Non-QM Mortgage Guidelines: Your Guide to Getting Approved in 2025

If you’ve been told you don’t qualify for a traditional mortgage, don’t give up. Many homebuyers and investors are getting approved through non-QM mortgage loans. In this guide, we’ll break down the latest non-QM mortgage guidelines in 2025 so you understand your options and how to get approved through Gustan Cho Associates.

What Are Non-QM Mortgage Loans?

Non-QM stands for non-qualified mortgage. These home loans don’t follow the strict rules set by Fannie Mae, Freddie Mac, or the government (FHA, VA, USDA). But that doesn’t mean they’re risky or shady.

Non-QM mortgage guidelines are more flexible, giving real people with unique situations a second chance to buy or refinance a home.

Non-QM loans are perfect for:

- Self-employed borrowers

- Investors and landlords

- Borrowers with recent bankruptcies or foreclosures

- Foreign nationals or those without U.S. credit

- Retirees with non-traditional income

- People with high debt-to-income (DTI) ratios

Unlock Flexible Financing with a Non-QM Mortgage Loan!

Apply Now And Get recommendations From Loan Experts

2025 Updates: What’s New in Non-QM Loans?

In 2025, non-QM lending is booming. Here are the latest trends:

- Bank statement loans are more popular than ever for self-employed borrowers. There are no loan limits on non-QM and bank statement mortgage loans for self-employed borrowers.

- DSCR (Debt Service Coverage Ratio) loans make it easy for investors to qualify based on rental income

- Interest-only loans are back, helping borrowers keep payments lower

- No income, no ratio loans are available for asset-rich borrowers

- One day out of bankruptcy or foreclosure is still allowed

- Foreign national loans are growing in demand

HUD guidelines do not require borrowers to pay off an outstanding unpaid collection to qualify for FHA Loans. Non-QM mortgage guidelines continue to expand, making qualifying easier, even with past credit issues or non-traditional income.

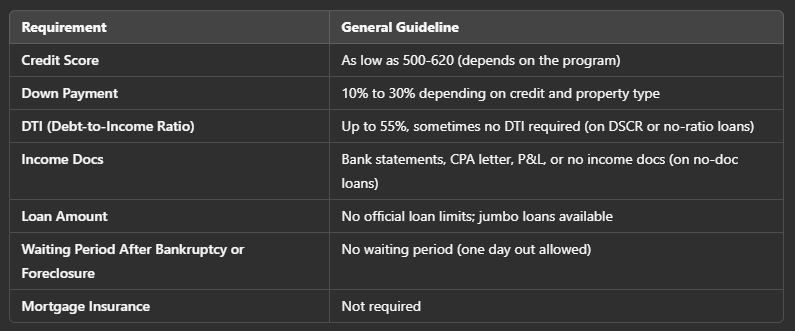

Non-QM Mortgage Guidelines: The Basics

Here are the general non-QM mortgage guidelines most lenders follow. Remember, each lender has their own rules, so working with a broker like Gustan Cho Associates gives you more options.

These non-QM mortgage guidelines are designed to help people who don’t fit the cookie-cutter mold of traditional loans.

Types of Non-QM Loans

When it comes to securing financing for a home, traditional Qualified Mortgages (QM) often dominate the conversation. Whether you’re a self-employed individual with variable income, an investor looking to expand your portfolio, or someone with a unique financial situation, Non-QM loans provide various options to help you achieve your homeownership goals. Here’s a quick breakdown of the most popular types of non-QM loans and how they work:

1. Bank Statement Loans

Bank statement loans are a special type of non-QM mortgage designed for people who are self-employed. Instead of relying on tax returns to verify your income, you can provide either 12 to 24 months of business or personal bank statements. This makes it easier for those who don’t have proof of traditional income. With these loans, you can borrow up to 90% of the home’s value. So, if you’re self-employed and looking for a loan, these non-QM mortgage guidelines might be just what you need.

2. DSCR Loans (Investor Loans)

DSCR loans, also known as investor loans, are an excellent option for those looking to purchase rental properties. One of the standout features of these loans is that they do not require personal income documentation, which simplifies the application process significantly. Qualification is determined by the rental income produced by the property rather than personal earnings. A 1.0 Debt Service Coverage Ratio (DSCR) or higher means your rental income is enough to pay your mortgage. This makes DSCR loans a fantastic choice for savvy real estate investors.

3. No-Doc / No-Ratio Loans

No-Doc and No-Ratio loans are special loans that follow non-QM mortgage guidelines. They are great for people with a lot of money but can’t show regular income. With these loans, you don’t have to prove your job or income, making it easier for some borrowers. However, they usually require a bigger down payment, like 25% or more, to help make sure the lender feels safe about the loan.

4. Asset Depletion Loans

Asset depletion loans are special types of loans under the non-QM mortgage guidelines. They allow you to use your retirement funds, investment accounts, or savings to qualify for a mortgage. This is especially helpful for retirees or those with a lot of money saved. It makes getting loans easier by looking at their available assets instead of just their regular income.

5. Interest-Only Loans

Interest-only loans offer borrowers the opportunity to make payments that cover only the interest for five to ten years, which can significantly lower monthly payment amounts in the initial stages of the loan. This structure provides enhanced cash flow flexibility, allowing individuals to allocate their funds toward other financial priorities or investments during the interest-only period. As a result, these loans can be particularly appealing to those who anticipate increased income in the future or who wish to manage their monthly expenses more effectively in the short term.

These non-QM loan types follow their own unique non-QM mortgage guidelines depending on the lender and program.

Property Types Allowed Under Non-QM Mortgage Guidelines

Non-QM loans are super flexible with property types. You can use them for:

- Primary residences

- Second homes or vacation homes

- Investment properties

- Condotels (condo hotels)

- Non-warrantable condos

- 1-4 unit properties

- Ground-up construction

- Mixed-use buildings

Even if your property is unique or doesn’t meet Fannie/Freddie rules, non-QM lenders may still approve you.

Struggling to qualify for a traditional mortgage?

Apply Now For Non-Qm Loan And Get recommendations From Loan Experts

Credit Challenges? Non-QM May Still Work

Non-QM loans offer valuable opportunities for those facing credit challenges, as they don’t automatically disqualify applicants for credit issues. Unlike traditional lending criteria, individuals can still qualify for a non-QM loan despite recent late payments, collections, or charge-offs. Remarkably, you can be just one day out of bankruptcy or foreclosure and still be eligible for these loans.

Also, tax liens or judgments won’t prevent you from qualifying if you’re already in a payment plan. If you’ve been turned down by a bank, it’s important not to give up hope. Non-QM mortgage guidelines are designed to provide second chances for borrowers who might otherwise feel excluded from the mortgage market.

How to Qualify for a Non-QM Loan

To get approved for a non-QM mortgage, here’s what you typically need:

- Decent credit score (even as low as 500 with a higher down payment)

- Down payment (usually 10% or more)

- Alternative income proof (bank statements, P&L, rental income, or assets)

- Proof of funds for the down payment and reserves.

- Strong explanation for any recent credit events (optional but helpful)

Non-QM mortgage guidelines vary by lender, so working with a broker like Gustan Cho Associates gives you an advantage. We have access to dozens of wholesale non-QM lenders.

Real-Life Example: Self-Employed Borrower With 580 FICO

Sarah is a self-employed baker in Florida. She writes off most of her income and has a 580 credit score. She was denied a mortgage by her bank.

With a bank statement loan through Gustan Cho Associates, we used 12 months of her personal bank statements to show $10,000/month in deposits. She put 15% down and got approved!

Non-QM mortgage guidelines made her dream of homeownership real.

Why Choose Gustan Cho Associates for Non-QM Loans?

At Gustan Cho Associates, we specialize in non-QM mortgage loans. We work with homebuyers, real estate investors, and self-employed borrowers nationwide.

What makes us different:

- No lender overlays

- Loans for bad credit

- Fast closings

- Access to 100+ non-QM loan products

- We work evenings, weekends, and holidays

Even if other lenders have denied you, we can help. Our job is to find a non-QM mortgage that fits your story.

Key Takeaways

- Non-QM mortgage guidelines are more flexible than traditional loans

- Perfect for self-employed, investors, and borrowers with credit issues

- Options include bank statements, DSCR, no-doc, and asset depletion loans

- Property types can include primary homes, second homes, rentals, and condotels

- Get approved even 1 day out of bankruptcy or foreclosure

- Work with a broker like Gustan Cho Associates to find the best non-QM loan for you

Ready to Apply for a Non-QM Loan?

If you’ve been turned down for a traditional loan or want to explore better options, we’re here to help. Contact Gustan Cho Associates today to speak with a loan officer who understands your unique situation.

Call us at 800-900-8569, text us for a faster response, or email alex@gustancho.com. We’re available 7 days a week. Non-QM mortgage guidelines don’t have to be confusing. Let us help you turn the page and get approved.

Frequently Asked Questions About Non-QM mortgage Guidelines:

Q: What Does Non-QM Mean?

A: Non-QM stands for non-qualified mortgage. This means the loan doesn’t follow the standard rules set by Fannie Mae, Freddie Mac, or government loans like FHA. Non-QM mortgage guidelines are more flexible, especially if you’re self-employed or have credit issues.

Q: Can I Get a Mortgage if I’m Self-Employed?

A: Yes! Many self-employed borrowers qualify with non-QM mortgage guidelines using 12 to 24 months of bank statements instead of tax returns. You don’t need W-2s or pay stubs.

Q: What’s the Lowest Credit Score Allowed?

A: Certain lenders may consider scores as low as 500 based on the type of loan and the size of your down payment. Generally, most non-QM mortgage criteria permit poor credit or recent financial challenges such as foreclosure or bankruptcy.

Q: What Kind of Income Proof do I Need?

A: You don’t need traditional income proof. Under non-QM mortgage guidelines, you can use bank statements, rental income, or assets instead of showing paychecks or tax returns.

Q: Do I Need a Big Down Payment?

A: Most non-QM mortgage guidelines require 10% to 30% down. The better your credit, the lower the down payment. Some programs, like DSCR or asset-based loans, may require more.

Q: Can I Get Approved After a Foreclosure or Bankruptcy?

A: Yes! One of the best parts about non-QM mortgage guidelines is that you can get approved even one day after a foreclosure or bankruptcy.

Q: Are Non-QM Loans Only for Investment Properties?

A: Not at all. Non-QM mortgage guidelines allow loans for primary homes, second homes, rentals, condos, and even unique properties like condotels or mixed-use buildings.

Q: What if I Don’t Have a Job But Have Money Saved?

A: You may still qualify under non-QM mortgage guidelines. Asset depletion or no-doc loans let you use savings, investments, or retirement funds instead of showing job income.

Q: Can I Qualify with Rental Income?

A: Yes! DSCR loans, a non-QM loan, let you qualify based on rental income instead of personal income. These non-QM mortgage guidelines are great for investors.

Q: Why Work with Gustan Cho Associates for a Non-QM Loan?

A: We specialize in helping borrowers who don’t fit the usual mold. With access to over 100 non-QM products, we can match you to a lender with the proper non-QM mortgage guidelines for your situation.

This blog about “Denied a Loan? Non-QM Mortgage Guidelines Can Help” was updated on March 27th, 2025.

We’ll help you understand your options and guide you through the Non-QM loan process

Apply Now And Get recommendations From Loan Experts