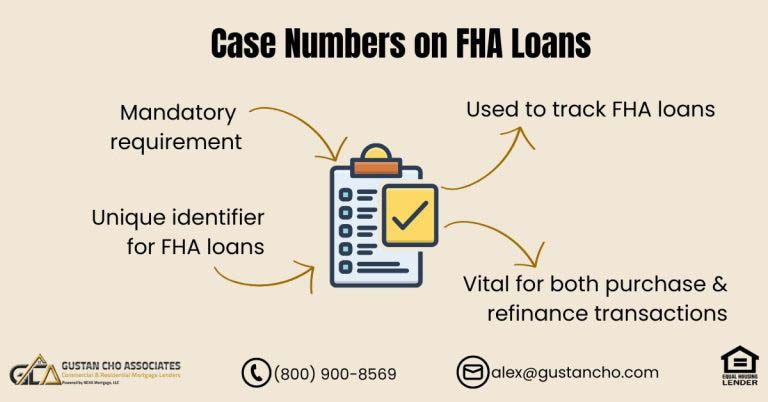

What is an FHA Case Number on FHA Home Loans

This blog will cover and discuss the FHA case number on new FHA mortgage applications. We will also discuss transfers…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This blog will cover and discuss the FHA case number on new FHA mortgage applications. We will also discuss transfers…

This GUIDE covers debt-to-income ratio limit to qualify for a mortgage loan. Home loans and debt-to-income ratio limit. Every mortgage…

This guide covers Fannie Mae and HUD Guidelines on conventional versus FHA loans. Fannie Mae and HUD guidelines on conventional…

This guide covers how does FHA define family member. In this blog post, we’ll explore FHA’s criteria for defining a…

Mortgage Underwriters will require one or more compensating factors for borrowers with higher debt to income ratio on manual underwrites to offset the risk of the higher DTI.

This guide covers the credit scores required for FHA and VA loans. Many borrowers are confused about the credit scores…

This guide covers solutions for no credit scores on mortgage loan approvals. There are cases where consumers do not have…

Today’s blog is a follow-up to last week’s blog, Opportunities for First-time Homebuyers in 2023. If you did not have a chance to read last week’s blog, I would suggest you do so. It is a quick and informative read. I will discuss the benefits of FHA down payment assistance programs for anyone who is…

This blog will cover the credit score needed for mortgage on home loans. We will cover the frequently asked question…

In this article, we will cover and discuss qualifying for FHA loans with under 620 FICO in Utah with outstanding…