This article on Illinois rising property taxes was published on September 30th, 2019

Illinois rising property taxes are hitting the national news

- Illinoisans had high hopes with the election of new Governor JB Pritzker to take office and start fixing the financial mess in the state

- The opposite happened

- After the new Illinois Governor took office, things started to get worse

- Every successful businessman, CEO, a political leader knows to fix an organization’s finances, it is not how much you make but what you spend

- Pritzker’s solution to raising more revenues is to tax as much as possible

- The governor has literally taxed everything he can think of including doubling the state’s gas tax

- However, the governor and lawmakers are not cutting spending but rather increasing

- This signals disaster for Illinois

- To make voters even more furious, JB Pritzker has approved a bill giving state lawmakers a raise

- The state is on the verge of bankruptcy

- Illinois pension debt surpassed the $241 billion dollar mark

- With all the tax increases the new governor implements, it will not be enough to cover the pension debt shortfall

In this article, we will cover and discuss Illinois rising property taxes and the financial crisis facing the Land of Lincoln.

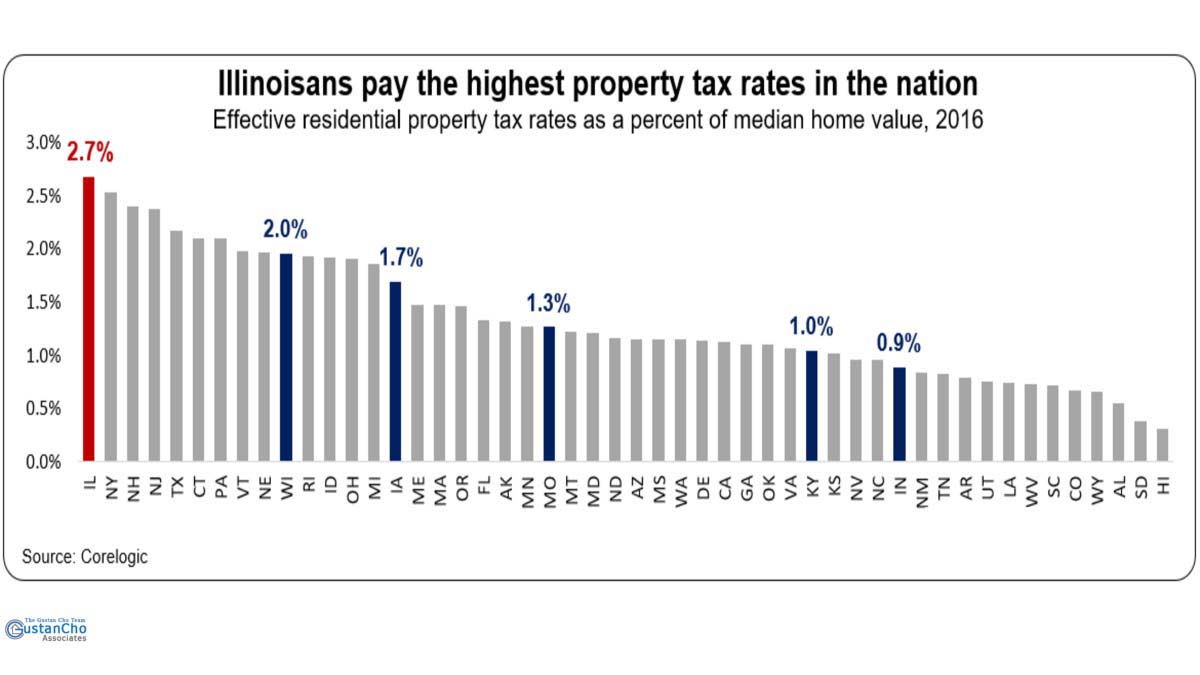

Illinois Rising Property Taxes Makes It The Highest Taxed State

Illinois rising property taxes have put the state on the national radar.

- Illinois has the second-highest property tax state in the U.S. New Jersey has the highest property tax in the nation

- However, many analysts predict that Illinois will oust New Jersey’s highest property tax position by the end of 2020

- Peoria, Illinois recently added a separate property tax on its homeowners to meet the police and firefighters pension debt for this year

- Pritzker’s progressive tax plan and other tax increases are forcing taxpayers to flee the state

- One thing the Pritzker Administration does not realize is that by imposing high taxes and imposing newly created taxes, it is not just driving individual taxpayers but businesses and corporations as well

- For example, NEXA Mortgage, LLC, a national direct lender licensed in multiple states is headquartered in Lombard, Illinois

- The board of directors at NEXA Mortgage, LLC recently had a closed-door meeting in relocating its corporate headquarters to neighboring lower taxes states like Indiana, Tennessee, or Kentucky

- The exodus of businesses is creating stagnant incomes and fewer job opportunities for Illinoisans

- Just under 2 million taxpayers have left the state since 2002

Countless others are seriously thinking of leaving the state. The Pritzker Administration new progressive tax for the state will definitely expedite the exodus of residents to other lower-taxed states.

How Illinois Rising Property Taxes Are Hurting Homeowners

Illinois rising property taxes are hurting homeowners.

- Illinois rising property taxes dwarf real estate appreciation

- Illinois is one of the very few states in the nation where home values have decreased since the 2008 Housing and Credit Meltdown

- Recent data state DuPage County Home Prices Decreased 24% while taxes increased 7%. Data also show that nine Illinois communities have been the worst in the nation

- Homeowners in lower-taxed states such as Florida, Texas, Georgia, Tennessee, Alabama, North Carolina, Ohio have enjoyed double-digit housing appreciation

- Unfortunately, Illinois homeowners have little to no equity in their homes due to the state’s financial mess

- Homebuyers who are planning on buying a home in Illinois can get affordable housing at great prices

- However, the chances of their homes appreciating is little to nil

Illinois homebuyers need to plan on taking on the risk of future property tax increases and paying high property taxes than other states.

What Experts Say About Illinois Rising Property Taxes

Illinois will no doubt be the highest property tax state in the nation.

- Michael Gracz, the National Sales Manager and monetary policy expert for Gustan Cho Associates Mortgage News is one of the Illinois taxpayers that left the state

- Mike Gracz could no longer take the consistent tax increases

- Born and raised in DuPage County, Mike decided to pull the trigger once he saw the actions of Governor JB Pritzker

- It does not take a genius to figure out that raising taxes and not cutting spending will make this financial crisis worse

- When Mike heard that Pritzker approved wage increases to state lawmakers, he decided to sell his townhome in Barlett and move to Colorado

- Today, Mike said he is lucky his townhome sold

- He was paying $6,800 in property taxes on a $200,000 townhome in Barlett

- He considers himself very lucky in finding a buyer and selling his home as fast as he did

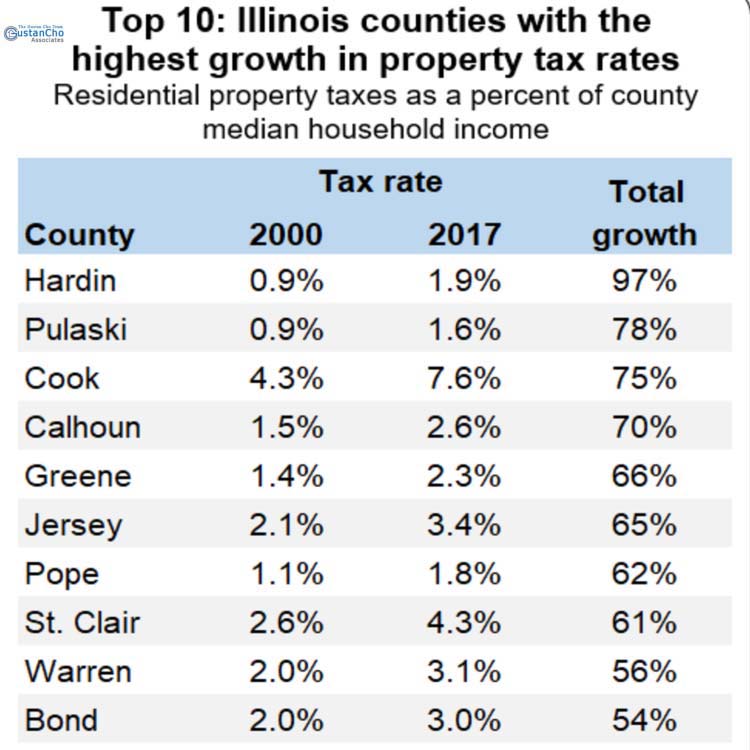

Due to Illinois rising property taxes, both individual taxpayers and business of all sizes are fleeing the state of Illinois in record numbers. Please look at the chart below.

How Illinois Rising Property Taxes Affect Taxpayers

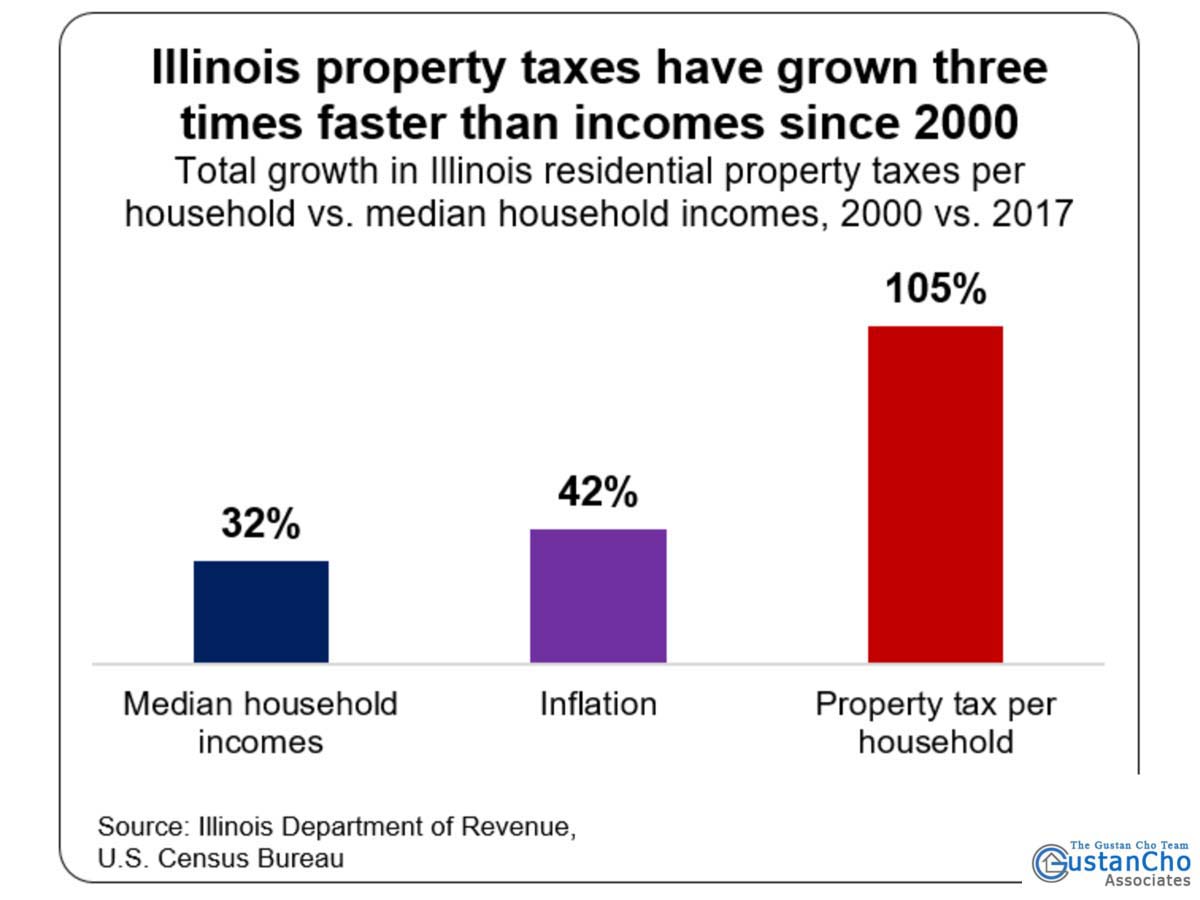

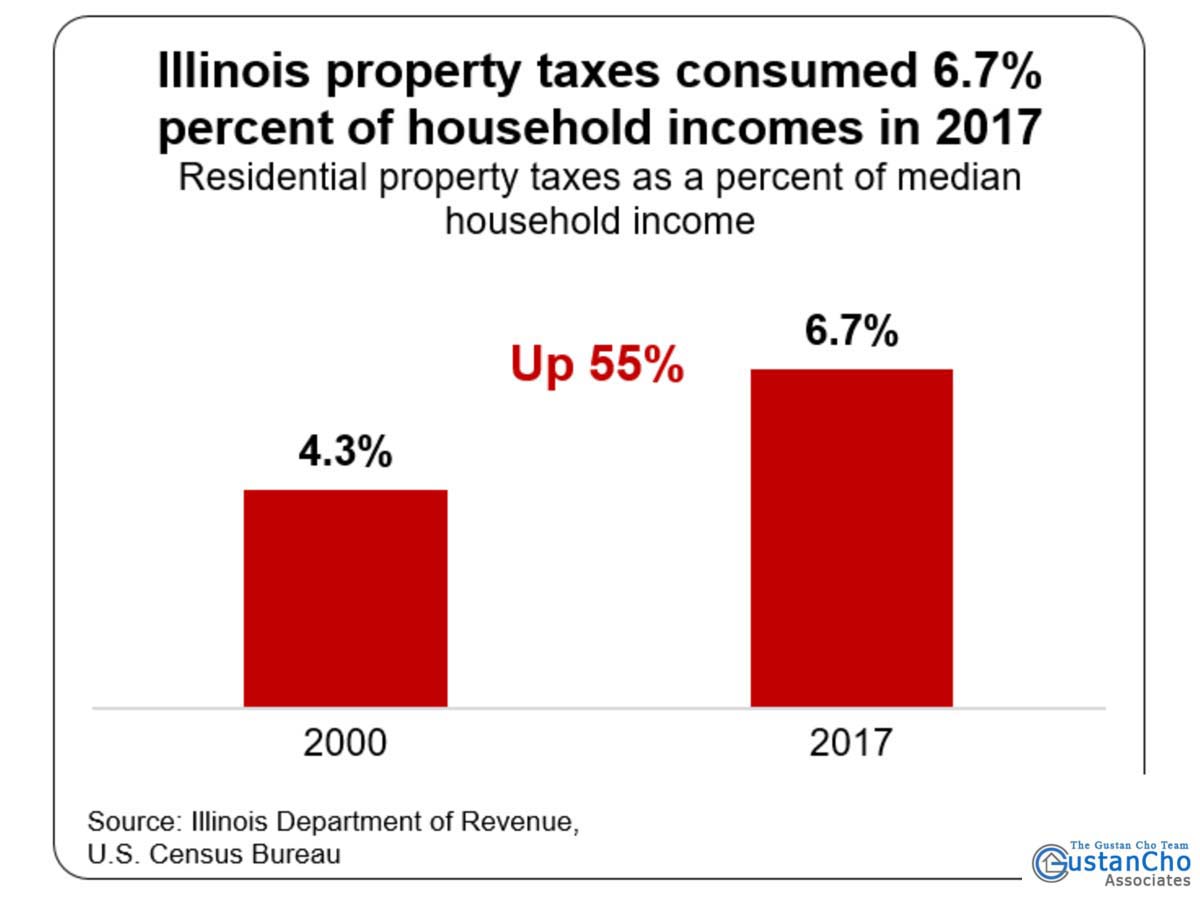

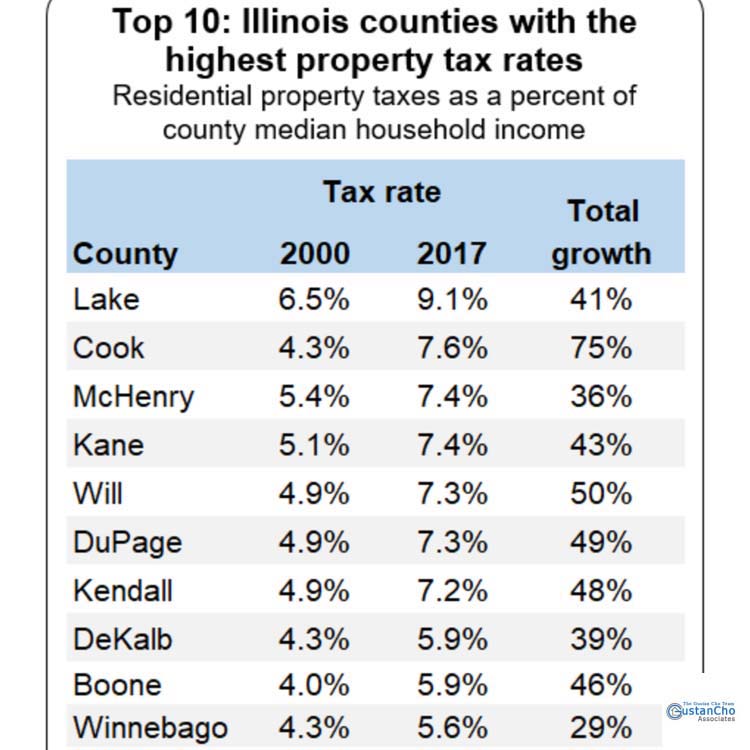

Besides a mortgage payment, property taxes are the second largest expense for homeowners. Even senior homeowners with limited fixed income with no mortgages need to pay their property tax bills. Below is a chart of comparing a homeowners property tax bill to their household income. Many folks are living day to day with their household income. Even a $100 increase a month in additional debt can affect them.

The Economy Of Illinois Versus Other States

Florida is raking in billions in revenues by new residents migrating. Many corporations from high taxed states like New York, Illinois are moving to lower-taxed states like Florida, Tennessee, Texas and a dozen of others. Home values have gone up double-digits in Florida and Texas. Tennessee is becoming the leading state attracting out of state residents to migrate. Tennessee has no state income taxes along with 9 other states. Income in Illinois has been stagnant for over 10 years with no light at the end of the tunnel. As of today, income projections the state is in a downward trend.

Property taxes have escalated three times faster than the average household income in Illinois since 2000.

- This translates that more workers allocated their incomes towards their property taxes and had to cut other expenses

- Stats show that the average Illinoisan allocated 7.1% of their household incomes towards their property taxes in Illinois

- This far exceeds the national average of 2.1%

Are High Property Taxes A Statewide Problem?

There are many counties in every state.

- This holds true in Illinois. Some counties have higher property taxes than others

- Lake Country, the most northern county in the state, has the highest property tax rates in the state

- Lake County’s property tax rate increase 40% from what they were back in 2000

- 6.5% of the household income went to property taxes back in 2000 by homeowners in Lake County

- Today, that number skyrocketed to 9.1% of the household income being allocated to property taxes thus a 40% increase

- The median homeowner property tax bill annually in Lake County is $7,500

- Compare to a similar and like home in Crown Point, Indiana where the property taxes is $3,250

Below is a chart of the Top 10 Counties with the highest property tax rate in Illinois:

Illinois finances are in chaos. Many wonder if it is fixable. The state is so much in debt that no tax increase in the world will put the finances back in the black. What Pritzker is doing by raising taxes will come back and bite him. It is one thing if he is raising taxes on everything he can think of. However, he is not cutting any spending. He is also raising wages on lawmakers. He just doubled the gas tax in Illinois which is hurting gas stations that are on the border. What Illinois needs is a new governor with a team of financial geniuses who can run the state like a business.

Here are some thoughts:

- Run the state like a business where it is not how much you make but what you spend

- The pension debt in the state needs full reform

- There is no way the pension debt will get resolved no matter how much taxes you increase nor what type of new taxes you impose

- Increasing and imposing new taxes will force taxpayers to leave the state

Thinks about this; A police officer joins the force at the age of 21 years of age. The police officer retires the force at 51 years of age which gives him 30 years of service. If at the time of retirement the police officer made $100,000, the officer can retire with 75% pay as his pension for the rest of his life. This means the retired public employee will make $75,000 for the rest of his and/or her life. This is for all public employees such as cops, firefighters, teachers, and other government workers with pensions. Many people are now living past 80 years old. There is no way in the world that without pension reform, the state will be in business. Government workers who were promised a pension may not get their initial pension plan honored in the coming years. The system is severely broken and does not and will not work. In the meantime, the Pritzker Administration is forcing many Illinois residents to flee the state.