This Article Is About Conventional Mortgage Rates Drop To A 24 Month Low

Conventional Mortgage Rates hit a 24 month low.

- The Federal Reserve Board has announced they will not be increasing interest rates for the remaining year of 2019

- Mortgage Rates have been dropping since January 2019 and has recently hit a 24 month low

- Homeowners who closed on their home loans last year should explore refinancing their mortgages

- Others who need to get non-occupant co-borrowers off a loan or those needing a cash-out refinance should take advantage of the lower conventional mortgage rates to refinance

In this blog, we will discuss conventional mortgage rates the benefits of refinancing today.

FHA Versus Conforming Loans

FHA loans are a great mortgage loan product. It is much easier to qualify than conventional loans due to the more lenient mortgage guidelines.

- Many buyers, especially first time home buyers, are forced into going with an FHA loan

- This is because they are limited with the down payment, higher debt to income ratios, or lower credit scores

- However, one of the major disadvantages with FHA versus Conventional loans is that FHA loans have the lifetime mandatory FHA mortgage insurance premium

- FHA MIP is 0.85% of the mortgage loan balance

- This FHA mortgage insurance premium is required to be paid throughout the lifetime of the FHA loan

- Conventional loans do not require mortgage insurance on any loans with a loan to values of at least 80%

- Those who have mortgage insurance required on their loans due to higher than 80% loan to values only have to pay a fraction of the 0.85% mortgage insurance premium mandated by FHA

- FHA loans have lower rates than conventional loans

- Current 30 year fixed FHA mortgage rates as of May 2, 2019, were at 4.25%

- We can offer conventional mortgage rates as low as 4.25% on a 30 year fixed rate conventional mortgage loan as of 05/02/2019

If you currently have an FHA loan and are thinking of eliminating your FHA mortgage insurance premium, this might be the time to explore the idea of refinancing your FHA into a conventional loan.

Requirement For Conventional Versus FHA Loans

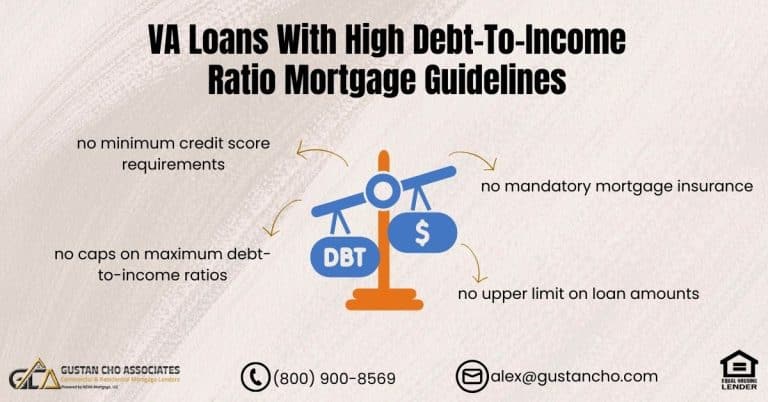

Not everyone can qualify for a conventional loan. Conventional loan programs are tougher to qualify than FHA loans.

- Those who currently have an FHA loan might not qualify to refinance their current loan to a conventional loan

- For example, the waiting period after a bankruptcy, foreclosure, deed in lieu of foreclosure, a short sale is different for conventional loan programs than it is for FHA loans

- Waiting periods after bankruptcy for an FHA loan is two years after the bankruptcy discharge date

- The waiting period after bankruptcy for a conventional loan is normally between 4 to 7 years after the discharge date of the bankruptcy

- The waiting period after foreclosure for an FHA loan is 3 years after the recorded date of the foreclosure

- However, the waiting period after a foreclosure to qualify for a conventional loan is 7 years after the recorded date of the foreclosure’s recorded date

- The waiting period after a deed in lieu of foreclosure and/or short sale for an FHA loan is three years from the recorded date of the deed in lieu of foreclosure

- Or the HUD’s settlement date of the short sale

There are special waiting period requirements for those who have had a prior deed in lieu of foreclosure and/or short sale for conventional loans.

Waiting Period For Conventional Loan After Deed In Lieu Of Foreclosure And Short Sale

If you had a deed in lieu of foreclosure or a short sale, you may qualify for a conventional loan if you can have a 5% down payment on a home purchase or can qualify for a conventional refinance loan if you have at least 95% LTV in your home.

- It is four years after a deed in lieu of foreclosure or short sale if you have a 5% down payment for a home purchase

- Or a 5% equity position in your home for a conventional refinance mortgage loan

- Foreclosures do not apply

There is a seven-year waiting period to qualify for conventional loans after foreclosure.

Eliminate FHA Mortgage Insurance Premium By Refinancing To Conventional Loan

Mortgage rates for conventional loans are now the same as rates for FHA loans as of May 2, 2019, for those borrowers with at least a 700 FICO credit score.

- Even if conventional mortgage rates were slightly higher than FHA rates, it may be wise to explore the idea or refinancing your current FHA loan to a conventional loan

- This is due to either the total elimination or reduction of FHA mortgage insurance premium

- For those who have higher than 80% loan to values, there are conventional loan programs which require no mortgage insurance paid by the borrower

- This no mortgage insurance required conventional program is called Lender Paid Mortgage Insurance, also known as LPMI

LPMI is available by many conventional mortgage lenders for slightly higher mortgage rates.

Changes To Conventional Loans

The 2 year waiting period after short sale and deed in lieu of foreclosure with 20% down payment to qualify for a conventional loan is no longer in effect as of August 2014. Borrowers who had a prior mortgage included in bankruptcy has a four year waiting period from the discharge date of the bankruptcy to qualify for conventional loans. The date of the foreclosure does not matter. The housing event date does not count. Income-Based Repayment (IBR) is allowed on conventional loans but not on FHA, VA, and USDA Loans.