This guide covers realtors marketing package for home buyers, real estate agents and referral partners. Home buyers rely on their real estate agents for advice, and one of the most important roles of a realtor is to give their home buyers a referral to a loan officer. Giving the wrong loan officer referral partner as a real estate agent can damage their reputation and cost them a closing.

Just being able to work with a loan officer is not enough. The loan officer needs to be able to perform. Not just be able to close the home loan but needs to close the home loan on time.

This realtors marketing package for home buyers was created to educate real estate professionals on the basics of mortgage lending. Not all borrowers can qualify with a particular lender. Most lenders have overlays. Lender overlays are additional lending requirements imposed by the lender above and beyond the minimum mortgage agency guidelines of HUD, VA, USDA, FANNIE MAE and FREDDIE MAC.

National Reputation of Gustan Cho Associates

Just because a borrower may meet FHA, Fannie, or Freddie guidelines does not mean they can qualify for an FHA or Conventional loan with a particular lender. The good news is that there are mortgage lenders like Gustan Cho Associates.

The loan can be done and closed as long as the borrower meets the minimum agency mortgage Guidelines.

Gustan Cho Associates at NEXA Mortgage, LLC, dba as Gustan Cho Associates, is a national mortgage company headquartered in Oakbrook Terrace, Illinois. We are licensed in multiple states. Gustan Cho Associates Mortgage Group has a national reputation for having no lender overlays on FHA, VA, USDA, and FANNIE/FREDDIE mortgage loans.

Take First Step Toward Making Your Dream A Reality

Apply Now And Get recommendations From Loan Experts

Who Comes To Gustan Cho Associates Mortgage Group

Over 80% of our borrowers are folks who either have been denied at the last minute or could not qualify for a mortgage loan with another lender. They could not qualify at other lenders either because of lender overlays or because the loan officer did not properly pre-approve the borrower.

A substantial percentage of our business is from hard-working professional realtors who call us on their client’s behalf due to the major hurdles their home buyer is dealing with their current lender

Since Gustan Cho Associates is a dba of NEXA Mortgage, LLC dba, the team at Gustan Cho Associates get countless daily calls from both home buyers and realtors. We have decided to create this realtors marketing package for home buyers. The realtors marketing package for home buyers is a comprehensive, easy-to-understand guide on qualifying for a mortgage loan.

Not All Lenders Are The Same

All the information listed on this realtors marketing package for home buyers are facts. If you meet the mortgage guidelines listed on this realtors marketing package For homebuyers, you can get approved for a mortgage loan at Gustan Cho Associates. The borrower went to their local bank and was told they did not qualify for a loan because they had been late after bankruptcy and foreclosure. The borrower went to their local bank and was told they did not qualify for a loan because they had gaps in employment in the past two years.

The borrower went to their local bank and was told they did not qualify for a mortgage. They just had a Chapter 13 Bankruptcy discharge.

The borrower went to their local bank and was told they did not qualify for a mortgage because they had a loan modification. Not all homebuyers have 800 FICO credit scores, 40% debt-to-income ratios, and a perfect payment history. Most homebuyers have credit and income flaws, and choosing the right lender is key. This blog will discuss helping our real estate partners with realtors marketing package for home buyers.

Typical Borrowers at Gustan Cho Associates

In this section, we will cover some of the most common case scenarios of borrowers who come to us: The borrower went to their local bank and was told they did not qualify for an FHA loan because they did not have a 640 credit score. The borrower went to their local bank and told they do not qualify for an FHA loan because their DTI is over 45% DTI.

A different case scenario, a borrower went to their local bank and was told they did not qualify for an FHA loan because they had outstanding collection accounts.

They were told they needed to have not just paid off, but all collections accounts paid off for at least two years. The borrower went to their local bank and was told they did not qualify for a mortgage loan because they had one late payment in the past 12 months. The borrower went to their local bank and was told they did not qualify for a mortgage loan because they had an overdraft in the past 12 months.

Problem-Solving Experience at Gustan Cho Associates

Solutions to the above case scenarios With Gustan Cho Associates: The minimum credit score to qualify for an FHA loan with us is 580 FICO. Our maximum debt-to-income ratio cap is 56.9% DTI if your credit scores are at least 620 FICO. If under 620 FICO, then the DTI cap is 43% to get an approve/eligible per automated underwriting system (AUS).

HUD Guidelines on Collections on FHA Loans

Outstanding collection accounts and charge-off accounts do not have to be paid. HUD exempts medical collections and charged-off accounts from DTI calculations. However, 5% of the outstanding balance on non-medical collection accounts will be used as a borrower’s monthly debt in calculating the borrower’s debt-to-income ratios. This holds true even though nothing needs to be paid to the creditor.

HUD Guidelines on FHA Loans With Late Payments

Late payments in the past 12 months or after bankruptcy or foreclosure are allowed if you get approve/eligible per the Automated Underwriting System. Manual Underwriting is available if you get referred/eligible per AUS. Overdrafts are allowed if a good letter of explanation is provided and are not deal killers like other lenders. Late payments in the past 12 months and late payments after bankruptcy or foreclosure are permitted as long as it passes the automated underwriting system.

Looking to Attract More Home Buyers? Get Our Comprehensive Realtor Marketing Package Today!

Contact us today to learn how our tools and strategies can boost your sales.

Gaps in Employments in The Past 24 Months

Gaps in employment is not a problem in the past 24 months. If the gap in employment is less than six months, then 30 days of paycheck stubs are required from the current employer to close on a home loan. If a borrower has had longer than six months of employment gap, then six months of seasoning on a new job is required. Borrowers can qualify for an FHA loan after one year into a Chapter 13 Bankruptcy Repayment plan with the approval of the Chapter 13 Bankruptcy trustee.

HUD Guidelines on FHA Loans During Chapter 13 Bankruptcy

There is no waiting period after a Chapter 13 Bankruptcy discharge date. Still, manual underwriting must be done if a borrower does not have two years of seasoning after a Chapter 13 Bankruptcy discharge. Most lenders will require a two-year waiting period after a Chapter 13 Bankruptcy discharge. Gustan Cho Associates does not have any waiting period after the Chapter 13 Bankruptcy discharge date. After a loan modification, there is a one-year waiting period to qualify for an FHA loan.

Services Provided By Gustan Cho Associates Mortgage Group

Gustan Cho Associates has its marketing department headed by the digital media marketing team at Gustan Cho Associates to offer full marketing support to all preferred realtor partners and co-brand our dual relationship. We will keep on updating the realtors marketing package for home buyers.

Under the direction of our marketing staff, Gustan Cho Associates will offer website design, SEO services, mailers, email marketing campaigns, webinars, and training materials on mortgage loan products that Gustan Cho Associates offers

Over 80% of the borrowers of Gustan Cho Associates are folks who either got a last-minute mortgage loan denial by other lenders or could not qualify due to their lender overlays. This mortgage guide for realtors marketing package for home buyers was created for real estate professionals as an informational resource guide so real estate agents can educate themselves on the latest mortgage guidelines.

How Gustan Cho Associates Will Update Realtors Marketing Package For Homebuyers

Gustan Cho Associates offers the following services to our preferred realtor partners nationwide: We are available seven days a week, evenings, and holidays, and all calls are returned promptly. Call or text Gustan Cho Associates at 800-900-8569 or email us at gcho@gustancho.com

Borrowers can apply online, 24/7, by going to www.gustancho.com and clicking the APPLY NOW icon on the top right category section. Pre-approvals are issued seven days per week.

Once the borrower applies online, I run a credit check and can submit the credit profile to our Automated Underwriting System for an automated Fannie Mae approval. The pre-approval process is very thorough, and all pre-approvals will close. 80% of our borrowers have got last-minute mortgage loan denials due to the lender overlays or not being pre-approved by previous lenders. We close 100% of all of our pre-approvals.

Take First Step Toward Making Your Dream A Reality

Apply Now And Get recommendations From Loan Experts

Realtors Marketing Package For Homebuyers on Loan Programs

There are various mortgage loan programs for home buyers. Just because a lender is an FHA Lender does not mean they all have the same FHA loan requirements. The borrower who does not qualify with one Lender does not mean that they cannot qualify with another lender. Gustan Cho Associates is unique compared to other lenders because we do not have any FHA Lender Overlays. We will go off just the automated findings of the Automated Underwriting System, or AUS. As long as the borrower has an approve/eligible per AUS FINDINGS and the borrower can meet all the conditions of the automated findings, the borrower can rest assured that their FHA Loan will close.

Lender Overlays Versus Agency Mortgage Guidelines

FHA Lender Overlays are additional requirements set by each FHA Lender in addition to the minimum FHA Guidelines set by HUD 4000.1 FHA Handbook . For example, HUD requires a minimum credit score of 580 FICO for a home buyer to qualify for a 3.5% down payment FHA loan. However, a home buyer with a 580 credit score who goes to their local bank to apply for an FHA Loan and get a pre-approval letter will get turned down by the bank because they do not meet the bank’s minimum credit score requirement of 640 FICO.

Typical Lender Overlays

Most banks do not accept anyone who qualifies for an FHA Loan who does not have a 640 credit score even though the borrower meets the minimum 580 FICO credit score required by FHA. The bank has its own FHA requirements on credit scores, called an FHA lender Overlay on credit scores. Lenders do not have to abide by the minimum requirements that HUD has set. It is the same with collection accounts and charge-off accounts.

FHA Loans For Bad Credit

HUD does not require borrowers to pay off outstanding collection accounts or charge-off accounts. However, most mortgage companies may require the borrower to pay off all of their collection or charge-off accounts. Some may have a maximum collection account limit to qualify with their lending institution. Gustan Cho Associates does not have any lender overlays on FHA loans. This is why The Gustan Cho Team @ NEXA Mortgage, LLC dba as Gustan Cho Associates has a national reputation for being the number one lender with no FHA Lender Overlays.

FHA Loans With No Lender Overlays

What Are FHA Lender Overlays? Most mortgage lenders will have FHA Lender Overlays on FHA Loans they offer. A lender overlay is when a particular lender will have additional standards and requirements above and beyond the minimum FHA Guidelines. The best way to explain a lender overlay is by taking a case scenario example. HUD requires a minimum credit score to qualify for a 3.5% down payment.

The FHA loan is a 580 credit score. However, if you have a 580 credit score and go to any local bank and ask to get pre-approved for an FHA Loan, the loan officer will tell you that you do not qualify for an FHA Loan.

This is because your credit score is not 640 FICO. Why can you not qualify for an FHA loan at Bank of America or Chase Bank with a 580 credit score when HUD says you meet the minimum credit score requirement? Why are Bank of America and Chase Bank requiring a 640 credit score and denying you getting an FHA loan? The reason is that Bank of America and Chase Bank has their own FHA requirement on credit scores, which is higher than the minimum required by these banks.

Collections and Charged-Off Accounts Mortgage Guidelines

Other common case scenarios of lender overlays are overlays on collection accounts and charge-offs. HUD does not require you to pay off outstanding collections and charge off accounts for you to qualify for an FHA loan.

These additional requirements are called lender overlays on credit scores. This is perfectly legal, and a lender does not have to honor the minimum requirements imposed by FHA and can request higher standards than those set by FHA.

Most banks and lenders will require you to pay off outstanding collection and charge-off accounts.. Some may even require you to have the paid-off collection accounts and charge-off accounts be seasoned for at least two years before they will approve you for an FHA loan,

DTI Agency Mortgage Guidelines Versus Lender Overlays

Debt-to-income ratio overlays are very common among most lenders. HUD allows up to a 56.9% DTI on borrowers with at least a 620 credit score. However, most lenders will cap the debt-to-income ratios at 45% DTI, Some lenders may let you go up to 50% DTI. Gustan Cho Associates at Loan Cain Inc. has no FHA Lender Overlays. As long as a borrower meets the minimum FHA Loan Requirements and can get an approve/eligible per the Automated Underwriting System and meets the conditions on the automated approval, the loan will close.

Minimum FHA Lending Guidelines

Here Are The Minimum FHA Loan Requirements: 3.5% down payment on FHA loans over 580 credit scores with no lender overlays. Debt-to-income ratios up to 56.9% DTI for borrowers with at least a 620 FICO credit score. Borrowers with debt-to-income ratios under 620 FICO credit score are capped at 43% DTI. Non-occupied co-borrowers are allowed on FHA loans.

The non-occupant co-borrowers must be related to borrowers by law, blood, and marriage. Up to 6% seller concession allowed.

Seller concessions can be used to cover all closing costs, which include pre-paid (two month’s escrow for homeowners insurance and property taxes), one-year homeowners insurance premium, title charges, recording fees, points to buy down the rate, upfront FHA mortgage insurance premium, appraisal fees, home inspection fees, attorney fees, origination fees, and other fees and costs associated with the closing of the home purchase or refinance mortgage.

Want to Close More Deals? Unlock Our Realtor Marketing Package for Home Buyers!

Reach out today to discover how we can help you grow your business.

HUD Guidelines on Medical Collections

Medical collection accounts and charge-off accounts are exempt from debt-to-income calculations. Non-medical collection accounts count in debt-to-income ratio calculations only if the total sum of all the outstanding unpaid non-medical collection accounts is greater than $2,000.

HUD does not require borrowers to pay off outstanding collection accounts or charge-off accounts.

If the total sum of the outstanding unpaid collection account balance is greater than $2,000, then HUD requires that 5% of the unpaid outstanding non-medical collection account balance be taken into account as the borrower’s monthly debt and be used in the calculations of the borrower’s debt to income ratios. This holds even though the borrower does not have to pay for it.

Realtors Marketing Package For Home Buyers Judgments and Tax Liens

Borrowers can qualify for FHA loans with outstanding judgments and tax liens only if the judgment or tax lien will be paid off in full before or at closing. If the borrower cannot pay off the judgment or tax lien in full, HUD will allow the borrower to enter into a written payment agreement.

The borrower can qualify as long as the borrower has made at least three monthly payments, which are agreed upon in the written payment agreement.

The borrower must have made at least three months of payments and provide proof of three months of canceled checks or bank statements. A borrower cannot enter into a written payment agreement and pay the three months of payments upfront.

Gift Funds For a Down Payment and Closing Costs on a Home Purchase

They need to wait thirty days for each payment. 100% gifted funds are allowed by family members to be used for the down payment of the borrower’s home purchase. However, the donor of the gift funds must sign and attest that the gift funds are solely a gift, not a loan. The donor needs to provide 30 days’ bank statements showing that the gift funds have been seasoned and the funds leaving the donor’s account into the home buyer’s bank account needs to be provided

HUD Guidelines To Qualify For FHA Loans After Loan Modification

FHA LOAN AFTER LOAN MODIFICATION: homebuyers can qualify for an FHA Loan one year after a Loan Modification. No late payments are permitted after a loan modification. You can purchase a one to four-unit property with an FHA loan with a 3.5% down payment. Two-to-unit properties can be purchased with an FHA Loan, and a 3.5% down payment is required. 85% of the potential rental can be used on the rental units as long as the appraisal can note the potential market rental value on the appraisal. The potential rental income can be used as qualified income in calculating the borrower’s debt-to-income ratios to qualify for a 2 to 4-unit property.

FHA Loans After Bankruptcy and Foreclosure

Home Buyers can now qualify for an FHA Loan after bankruptcy and foreclosure after mandatory waiting periods. Here are the requirements to qualify for an FHA Loan after a bankruptcy, foreclosure, deed-in-lieu of foreclosure, or short sale:

The two-year waiting period to qualify for an FHA Loan after a Chapter 7 Bankruptcy discharge date.

A home buyer can qualify for an FHA Loan one year into a Chapter 13 Bankruptcy Repayment Plan with the approval of the Chapter 13 Bankruptcy Trustee. This holds true as long as they can provide 12 months of timely payment on all their bills and repayment to their creditors. There is no waiting period to qualify for an FHA Loan after a Chapter 7 Bankruptcy discharge date. However, if the Chapter 13 Bankruptcy has been discharged for less than two years, it must be downgraded to a manual underwrite. All manual underwrites require rental verification.

What Is Verification of Rent

Rental Verification, also called Verification Of Rent or VOR, is when the renter can provide 12 months of timely payment to their landlord with canceled checks or bank statements. If a renter has rented their apartment or home from a registered property management company, then a VOR completed and signed by the property management company manager stating that the renter has paid their rental payments on time for the past 12 months, then the 12 months canceled checks or bank statement requirement is waived.

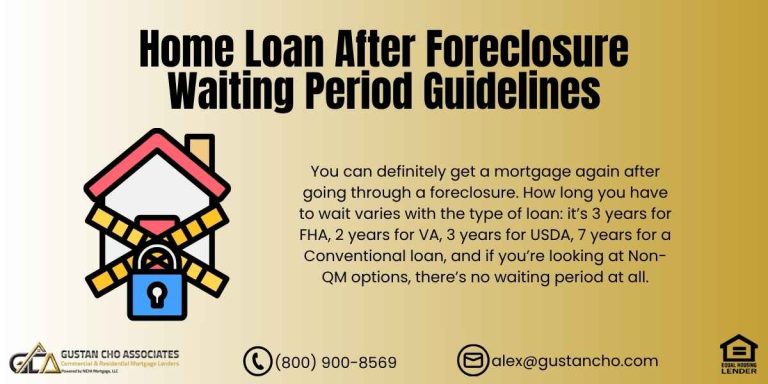

Waiting Period After a Housing Event

There is a three-year waiting period to qualify for an FHA loan after the recorded foreclosure date or foreclosure deed. The waiting period start date does not begin until the date of the sheriff’s sale or the date that the deed of the property has been transferred from the name of the homeowner into the name of the lender or someone else’s name. After a short sale, there is a three-year mandatory waiting period to qualify for an FHA loan.

Waiting Period After a Short Sale

The three-year waiting period starts from the short sale date reflected on the HUD-1 Settlement Statement. There is no mandatory waiting period to qualify for an FHA Loan after a short sale if the borrower was timely on all of his or her mortgage payments up to date of the short sale.

This type of case scenario is rare. Most lenders require the homeowner to be late on their mortgage payment before approving a short sale.

I have seen a few cases where a homeowner who had a short sale was current and up to date with their mortgage payment up to the date of their short sale. Those folks did not have a mandatory waiting period to qualify for an FHA Loan after their short sale.

Qualifying For FHA Loan If You Have Mortgage Part of Bankruptcy

Many folks who had a Chapter 7 Bankruptcy have included their mortgage as part of their Chapter 7 Bankruptcy. There are mandatory waiting periods after the Bankruptcy and Foreclosure to qualify for an FHA loan. If you had a mortgage as part of your Chapter 7 Bankruptcy, there is a three-year mandatory waiting period from the recorded date of your foreclosure to qualify for an FHA loan.

When someone files for Chapter 7 Bankruptcy and has their home loan as part of their Chapter 7 Bankruptcy, their balance is discharged. They are no longer liable for their mortgage debt.

However, the mortgage loan lender still needs to foreclose, which takes time after the discharge date of the Chapter 7 Bankruptcy. The three-year waiting period does not begin until the deed of the property has been transferred out of the mortgage note holder’s name, whether through a sheriff’s sale, short sale, or regular foreclosure. This is not the case with Conventional loans.

Fannie Mae Guidelines on Conventional Loans After Bankruptcy

There is a four-year waiting period to qualify for a Conventional Loan from the discharged date of your Chapter 7 Bankruptcy if you have a mortgage part of your Chapter 7 Bankruptcy. This holds even if the foreclosure was not recorded until much later. We will cover this topic more in-depth when I discuss Conventional Mortgage Requirements.

Conventional Loan Programs At Gustan Cho Associates Mortgage Group

Fannie Mae and Freddie Mac are the two mortgage giants in the United States that set the mortgage lending guidelines for Conventional loans. Conventional loans differ from FHA loans because they are not insured by any government entity such as FHA, VA, or USDA against the borrower defaulting on their home loans.

Conventional loans are also called Conforming loans. They must conform to Fannie Mae or Freddie Mac lending requirements.

Lenders who originate and fund Conventional loans need to ensure the Loans they originate, process, underwrite, and fund conform to Fannie Mae/Freddie Mac standards. This is because they cannot sell the Conventional Loan to Fannie/Freddie if they do not. They will be stuck holding the loan in-house, which lenders do not want to do.

Private Mortgage Insurance Guidelines on Conventional Loans

Conventional loans require private mortgage insurance on all borrowers with less than a 20% down payment. Conventional loans have much higher standards than FHA loans regarding credit score requirements, debt-to-income ratio standards, and waiting periods after bankruptcy and foreclosure.

Gustan Cho Associates at NEXA Mortgage, LLC dba as Gustan Cho Associates is a national mortgage company with a national reputation for originating and funding conventional loans.

We have no lender overlays on conventional loans. As long as a borrower can get an approve/eligible per Automated Underwriting System, Gustan Cho Associates Mortgage Group will close the loan as long as the borrower can meet the conditions from the automated findings.

Realtors, Ready to Grow Your Business? Get Our Marketing Package for Home Buyers Now!

Contact us now to get started with our Realtor marketing package.

Conventional Loan Requirements

Sometimes, a home buyer must go with a Conventional Loan instead of an FHA Loan. Second homes, investment homes, and Condos that are not FHA-approved can only be financed with Conventional Loans. In this guide, we will cover the Conventional loan Matrix at Gustan Cho Associates:

- The minimum credit score requirement to get an approve/eligible per automated findings on Conventional loans is 620 FICO.

- There are 3% down payment and 5% down payment Conventional Loan Programs for owner-occupant primary homebuyers.

- Sellers can contribute up to 3% seller concession for a primary owner occupant and second home Conventional Loan home buyer.

- 2% seller concession for an investment home Conventional Loan home buyer.

- The minimum down payment requirement for second home financing with a Conventional Loan is a 10% down payment.

- Investment homes require a 20% down payment. A 15% down payment is allowed on investment property.

Conventional Loan financing on a single-family home. 2 to 4-unit properties require larger down payments and reserves. Contact Gustan Cho Associates at 800-900-8569, text for a faster response, or email us at gcho@gustancho.com for more details. Borrowers with a Chapter 7 Bankruptcy can qualify for a Conventional loan four years after a Chapter 7 Bankruptcy discharge date. There is a two-year waiting period to qualify for a Conventional loan after a Chapter 13 Bankruptcy discharge date.

Fannie Mae Guidelines After Short Sale and Deed-in-Lieu After Foreclosure

There is a four-year waiting period to qualify for a Conventional loan after a short sale or deed in lieu of foreclosure. The waiting period start clock begins from the short sale date, which is reflected in the HUD Settlement Statement.

The waiting period starts from the recorded date of the deed in lieu of foreclosure and not the day the homeowner has turned their keys into the bank, seven years after a foreclosure to qualify for a Conventional loan.

The seven-year start clock begins from the recorded date of foreclosure. The maximum debt-to-income ratio allowed to get an approve/eligible per automated underwriting system approval is 50% DTI. After a loan modification, there is a four-year period to qualify for a Conventional loan.

Mortgage Included in Bankruptcy: Conventional Loans

Sometimes, a borrower qualifies for a Conventional Loan but not an FHA loan. This is the case where if a mortgage borrower had a prior Chapter 7 Bankruptcy and had a mortgage as part of their Chapter 7 Bankruptcy, the waiting period to qualify for a Conventional loan is four years from the discharged date of their Chapter 7 Bankruptcy. This holds true even though their foreclosure was recorded at a later date.

To qualify for an FHA loan when you have a mortgage part of your Chapter 7 Bankruptcy, there is a three-year waiting period from the recorded date of your foreclosure, whereas, with a Conventional loan, the foreclosure recorded date does not matter.

All you need to do is pass a four-year waiting period after the discharged date of your Chapter 7 Bankruptcy. The foreclosure can be recorded four years after the discharge date of your bankruptcy, and you would still qualify as long as the four-year waiting period has passed from the discharge date of your Chapter 7 Bankruptcy.

Realtors Marketing Package For Home Buyers on Home Path Loans

UPDATE ON HOMEPATH MORTGAGE LOANS: Fannie Mae discontinued the HomePath Mortgage Loan Program in 2014. HomePath homes are still available. However, the HomePath Loan Program has been discontinued. The regular HomePath Loan Program and the HomePath Renovation Mortgage Loan Program have been discontinued. If you need an acquisition and renovation loan, the FHA 203k Loan Program is the most popular mortgage loan program today.

Realtors Marketing Package For Home Buyers on VA Loans

VA loans are the best mortgage loan program available today. However, VA loans are only limited to home buyers who are veterans of the U.S. Armed Services with a Certificate Of Eligibility, COE. VA loans do not require any down payment, no annual mortgage insurance premium required, and mortgage rates on VA loans are one of the lowest out of all mortgage loan programs.

Gustan Cho Associates are VA-approved lenders with no lender overlays, and as long as you can get an approve/eligible per AUS FINDINGS, we can close on your VA LOAN—100% financing with no down payment required.

VA Funding Fee can be rolled into the VA loan. 580 FICO minimum credit scores. VA borrowers can qualify for a VA Loan with outstanding collections, charge-offs, late payments, and other prior credit bad credit. 2 year waiting period after bankruptcy, foreclosure, deed in lieu of foreclosure, and short sale. 100% LTV cash-out refinance

Realtors Marketing Package For Home Buyers on FHA 203K Rehab Loans

Gustan Cho Associates offers FHA 203k Rehab Loans, which are acquisition and construction loans, all in one loan program and one closing. FHA 203k loans are an excellent loan program for homebuyers who want to purchase fixer-uppers or homes and do a total gut rehab and major room additions. FHA 203k loans only require a 3.5% down payment of the after-improved value. There is no construction limit as long as the property appraises after the improvements have been made.

Realtors Marketing Package For Home Buyers FHA 203k Streamline Loans

There are two types of FHA 203k loans: The maximum construction limit with an FHA 203k Streamline Loan is $35,000. There cannot be any structural changes or alterations, such as room additions. You can remodel the basement, attic, new siding, windows, roof, millwork, kitchens, bathrooms, flooring, appliances, and other remodeling projects. You cannot do luxury add-ons like outdoor kitchens, swimming pools, and tennis courts.

Realtors Marketing Package For Home Buyers on Full Standard FHA 203k Loans

There are no construction budget caps with a Full Standard FHA 203k loan, and you can do structural changes and room additions, too. The maximum loan amount will be the maximum loan limit per county limits. Many parts of the mortgage business do not make sense and are often confusing. The business really stinks, but the rewarding part of this business is helping those borrowers who really need help. I promise you that my staff and I will always be available and do our best not to disappoint you in any way and make you look like a rock star with your clients.

Other Loan Programs Realtors Marketing Package For Home Buyers

Gustan Cho Associates offers Non-QM, USDA, and Jumbo Mortgages. Please get in touch with us for more information on Non-QM, USDA, and Jumbo Mortgages. Gustan Cho Associates offers other non-traditional mortgage loan programs. However, these non-conforming niche loan programs change from time to time. Contact our offices at 800-900-8569 or text us for faster response. Or email us at gcho@gustancho.com if you are interested in a niche loan product or a particular home buyer assistance program in a particular county or state.

In Conclusion Realtors Marketing Package For Home Buyers

I have been in the real estate business for over 25 years as a real estate developer and investor and have been on both ends of ending as a borrower and loan originator. I have owned, managed, and operated over 3,000 residential units simultaneously and purchased and sold hundreds of single-family homes throughout my real estate career.

If you are purchasing a two-unit owner-occupant property with a Conventional loan, a 15% down payment is required, and 75% of the potential rental income of the non-occupying unit can be used as qualified income and be used to offset the borrower’s debt to income ratios.

I have dealt with hundreds of mortgage lenders and know what it feels like to be on the other side as a client. Past bad experiences I have had as a mortgage loan client include getting false promises, getting shuffled to assistants, not getting my deals closed on time, not getting return phone calls, and not getting a hold of my loan officer after hours and on weekends. The mortgage business is undergoing many changes with new rules and regulations, which is hard work.

Benefit of Realtors Marketing Package For Home Buyers

Gustan Cho Associates also has a full-service SEO/MARKETING/IT Department headed by Area Marketing Manager Sapna Sharma. We are always looking to partner and co-brand with realtor partners. If you are a realtor whose mission is to help home buyers and want to work with us to make the dream of homeownership a reality, please get in touch with us so we can start working together. Thank you for the opportunity to take the time to read this mortgage guide for realtors and the services and loan products Gustan Cho Associates has to offer, and I hope we can work together for many years to come. Visit us at www.gustancho.com . Contact us at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. You can also visit us and subscribe to our daily free newsletter at www.gustancho.com.

This BLOG On Realtors Marketing Package For Home Buyers Was UPDATED And Published on May 28th, 2024.

- Related> Benefits Of Hiring A Real Estate Agent

- Related> Benefits Of Hiring A Realtor

- Related> First-Time Home Buyer Advice

FAQs: Realtors Marketing Package For Home Buyers

- 1. How Do Student Loan Balances Affect Mortgage Eligibility? Both FHA and conforming loans allow income-based repayment (IBR) plans. FHA now uses either a 0.50% hypothetical debt of the outstanding balance or the IBR payment if it reports on the credit bureau, making it easier for borrowers with high student loan balances to qualify.

- 2. Can Prior Mortgages Included in Chapter 7 Bankruptcy Qualify for a New Mortgage? Can prior mortgages included in a Chapter 7 bankruptcy qualify for a new mortgage? For conforming loans, there is a requirement of a 4-year waiting period after the discharge of Chapter 7 if prior mortgages were included, regardless of the foreclosure date. Meanwhile, FHA loans necessitate a 3-year waiting period following the recorded date of the housing event rather than the discharge date.

- 3. Which Loan Program is Best for You? The best loan program depends on your credit profile, available down payment, desired loan amount, and long-term costs associated with mortgage insurance premiums. FHA and conforming mortgages have advantages and cater to different borrower needs.

- 4. What makes Gustan Cho Associates different from other lenders? Gustan Cho Associates does not impose additional requirements on FHA, VA, USDA, and Fannie/Freddie mortgage loans. They strictly follow the minimum agency guidelines, simplifying the qualification process for borrowers who meet these standards.

- 5. Who typically seeks services from Gustan Cho Associates? Over 80% of borrowers at Gustan Cho Associates were denied loans by other lenders due to lender overlays or improper pre-approvals. They often receive referrals from realtors facing major hurdles with their clients’ current lenders.

- 6. What types of borrowers does Gustan Cho Associates assist? Gustan Cho Associates assists many borrowers, including those with credit scores below traditional thresholds, such as under 640 FICO. They also help individuals with high debt-to-income ratios, up to 56.9% for certain credit scores, and those with outstanding collections or charge-off accounts. Additionally, they offer support to borrowers with gaps in employment and those who have experienced previous bankruptcies, foreclosures, or loan modifications.

- 7. What are the minimum requirements for an FHA loan with Gustan Cho Associates? The minimum qualifications for an FHA loan with Gustan Cho Associates include a credit score of at least 580 FICO to qualify for a 3.5% down payment. Applicants with 620 FICO or higher credit scores can have a debt-to-income ratio of up to 56.9%. There is no requirement to pay off outstanding collections or charge-offs under specific conditions, and late payments may be accepted under certain circumstances.

- 8. How does Gustan Cho Associates handle borrowers with previous bankruptcies or foreclosures? Gustan Cho Associates has particular rules for dealing with borrowers who have previously experienced bankruptcies or foreclosures. For FHA loans, no waiting period is necessary after a Chapter 13 Bankruptcy discharge. However, manual underwriting is necessary if the discharge occurred within two years. In the case of conventional loans, there is a four-year waiting period from the discharge date of a Chapter 7 Bankruptcy, provided that the mortgage was part of the bankruptcy.

- 9. What marketing support does Gustan Cho Associates provide to realtors? Gustan Cho Associates offers comprehensive marketing support, including website design, SEO services, mailers, email marketing campaigns, webinars, and training materials. They aim to co-brand and fully support their realtor partners.

- 10. How can realtors and borrowers contact Gustan Cho Associates? Realtors and borrowers can contact Gustan Cho Associates in several ways. They can call the team at 800-900-8569, email gcho@gustancho.com, or apply online by visiting www.gustancho.com.

Want to Stand Out as a Realtor? Get Our Marketing Package to Attract Home Buyers!

Reach out today to learn how we can help you.