In this article, we will discuss and cover refinancing land contract homes to government or conventional loans. There are factors to address when refinancing land contract homes to government and conventional loans.

In today’s crazy mortgage market, more and more Americans are purchasing homes with a land contract. This is an alternative to traditional mortgage financing that can be confusing to understand.

Since Gustan Cho Associates is experiencing more and more clients reaching out to us to refinance their land contract into a traditional mortgage, we figured we would write an article on this topic. In this article, we will detail the basics of a land contract, some rules to follow, and how to refinance into a traditional mortgage product.

Basics Of Land Contracts

Before proceeding, it’s essential to grasp the fundamentals of a land contract. This contract is a written agreement for acquiring various real estate types, including vacant lots, homes, or apartment buildings. A land contract facilitates the purchase of any real property by establishing terms between the buyer and seller.

In essence, a land contract represents a form of seller financing. It operates similarly to a traditional mortgage but with the distinction that the buyer makes payments directly to the current property owner instead of obtaining funds from a lender or bank. These payments continue until the full purchase price is satisfied or until a predetermined balloon payment becomes due.

Benefits of Using Land Contract on Home Purchase

Why opt for a land contract? Both buyers and sellers can reap benefits from this arrangement. A land contract offers a viable solution for buyers who face challenges qualifying for a traditional mortgage due to credit or down payment issues. It enables them to purchase the property by directly paying the seller.

As for sellers, despite not receiving the full purchase price upfront, as in a typical mortgage transaction, they may negotiate a higher sales price and receive installments until the property is paid in full. This setup creates a long-term revenue stream for sellers.

On a Land Contract? Ready to Refinance Into a Real Mortgage?

Learn how refinancing land contract homes to government or conventional loans can lower risk and payments

Factors To Address When Refinancing Land Contract Homes To Government And Conventional Loans

When refinancing land contract homes, adhering to specific rules governing these agreements for homebuyers is crucial. One critical aspect is understanding the ownership transition, which is nebulous. As payments are made to the seller, buyers acquire what is termed as an “equitable title” to the property. This status signifies a legal right to own the property, albeit eventually without full legal ownership.

Sellers are restricted from selling the property to another buyer during this period, as legal title remains in their possession until all payments are completed.

Ensuring a smooth refinancing process for land contract homes hinges on comprehending these essential principles. Buyers and sellers can navigate the transition effectively by recognizing the nuances of equitable title and the timeline for full ownership transfer. It’s crucial to prioritize clear communication and compliance with legal guidelines to protect the interests of everyone involved in the land contract transaction.

Paying Land Contract Seller In Full

Once paid in full the title is deeded over to the buyer. It is incredibly important to add yourself to the title with a quitclaim deed when executing the land contract if you plan on refinancing the mortgage before it is paid in full. You must be on the title for a minimum of six months before you are eligible to refinance the property.

This six-month seasoning requirement starts on the date the county record the title. We have run into many issues where the buyer is not on the title to the property, so they cannot refinance. This can create headaches down the road.

What Are The Consequences When You Stop Making Payments On A Land Contract Home

What happens when you stop making payments? If you stop making payments on your land contract, this will result in a default. Similar to foreclosure for a regular mortgage, forfeiture will result in the buyer giving up all monies paid to the seller for the property under the land contract. In more simple terms, you are out all the money you invested in the land contract.

It is important to factor in monthly bills and emergency expenses before settling on a payment for the land contract. Since there will be less documentation involved in a transaction and no Debt to Income verification, you MUST stay within a comfortable financial situation for yourself and your family.

Steps In Refinancing Land Contract Homes To Government And Conventional Loans

What are the steps to take if you would like to refinance out of your land contract? Refinancing out of the land contract can be confusing. In fact, many mortgage companies will not complete this transaction due to their lender overlays. For more information please see our blog on LENDER OVERLAYS.

As mentioned above, the most important rule to follow in order to refinance the land contract is; you must be added to the title with the county. Your name must be recorded on the title for a minimum of 180 days or 6 months. This will be done with a quitclaim deed. Assuming you have been on the title for at least six months, the refinance process is very similar to refinancing a standard mortgage loan.

Documents Required To Proceed With Mortgage Process

First, you will need to gather the documentation below:

- Driver’s License

- Last 30 Days of Pay Stubs

- Last Two Years Tax Returns

- Last Two Years W2 or 1099s

- Land Contract

- Owner’s contact information

- Homeowners Insurance Policy

From there please call Alex Carlucci at 800-900-8569 or text us for a faster response. Or email Alex at alex@gustancho.com. Either Alex or one of his highly-skilled loan officers will assist you with the refinance. Once we have your application, we will order your appraisal and contact the owner of the property for an exact payoff.

Other than that, the process is just about the same as refinancing a regular mortgage. We are experts in helping Refinancing Land Contract Homes.

Refinancing Land Contract Homes to Government or Conventional Loans

We’ll walk you through title, seasoning, and appraisal step by step

Loan Programs Refinancing Land Contract Homes That Benefit Borrowers

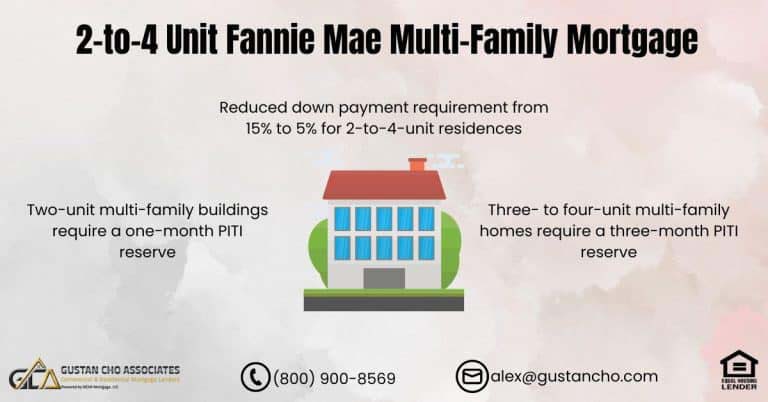

When refinancing out of a land contract, you may use any loan program such as a conventional loan, FHA loan, VA loan, or even a USDA loan. If the balance is higher than these loans allow, you may use a jumbo mortgage to refinance the land contract. S

ince a land contract may be your only option to purchase a home, it is important to contact a real estate attorney before entering the agreement. You will want to verify the contract follows all state regulations.

Importance of Having Real Estate Attorney Representing You on Land Contract Real Estate Transactions

The attorney will protect you long-term against any violations of your land contract. Since these are unregulated you need somebody in your corner to make sure things are going smoothly. While this may add cost to the transaction we highly recommend using a real estate attorney.

Gustan Cho Associates has no LENDER OVERLAYS. Since lender overlays do not get in our way, we are able to help more families than most mortgage lenders. Whether you have been turned down before or not getting the service you deserve, please reach out to us for help. We are available 7 days week mornings and evenings.

If you have any doubts about our company, please check out our reviews. We strive on being up to date on all mortgage guidelines and offer the best customer service in the business.

FAQ: Refinancing Land Contract Homes To Government Or Conventional Loans

- 1. What is a land contract? A land contract in real estate transactions is a written agreement where the buyer pays the seller directly until the purchase price is fully paid or a balloon payment is due. It functions as seller financing, allowing individuals to purchase property without traditional mortgage financing.

- 2. Why consider refinancing a land contract into a traditional mortgage? Refinancing a land contract into a traditional mortgage can offer several advantages, including accessing lower interest rates, adjusting loan terms, and obtaining better financing. Additionally, it may provide stability and security for both the buyer and seller involved in the transaction.

- 3. What factors should be addressed when refinancing from a land contract to a government or conventional loan? Several important factors need consideration, including the transfer of title to the buyer, minimum seasoning requirements before refinancing, potential consequences of defaulting on the land contract, and documentation necessary for the refinancing process.

- 4. What steps are involved in refinancing a land contract into a traditional mortgage? To initiate the refinancing process, individuals must ensure they meet the requirements, including being added to the property title, gathering required documentation, contacting a mortgage professional, and selecting an appropriate loan program tailored to their needs.

- 5. What loan programs are available for refinancing land contract homes? Various loan programs, including conventional, FHA, VA, USDA, and jumbo mortgages, are available for refinancing land contract homes. Each program has its eligibility criteria and benefits, so borrowers can select the one that best fits their financial situation and objectives.

- 6. Why is involving a real estate attorney in land contract transactions essential? To guarantee adherence to state guidelines and safeguard the welfare of all parties involved, involving a real estate attorney in a land contract transaction is crucial. Attorneys can offer legal guidance, review contracts, and mitigate potential risks, leading to a smooth and legally sound transaction process.

This blog about Refinancing Land Contract Homes To Government Or Conventional Loans was updated on March 20th, 2024.

Don’t Wait Until Your Land Contract Becomes a Problem

AGet ahead of balloons, rate hikes, and seller issues with a real mortgage