In this guide, we will cover how much house can I afford versus qualify. First-time and seasoned home buyers must consider ” How much house can I afford to buy?” when buying a home. Mortgage lenders will qualify borrowers on the maximum housing budget buyers can afford.

Just because the lender qualifies for a loan based on the down payment, income, and credit history does not mean home buyers can afford a new home purchase. Always ask How Much House Can I Afford To Buy. Lenders do not consider personal expenses that do not report on the credit report.

Homeowners will still want to maintain the living lifestyle like they were as renters. Upgrading to a bigger, more expensive home will add to monthly expenses. Just because a lender qualifies and is willing to lend the funds to purchase home borrowers can afford does not mean that How many houses Can I Afford To Buy.

How Mortgage Underwriters Calculate DTI

How Much House Can I Afford To Buy is not the lender’s job. This is the buyer’s responsibility. Mortgage Underwriters will not consider how much the borrowers’ monthly budget is. Liabilities and debts that do not report on the credit report are not taken into account, such as the following expenses:

- utility bills

- private school bills

- helping out with elderly payments

- supporting kids for college tuition

- vacations

- pet care

- hobbies

- mortgage lenders do not consider other personal expenses

New homeowners must seriously consider these added expenses and decide whether a particular home they want to purchase is realistically affordable and will not make a big dent in their lifestyle. We will cover how mortgage lenders calculate how much home you can afford and help answer the question of “HOW MUCH HOME CAN I AFFORD TO BUY” in this blog. Hopefully, this article will help help to decide in not to buy too much house where it affects the new homeowners’ lifestyle.

How Lenders Qualify Versus How Much House Can I Afford To Buy: Debt To Income Ratio Explained!

How much home a new homeowner can afford is not based on how expensive the value of the home purchase is. It is how much monthly housing payment consists of principal, interest, taxes, and insurance based on the loan balance and other monthly expenses.

Homeowner association dues, as well as mortgage insurance premiums, are also added in calculating both front-end debt-to-income ratios as well as back-end debt-to-income ratios. Underwriters calculate Front-end debt-to-income and back-end debt-to-income ratios.

For example, if a borrower makes $3,000 gross per month and the minimum housing payment is $1,000, the front-end debt-to-income ratio is 33%. The maximum front-end housing ratio allowed for FHA is 46.9% to get an approve/eligible per Automated Underwriting System Findings (AUS).

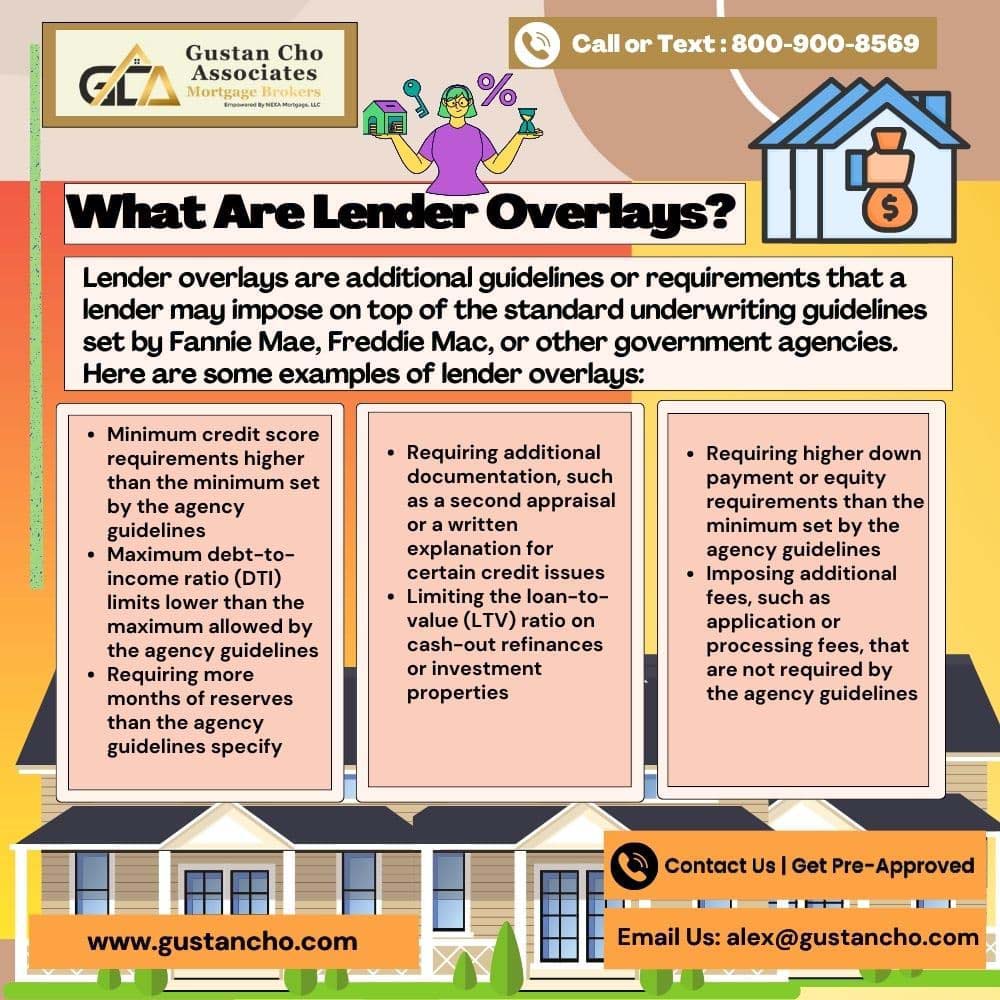

What Are Lender Overlays

Lender overlays are mortgage guidelines above and beyond those agency guidelines. Many lenders have mortgage overlays, which is their added mortgage guideline on top of the mandatory federal mortgage lending guidelines.

There is no front-end debt-to-income ratio requirement for conventional loan programs. However, the maximum debt-to-income ratio allowed per conventional mortgage guidelines is 50% to get an approved eligible per DU or LP FINDINGS, the Automated Underwriting System. Just because the maximum front-end debt-to-income ratios are capped at 46.9% does not mean all mortgage lenders will allow you to have the 46.9% debt-to-income ratios on FHA Loans.

For example, if the borrower’s front-end ratio is at 46.9% and the borrower goes to MORTGAGE LENDER A, MORTGAGE LENDER A may impose their own front-end debt-to-income ratio cap at no greater than 31%. This is called an overlay on debt-to-income ratios by the individual lender. In such cases, borrowers may have to choose a lender with no lender overlays on front-end debt-to-income ratios and go off the automated findings generated by the Automated Underwriting System, also known as AUS.

Back End Debt To Income Ratio

The second debt-to-income ratio component that mortgage lenders consider in calculating how much home a home buyer can afford is the back-end debt-to-income ratio. The back end debt to income ratios consider the sum of the housing payments and borrowers all other minimum monthly payments divided by the borrower’s monthly gross income. All monthly debts that are taken into consideration when underwriters are calculating back end debt to income ratios are the following:

- minimum auto payments

- minimum credit card payments

- minimum student loan monthly payments

- minimum monthly child support payments

- minimum monthly alimony payments

- all other minimum monthly payments that is reflected on the mortgage loan borrower’s credit report

Case Scenario And Example Of Debt To Income Ratio Calculations

Here is how debt-to-income ratios are calculated. Let’s take a case example. Say the borrower proposed the monthly minimum payment of his new home is $1,000.00. They also have the following:

- $200.00 monthly minimum car payment

- $50.00 minimum Capital One Credit Card minimum payment

- $100.00 minimum student loan payment

- $200.00 minimum child support payment

Adding the sum of the borrower’s other payments, the monthly expenses the borrower is obligated to pay each month is $550.00 per month. Adding a housing payment of $1,000.00, which includes the principal, interest, taxes, insurance, mortgage insurance, and homeowners association fees to other monthly minimum payments of $550.00, yields the total sum of $1,550.00 per month. Say the borrower has a $3,000 monthly gross income. The back-end debt-to-income ratio is calculated by dividing the total expenses of $1,550.00 by the gross monthly income of $3,000.00, which yields a back-end debt-to-income ratio of 52%.

Automated Approval Via Automated Underwriting System

To get an approved eligible per FANNIE MAE or FREDDIE MAC AUTOMATED UNDERWRITING SYSTEM, AUS, the maximum back end debt to income ratio for FHA that is allowed is 56.9% for borrowers with credit scores of 620 or higher. With credit scores lower than 620, the back-end debt-to-income ratio is lowered to 43%.

Underwriters calculate front-end debt-to-income ratios by taking the sum of the minimum housing monthly payments, which consists of PITI. PITI is the principal, interest, taxes, interest, homeowners association dues, and mortgage insurance premium dividing it by gross monthly income.

Again, as with front-end debt-to-income ratio caps, many lenders have their own internal mortgage lender overlays on back-end debt-to-income ratio requirements. Many banks and credit unions cap back-end debt-to-income ratios to 45% DTI when AUS gets automated underwriting system approval with a back-end DTI of 56.9%. Borrowers with mortgage denial due to high debt-to-income ratios contact us at Gustan Cho Associates, where we have no lender overlays on government and conventional loans. Lenders have no mortgage lender overlays and will go off the automated findings per DU or LP FINDINGS, which is Fannie Mae’s or Freddie Mac’s Automated Underwriting System automated approval.

Front End And Back End Debt To Income Ratio

So in this particular scenario, the maximum loan amount borrower who is making a gross income of $3,000.00 per month will qualify is the following:

FRONT END DEBT TO INCOME RATIO REQUIREMENT IS CAPPED AT 46.9%:

- 46.9% of the borrower’s $3,000.00 gross monthly income is $1,407.00

BACK END DEBT-TO-INCOME RATIO REQUIREMENT IS CAPPED AT 56.9%:

- 56.9% of the borrower’s $3,000.00 gross monthly income is $1,707.00

The lender will deem the above case study scenario of the above borrower as able to afford the above payments.

How Much House Can I Afford To Buy Versus Qualify: Borrowers Need To Understand Underwriters Do Not Take Personal Debts When Calculating DTI

The lender did not take into consideration the mortgage loan borrower’s private monthly expenses, such as the following:

- utility payments

- auto insurance payments

- private education payments

- summer camps

- maintenance expenses

- other expenses that are not reported on the borrower’s credit report

The question of how much house can I afford needs to be asked and answered by the home buyer.

How Much House Can I Afford To Buy Versus Qualify: Homeowner Versus Renter

How Much House Can I Afford To Buy should always be considered when shopping. There are many more advantages of being a homeowner than being a renter. However, with the many advantages comes disadvantages as well.

Renters do not have to worry about maintenance expenses. However, being a homeowner comes with maintenance responsibilities, such as mowing your lawn, trimming trees and shrubs, repairing or replacing appliances when they break down, and fixing plumbing, electricity, and HVAC when they break down.

Some of these repairs can be quite costly, and it is suggested that all homeowners have reserves. Those who are barely getting by and all of a sudden furnace breaks down in the middle of a sub-zero temperature winter and need a new furnace, where will the money come from? Homeowners should set aside a certain budget towards reserves in the event of unexpected expenses.