Reaffirming Debts After Bankruptcy: A Complete Guide for Borrowers in 2025

Filing for bankruptcy can feel like a major setback, but it’s often the first step toward rebuilding your financial future.

For many, reaffirming debts after bankruptcy is a key decision in regaining financial stability and even qualifying for a mortgage again. At Gustan Cho Associates, we understand that life happens, and we’re here to help you navigate your options and move forward.

This guide will cover everything you need to know about reaffirming debts after bankruptcy, including updated guidelines for 2025. It will also explain how it affects your ability to get a mortgage and how non-QM loans can be a lifeline when traditional loans are out of reach.

What Is Reaffirming Debts After Bankruptcy?

Reaffirming debts after bankruptcy means agreeing to continue paying certain debts even after your bankruptcy has been discharged. You’re telling your creditor, “I still want to be responsible for this debt.” This process is common with secured debts such as mortgages, car loans, or loans tied to specific property like furniture or jewelry.

When you reaffirm a debt, you sign a reaffirmation agreement during the bankruptcy process. This agreement keeps the debt from being discharged, meaning you remain legally obligated to pay it. In return, you often get to keep the property tied to the debt (like your car or home) and maintain a good payment history on your credit report.

Why Do People Reaffirm Debts After Bankruptcy?

Borrowers reaffirm debts after bankruptcy for several reasons:

- Keeping Property: If you want to keep your car, home, or other secured property, reaffirming the associated debt is often necessary.

- Rebuilding Credit: Reaffirming allows your payments to be reported to the credit bureaus. Without reaffirmation, creditors aren’t required to report your payments, which can stall your efforts to rebuild credit.

- Future Loan Options: Reaffirming a mortgage, for example, makes it easier to refinance or modify the loan later since your payment history will be verifiable.

- Maintaining Stability: For some, reaffirming debts provides peace of mind and stability in their financial recovery.

However, it’s important to weigh these benefits against potential risks, such as being held liable if you can’t make payments in the future.

Ready to rebuild your future? Reaffirm your debt and keep what matters most.

Apply now to take the next step toward financial stability!

Types of Debts You Can Reaffirm

The types of debts that are typically reaffirmed include:

- Mortgage Loans: Reaffirming an auto loan can be an essential step in retaining your vehicle while preventing repossession. This process provides an opportunity to maintain your transportation, which is crucial for daily tasks and overall stability.

- Car Loans: Reaffirming an auto loan can be an essential step in retaining your vehicle while preventing repossession. This process provides an opportunity to maintain your transportation, which is crucial for daily tasks and overall stability.

- Other Secured Debts: These loans are associated with particular assets, such as furniture, appliances, or jewelry. It’s important to recognize that these debts are directly tied to the value of the items purchased.

Unsecured debts – debts that are not backed by a collateral, like medical bills and credit card balances, are seldom reaffirmed since they are commonly eliminated during bankruptcy proceedings. It is important to understand that this can provide relief and help you move forward.

How Reaffirming Debts Works During Bankruptcy

The process of reaffirming debts after bankruptcy involves several steps:

- Creditor Agreement: Your creditor must provide a reaffirmation agreement outlining the terms of the debt you’re reaffirming.

- Attorney Review: Your bankruptcy attorney will review the agreement to ensure it’s in your best interest.

- Court Approval: The proposed agreement will be submitted to the bankruptcy court for authorization. Sometimes, the judge may pose questions to confirm that you fully understand the terms and conditions. This process is important for ensuring clarity and understanding. Remember, it’s all part of the journey toward financial recovery.

- Signed and Filed: Once approved, the agreement is signed and filed before your bankruptcy discharge.

If the reaffirmation agreement isn’t finalized before your discharge date, you won’t be able to reaffirm the debt.

Updated Guidelines for Reaffirming Debts in 2025

As of 2025, there have been no major changes to the reaffirmation process itself, but certain trends and lender practices are worth noting:

1. Non-QM Loan Flexibility:

-

- Non-QM (non-qualified mortgage) lenders remain a go-to option for borrowers recovering from bankruptcy. While traditional loans often have strict waiting periods, non-QM loans may offer immediate financing options.

2. Waiting Periods for Government and Conventional Loans:

-

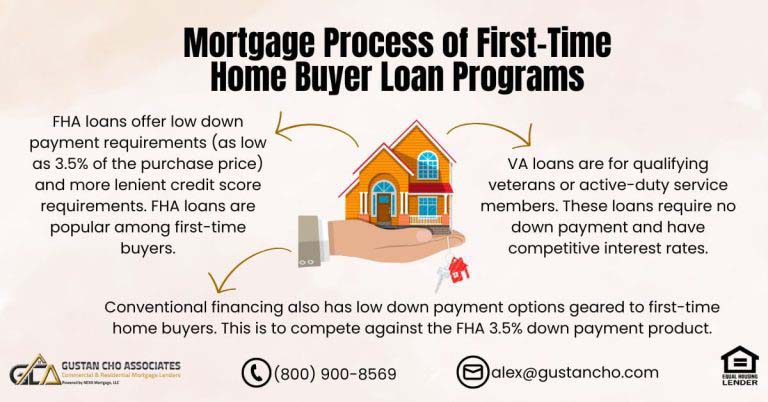

- FHA Loans: 2-year waiting period after Chapter 7 discharge, no waiting period after Chapter 13 discharge (with trustee approval during repayment).

- VA Loans: 2-year waiting period after Chapter 7 discharge, no waiting period after Chapter 13 discharge (with trustee approval).

- USDA Loans: 3-year waiting period after Chapter 7 discharge or a foreclosure.

- Conventional Loans (Fannie Mae/Freddie Mac): 4-year waiting period after Chapter 7 discharge, 2 years after Chapter 13 discharge.

3. Credit Rebuilding Post-Bankruptcy:

-

-

- Many borrowers see their credit scores rebound quickly with timely payments on reaffirmed debts, often reaching 700+ within 12 months of discharge.

-

Pros and Cons of Reaffirming Debts

Pros:

- Maintain Ownership: Keep important assets like your home or car.

- Rebuild Credit: Payments on reaffirmed debts are reported to credit bureaus, boosting your credit score.

- Future Refinancing: It is easier to refinance or modify reaffirmed loans.

Cons:

- Financial Risk: You remain liable for the debt even if circumstances change.

- Court Scrutiny: Judges may deny reaffirmation if they believe it’s not in your best interest.

- Limited Relief: Reaffirming a debt means not taking full advantage of the bankruptcy discharge.

Mortgage Options After Bankruptcy

Traditional Loans:

Government-backed and conventional loans have strict waiting periods, as outlined above. These loans are great if you’ve met the time requirements and rebuilt your credit.

Non-QM Loans:

If you’re ready to buy a home but haven’t met the waiting period requirements, non-QM loans are a fantastic alternative. These loans:

- Have no waiting period requirements after bankruptcy, foreclosure, or short sale.

- Offer flexible qualifying criteria, such as using bank statements or asset depletion for income verification.

- Provide competitive rates tailored to borrowers recovering from financial setbacks.

At Gustan Cho Associates, we specialize in non-QM loans and can help you find a solution that fits your needs.

How Gustan Cho Associates Can Help

Navigating bankruptcy and reaffirming debts can be overwhelming, but you don’t have to do it alone. At Gustan Cho Associates, we specialize in helping borrowers recover from financial challenges and achieve their dream of homeownership.

Whether you need a traditional loan or a non-QM solution, our team is here to guide you every step of the way.

Contact us today at 800-900-8569 or at gcho@gustancho.com. We’re available seven days a week, including evenings and holidays, to answer your questions and help you move forward.

Reaffirming debts after bankruptcy doesn’t have to be a roadblock to your financial goals. With the proper support and loan options, you can rebuild your credit, secure a mortgage, and start fresh. Let Gustan Cho Associates help you take the next step toward financial freedom.

Frequently Asked Questions About Reaffirming Debts After Bankruptcy:

Q: What Does Reaffirming Debts After Bankruptcy Mean?

A: Reaffirming debts after bankruptcy means agreeing to keep paying certain debts, like a mortgage or car loan, even after your bankruptcy is discharged.

Q: Why Should I Reaffirm My Mortgage After Bankruptcy?

A: Reaffirming your mortgage helps maintain your payment history on your credit report, which is crucial for rebuilding credit and refinancing later.

Q: Can I Reaffirm Unsecured Debts Like Credit Cards?

A: No, unsecured debts are usually discharged in bankruptcy and are not typically reaffirmed.

Q: What Happens if I Don’t Reaffirm My Car Loan?

A: You may still be able to keep the car by continuing payments, but the lender isn’t required to report your payments to credit bureaus.

Q: Is Reaffirming Debts Mandatory to Qualify for a Mortgage Later?

A: No, but reaffirming debts can make the process easier by verifying your payment history.

Q: Can I Reaffirm Debts During a Chapter 13 Bankruptcy Repayment Plan?

A: Yes, reaffirmation is possible during Chapter 13, but it requires trustee approval.

Q: What are the Risks of Reaffirming Debts After Bankruptcy?

A: The main risk is that you’ll remain liable for the debt. You could face repossession or foreclosure if you can’t make payments later.

Q: Do I Need a Lawyer to Reaffirm My Debts?

A: Yes, your bankruptcy attorney will review the reaffirmation agreement to ensure it’s in your best interest.

Q: How Does Reaffirming Debts Affect My Credit Score?

A: Reaffirming debts allows your payments to be reported to credit bureaus, which helps rebuild your credit score.

Q: Can I Get a Mortgage Without Reaffirming Debts After Bankruptcy?

A: Yes, securing a mortgage is still possible. However, lenders might ask for extra documentation to verify your payment history thoroughly.

This blog about the waiting period after foreclosure requirements for borrowers on title but not on mortgage was updated on January 21st, 2025.

Get a Mortgage Without Reaffirming Debts After Bankruptcy

Apply Online And Get recommendations From Loan Experts