This Article Is About Home Loan With Low Mortgage Rates On Purchase And Refinance

The first thing most homebuyers think about when they have decided to buy a home is mortgage rates. What are the mortgage rates and what is the best mortgage rates they can qualify for? Low mortgage rates mean lower payments and savings on mortgage interest. Unfortunately, to get low mortgage rates, mortgage loan applicants need high credit scores. Mortgage rates quoted in the media and by mortgage companies are par rates. Par rates are mortgage rates for prime borrowers.

What Are Par Mortgage Interest Rates For Prime Borrowers?

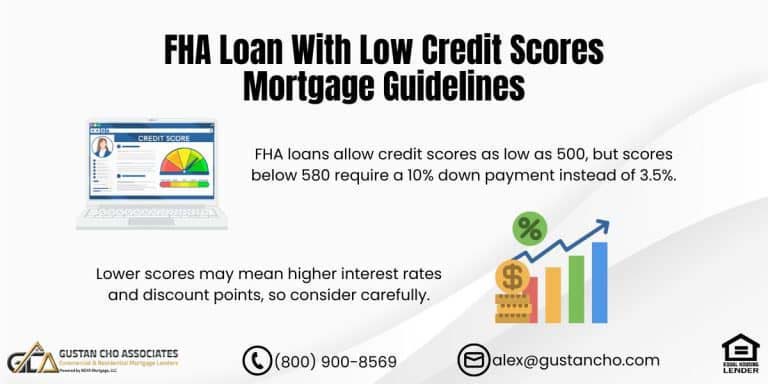

Prime borrowers are mortgage loan borrowers with over 740 FICO credit scores with at least 20% to 25% down payment on a home purchase. For example, if Fannie Mae or Freddie Mac announces that mortgage rates have dropped to 3.75% on conventional loans, it means that the 3.75% mortgage rates are available for borrowers with 740 credit scores with at least 20% down payment on a single-family home. From the 3.75% mortgage rate, there are price adjustments, which means higher mortgage rates for lower credit scores, property types, and lower down payment. When mortgage rates are 3.75% on a 30 year fixed rate conventional mortgage loan, a borrower with a 620 credit score and a 3% down payment will most likely not qualify for the 3.75% mortgage rate. The minimum credit score required to qualify for a conventional loan is 620 FICO. So a 620 credit score is considered a poor score and a higher risk conventional borrower. The chances are that a 620 FICO credit score borrower will have much higher mortgage rates on a conventional loan.

Consult With Loan Officer For Home Loan With Low Mortgage Rates

If you are planning on becoming a home borrower in the distant future, consult with a loan officer first and see what mortgage loan program you qualify for. Depending on your credit history and credit score, you may only be limited to a certain mortgage loan program. Everyone can get an FHA loan and/or conventional loan even with a prior bankruptcy and foreclosure as long as they meet the mandatory waiting period guidelines. However, there may be errors on your credit report that do not belong to you. Errors on credit reports take a lot of time to get corrected. It takes months. Many months and not weeks to have errors deleted off your credit report or corrected. If you have credit disputes, you need disputes retracted in order to proceed with the mortgage application and approval process.

Work On Maximizing Credit Scores For Home Loan With Low Mortgage Rates

If you are looking for a home loan with low mortgage rates, you need to maximize your credit scores.

If your credit scores are low, consult with a loan officer and he or she will help you maximize your credit scores before you formally apply for a mortgage loan. Maximizing your credit scores may be as simply paying down your credit cards or getting one or two more secured credit cards. Never miss a minimum payment due and always keep your credit card balances to a 10% balance of your available credit limit.

Do not apply for new credit unless you absolutely have to because each hard inquiry means a 2 to 5 point drop off your credit scores.