BREAKING NEWS: Progressive Tax Could Affect 47 Percent Of Illinois Business Owners

Governor JB Pritzker’s Progressive Tax Could Affect 47 Percent Of Illinois Business Owners.

- Illinois is in a financial crisis like never before

- The U.S. economy was booming prior to the coronavirus pandemic

- Many states such as Florida, Texas, Georgia, Tennessee, and dozen of others have been raking in billions in revenues

- Most Republican-led states had billions in reserves

- Dozen of low-taxed states had floods of new families and moving to their states

- However, Illinois was in a financial crisis prior to the COVID-19 pandemic

- The coronavirus pandemic made the financial situation worse in Illinois

- Rookie Governor JB Pritzker does not seem to know how to solve the state’s financial crisis

- The only solution Pritzker has in solving the budget deficit is to increase existing taxes and creating new taxes

- Many voters had high hopes for Pritzker when he got elected in 2018

In this article, we will discuss and cover Progressive Tax Could Affect 47 Percent Of Illinois Business Owners.

JB Pritzker Progressive Tax Could Affect 47 Percent Of Illinois Business Owners And High-Income Wage-Earners

Pritzker is the heir of the Hyatt Hotel Chain and a billionaire.

- However, it proved that JB Pritzker has no clue in running a business and balancing a budget deficit

- He raised taxes on over 20 items and created new taxes

- He has doubled Illinois gas tax

- The problem with Pritzker is not only is he increasing taxes but is not cutting spending

- Pritzker recently approved pay raises for state lawmakers which is a very unpopular move

- Pritzker also gave over $200 million in raises for high wage-earning state workers

- Pritzker and other politicians keep on increasing property taxes to solve the pension debt shortage

- No tax increases in the world will fix the state’s pension debt crisis

- The state needs pension reform and/or bankruptcy

- Pritzker said no for both

- He is now proposing changing the state’s flat-tax to a progressive tax system which will hurt small business owners and higher-income wage earners

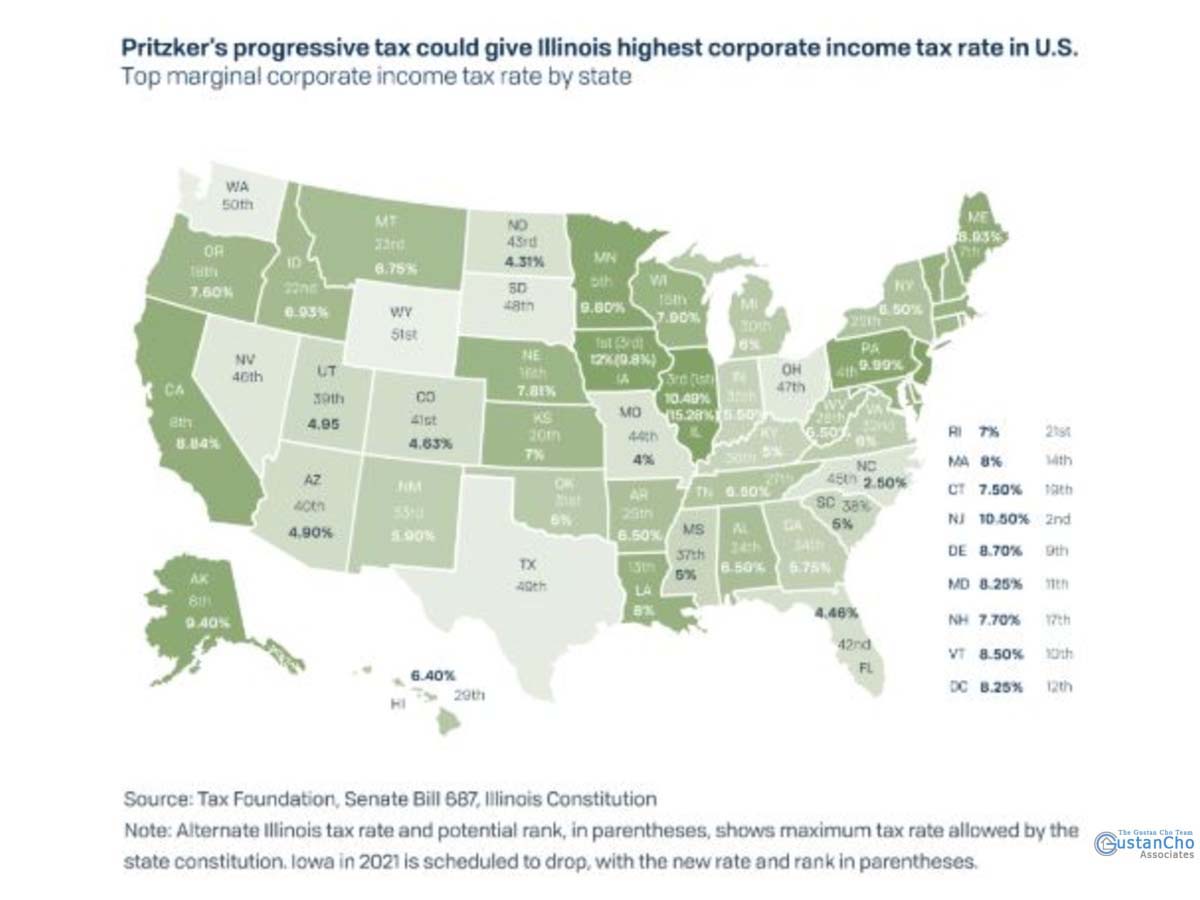

Due to having the highest tax rates in the Nation, thousands of businesses and families are moving out of state to lower-taxed states. Never in history has such out-migration numbers in Illinois been so high.

Progressive Tax Could Affect 47 Percent Of Illinois Business Owners: Many Are Expecting To Flee State To Lower-Taxed States

JB Pritzker’s progressive tax could affect 47% of Illinois small business owners.

- This can be disastrous for small business owners who already had a huge negative financial impact due to the COVID-19 pandemic

- Illinois business owners are the largest impacted financially than any other state

- Illinois was the first state to close and the last state yet to reopen due to JB Pritzker’s executive stay at home order extensions

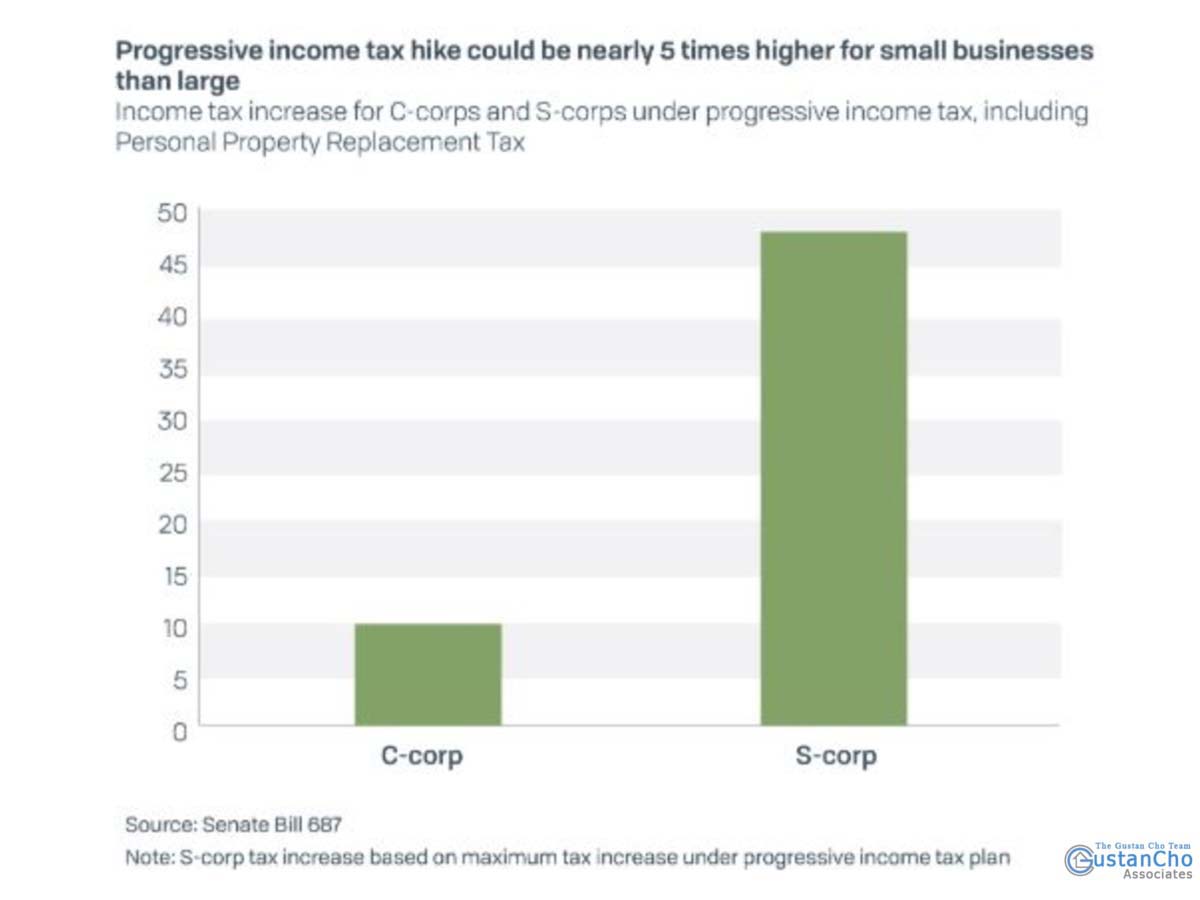

- Small businesses in Illinois face a potential income tax hike nearly 5 times larger than corporations under J.B. Pritzker’s “fair tax” amendment

- Pritzker has extended his stay-at-home order to at least the end of May in order to combat the spread of COVID-19

- The governor’s extension means that small businesses need to remain closed until Pritzker reopens

As time passes, the chances of long term survival for small businesses remain glim.

What Experts Are Saying About Pritzker’s FAIR TAX

There is no doubt the changing the state’s flat-tax to the progressive-tax system both individual taxpayers and businesses will leave the state.

Illinois Tops In Being The Most Financially Mismanaged State In The Nation

Illinois ranks as the top financially irresponsible state in the Nation. Most politicians such as Pritzker have no clue that you cannot spend more than you take in.

- The state of Illinois is out of control on the way they are spending taxpayer’s money

- It is common economics 101 that you cannot outspend the revenues you receive

- This is exactly what Illinois is doing

- Pritzker and his allies think raising taxes is key in solving the state’s budget deficit

- They do not realize the state is heading into becoming a ghost town

- Data and statistics prove small businesses are responsible for 60% percent of the net jobs created in Illinois

- Many small businesses are not expected to reopen as Pritzker prolongs the reopening of Illinois

- Many are will face bankruptcy and will need to permanently lay off workers

- Small business owners in Illinois can see an income tax hike nearly five times higher than larger businesses and corporations

JB Pritzker and the Democrats are absolutely clueless about how they are hurting small business owners and the state economy.

See the chart below:

Illinois is losing tens of thousands of families and business owners. Never in history has the out-migration rate been so high. JB Pritzker and Democrats need to realize Illinois is facing a major out-migration crisis. However, Pritzker said that Illinois will always attract new businesses and families due to the great cities, counties, landmarks, universities, and other amenities. Experts and analysts disagree. Many analysts and economists say the heavyset governor is in a state of denial and Illinois can be facing a serious financial collapse in the coming months.

What Is Pritzker Thinking

Many Illinoisans are confused about what Pritzker is trying to accomplish. This holds especially true with well-known economists. It is no rocket science that by increasing taxes, there will be a decrease in hiring activity by small business owners. High taxes also means lower wages and reduced spending. So why is Pritzker pushing so hard in changing the state’s flat-tax to a progressive tax system when the Illinois economy is so fragile. Many small businesses are already setting plans to move out of Illinois to other tax-friendly states. Pritzker does not seem to understand this and is in a state of denial.

See the image below:

No tax hikes in the world can fix Illinois’ financial crisis. The state has been plagued with incompetent and corrupt politicians. Voters need to elect competent and honest politicians who can run the state as a business. Politicians need to realize they cannot spend more than they bring in. This is exactly what is happening now in Illinois. JB Pritzker is absolutely clueless and many think he is dangerous due to his incompetency. The number of families and small businesses escaping to other states with lower taxes and lower cost of living is alarming. Many homeowners in Illinois do not see their homes appreciate in value due to having the second-highest property tax rate in the nation. Voters need to get out and vote in the next Illinois election. Vote for an honest and competent governor and politicians.