BREAKING NEWS: Jumbo Loans During Coronavirus Pandemic Mortgage Crisis

Jumbo Loans During Coronavirus Pandemic is an issue.

- The high-end housing market was booming prior to the coronavirus pandemic

- High-end homes were very much in demand

- Custom home builders were having record sales year after year

- The economy was the best ever prior to the coronavirus pandemic crisis

- Unemployment rates hit a 50-year low at 3.5%

- The Dow Jones Industrial Average hit a historic high as well as other equity markets

- The Dow surpassed 29,000 in February 2020

- 2020 housing market forecast was strong and was supposed to surpass 2019 numbers

- Mortgage rates hit all-time lows

- Non-QM loans were the hot ticket in town

- Many lenders have launched Jumbo Non-QM loans with low credit scores

- Bank statement loans for self-employed borrowers were one of the hottest mortgage programs

- For once Jumbo Loans for borrowers with lower credit scores were available

- Then the economy and housing market came crashing down in a matter of a few weeks

- Over 22 million Americans filed unemployment in the past three weeks

- The whole U.S. economy shut down due to the very known contagious coronavirus

- The coronavirus pandemic turned the housing and mortgage markets into chaos

- This holds especially true on Jumbo mortgages

In this breaking news article, we will discuss and cover Jumbo Loans During Coronavirus Pandemic Mortgage Crisis.

What Are Jumbo Loans

- A jumbo mortgage is any mortgage loan where the loan amount is greater than the county conforming loan limit

- The conforming loan limit is $510,400 for the calendar year of 2020 in most counties across the United States

- There are many counties across the nation that are considered “high balance”, where the average median cost of a home is greater than $510,400

- In areas such as San Francisco California, Denver Colorado, and Fairfax, Virginia the average home costs more than the conforming loan limit

- Fannie Mae and Freddie Mac will allow counties to have high balance loan limits all the way up to $765,600

- In a high balance county, any loan amount above that number will be considered a jumbo mortgage

Jumbo Mortgage Guidelines During The COVID-19 Pandemic: Eligibility Requirements

Are the qualifications for jumbo mortgages different?

- The qualifications for a jumbo mortgage are much more strict compared to a conventional or FHA financing

- Since you are borrowing such a large sum of money, it makes sense for the guidelines to be more strict

- The main difference between a conventional and a jumbo mortgage is the reserve requirement

- Reserves are liquid assets available after you pay down payment and closing costs

- Many jumbo products require 12 months of the mortgage payment to be in your bank after closing

There are jumbo programs that allow less and they are jumbo programs that require more reserves.

Credit Score Requirements On Jumbo Mortgages

Credit score requirements on jumbo mortgages are also higher.

- Some of the most favorable jumbo mortgage products require a 720 or even a 740 credit score or higher

- Generally speaking, the higher the credit score the better loan terms you look at in the lower reserve requirement

- You can still obtain a jumbo mortgage with credit scores in the 600’s

Most jumbo programs will start at credit scores of 680 or higher, but programs are available with lower credit scores.

Changes On Jumbo Mortgage Guidelines During The COVID-19 Pandemic

During the COVID-19 coronavirus outbreak, we saw many loan programs disappear overnight.

- Most jumbo mortgages and NON-QM mortgage lending products were put on hold

- NON-QM programs have slowly returned with more strict underwriting requirements

- It used to be possible to get a jumbo NON-QM mortgage loan with a 600 credit score and only 3 months reserves

- Now the requirements are upper 600’s with at least 6 months of reserves

- However, we see the trend going back to normal

Conforming Versus Jumbo Mortgages

Any mortgage loan that is greater than the conforming loan limit of $510,400 is called a jumbo mortgage.

- Jumbo mortgages are considered riskier loans than conforming loans

- If an average priced home forecloses, the lender can normally sell the home within a certain reasonable period of time

- There are many home buyers for an average priced home

- However, it takes substantially longer to sell a high-end home

- High-end homes are normally custom homes

- You need a buyer that has the needs of that particular high-end home

- For example, some high-end homes may have 10 car garages, a music studio, a large barn, Olympic sized pool, or other amenities that are no common

- It may be an asset to some homebuyers while negative to others

- Since lenders take more risk on high-end homes, they will require higher credit profiles of borrowers

Mortgage rates on jumbo loans are higher than traditional conforming loans. Larger down payment and reserves are required on jumbo loans versus conforming mortgages.

Jumbo Loans During Coronavirus Pandemic Mortgage And Guideline Changes

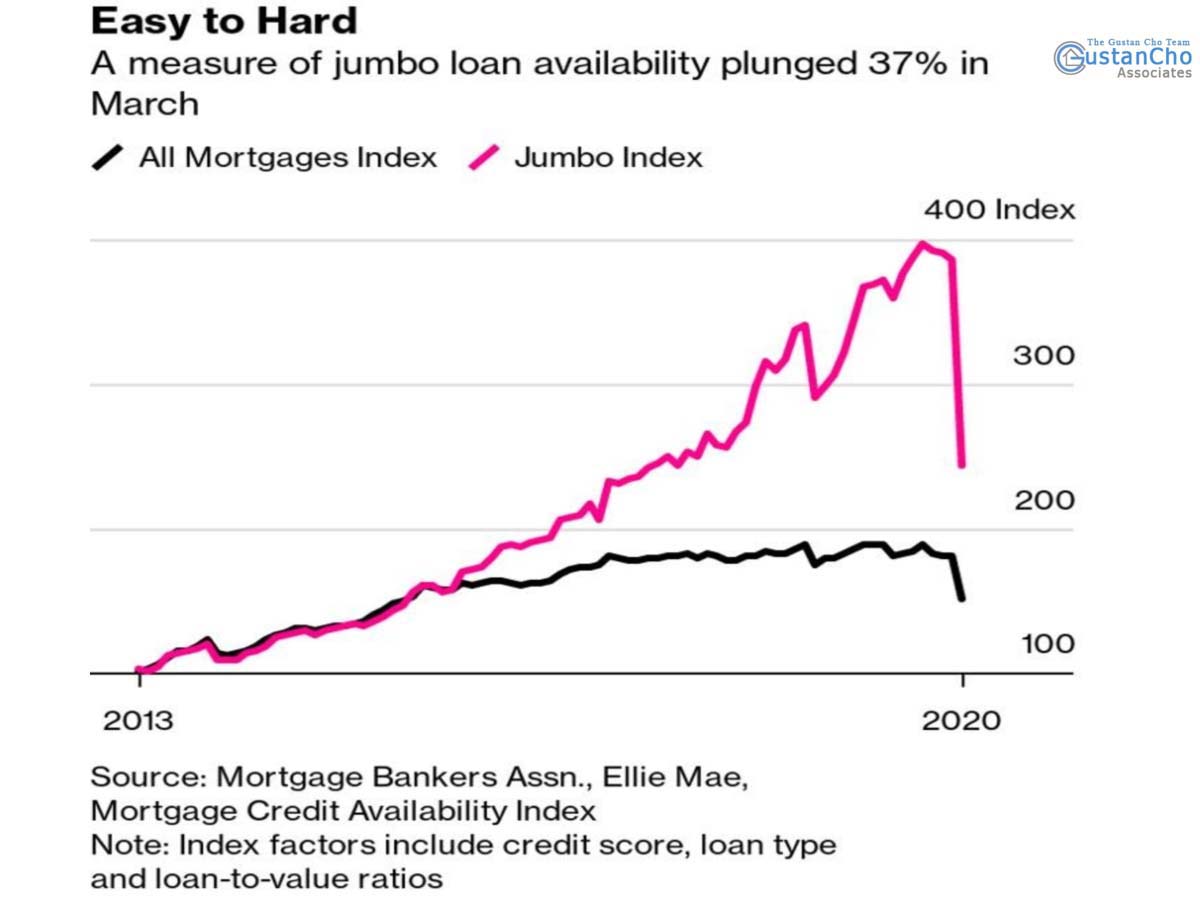

Lending guidelines on Jumbo Loans During Coronavirus Pandemic has changed overnight.

- Most lenders have suspended all jumbo mortgages until further notice

- Many high-end homebuyers with spectacular credit are shocked to be turned down for jumbo mortgages by lenders

- These are borrowers who have a 30% down payment, lower debt to income ratio, and 800 credit scores

- A large percentage of borrowers at Gustan Cho Associates are those needing jumbo mortgages

- Over 20% of our borrowers at Gustan Cho Associates are jumbo borrowers with an average loan size of $1.45 million

- The coronavirus pandemic has not just turned the economy upside down but has devastated the jumbo mortgage markets

- The good news is Gustan Cho Associates is one of the very few lenders that still originate and fund jumbo mortgages

The reason most lenders have halted approving jumbo mortgages is due to liquidity problems in the secondary mortgage bond markets.

What Experts Are Saying About Jumbo Loans During Coronavirus Pandemic

Massimo Ressa of Gustan Cho Associates Mortgage Group is one of the top loan officers that specialize in jumbo loans.

The jumbo mortgage market is expected to recover in the coming weeks. As of today, the jumbo market is at a standstill. As mentioned earlier, most lenders have suspended jumbo lending. Gustan Cho Associates Mortgage Group is still taking mortgage loan applications on jumbo loans.

See the chart below showing data on the number of jumbo mortgages plummeting due to the coronavirus pandemic mortgage crisis:

In the following paragraph, we will discuss why par mortgage rates are at an all-time low but why lenders are charging all-time high rates on mortgages.

Mortgage Rates On Jumbo Loans During Coronavirus Pandemic

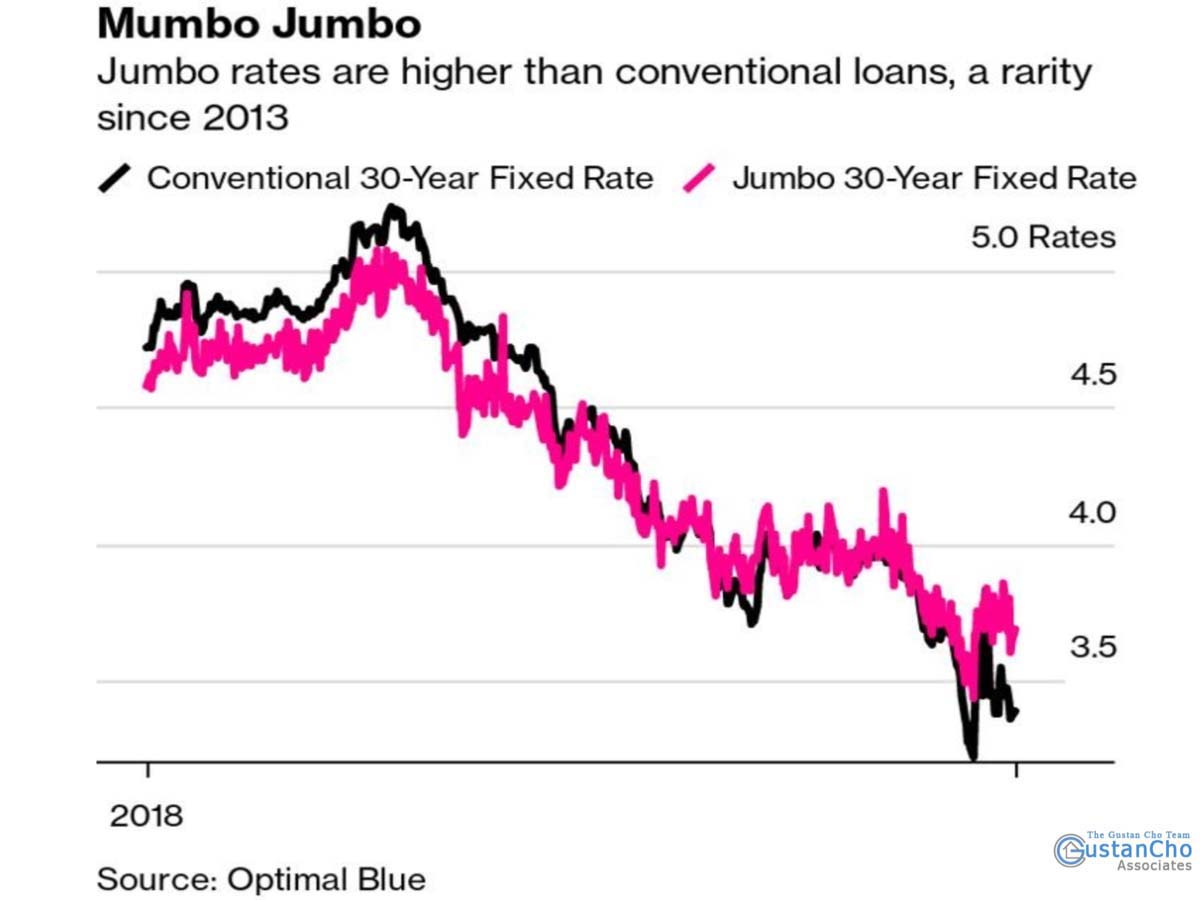

The pandemic sent stock markets tanking close to 40%.

- The yield on the 10-year Treasuries plummeted below 1.0% sending mortgage rates at an all-time low

- However, lenders increased mortgage rates instead of lowering them

- Prime borrowers with over 740 FICO and 30% down payment can still get great rates on conventional loans

- However, any borrowers with pricing adjustments can expect huge LLPAs and high rates

- Due to the coronavirus mortgage meltdown, secondary market bond buyers have no interest in buying mortgage-backed securities (MBS) on government loans and borrowers with under 680 credit scores due to liquidity issues

- Hopefully, this will change in the coming weeks

- All lenders suspended doing non-QM loans and Jumbo mortgages until further notice

The good news is Gustan Cho Associates Mortgage Group still has a few investors that are willing to take on non-QM and jumbo mortgages.

What Housing Analysts Are Predicting On High-End Real Estate Market

The Once Lucrative Jumbo Mortgage Market In Turmoil

There is still a strong market for jumbo loans in the housing market.

- Most traditional high-end home buyers have high credit scores, low debt to income ratio, and large down payment

- However, due to the coronavirus mortgage crisis, many pre-approved and qualified jumbo mortgage borrowers are being told their pre-approvals and conditional loan approvals are null and void

- Many jumbo borrowers who had CTC’s (clear to close) have been told their clear to close is no longer valid

The lucky few were told their mortgage locks were not valid but they can still close with a higher rate PLUS origination discount points.

See the chart below comparing conventional versus jumbo loans:

Trump’s $2.2 Trillion Coronavirus Pandemic Stimulus Package

Included in the recent $2.2 trillion coronavirus pandemic stimulus package is lenders to offer homeowners forbearance affected by the pandemic.

- Over 27 million Americans filed unemployment claims in the past 4 weeks

- High wage earners are part of this group

- This will affect jumbo mortgage lenders as well

- No matter how much money you make, if you are unemployed due to the pandemic, you will most likely not be able to pay your mortgage payments

- As of today, over 12% of jumbo borrowers have requested forbearance from their lenders

- This number is expected to hit over 20%

- Business owners, especially owners in the restaurant and hospitality fields, have been hurt hard

- Many businesses that have shut down during the pandemic are not expected to reopen

- Many business owners have high-end homes

- Unfortunately, many are not expected to recover and may eventually face foreclosure

- Bankruptcy and foreclosure numbers are expected to skyrocket in the coming weeks and months

- This news is alarming jumbo mortgage lenders

- There is no interest in jumbo loans in the secondary jumbo mortgage bond markets

Things can change in the coming weeks and/or months. However, there is not enough data available this early in the game to predict how the economy will recover once it reopens.

Is The Jumbo Mortgage Market Dead?

The jumbo mortgage market will come back in the coming weeks and months. Loan officers at Gustan Cho Associates Mortgage Group are very busy approving jumbo loans. It is not like it used to prior to the coronavirus pandemic crisis. For example, the Gustan Cho Associates was able to approve a borrower with a 10% down payment on a non-QM jumbo mortgage prior to the pandemic. However, now, we may require 20% to 35% down payment and reserves. The 10% down payment non-QM jumbo mortgage program may never return. However, the 15% down payment non-QM jumbo loan program is expected to return soon. We will keep our viewers and clients of Gustan Cho Associates updated as we get more development on this story.

Non-QM Jumbo Mortgage Guidelines During The COVID-19 Pandemic

Non-QM jumbo mortgages. NON-QM jumbo mortgages are just now returning since the outbreak started.

- As mentioned above, they do have additional requirements

- BANK STATEMENT LOANS are incredibly popular for self-employed borrowers

- These programs went away right after the outbreak but are now available again

- There are additional requirements based on the current bank statement

- An underwriter must prove that you have been able to work during the outbreak

- Your income will be calculated accordingly

- If you have not had an income since the outbreak, you are more than likely not eligible to qualify for a Jumbo loan

You must have current business-related deposits to verify your business has current income.

Traditional Jumbo Mortgage Guidelines

Standard jumbo mortgage product. It is no secret that interest rates are incredibly low during these unprecedented times.

- The economy is in a tailspin and the FEDERAL RESERVE cannot raise rates on the American people right now

- Jumbo mortgage rates are very low

- If you feel like your rate is high please give us a call today on (800) 900-8569

- Mike Gracz will be able to provide you with a rate quote from a licensed loan officer in your state

- Most jumbo mortgage products typically require a 12-month reserve threshold as well as a 680 credit score or higher

- Depending on the loan program, your debt to income usually needs to be below 43%

- Many products were as low as 41%

- The highest loan to value currently available is 90% CLTV

- That means combined loan to value

The first jumbo mortgage will be up to 80% loan to value and you are eligible to use secondary financing for the remaining 10%.

95% LTV Non-QM Jumbo Loans

95% jumbo mortgage loan without mortgage insurance.

- This loan program is currently on hold due to the COVID-19 coronavirus outbreak

- We have received many phone calls during these months asking if this product is available

- As of today, it is not available

- There is no clear timeline on if and when this product will be available again.

There is no clear timeline on if and when this product will be available again. Gustan Cho Associates will keep our viewers updated when the 95% LTV Non-QM loan program becomes available.

Refinancing Jumbo Mortgage Guidelines

Jumbo refinance?

- Many Americans who are currently in a jumbo mortgage can benefit greatly from refinancing their mortgage loan

- Interest rates are incredibly low, and this can be a great time to take it vantage of the market

- Cash-out jumbo mortgages are currently back in circulation

- This could be a great opportunity to lower your overall monthly payments with the equity in your home

- For a cash-out jumbo mortgage, quote call Mike Gracz on (800) 900-8569 or email gcho@gustancho.com