BREAKING NEWS: Indiana versus Illinois tax rates making taxpayers flee Illinois. This guide covers Illinois versus Illinois tax rates. Indiana Versus Illinois Tax Rates are one of the main reasons for a mass exodus of Illinois businesses and taxpayers to Indiana. Indiana is booming. The low tax rates in Indiana are attracting tens of thousands of small business owners from Illinois.

The shift in companies changing their business models to remote job positions is creating a mass exodus of Illinois workers to flee their state to nearby low-taxed states such as Indiana.

The talk of the town in obese Illinois is Governor JB Pritzker’s aggressive lobbying of changing the current flat-tax protection to a progressive tax system. JB Pritzker has invested over $51 million to lobby and promote the progressive tax. JB Pritzker calls it the FAIR TAX. In the following paragraphs, we will cover Indiana versus Illinois tax rates.

Indiana Versus Illinois Tax Rates: Incompetent Politicians

JB Pritzker and state lawmakers are not concerned about the state being shut down for so long because they are confident the Trump Administration will be bailing them out. However, President Trump and Republican leaders said DOA is bailing out financially irresponsible states.

Pritzker lied and said Illinois had a balanced budget before the pandemic. This was not the case. JB Pritzker is losing popularity. Many experts think he is the most incompetent governor in the nation. During times of national emergency, you do not raise taxes.

Pritzker said there is no better time to increase taxes and change the state’s flat tax to a progressive tax system than now. The new FAIR TAX would affect over 100,000 small business owners. The progressive tax will tax the rich and affect middle-class wage earners. 2,600 of the 4,400 closed businesses in Illinois due to the COVID-19 pandemic are not expected to reopen. This breaking news article will discuss and cover Indiana Versus Illinois Tax Rates.

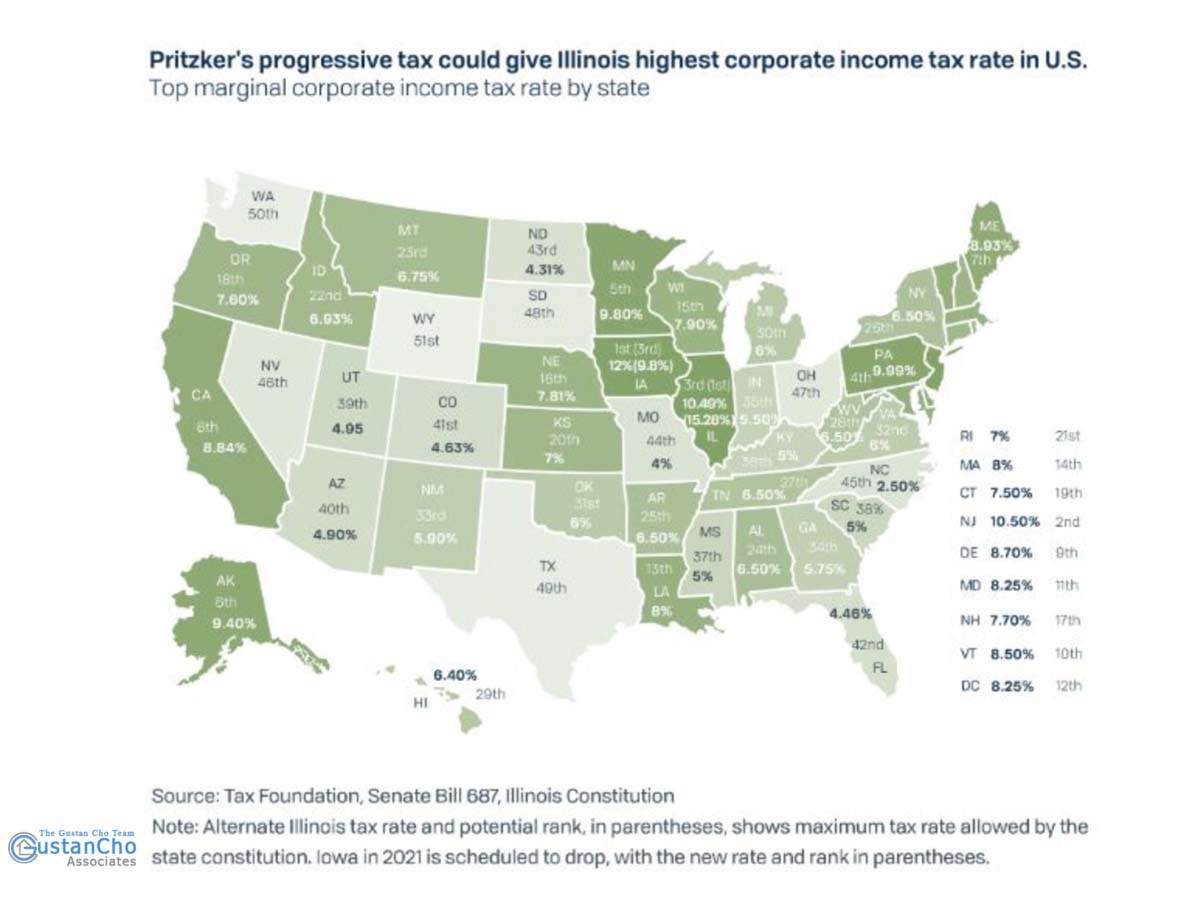

Indiana Versus Illinois Tax Rates: Illinois FAIR TAX Would Rank Illinois The Highest Taxed State In The Nation

From the day Pritzker set foot as Illinois governor, he started increasing taxes and creating new taxes to fix the financial crisis. The governor is pushing for the FAIR TAX. He got lawmakers’ approval through his relentless lobbying efforts. However, he needs voters’ approval on this coming November 3rd, 2020 election. If voters vote on the FAIR TAX, the Illinois Constitution can be changed, making the FAIR TAX into law.

Passage of the FAIR TAX would increase Illinois’ business taxes to be the highest in the United States. In the meantime, neighboring Indiana is working on cutting taxes to attract more businesses and taxpayers to their state.

Most other states are working on lowering taxes and offering incentives to attract new taxpayers and businesses. Illinois is doing the exact opposite. Pritzker is hands down clueless and lost. He is playing with fire. This incompetent governor does not realize the number of small businesses and taxpayers either moving out or planning on moving out of Illinois due to high taxes.

States Cutting Taxes To Attract Taxpayers While Illinois Increases Taxes To Historic High Levels

Most profitable states with billions in surplus are lower-taxed Republican-led states. Neighboring Indiana cut the corporate tax rate from 5.5% to 5.25%. Indiana reduced the corporate tax rate from 5.5% to 5.25%. Back in 2012, the corporate tax rate in Indiana was 8.5%. The obese governor and Indiana state lawmakers have been dropping corporate tax rates yearly since July 2012 to attract more small businesses.

This strategy by Indiana politicians is working. There is nothing good about the FAIR TAX. The FAIR TAX will devastate Illinois. Illinois is in a major financial crisis. The state was in a financial mess before the coronavirus pandemic due to financial irresponsibility and mismanagement. The state was the first to shut down and the last to reopen.

By lowering the corporate tax rates, the state is getting a flood of new businesses moving to their state, thus increasing revenues every year. Next July, the Indiana corporate tax rate will fall below 5.0% to 4.9%. On the other hand, the corporate tax rate will increase from 9.5% to 10.49% in Illinois. Illinois is going in the other direction, which will backfire on the governor and state lawmakers. Would you rather take a dime on every dollar or 90 cents on zero? The answer is quite simple. For some reason, Pritzker is not getting it.

See the graph below:

The health of the Illinois economy and an incompetent governor concerns small business owners and individual taxpayers. The FAIR TAX would affect over 100,000 small business owners. Small business owners can see a tax increase of more than 47% if the FAIR TAX becomes law. The tax rate would be from 6.45% to 9.45%. This would make it double the corporate tax rate of Indiana. This would mean high unemployment rates in Illinois. Small businesses account for 65% of Illinois’ job creation.

Of the 4,400 closed businesses in Illinois due to the coronavirus pandemic, over 2,600 businesses are not expected to reopen. Chicago’s largest employer, United Airlines, said the airline giant will lay off over 50% of its employees.

Besides small businesses, medium-sized and large corporations are expected to move out of Illinois if the FAIR TAX becomes law. One anonymous CEO of a Chicago-based company said they expect to close its headquarters in Rolling Meadows, Illinois, and relocate to a state encouraging their growth rather than punishing them with high taxes. Undoubtedly, Pritzker’s progressive tax will start pushing taxpayers out of Illinois. Indiana, Tennessee, Missouri, and Wisconsin are welcoming Illinois taxpayers fleeing to a lower-taxed welcoming state. JB Pritzker is no doubt not too sharp when it comes to basic business. Increasing taxes and proposing a progressive tax system for a state on the verge of bankruptcy would backfire on Pritzker. There is no doubt JB Pritzker will be a one-term governor.