In this guide, we will cover what to do if borrowers get mortgage denial from bank. First and foremost, find out the reason why you got denied. Is it because of having lower credit scores? Was it because of prior bad credit? Was it due to high debt-to-income ratios? Is it due to outstanding collections and charge-off accounts? Was it due to late payments? Was it due to a prior bankruptcy or foreclosure? Was it because the income or assets could not be verified? Was it because being self-employed and declaring too much unreimbursed expenses? Whatever the reason, you have options.

Most first-time homebuyers normally go to their local bank to see if they qualify for a residential mortgage loan. Banks are full-service lending institutions. One thing about banks is they want borrowers with stellar credit. Banks have lenders overlays. The have more overlays than other financial institutions that off mortgage loans. In the following paragraphs, we will cover what can you do after a mortgage denial from bank.

Understanding Mortgage Denial From Bank

In this section, we will cover what to do if a bank says no to you mortgage? Seeing the word “denied” on your mortgage application letter can hit hard, especially after hunting homes and gathering docs for weeks. Whether you’re trying to buy your first house or refinance the one you love, a denial letter feels like a heavy weight. The good news is that it usually acts more like a speed bump than a brick wall. Alex Carlucci, a senior mortgage loan officer at Gustan Cho Associates says the following about understanding denial from bank:

To keep going, you only need to figure out the reason for the no and fix what you can. In the sections that follow, well show you the most common denial triggers and simple ways to turn them into yes answers.

One of the key question you need to ask yourself is why was my mortgage denied by the bank? Lenders have their own checklist, and missing even one item can lead to a flat-out no. But understanding that list lets you tackle the problems before you try again. In the next paragraph, we will cover the various reasons for a mortgage denial from bank.

Denied by a Bank? You Can Still Get Approved for a Mortgage

Learn your next steps and explore alternative options to secure financing.

What Are Reasons Applicants Get Mortgage Denial From Bank

Many folks get a mortgage denial from bank. Here are a few reasons banks often turn down a mortgage request:

- Low Credit Score: Your credit score is like your financial report card, and it carries a lot of weight with lenders. Most standard home loans want a score of at least 620. FHA or VA loans are kinder, though they still expect something in the 500s upward.

- High Debt-to-Income Ratio (DTI): When you apply for a mortgage, lenders check your debt-to-income ratio, or DTI, to make sure you can cover the new payment along with all your other bills.

- A DTI over 43%-especially when you include the mortgage payment itself-can raise red flags and lead to an outright denial.

- Insufficient Income or Job Instability: Stable, reliable income is one of the first things lenders want proof of.

- If you’re earning too little, working only part-time, or have jumped between jobs very recently, they may feel you’re not yet financially secure enough, and that can sink your application.

- Inadequate Down Payment: How much cash you put down when buying a home impacts both the loan amount and the interest rate.

- A down payment of less than 3% to 5%-or no money at all-makes lenders see you as a riskier borrower, so they might reject the loan.

- Errors or Issues on Your Credit Report: Sometimes a denial stems from plain bad luck: a mixed-up name, an overlooked bill, or an old account nobody told you about.

- You can often flip the decision by disputing these mistakes with the credit bureaus, so always check your report before you apply.

- Appraisal Issues: When the appraisal notice comes back lower than the price you agreed to with the seller, the lender might pull back its loan approval.

- That can sting, especially in a hot or see-saw market where values change week to week.

What To Do After a Mortgage Denial From Bank

Request a Reason After Mortgage Denial From Bank

After a mortgage denial, your first job is to ask the lender for a clear, written explanation of why the yes turned into a no. Knowing the exact issue- whether it was income, debt, or something else- helps you fix what really matters. Under the Equal Credit Opportunity Act, banks have to give you that reason.

Review Your Credit Report

If your score or report played a part, order your full credit file and read it line by line. Pay special attention to these red flags:

- Errors or inaccuracies: Spot a wrong name, wrong balance, or account that isnt yours? Dispute it right away with the credit bureaus.

- High credit utilization: If cards are close to their limit, pay them down fast. Lower balances can boost your score inside weeks.

- Late payments or collections: Tackling any unpaid bills or overdue accounts will show lenders you are back on track.

Improve Your Debt-to-Income Ratio

A high debt-to-income (DTI) ratio is one of the most common reasons lenders turn down a mortgage application. Thankfully, there are steps you can take to bring that number down:

- Pay down existing debt: Start by chipping away at credit card balances, personal loans, or any other monthly obligations.

- Increase your income: Look for side gigs, freelance projects, or even a part-time job to add extra money to your budget.

- Avoid taking on new debt: New loans or purchases will only raise your DTI further, so hit pause on big borrowing until after your mortgage closes.

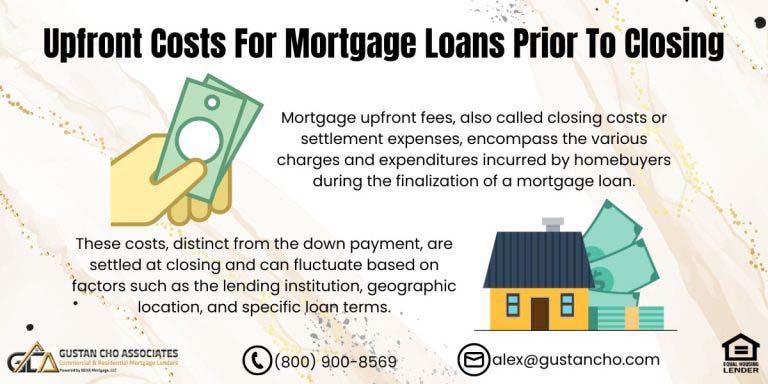

Save for a Larger Down Payment

Was your down payment too small? Boosting that amount can make a big difference. A bigger deposit will:

- Lower your loan-to-value (LTV) ratio, which makes lenders happy.

- Potentially score you a better interest rate, saving money over the life of the loan.

- Strengthen your overall application, especially if your credit is not yet perfect.

Consider Government-Backed Loans

If conventional loans keep slipping through your fingers, look at government-backed programs. They tend to be friendlier to borrowers with rougher finances:

- FHA loans work for first-timers and those with scores around 580, requiring just 3.5 percent down.

- VA loans, open to veterans and active service members, offer zero down and skip monthly mortgage insurance altogether.

- USDA Loans: Great option for rural buyers; they need no money down at closing.

Connect With A Mortgage Broker

When your bank says no or just gives you one choice, a **broker** opens more doors. Brokers sniff out lenders who may overlook small credit problems or who show you better rates than your bank offered.

Mortgage Denied? Here’s What You Can Do Next

Don’t give up! We help borrowers find solutions and get back on track for homeownership.

Can I Apply Again After Mortgage Denial From Bank?

Yes, you can try again after a no, but fix the problems first. Reapplying without change will still lead to the same no, and too many hard pulls can hurt your score. Wait until you improve your credit, pay down debt, or save cash, then go for the new application.

Getting a mortgage denial from bank might sting, but it isn’t the final answer. Most important is learning the reason behind the no and fixing that piece. Maybe your credit needs a lift, debt has to drop, or a bigger down payment must be saved; whatever it is, tackling that issue turns rejection into approval. If you’re set to pivot and look at fresh mortgage options, Gustan Cho Associates is ready to back you up. We’ll steer you through each step so you can finally call a place your own.

Banks vs Mortgage Companies

Banks cater to the general public in lending the following types of loans:

- Auto loans

- Home loans

- Personal loans

- Business loans

- Commercial loans

Offer other financial services such as the following:

- Saving accounts

- Checking accounts

- Retirement accounts

- Investment accounts

- Credit cards, and such

Unfortunately, banks have many mortgage lender overlays when it comes to approving mortgage loans.

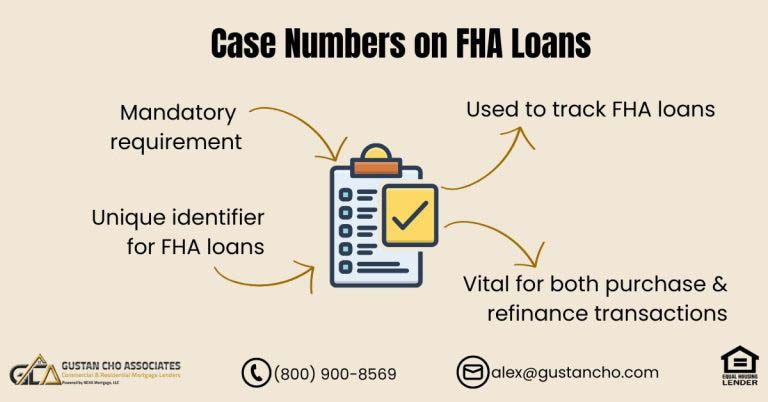

What Are Mortgage Lender Overlays?

Lender overlays are when a mortgage lender has additional requirements on top of the minimum mortgage lending guidelines by FHA, VA, USDA, Fannie Mae, and Freddie Mac.

For example, minimum credit score requirements for a 3.5% down payment FHA loan program is 580 per HUD lending guidelines. A lender with no overlays and that go strictly by DU FINDINGS of approve eligible will approve you for a 3.5% down payment FHA loan. This holds true as long as borrowers meet the rest of HUD Guidelines. However, most banks have their own overlay on credit scores. Even though HUD may require 580, banks can have overlays on credit scores where they require 640 credit scores.

Lenders With No Overlays

There are direct mortgage lenders with no overlays where they will just go off Automated Underwriting System Approval Findings. However, most banks and mortgage companies have lender overlays on the following:

- Credit Scores

- Debt To Income Ratio

- Collections And Charge Offs

- Credit Tradelines

- Overlays On FHA Loans During And After Chapter 13 Bankruptcy

Gustan Cho Associates is a national lender with no overlays on government and conventional loans.

Take First Step Toward Making Your Dream A Reality

Apply Now And Get recommendations From Loan Experts

Reasons For Mortgage Denial From Bank

A mortgage borrower should never get a mortgage denial from bank or stress during the mortgage process. The main reason for last-minute mortgage denial from banks or stress during the mortgage process is because borrowers were not properly qualified. A loan officer should not sign off on a pre-approval letter. All of our pre-approvals at Gustan Cho Associates are fully underwritten TBD Property Underwriting Approvals and signed off by our mortgage underwriters.

- Also, many borrowers get mortgage denial from bank because most bankers require no late payments after bankruptcy or foreclosure

- Other reasons borrowers get denial from bank is because they do not have enough credit tradelines and no rental verification

- Not having two continuous years of employment is another reason for mortgage denial from bank

- All the reasons I have given above are examples of overlays

- That does not mean every bank has these overlays

- Most of the banks that I know of do have them

- Another example of mortgage denial from bank is that most banks want to see borrowers with no open collections

- Open collections is not an FHA mortgage lending guideline

- Borrowers can still qualify and get mortgage approval with open collections

Another thing you need to be aware of is that paying off an open collection will severely drop your credit scores.

Seek Other Lenders If Mortgage Denied From Bank

Mortgage companies just deal with home loans. There are different types of mortgage lenders. You have mortgage bankers, correspondent lenders, and mortgage brokers. There are lenders with little to no lender overlays. Mortgage brokers has many wholesale lenders they network with.

Gustan Cho Associates, a dba of NEXA Mortgage is a mortgage broker and correspondent lender that has close to 300 wholesale lenders which include many wholesale lenders with no overlays.

Over 80% of borrowers at Gustan Cho Associates are folks who have gotten denied for a mortgage due to overlays or other lending restrictions. Reach out to Gustan Cho Associates at 800-900-8569 or email us at alex@gustancho.com and let us give your mortgage application the boost it needs!

Partnering with Lenders Like Gustan Cho Associates

Gustan Cho Associates helps buyers who hit a wall with banks. Whether credit scars, high DTI, or unique income mix hold you back, our experts craft a plan so you move forward, not sideways, toward owning your own home.

We don’t pile on extra rules when you apply for a government or conventional loan. It’s simply the baseline the program already requires, nothing more. Our team walks with you step by step, ironing out roadblocks and finding ways to land you the best rates.

Borrowers who got a mortgage denial from bank or other mortgage company with overlays, please contact us anytime 7 days a week at Gustan Cho Associates at 800-900-8569 or text us for faster response. Or email us at gcho@gustancho.com. We close 100% of all of our pre-approvals because all of our pre-approvals are fully underwritten and signed off by our mortgage underwriters.

Denied for a Mortgage? We Have Other Lenders Who Can Help

Explore your options with alternative lenders and improve your chances of approval.