BREAKING NEWS: Illinois Ranked As Highest-Taxed State In The Nation For Taxpayers

Illinois Ranked As Highest-Taxed State In The Nation For Taxpayers and is expected to remain the ranking for many years.

- While other states are freezing and/or reducing taxes during the coronavirus pandemic, Illinois is doing the exact opposite

- What kind of idiot raises taxes during a recession?

- What type of incompetent politician will keep on implementing tax hikes multiple times?

- What type of loser will not be concerned with the mass exodus of businesses and taxpayers?

- JB PRITZKER

- Under the leadership of rookie freshman governor JB Pritzker, Illinois plans on not just increasing taxes across the board but changing the current flat-tax to a progressive tax system

- JB Pritzker is really pushing hard in trying to persuade voters to vote for his FAIR TAX come November 3rd, 2020

- JB Pritzker calls the proposed progressive tax the FAIR TAX

- There is nothing fair about Pritzker’s FAIR TAX proposal

- Recent studies found Pritzker’s FAIR TAX will affect over 100,000 small business owners

- 100,000 small businesses will get a 47% percent tax increase under JB Pritzker’s FAIR TAX

In this breaking news article, we will discuss and cover Illinois Ranked As Highest-Taxed State In The Nation For Taxpayers.

Illinois Ranked As Highest-Taxed State Causing Taxpayers To Flee To Other Low-Taxed States

Most states were booming and raking in billions in revenues prior to the coronavirus pandemic.

- Unfortunately, Illinois was in a major financial crisis prior to the pandemic

- Why are neighboring states like Indiana, Kentucky, Michigan, Wisconsin, Iowa, Tennessee raking in billions and booming and Illinois is on the verge of bankruptcy?

- Why do neighboring booming states have lower taxes and raking in billions in reserves and Illinois has the highest tax rate in the nation and is constantly broke?

- Why can’t Illinois follow the model of Indiana or other states who are not in a financial crisis?

Incompetence fueled by arrogance is the reason why Pritzker and the governors of financially strapped states do not follow other profitable states’ business models.

Incompetence And Corruption Leads To The Financial Demise Of Illinois

The simple blunt answer is incompetent politicians.

- Electing incompetent politicians such as JB Pritzker, Lori Lightfoot, and others who are clueless in running the government is one of the main causes for states and cities to go under

- Corruption is another leading cause of the collapse of state and local governments

- It took no more than 4 months after getting elected for JB Pritzker to be under federal tax investigation for tax fraud along with his wife MK Pritzker

- MK Pritzker ordered her contractors to remove all toilets from a mansion they owned next to their primary home in Chicago’s Golf Coast

- By doing so, the property can be deemed uninhabitable which means a substantial decrease in property taxes

- The assessed valuation of the property went from $6 million to $1 million due to no working toilets

- A classic case of property tax fraud

- The removal of the toilets saved JB and MK Pritzker $331,400

- After the home inspector from the Cook County Assessors Office inspected the property, MK Pritzker instructed her contractors to reinstall the toilets

- After Pritzker got caught of property tax fraud, he immediately wrote a $331,400 personal check to the Cook County Assessor’s Office

JB Pritzker and MK Pritzker is still under federal criminal investigation by federal investigators and the U.S. Attorney’s Office for tax fraud.

Illinois Ranked As Highest-Taxed State Due To Consistent Tax Hikes

Many Illinoisans had high hopes for the freshman rookie governor when they voted for him in 2018.

- Most figured JB Pritzker is a billionaire, that he was business savvy, and will be the solution in fixing the financial crisis of Illinois

- This backfired. Pritzker is not a self-made billionaire

- He inherited his money

- Pritzker is clueless and lost with finances

- The only solution Pritzker knows is to increase and create taxes to fix the financial crisis of Illinois

- Not only is Pritzker incompetent and has no idea about balancing the state’s deficit but he is also increasing spending

- Any idiot with some business sense can tell you that it is not how much you take in but rather how much you spend

- Pritzker has also given state lawmakers a hefty raise but also approved $200 million of pay raises to high-level state workers

Illinois collects more taxes per individual taxpayer than any other state.

Illinois’ History Of Financially Irresponsibility And Incompetent Politicians

JB Pritzker was always a politician wannabe. He ran unsuccessfully for many public office posts. Pritzker was even caught on the recording talking to former Illinois Governor Rod Blagojevich about getting a state-appointed position. Pritzker had an interest in getting an appointment as the state treasurer or replacing Barack Obama Senate seat. However, the bribe scheme in paying Blagojevich never happened. However, Pritzker and Blagojevich were recorded on tape. JB Pritzker ended up spending over $171 million of his own money in getting elected as governor of Illinois in 2018.

- Illinoisans are overtaxed

- There are plenty of tax revenues to run a state the size of Illinois

- In fact, the state should have billions in surplus

- The financial crisis in Illinois is hands down to incompetent politicians like JB Pritzker who are clueless and lost in running state government

- Politicians are grossly overspending taxpayers’ money like there is no end

- Incompetent politicians are misplacing spending priorities

- Every year, the state has a huge budget deficit that is carried to the next year

- The state is robbing Peter to Pay Paul and vice versa

- It is like a PONZI SCHEME

- This has created a fiscal deterioration of its finances and created a budget crisis that has plagued the state since 2015

- Illinois under the leadership of the obese rookie freshman governor JB Pritzker now faces the highest overall tax burden in the United States

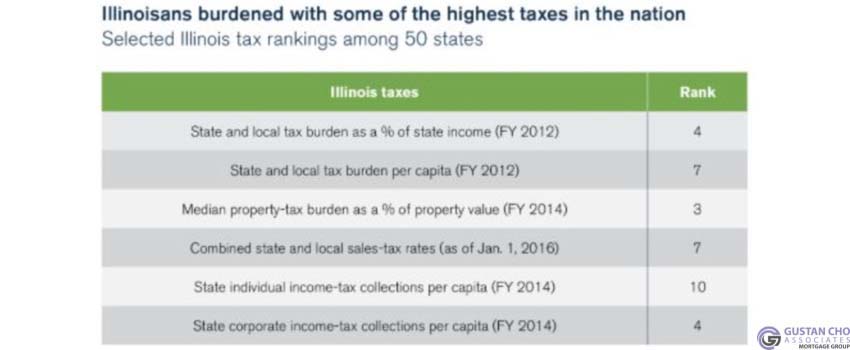

See the chart below on how Illinois is one of the highest taxed states in the nation:

Chicago Ranked As Highest Taxed City In The Nation

Chicago is ranked as the highest taxed city in the nation. Yet, the city is in a financial crisis.

- Again, due to incompetence by lawmakers, especially the far-left liberal mayor.

- Chicago Mayor Lori Lightfoot is more concerned about defunding the police and making the Black Lives Matter (BLM) cult happy rather than doing her job as mayor

- Lightfoot recently announced she cannot take another property tax hike this year

- High taxes, high crime rates, the highest murder rate in the nation, public corruption, and incompetent politicians are causing a massive out-migration of businesses and taxpayers to other lower-taxed cities and states

Politicians keep on increasing and creating new taxes.

- JB Pritzker recently doubled the state’s gas tax

- Pritzker was asked if he was still planning on pushing the FAIR TAX during a time of record unemployment and the coronavirus pandemic

- He quickly responded: Good question. Right now is the best time to get the FAIR TAX passed. Wealthy taxpayers want to pay more in taxes and do their fair share.”

Many experts believe Pritzker will fast track Illinois’ road to bankruptcy and ruin the livelihood of Illinois. All of these tax increases and new taxes will end up backfiring. Taxpayers are not stupid. Illinois’ out-migration numbers are skyrocketing. Pritzker was asked about the enormous number of out-migration in Illinois due to high taxes. He responded that he is not a bit concerned about it.

Illinois Ranked As Highest-Taxed State: Second Highest Property Tax Rate In The Nation

Illinois has the second-highest property tax rate in the nation.

- New Jersey currently has the highest property tax rate in the nation

- However, countless counties in Illinois are hiking property taxes due to budget shortfalls

- Even in Chicago, Mayor Lori Lightfoot plans on increasing property taxes this year to cover the city’s $700 billion shortfalls

- Bond-rating agencies have downgraded Illinois bond ratings to junk bond status

- Illinois property tax rates are expected to surpass New Jersey’s in the next year or two

- High property taxes normally mean low home values

- Illinois has the slowest home appreciation rate in the country due to increasing property taxes

Illinois had the tenth highest individual income tax rate in the country. The average Illinois taxpayer pays an average of $1,200 in state income taxes. This is much higher than neighboring states. Tennessee and a handful of other states do not have any income tax. State with no state income taxes is thriving.

Illinois corporate tax rates are among the highest in the country. In 2014, the state had the fourth-highest corporate tax rates in the nation. Illinois’ corporate tax rate is ranking fourth in the nation behind only Alaska, New Hampshire, and North Dakota. There were no other states that came close in matching the Illinois corporate income-tax collections. Wisconsin’s per capita corporate income-tax collections came in at a little more than half Illinois’ collections.

Look at the chart on Illinois corporate income tax rates:-+

Illinois is in a financial mess. JB Pritzker and the state’s Democrats are trying to get the federal government to bail the state’s financial deficit from its mismanagement. However, the White House and the Republican-led Senate already told the heavyset obese Illinois governor ” NO WAY, JOSE.” Illinois needs new leadership. Illinois is a beautiful state that has hopes. However, under the management of incompetent politicians like JB Pritzker, the state is bound to self-destruct.