This Article Is About Qualifying For A Home Loan With High DTI And Bad Credit Guidelines

With the exception of VA loans, all agency guidelines have a mandatory maximum debt to income ratio cap. The back-end debt to income ratio is the total monthly minimum payments including the proposed housing payment (P.I.T.I.) divide by the monthly gross income of the borrower. The front-end debt to income ratio is the proposed monthly housing payment (P.I.T.I.) and divide by the borrower’s monthly gross income. The lower the debt to income ratio, the better and less risk the lender has. VA loans do not have a maximum debt to income ratio cap as long as the borrower can get an approve/eligible per automated underwriting system. Borrowers can get an approve/eligible per AUS with high debt to income ratio as long as the borrower has a high residual income.

Importance Of The Borrower’s Ability To Repay: Qualified Mortgage

The ability to repay their new home mortgage is what lenders are concerned about. Credit and Income are two of the most important factors on mortgage underwriters place a lot of emphases. Qualifying for Home Loan With High DTI triggers concerns for mortgage underwriters. Homeowners can be financially responsible. However, if they are struggling to pay their monthly bills, it means they may struggle with their monthly mortgage payments. There are more important priorities homeowners need to worry about than their mortgage payments. Food, health care, auto payments may take priority. We will cover qualifying for Home Loan With High DTI on this blog.

Qualifying For Home Loan With High DTI

All consumers have debt and monthly payments. Homebuyers thinking of qualifying for a mortgage need fair credit, savings, and qualified income. Debts are equally as important as qualified income. Income and monthly debts, as well as proposed housing expenses, are what determines debt to income ratios. There are agency guidelines on maximum debt to income ratios. Each individual lender can have its own overlays on DTI that are above and beyond federal agency guidelines. Gustan Cho Associates is a mortgage company licensed in multiple states with no lender overlays on debt to income ratios on government and conventional loans.

Understanding On How Lenders Underwrite Home Loan With High DTI

All lenders need to meet agency DTI requirements by FHA, USDA, VA, and Conventional Loans. Most lenders have overlays on debt to income ratios on government and conventional loans. Gustan Cho Associates is one of the very few lenders licensed in multiple states with no overlays on government and conventional loans.

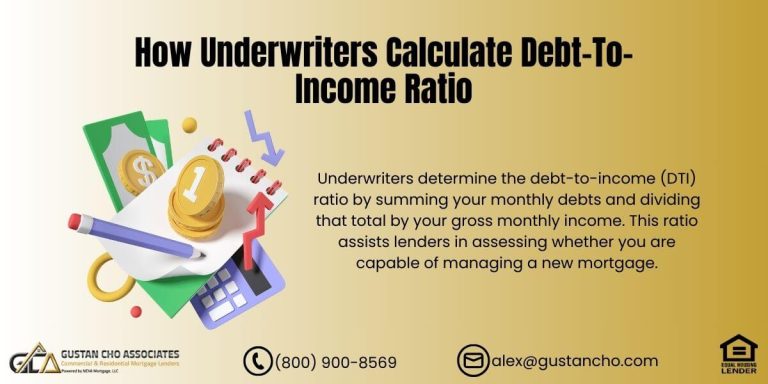

How Mortgage Underwriters Calculate Debt To Income Ratio

Here is how mortgage underwriters calculate debt to income ratios:

The front-end debt to income ratio is the proposed monthly housing payment consisting of principal, interest, taxes, insurance which is the P.I.T.I.) divided by the borrower’s monthly gross income. A borrower’s back-end DTI is the total amount of monthly minimum payments of borrowers divided by total gross income. Borrowers proposed housing payment (PITI) is added as part of monthly debt payments when calculating the back-end debt to income ratio.

Types Of Debt To Income Ratio

There are two types of debt to income ratios.

- Front End DTI

- Back End DTI

Front-End Debt-To-Income Ratio – The front-end DTI is the proposed monthly mortgage payment (PITI) which includes HOA, divided by the borrower’s monthly gross income. Back-End Debt-To-Income Ratio is the sum of the proposed PITI PLUS all other debts of borrower divided by monthly gross income.

Increasing Credit Scores Prior To Locking Mortgage Rates

Out of all debts, credit card debt lowers credit scores. Out of all components that make up consumer credit scores, the credit utilization ratio is the second-largest impact on credit score determination. Credit utilization comprises 30% of credit scores. Credit utilization ratios are the available credit available compared to the credit limit. To get the maximum credit score optimization, consumers should have lower than 10%. All revolving accounts should be paid down to 10% utilization prior to locking a loan. Higher credit scores mean lower mortgage rates.

Qualifying For Home Loan With High DTI With High Student Loans

Borrowers with high student loan balances can have issues with their debt-to-income ratios. There are many professionals who are doctors, dentists, nurses, lawyers, and educators who have student loan balances in the six figures. Every loan program has its own methods in treating student loans in DTI Calculations. Deferred student loans that have been deferred for 12 or more months are exempt from DTI Calculations ONLY with VA Loans.

With FHA and USDA Loans, 0.50% of the outstanding student loan balance is counted as hypothetical debt on deferred student loans. Only student loan payments that are fully amortized over an extended payment plan can be used on FHA and USDA Loans. Fannie Mae and Freddie Mac allow Income-Based Repayment (IBR) on conventional loans. Borrowers with high outstanding student loans need to see if they qualify for conventional versus FHA Loans. VA Loans allow deferred student loans that have been deferred for longer than 12 months. Or student loan payments that are fully amortized reporting on credit reports. VA student hypothetical monthly student loan payments are calculated by taking 5% of the student loan balance and dividing it by 12. All student loans that are fully amortized on an extended payment plan and reporting on credit reports are allowed on all mortgage programs.

Home Loan With High DTI With Oustanding Collection Accounts

Borrowers do not have to pay outstanding collections and charge off accounts to qualify for home loans. However, outstanding non-medical collections will affect debt-to-income ratios. Medical collections and charged-off accounts are exempt from DTI calculations. However, in non-medical collections with over $2,000 outstanding balance, mortgage underwriters will take 5% of the outstanding balance and use it as a hypothetical debt. This 5% will be used as a hypothetical monthly debt. Borrowers do not have to pay it. But it will be used as a monthly expense when mortgage underwriters are calculating borrower’s DTI. Borrowers who need to qualify for a home loan with high DTI, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. We are available 7 days a week, evenings, weekends, and holidays.