This Mortgage Blog On Mortgage Terminology That You Need To Know Before Applying For A Home Loan

Buying a home can be very stressful with all its uncertainties and ups and downs.

- A person can find themselves on an emotional roller coaster

- This holds especially true with all the mortgage terminology that is used through the mortgage process

- What can even discombobulate your mind more is talking to a mortgage loan professional who talks to you, using lending verbiage that you do not understand as if you know the mortgage terminology

- What I’d like to share with you is some common lingo that we use in the industry to unease your mind some

- Almost 10 years ago, when I entered the mortgage business, I had not a clue what this foreign language was either

- This article breaks down some basic common terms with definitions and sentences to help you feel more comfortable during the mortgage loan process

In this article, we will discuss and cover Mortgage Terminology Explained For Borrowers And Loan Officers.

Common Mortgage Terminology

1003-This is the name of the residential mortgage loan application and it is pronounced Ten-Oh-

Three. Filling out a 1003 application is the first step to purchasing or refinancing a home.

Amortization:

- A schedule that breaks down the loan payments, showing the payoff date. Your amortization schedule shows that your interest rate is 5% with a 30 year fixed mortgage

Appraisal:

- An evaluation of the property’s value performed by a professional appraiser

- The appraisal is done during the mortgage process and paid for by the borrower

Asset:

- Something that has monetary value like cash, 401K, stocks, bonds, real estate, etc.

- You might be able to use your 401k as a down payment since this is an asset

AUS:

- Automated Underwriting System

- Pronounce A U S. A computer-generated mortgage loan decision based on the application provided after being uploaded

- After submitting Mrs. Jones’s information through AUS, we received an approval eligible and can now issue her a pre-approval letter

Conditional Loan Approval:

- This means the loan is approved but subjected to additional conditions or stipulations that must be provided or meet to the satisfaction of the Underwriter

- The underwriter has issued a conditional loan approval to the borrower

Closing Costs:

- Estimated fees paid at the closing of a real estate transaction

- The closing costs and down payment are two separate costs when buying a home

- When refinancing a home, a borrower is only responsible for the closing cost

Deed:

- A legal document that is signed and delivered, especially one regarding the ownership of property or legal rights

- John’s grandfather signed the deed to him and now he legally owns the house

Debt to Income- Known as DTI:

- The total amount of recurring monthly debt divided by total monthly income deriving at a percentage

- Measures the ability to pay back a mortgage

- Your debt to income is too high, therefore; you will not qualify to purchase a $350,000 house

Escrow:

- A portion of a mortgage payment that is designated to pay for real property taxes and hazard insurance

- The lender will hold funds in an escrow account at closing

Gift-Funds:

- Gift funds are given to a borrower by a relative such as sister, brother, or parent that doesn’t have to be paid back

- You may use your gift money as a down payment for your home

HOA Fees-Home Owner’s Association fees:

- A number of monthly payments paid by owners of certain types of residential property to an organization that assists with maintaining and improving that property and others in the same group

- The realtor failed to let the buyer know that HOA fees had to be paid on the condo

Liabilities-debt or financial obligations:

- Although the borrower co-signed for her brother and sister’s car, this is still considered as her, liabilities unless we can prove that they paid for them, usually with 12 months of canceled checks

Mortgage:

- A legal agreement that conveys the conditional right of ownership on an asset or property by its owner (the mortgagor) to a lender (the mortgagee) as security for a loan

- Unless they are divorced, neither one of them may close on a mortgage loan unless either one of them signs off on the deed at closing to let us know they have no interest in each other’s property

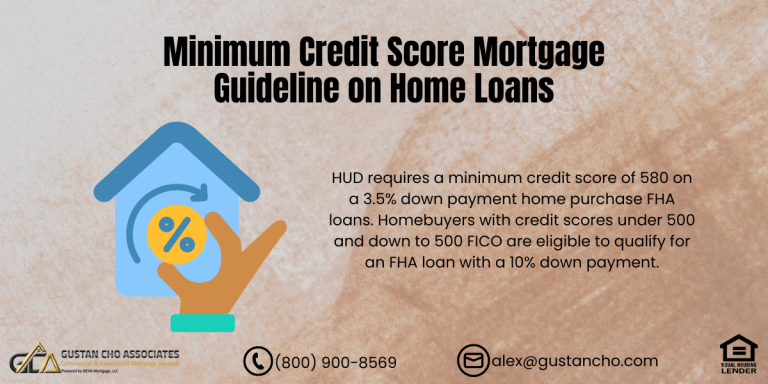

Mortgage Insurance:

- A policy which compensates lenders or investors for losses due to the default of a mortgage loan

- If you put 20% down on your home, you will not be responsible for paying mortgage insurance every month

PITI-Principal, Interest, Taxes, and Insurance. Pronounced pity:

- The principal is the money used to pay down the balance of the loan; interest is the charge paid to the lender for the privilege of borrowing the money; taxes refer to the property taxes paid as a homeowner, and insurance refers to both property insurance and private insurance

- The borrower had to pay one combined payment for their mortgage which is called PITI

Pre-Approval:

- An evaluation of a potential borrower by a lender that determines whether the borrower qualifies for a loan from the lender, or the maximum amount that the lender would be willing to lend

- The loan officer has provided a pre-approval letter to the realtor and now the client can shop for a home

Processor:

- A mortgage loan processor completes several tasks on behalf of the lender which can include handling paperwork, ordering the appraisal, title, and homeowner’s insurance as well as putting a package together to send to underwriting

- The processor will submit your paperwork to the underwriter as soon as she receives it

Record:

- The recording process is when the legal binding loan documents you signed and notarized are taken to the county office and recorded

- After the attorney’s office record everything, you will receive the keys to your new home

Reserves:

- Assets like cash, the vested amount in a retirement account, stock, cash value of life insurance, or bonds

- Since you will have 3 months reserves after your loan close, we will be able to approve your loan

Right of Rescission:

- The “right to cancel” the mortgage transaction if you aren’t happy with the loan for any reason

- After the 3 day right to rescission period has ended, the attorney will disburse your check to you

Seasoned Funds:

- A specific period of time that a lender will accept that you kept money in your established bank account

- Do not borrow money to put into your bank account to use as seasoned funds as you will have to pay the loan back

- Doing so can get your loan denied

Sourcing Funds:

- Sourcing funds simply means determining where the funds came from originally

- This is known as a paper trail. We cannot prove where your sourced funds came from and this is a major issue

Underwriter- The underwriter ensures your financial profile meets guidelines and loan criteria before issuing an approval. The underwriter has issued a clear to close on your loan and the closing department is preparing your package to be sent out to the attorney’s office.