How to Improve Credit to Qualify for VA Loans (2025 Update)

Buying a home with a VA loan is an incredible opportunity for veterans and military families. It can help you get a place you can call your own. However, if your credit score isn’t the best, you might be worried about qualifying for that loan. Don’t worry! You are not alone in this situation. Many people ask themselves how to improve credit to qualify for VA loans. The good news is that it’s easier than you think! Here’s what you need to know in simple, easy-to-understand steps.

How Credit Scores Affect VA Loans in 2025

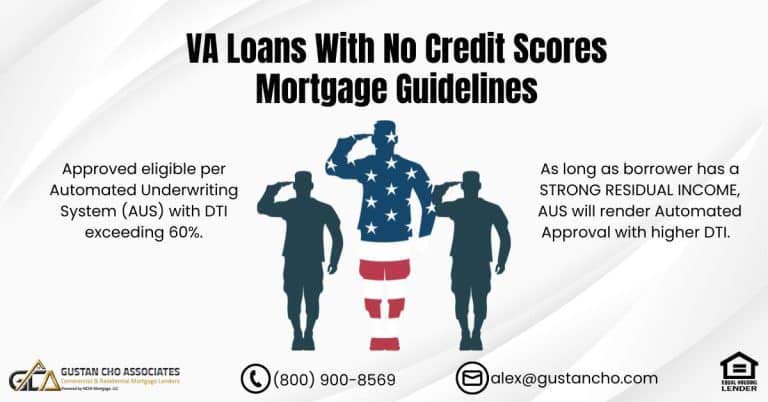

First, let’s clear up a common misunderstanding: the VA does not set a minimum credit score for loans. Instead, each lender has its own rules, often called overlays. Most lenders prefer to see a credit score of no less than 620. However, some lenders, such as Gustan Cho Associates, may accept lower scores if you meet other requirements. This means that even if your score isn’t perfect, you still might have a chance to get a VA loan.

Better Credit = Better Interest Rates – Higher scores can help you secure a lower rate

Apply Now And Get recommendations From Loan Experts

What Credit Issues Can You Have and Still Qualify?

Believe it or not, VA loans let you qualify even if your credit isn’t perfect. If you’re thinking about getting a VA loan but are worried about your credit, you might wonder how to improve credit to qualify for VA loans. It’s possible to qualify even if your credit isn’t perfect. You can have:

- Open collections

- Charge-offs

- Late payments

- Past bankruptcy (Chapter 7 or 13)

- Foreclosures

- Short sales

The key is to have re-established credit. Let’s talk about how to improve credit ti qualify for VA loans.

Simple Ways on How to Improve Your Credit to Qualify for VA Loans

Check Your Credit Report Carefully

Look at your credit report closely. Sometimes, mistakes can happen on your report, making your score lower. If you see an error, fix it right away. Disputing mistakes can help your credit score go up, making it easier to get a VA loan.

- Write a simple dispute letter explaining the mistake.

- Include proof, like receipts or payment confirmations.

- Mail it to the three main credit bureaus (Equifax, Experian, and TransUnion).

Doing this correctly can quickly boost your credit scores.

Step-by-Step Credit Repair to Qualify for VA Loans

You don’t need to pay for expensive help to fix your credit. You can do it yourself! Here’s how:

- Get Your Credit Report: Start by getting your credit report for free. Go to AnnualCreditReport.com to get your report.

- Look for Problems: When you have your report, look for negative things that might hurt your score, like late payments or mistakes.

- Check Dates: Make sure all the dates on your report are correct. Errors can make your credit look worse.

- Dispute Mistakes: If you notice any inaccuracies, write a straightforward letter to the credit bureau. Inform them about the error, and they will investigate the matter.

By following these steps on how to improve credit to qualify for VA loans, you are setting yourself up for success.

Can Paying Collections Actually Hurt Your Credit?

Yes! Paying older collections lowers your score. If you pay an old collection, it updates as new and drops your credit score. The FCRA, Fair Credit Reporting Act, is the federal law that regulated the information that can or cannot be reported on the credit report and the time a derogatory credit item can be posted. If the collection is very old, consider leaving it alone or negotiating a “pay for delete” agreement:

- Offer the creditor a payment in exchange for deleting the negative mark.

- Always get this agreement in writing.

Find Out How Your Credit Score Affects Your Eligibility

Apply Now And Get recommendations From Loan Experts

Why Secured Credit Cards Are Your Secret Weapon

If you want to know how to improve your credit to qualify for VA loans, stick with us. A secured credit card may be advantageous for you. Here’s the way it works:

- Get a Secured Credit Card: This kind of card requires a deposit. You can contribute between $300 and $500 as your own funds.

- Use It for Small Purchases: Once you have your card, use it to buy small things each month. This could be stuff like groceries or gas.

- Pay On Time: It is super important to pay your bill on time monthly. This shows that you are responsible with money.

- Keep It Up: Your credit score will increase if you keep using the card and paying on time.

Doing these things regularly will help you fix your credit and get you closer to qualifying for a VA loan!

Important 2025 Updates You Should Know

New rules in 2025 help veterans even more:

- Medical collections under $500 won’t count against you.

- Medical collections less than a year old don’t affect VA loan approval.

- New credit scoring models (coming late 2025) may improve scores for those with medical debt.

These changes mean qualifying for a VA loan is easier if you know the right steps.

How Quickly Can You Improve Your Credit?

If you want to qualify for VA loans, improving your credit is important. Here are some easy steps you can take:

- Correct errors immediately (can increase score in 30 days).

- Pay down credit card balances under 30% of your limit.

- Set up automatic payments to prevent late payments.

- Use secured cards consistently.

If veterans follow these tips, their credit scores can rise from 580 to over 640. This score can help them qualify comfortably for VA loans. By taking action now, you can get the credit score you need!

Be Careful with Credit Disputes During the Mortgage Process

Disputing a collection with a balance right before applying for a mortgage is risky. Removing disputes later can drastically lower your credit score.

- Medical debts are safe to dispute.

- Avoid disputing non-medical debts right before loan applications.

Real-Life Examples (Yes, You Can Qualify!)

Mike is a veteran who faced credit problems, scoring just 580 because of old collections and a past bankruptcy. He learned how to improve credit to qualify for VA loans by taking some important steps. First, he used secured credit cards for six months, which helped him build his credit. He also took the time to dispute some inaccurate late payments and successfully removed them.

After all his hard work, Mike’s credit score jumped to 645, and he was approved for his VA loan by Gustan Cho Associates. If you follow the right steps as Mike did, you can also improve your credit and qualify for a VA loan.

Reasons to Work with Gustan Cho Associates for Your VA Loan

Even with lower credit, Gustan Cho Associates can help you get a VA loan. Here’s why:

- No overlays – easier credit guidelines.

- Personalized support for veterans with credit issues.

- Fast approvals and clear communication.

We understand veterans and focus on solutions rather than problems.

Final Tips on Improving Credit to Qualify for VA Loans

- Check your credit reports regularly.

- Pay bills on time every month.

- Avoid new debt (no new car loans or big purchases).

- Use secured credit cards wisely.

- Contact a VA-approved lender early (like Gustan Cho Associates) to create a personalized plan on how to improve your credit to qualify for VA loans.

Ready to Get Approved?

Don’t wait! Gustan Cho Associates specializes in VA loans with ZERO LENDER OVERLAYS. Even if you think your credit is too low, chances are good you can qualify.

- No minimum credit score requirements.

- No hassle from lender overlays.

- Direct, helpful answers 7 days a week.

Want help right now?

Gustan Cho Associates

Borrowers who need a five-star national mortgage company licensed in 48 states with no overlays and who are experts on how to improve credit to qualify for VA loans, please contact us 800-900-8569, text us for a faster response, or email gcho@gustancho.com.

Improving your credit and qualifying for a VA loan doesn’t have to be stressful. With the right steps and the right lender, your dream of homeownership can happen faster than you think.

qualifying for a VA loan, but you don’t need perfect credit to get approved

Apply Now And Get recommendations From Loan Experts

Take the Next Step Today!

Your dream home is closer than ever. Let us show you exactly how easy improving your credit and qualifying for a VA loan can be. Contact Gustan Cho Associates now and take control of your financial future today!

Frequently Asked Questions About How to Improve Credit to Qualify for VA Loans:

Q: Can I Qualify for a VA Loan if I have Poor Credit?

A: Yes! Even if your credit isn’t great, learning how to improve credit to qualify for VA loans can help you get approved.

Q: What Credit Score will I Require for a VA Loan in 2025?

A: Most lenders prefer 620 or higher, but some, like Gustan Cho Associates, accept lower scores. Improving your credit can improve your chances.

Q: Does Paying Off Old Collections Help Me Qualify for VA Loans?

A: Usually, no. Paying old collections can actually lower your score. Learn how to improve credit to qualify for VA loans by negotiating a “pay for delete.”

Q: How Quickly Can I Boost My Credit Score?

A: By following tips on how to improve credit to qualify for VA loans, your score can improve significantly within 3 to 6 months.

Q: Can I Qualify for a VA Loan After Bankruptcy?

A: Yes, you can! If you rebuild your credit, you can qualify after bankruptcy or foreclosure.

Q: Is it Easy to Fix Mistakes on My Credit Report?

A: It can be simple! Disputing mistakes quickly is one effective way to improve credit to qualify for VA loans.

Q: Why Should I Use a Secured Credit Card to Improve My Credit?

A: Secured cards help you build credit fast by showing lenders you pay bills on time, improving your chances for VA loans.

Q: Are Medical Debts Counted Against Me for VA Loans in 2025?

A: Medical debts under $500 no longer hurt your VA loan chances. Knowing these changes helps you plan to improve credit to qualify for VA loans.

Q: Can I Dispute Debts Right Before Applying for a VA Loan?

A: Be careful! Debts, except medical debts, that are disputed right before applying can hurt your score. Work with your lender on the best timing.

Q: Why Should I Choose Gustan Cho Associates for My VA Loan?

A: They offer easy credit rules, no overlays, and personalized help for veterans focused on how to improve credit to qualify for VA loans.

This blog about “How To Improve Credit To Qualify For VA Loans For Best Rates” was updated on March 18th, 2025.