This ARTICLE Is About Illinois Housing Market Recovery Still Lags The Rest Of The Nation

The economy has never been as good as it has been since President Donald Trump took office. Unemployment numbers hit a 50 year low at 3.5%. Record job numbers last Friday skyrocketed the stock markets to a historical high. Every day the Dow Jones Industrial Averages are going up it means a new stock market high has been recorded. The Federal Reserve Board has lowered interest rates for the third time in 2019 in concerns that the economy will not slow down.

The housing market is on fire. Home values in most states have been appreciating above and beyond expectations with no signs of a housing correction. Due to increasing home prices, both HUD and the Federal Housing Finance Agency (FHFA) have increased FHA and Conventional Loan Limits 2019 FHA Loan Limits are capped at $314,827. 2019 Conventional Loan Limits is capped at $484,350

Due to rising home prices, President Trump signed a bill eliminating VA Loan Limit Caps. Borrowers do not have to meet a maximum loan limit cap on VA mortgages. However, the joys and rewards of increasing home prices are not being enjoyed by all homeowners. High property tax states normally do not have homes appreciate in value. Home values drop in high property tax states. Unfortunately, Illinois is one such state.

In this article, we will cover and discuss Illinois Housing Market Recovery Still Lags The Rest Of The Nation.

Correlation Between High Property Taxes Versus Home Values

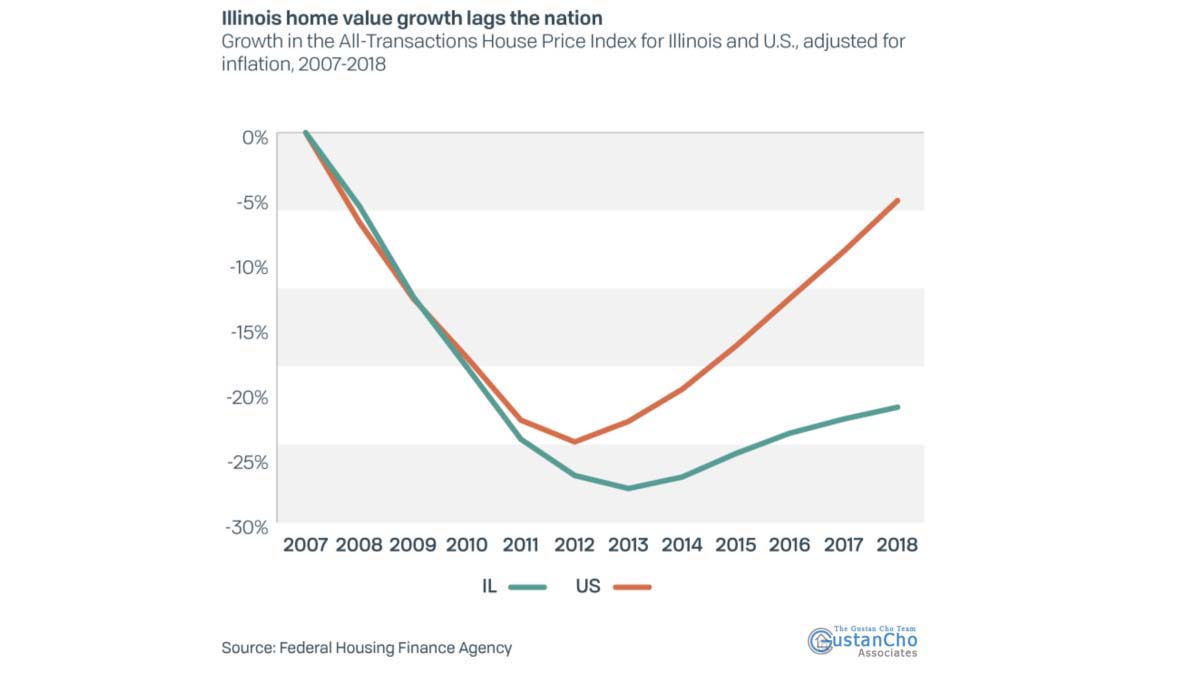

In general, high property taxes stump home value growth. For example, home values in DuPage County Illinois are down 24% in value since the Great Recession of 2008. While home values dropped 24%, property taxes in DuPage County went up 7%. Illinois Housing Market Recovery has been way slower than anticipated not just to property tax hikes, but tax hikes in general. Illinois Housing Market Recovery has been slow due to tax increases and the state creating and implementing new taxes.

Illinois Governor J.B. Pritzker has recently approved doubling of the state’s gas tax. To add fuel to the fire in angering Illinois taxpayers, Pritzker also approved wage increases to state lawmakers. The raise came at the wrong time when the state is on the verge of financial disaster. Illinois has the highest pension debt in the nation. The state has a $241 billion pension debt deficit. Chicago is in the worse financial crisis ever.

Newly elected Mayor Lori Lightfoot seems lost and clueless. Both Pritzker and Lightfoot’s solution to fixing the financial crisis is raising and creating new taxes. However, increasing taxes and creating new taxes is backfiring on them. Countless Illinoisans are moving out of Illinois to lower-taxed states.

Midland Metal Products, a Chicago-based company for 98 years, has moved to neighboring Indiana due to the high city and state taxes. More and more businesses and individual taxpayers are moving out of Illinois in record numbers. Illinois politicians need to shape up and get their acts together before the state has a financial meltdown.

Reasons For Slow Illinois Housing Market Recovery

High property tax state suppresses housing demands. Higher property tax states have a slower average home value growth than states with lower taxes. Home values in lower-taxed states like Florida, Texas, Kentucky, Tennessee are skyrocketing in home values.

Illinois has the second-highest property tax rate in the nation next to New Jersey. Illinois politicians plan on increasing property tax in the state to cover the pension debt shortage.

Look at the graph below:

Sales in Illinois trail other states. However, Illinois did have an increase of 0.30% in increased housing sales in July. Home sales in Illinois have been much weaker than other parts of the country. Many homebuyers fear high property taxes, declining home values, and the state of the economy in Illinois. Home sales in Illinois were 11% lower than the 12 month period of 2018.

What Analysts Say About Illinois Housing Market Recovery

According to Massimo Ressa, Chief Executive Officer at Gustan Cho Associates, he considers that Illinois will be in good shape as the state fixes its financial crisis:

In the meanwhile, there seems to be a sort of panic in Illinoisans fleeing the state to other lower-taxed states. Many homeowners are scared because of how much higher will property taxes increase. Until the state, especially the city of Chicago, can fix its pension debt issues, property taxes will continue to rise. Right now, the city of Chicago and the state of Illinois are swaying businesses and individual taxpayers from locating to Chicago. There are more businesses and taxpayers leaving the state than migrating to Illinois. This is a developing story. Gustan Cho Associates Mortgage News will update our viewers as more develops on this story. Stay Tuned!!!