankers, banks, and credit unions do not charge commissions. They get paid on the back end when they resell the loan. Lenders compensate brokers via yield spread premium. The mortgage broker needs to disclose the YSP unlike banks, mortgage banks, and credit unions.

Various Types of Mortgage Lenders and Differences

Bankers, credit unions, and mortgage bankers are direct lenders. Bankers are captive only to their own products and have their own overlays when offering residential mortgage loans. These direct mortgage lenders. Many banks do not provide unbiased recommendations or selection of other mortgage products.

The Important of Customer Service by Loan Officers

Many banks or lenders with overlays will not help borrowers raise their credit scores or work with borrowers who do not yet qualify. Bankers also do not recommend borrowers to other mortgage lenders in the event of borrowers do not qualify for their own products. Borrowers who do not qualify for their own loan products, the borrower is out of luck and left on their own to find another bank or mortgage banker.

Mortgage Shopping Starts With the Right Lender

Whether you need low rates, flexible guidelines, or fast closings—there’s a lender for that.Best Mortgage Lenders With No Overlays With Best Rates

Over 75% of the borrowers of Gustan Cho Associates are folks who have either gotten a last-minute mortgage loan denial or who are stressed with their current lender and mortgage process. There is no reason for any borrower to stress over the mortgage process.

The main and only reason why borrowers get a last-minute loan denial and/or stress during the mortgage process is that they were not properly qualified initially by their loan officer. They were issued a pre-approval letter when they did not qualify.

Mortgage Brokers Versus Mortgage Bankers

On the flip side, mortgage brokers represent dozens of lenders. Many lenders are only captive to their own loan products and do not want to broker loans. There are different types of mortgage lenders with different mortgage requirements. Brokers can be objective. Mortgage brokers can select the appropriate lender that suits the borrowers’ credit and financial criteria.

In lieu of the mortgage brokers’ services, lenders will compensate mortgage brokers a commission called yield spread premium (YSP) which is disclosed on the Closing Disclosure (CD). The yield spread premium paid to the mortgage broker is normally 2.75%

Case Scenario In Using Mortgage Broker Versus Mortgage Banker

For example, if a borrower walks into their local bank where they have a banking relationship and apply for a mortgage loan that does not qualify, the bank can no longer help the borrower.

However, with a mortgage broker, in the event, if the borrowers get denied a mortgage from a particular lender, the broker has the borrower’s files and can resubmit them to another lender. The borrower may have to sign new paperwork of the new lender and start the whole mortgage application again

Types of Mortgage Lenders: Hybrid Model of Being Correspondent Lender and Broker at the Same Time

NEXA Mortgage LLC dba Gustan Cho Associates has a national reputation for its no-lender overlays business model. We are also correspondent lenders and have the ability to broker loans. Borrowers who got denied from a bank, credit union, or other mortgage bankers due to their overlays, you have come to the right place. As long as the borrower has an Automated Underwriting System approval per DU Findings please contact us at gcho@gustancho.com or call us at 800-900-8569. Or text us for a faster response.

The AUS Approval is the final mortgage loan approval. I can also help borrowers after a one-year waiting period after a bankruptcy. No waiting period after foreclosure, deed in lieu of foreclosure, or short sale qualify for a residential mortgage loan with our NON-QM Loan Program. We launched our bank statement mortgage loan program for self-employed borrowers.

Types of Mortgage Lenders With a Reputation of Being Able to Do Loans Other Lenders Cannot Do

In this blog, we will cover and discuss the types of lenders for getting the best mortgage rates and having the most mortgage loan programs options available. There are various types of lenders. Borrowers may benefit from one type of mortgage lender versus a different type.

Mortgage Borrowers should do extensive research on the type of lenders they may benefit from. Not all lenders are the same. You often hear about a mortgage company being a direct lender versus a mortgage broker.

Best Mortgage Calculator with PMI and DTI

Types of Mortgage Lenders For The Best Rates

The key is what types of lenders offer the best rates. The key to getting the lowest rates possible is how much the lender makes on the back end. The more the lender makes on the back end means the higher the mortgage rates to consumers.

Mortgage brokers are capped at how much they can make by law. Mortgage bankers do not have a cap on how much they can make. We will explain the mechanics of mortgage brokers versus mortgage bankers and what types of lenders can yield the best rates and terms for you, the consumer. The best rates are offered by mortgage brokers.

Types of Mortgage Lenders With Most Loan Products

Mortgage brokers can offer hundreds of different types of mortgage options whereas most mortgage bankers are captive and can only offer government and/or conventional loans. Mortgage bankers will only offer FHA, VA, USDA, and conventional loans. However, mortgage bankers can offer wholesale mortgage products such as non-QM and alternative financing loan programs.

Comparing Rates Between Mortgage Bankers Versus Mortgage Brokers

Mortgage bankers will steer their loan officers to just offer their in-house government and conventional loans because they can only make a 2.75% yield spread premium on brokered mortgage products but can make 7% to 9% commission with their in-house banking products. Mortgage brokers can have hundreds of wholesale lending partners. Brokers can offer owner-occupant, second home, investment properties loan programs as well as commercial loans, hard money loans, no-doc loans, asset depletion mortgages, and hundreds of other loan programs in the marketplace.

Types of Mortgage Lenders With Lowest Rates

Mortgage brokers cannot charge more than a 2.75% yield spread premium (broker compensation/commissions) and the yield spread premium needs to be disclosed on the Closing Disclosure. There is no limit on the amount of commission a mortgage banker can charge and they do not need to disclose the commission.

The reason mortgage bankers do not need to disclose how much they make is because they close the loan under their own name using their warehouse line of credit. Most mortgage bankers charge substantially over 2.75%. The higher the lender compensation, the higher the rate to the borrower.

It is not uncommon for mortgage bankers to charge a 7% or higher commission on the back end which is almost triple the yield spread premium mortgage brokers can charge. The more a mortgage company charges on the back end, the higher the mortgage rates for the borrower. It is very important how much you get charged by mortgage bankers.

Where Do I Get More Options of Loan Programs

There are mortgage brokers who are middlemen between borrowers and lenders. There are full eagle mortgage bankers who are the actual lender where they have relationships with other larger mortgage bankers. Correspondent lenders are lenders who use their money from their warehouse lines of credit. Mortgage bankers fund loans with their own money with a partnership of a full eagle lender. Mini-correspondent lending is smaller types of mortgage lenders that originate and fund the loans under their own company name.

What Does High Lender Compensation Mean to Rates

Mortgage bankers have higher mortgage rates than mortgage brokers because they have higher overheads. There is no way mortgage bankers can survive with a 2.75% yield spread premium. Most mortgage bankers charge a 7% to 9% commission on the back end which means higher rates for consumers. We will discuss the types of lenders and how the mortgage process works in this blog.

Calculate Your Debt to Income Ratios

Choose the Right Lender for the Best Deal

Not all lenders are created equal. Learn the differences and find the best rate for your situation.What Types of Mortgage Lenders are Mortgage Brokers

Mortgage Brokers are licensed mortgage professionals. Brokers are licensed professionals who act as a go-between between a wholesale mortgage lender and a borrower. Brokers are not stuck with one particular mortgage lender’s processing and underwriting team. Brokers do have their own mortgage processors who are trained to be familiar with the actual wholesale lenders’ mortgage guidelines and requirements. Mortgage Brokers get paid a commission after the loan closes.

Mortgage Brokers versus Mortgage Bankers Commission

Broker’s commissions are disclosed on the Closing Disclosure as a Yield Spread Premium. One disadvantage of mortgage brokers is they are capped on only making a 2.75% yield spread premium whereas mortgage bankers can make more than 7% to 9% in compensation. However, borrowers benefit greatly from using mortgage brokers versus mortgage bankers because they get the lowest rates in the marketplace. The less the mortgage lender makes, the lower the rates.

Benefits of Using Mortgage Brokers For a Variety of Mortgage Options

Mortgage Brokers may have over a dozen or more lenders they do business with. Mortgage brokers can also have hundreds of wholesale lenders. Gustan Cho Associates empowered by NEXA Mortgage, LLC NMLS 1660690 has over lending associations and partnerships with over 280 wholesale mortgage lenders.

Types of Mortgage Lenders: Banks and Credit Unions

Many banks offer mortgage loans. Banks are FDIC regulated. Credit Unions are exempt from licensing as well. Here is what Investopedia defines a federal credit union as:

Types of Mortgage Lenders: Licensed Loan Officers Versus Non-Licensed Registered Loan Originators

Loan Officers at banks do not have to be licensed. Bank loan officers are exempt from NMLS Licensing. They just need to be registered with the NMLS. Most loan officers who work at banks can do business in all 50 states without being licensed. One disadvantage of working with a loan officer employed by a bank is banks have many overlays. For example, to qualify for an FHA loan with a 3.5% down payment, the minimum credit score required is 580 FICO.

Lender Overlays by Mortgage Bankers

Most banks require 640 FICO even though FHA only requires 580. The higher credit score required by banks is called lender overlays. FHA does not require outstanding collections and charged-off accounts to be paid to qualify for FHA loans. However, most banks require all collection and charged-off accounts to be paid in order to qualify for FHA loans. This is called a lender overlays on collections and charged off account. Borrowers with bad credit and/or lower credit scores will need other lenders with no overlays besides banks to qualify for home loans.

Types of Mortgage Lenders: Mortgage Bankers

Mortgage bankers are companies who use their own money to fund home loans. Mortgage Bankers have warehouse lines of credit they use to originate and fund government and conventional loans.

They tap into their warehouse lines of credit to fund the loan. After the loan funds, the mortgage banker then sells the loan they funded on the secondary market and/or to a larger mortgage banker that pools loans together and sells them to the secondary market.

Lender Compensation Among Types of Mortgage Lenders

Mortgage Bankers are exempt from disclosing how much they make like mortgage brokers. Mortgage brokers cannot make more than a 2.75% yield spread premium. However, mortgage bankers do not have to disclose their compensation on the closing disclosure because the law states if you fund and close the loan in your company name, you are exempt. Mortgage bankers have substantially higher rates than brokers.

How The Mortgage Banking and Warehouse Line of Credit Business Work

Once the loans are sold on the secondary market, the proceeds are used to pay down the warehouse lines of credit. Mortgage Bankers make money from the spread they make between the loans they fund and the sale on the secondary market. The yield spread premium (YSP) is not disclosed on the Closing Disclosure.

Types of Mortgage Lenders: Mortgage Bankers Do Not Have to Disclose Their Compensation

Due to being able to fund with their own money, mortgage bankers have full control over mortgage brokers. Mortgage Brokers are licensed professionals who have lending relationships with wholesale mortgage lenders. Brokers are dependent on lenders for underwriting and funding decisions. If brokers are not happy with a particular underwriter from a wholesale lender, they can always take the file to a different wholesale lender. Some mortgage bankers have the ability to broker loans out.

What Are Correspondent Lenders

Other types of lenders are correspondent lenders. Correspondent Lenders use their own money to originate and fund government and conventional loans. However, they partner up with a full eagle mortgage banker. The mortgage banker will underwrite the file. The correspondent lender will then close the loan under their name. The correspondent lender will prepare closing docs and fund the loan.

The correspondent lender will use their own warehouse line of credit to fund the loan. After the loan funds, the correspondent lender will sell the loan to the mortgage banker who has underwritten the loan. The mortgage banker will pay the correspondent lender. The correspondent lender will then pay down their warehouse lines of credit so they can originate and fund more mortgage loans

NON-QM and Portfolio Lenders

NON-QM Loans are alternative types of lenders that cater to borrowers who cannot qualify for government and/or conventional loans. There are no waiting period requirements after bankruptcy and/or a housing event such as foreclosure, deed in lieu, or short sale with non-QM loans. NON-QM Lenders partner with mortgage bankers and brokers to get business Self-employed borrowers can benefit from non-QM bank statement loans where no income tax returns are required. A large percentage of our business at Gustan Cho Associates are non-QM mortgages.

Which Types of Mortgage Lenders Is Best For Me?

A borrower with 800 FICO, low debt to income ratio, no credit blemishes, the large down payment can choose any types of mortgage lenders and will get approved. However, borrowers with past credit/income issues may need to choose a lender that can cater to their individual needs. Gustan Cho Associates is a mortgage company licensed in 48 states with lending partnerships with over 160 wholesale mortgage lenders.

Our wholesale lenders have no lender overlays on government and conventional loans. We also have the ability to broker non-QM loans as well as specialty loan programs with our many wholesale mortgage lending partners. Please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. We are available 7 days a week, on evenings, weekends, and holidays.

Looking for texas cash-out refinance

Please reach out to us at gcho@gustancho.com or call and/or text us at 262-716-8151. We are looking forward to working with you and your family.