In this blog, we will discuss and cover FHA streamline refinance Connecticut with no appraisal and no income docs required. FHA Streamline Refinance Connecticut is when a homeowner with a current FHA home loan refinances with a new FHA loan. Dale Elenteny, a senior mortgage loan originator at Gustan Cho Associates says the following about FHA streamline refinance Connecticut with no appraisal:

Discover everything you need to know about FHA Streamline Refinance in Connecticut, including benefits, requirements, and the no-appraisal process. Maximize your savings today!

HUD, the parent of FHA, does not require homeowners with an FHA loan to get another home appraisal or provide income documentation. The only requirement is for homeowners to have been timely on their current FHA loan for the past 12 months. In the following paragraphs, we will cover FHA streamline refinance Connecticut with no appraisal.

FHA Streamline Refinance in Connecticut With No Appraisal Reduces Payment and Requires Less Paperwork

Review The Guidelines, Benefits, and Qualification Requirements

What an FHA Streamline Refinance in Connecticut with no appraisal:

- If the payment on your CT home is an FHA Streamline Refinance, it is one of the fastest and easiest methods.

- Finding out that you qualify for a streamlined refinance with no appraisal is simpler.

- This includes Hartford, New Haven, Bridgeport, Stamford, Waterbury, and other cities.

- This guide will walk you through the process of an FHA streamline refinance, including who qualifies and how to get started.

FHA Streamline Refinance in Connecticut is a Core Phrase Used Strategically

What is an FHA Streamline Refinance Connecticut

The FHA Streamline Refinance in Connecticut is a refinance option available to individuals who already have an FHA loan. The purpose is to refinance in a faster method to decrease one’s rate and monthly payment.

How FHA Streamline Refinance Works

If you are in Connecticut and have an FHA streamline refinance:

- You have an existing FHA loan on the house already, and you cannot have a

- You’ve already been refinanced from FHA to FHA and cannot have a conventional loan.

- In almost all instances, an FHA streamline refinance does not require an appraisal.

- Hence, the home does not require a value to be verified.

- You have to meet the net tangible benefit definition, which includes a lower rate, a lower payment, or a transition from an ARM to a fixed-rate loan.

- The other documents can be less than what you would have to submit for a full refinance.

- For example, income, asset, and employment documents may be less extensive, depending on the lender’s guiding principles.

Lower your FHA payment in Connecticut—no appraisal needed

Streamline refi for current FHA borrowers with simple docs and fast closings

Key Benefits of FHA Streamline Refinance Connecticut With No Appraisal

No Appraisal Required in Most Cases

For people who want to have an FHA streamline refinance Connecticut with no appraisal, it offers the most benefit since there is no value on the home, which is recognized as the current market value.

This is particularly useful for:

- Areas of your home have lost value.

- Your home is in disarray.

- Being nervous about your home appraisal value potentially ruining your attempt to refinance.

- Unlike other refinance scenarios, which are based on appraisal value, the Connecticut streamline program is based on loan history, which allows homeowners to refinance with almost no equity.

Streamlined And Quicker Approval Process

Unlike full refinances, we notice that this option has:

- Decreased the amount of paperwork monotonously.

- A quicker, more efficient collection of documents.

- A shortcut for lengthy underwriting periods.

Because the borrower is associated with an FHA loan and has a set payment history, most lenders have no issue supplying a loan with basic information.

Interest Rate, Payment, and Other Charges are Quicker to Decrease

If, for some reason, the FHA mortgage you hold with your lending firm happens to fall within the timeframe of your loan period, you might be able to:

- Get a much lower payment.

- Decrease in your principal and entire mortgage interest payment.

- More flexibility by moving from an ARM to a fixed-rate mortgage.

- Although the rates might drop ever so slightly, the difference is tangible for homeowners in Connecticut.

Reducing Mortgage Insurance Premiums

FHA streamlined refinances depend on the current FHA mortgage insurance rules and the date on which your current FHA loan was endorsed, which might:

- Offer you the annual mortgage insurance premium (MIP) evaluated on the new loan without the increase.

- Which is lower than before.

- Renew the current MIP on the new loan under more favorable terms compared to the existing terms of your FHA loan.

- The combination of a lower MIP and a reduced interest rate can lead to significant savings.

Who Qualifies For an FHA Streamline Refinance Connecticut?

Although requirements might differ per lender, FHA has central rules that are applicable across the board, including in the state of Connecticut.

Fundamental Rules for Eligibility for an FHA Streamline Refinance Connecticut

To fulfill Ohio’s requirements for an FHA streamline refinance, you:

- Must also have an FHA-insured mortgage on record.

- Must also perform on the FHA loan at the moment.

- One 30-day late in the past 12 months.

- No late payments in the past 3 months.

- More than half of the total monthly payments have been paid throughout the life of your FHA loan.

- 210 days have to have elapsed from the time your FHA loan was originated to the date it was closed.

The refinance has to give something of value, like:

- A lower interest rate.

- Lower principal and interest payment.

- ARM to fixed-rate loans.

Guidelines Requiring Credit Score and DTI

The FHA has flexible requirements concerning credit scores, but most lenders tend to add their own stricter rules, known as overlays.

- Some lenders may require a minimum score like 640 or 660, even when FHA allows lower scores.

- Others may impose DTI ratio caps, when FHA would allow a higher DTI.

It is a huge benefit to work with a lender who has no overlays with FHA loans if:

- Mortgage scores are in the high 500s to mid 600s.

- You have higher DTI.

- You are recovering from some recent credit issues, as long as the FHA mortgage is up to date.

FHA Streamline Refinance Connecticut With No Appraisal vs. Other Types Of Refinance

Streamline vs. Full FHA or Conventional Refis

FHA Streamline (No Appraisal):

- No new appraisal in most situations.

- Less docs.

- Available to FHA borrowers only.

- Limited to mortgage payment history and payment benefit to the borrower.

Other FHA or Conventional Refinance:

- A Full appraisal is typically required.

- Full income, asset, and employment documentation needed.

Able to shift from FHA to Conventional

- There are cash-out options available if you have sufficient equity (not available on a streamline).

- For borrowers with FHA loans, the FHA streamline refinance option with no appraisal in Connecticut is, in most cases, the most straightforward and quickest transaction.

FHA Streamline Refinance Connecticut: Closing Costs and Prepaids

All streamline FHA refinances have closing costs and prepaids, but there are different methods for managing them.

How Closing Costs Are Paid

Typical alternatives include:

- Direct payment to closing cost.

- Slightly elevated interest rates with lender credit.

- In some situations, especially with an appraisal and significant equity, costs can be rolled in.

- However, for a true no-appraisal streamline, costs are mainly either paid at closing or lender credit is used.

Typical closing costs can be, but are not limited to:

- Closing costs.

- Title and attorney costs (that are common for Connecticut).

- Recording costs.

- Prepaid taxes for insurance adjustments.

- Mortgage insurance premium (UFMIP) at closing, which can be used with an existing FHA loan for the new loan.

- A loan officer will provide you with a good detailed, written Loan Estimate that includes different options and a breakdown of the costs to give you an idea of what you could be dealing with before you sign anything.

Cut your rate and skip the paperwork

Minimal income docs, no appraisal, and a shorter timeline to close

Step-by-Step Process: FHA Streamline Refinance Connecticut With No Appraisal

Overview of Steps to Qualification

Confirm the existing FHA mortgage loan on your property in Connecticut. Assess the loan payment history to determine the age of the loan, as well as the current payment and interest rate. Determine whether the refinance will still produce a net tangible benefit.

Checking Different Rates and Scenarios

Your loan officer will provide you with the current FHA Streamline refinance rates. Calculate your new payment amount. Discuss rate buy-down options and the use of lender credits.

Complete the Application and Submit the Required Documents

The following documents are most likely to be required: the current mortgage statement. Homeowners insurance policy details. Basic documents and income verification (these requirements may vary by lender).

Underwriting and Approval

The Underwriter will evaluate your FHA case number and payment history against the guidelines to determine compliance. Please note that appraisals are not required due to the relatively high loan-to-value ratios. Several FHA Streamline loans can undergo a sudden change from submission to being cleared for closing.

Closing and New Payment

In Connecticut, you have the option to be attended to by a mobile notary or attorney, allowing you to close your documents with ease.

- The old FHA loan is paid off.

- The new payment begins on the next due date at the lower rate and/or lower payment.

FHA Streamline Refinance Connecticut For Borrowers With Low Credit Scores

Many exporters in Connecticut feel somewhat hopeless since their credit scores have fallen since they purchased the house. However, the great thing about FHA streamline refinance is that they pay more attention to the payment history than the score.

This is the case. You may still have a shot:

- If you have credit scores that do not qualify as insane.

- You possess a few collections or accounts that are repeatedly paid late.

- Your income is more difficult to verify than the other methods.

- Provided that you maintain a consistent on-time payment record with the FHA mortgage and can satisfy essential FHA regulations, a lender without any overlays may still be able to do the FHA streamline refinance Connecticut without an appraisal.

Reasons Why Homeowners in Connecticut Opt for FHA Streamline Refinancing

Connecticut has a unique combination of:

- Antique properties which may appraise for lower than expected value.

- Some counties with significantly higher property taxes.

- Huge difference in home prices from small towns to expensive coastal regions.

If every month you worry about a different set of challenges while still trying to obtain Connecticut refinance loans, an FHA Streamline refinance Connecticut can:

- Reduce future payments.

- Allow you to retain your home for a longer duration.

- Increase available funds for a variety of other expenditures, funds, or home improvements.

- More often than not, you can refinance your loan regardless of the home value.

- Weak markets or homes in disrepair are not a deal breaker.

The Streamline FHA Refinance Connecticut Works Best with FHA Specialists

Fewer lenders than you may expect give equal treatment to FHA refinance loans. Most have their own set of policies that are far more stringent than the actual FHA requirements.

Such ‘overlays’ result in:

- Excessive credit score demands.

- Stricter debt-to-income ratio.

- Requiring more paperwork than is reasonably justified.

Being an FHA Streamline Refinance Connecticut loan with no associated appraisal, with proper documentation, the more flexible a lender can be, the closer they are to actual FHA requirements.

If you are motivated to complete an FHA Streamline Refinance Connecticut loan, which does not require an appraisal:

- Talk to the FHA streamline refinance specialists.

- Request for a floating rate and payment review for free, without any obligation.

- Get a comprehensive analysis of your potential savings.

FHA Streamline Refinance Connecticut – Frequently Asked Questions

What is an FHA Streamline Refinance Connecticut?

- An FHA streamline refinance in Connecticut is a refinancing program for homeowners who currently hold an FHA loan.

- You qualify for a rate or payment reduction without an appraisal, with less documentation, and a faster turnaround than a full refinance.

Do I Need an Appraisal For an FHA Streamline Refinance Connecticut?

- Generally, no.

- One of the advantages of an FHA streamline refinance Connecticut without an appraisal is that the loan can be secured based on the existing FHA loan and payment history.

Can I Withdraw Cash During an FHA Streamline Refinance Connecticut?

- No.

- The main function of the FHA streamline program is to lower your payment, lower your rate, or refinance from an ARM to a fixed-rate mortgage.

- The program, however, does not allow for cash-out loan options.

- Regular FHA cash-out refinance is more appropriate for your needs.

What is The Minimum Time I Must Wait to Perform an FHA Streamline Refinance After Purchasing My Home?

- More than six full monthly payments must be made, and at least 210 days must be counted from the start of the underlying loan.

- If certain criteria are met, it’s possible to perform an FHA streamline refinance Connecticut and still obtain a significant benefit.

- You would, however, need to fulfill the above requirements.

FHA Streamline Refinance Connecticut: Does The Property Need To Be My Primary Residence?

- An FHA streamline refinance does not require the property to be your primary residence.

- FHA streamline refinances are most commonly for primary residences.

- Some lenders still allow streamlines on FHA-financed investment properties or second homes, but this is more the exception than the rule, and it’s best to check.

- Contact your loan officer to obtain the most up-to-date information on your occupancy type.

Will My Credit Be Checked For an FHA Streamline Refinance Connecticut?

- Lenders typically conduct at least a soft or full credit check.

- However, the FHA streamline program focuses more on a mortgage payment history than on credit score.

Can I Refinance From an FHA ARM to a Fixed-Rate Loan Using a Streamline Refinance?

- Yes.

- Many homeowners in Connecticut use an FHA streamline refinance to transition from an adjustable-rate mortgage (ARM) to a fixed-rate loan, offering more stable and predictable payment options.

How Long Does an FHA Streamline Refinance Take to Close?

- Timelines vary by lender and the complexity and volume of the file, but an FHA streamline refinance Connecticut with no appraisal is typically faster than a full refinance because it requires fewer documents, eliminates appraisal delays, and involves less time overall.

Can I Change The Borrowers on The Loan With an FHA Streamline Refinance?

- HUD allows some limited changes to borrowers, such as removing a borrower under certain circumstances (e.g., divorce, death), as long as the other requirements are met.

- Significant changes may require a full refinance rather than a streamline.

How Do I Initiate an FHA Streamline Refinance Connecticut Without an Appraisal?

It’s pretty darn easy:

- Call an FHA loan officer.

- Tell them the current mortgage statement and some personal details.

- Look at the estimated new rate and payment.

- Fill out the application and the disclosures.

- After your loan officer helps with underwriting, closing, and the new payment.

- Homeowners, if you’re looking for an FHA streamline refinance Connecticut with no appraisal in this current financial climate, perhaps it’s time to weigh your options.

- A quick phone call, along with some assessments on your pre-existing FHA loan, can provide you with substantial savings within a short time frame.

No cash-out, just payment relief

Focused on lowering rate/MI and simplifying your monthly budget

The Booming Housing Market in Connecticut Despite Skyrocketing Mortgage Rates

The housing market in Connecticut is booming. Home prices in Connecticut have been skyrocketing for the past several years. Mortgage rates earlier this year hit a historic low of 2.75% on a 30-year fixed-rate mortgage. In less than six months, mortgage rates have peaked at a three-year high of over 5.0%. It is not IF rates is going to plummet, but WHEN. The Dow Jones Industrial Average, 10-year treasuries, and mortgage rates are expected to tank. If rates drop, many homeowners can take advantage of FHA streamline refinance at substantial lower mortgage rates.

FHA Streamline Refinance Connecticut Eligibility Requirements

Under FHA Streamline Refinance Connecticut, for a homeowner to be eligible for Streamline Refinance, the following requirements must be met:

- The homeowner needs to currently have an FHA Loan

- The FHA Loan needs to be current and in good standings

- The homeowner needs to have been timely with their FHA Loan monthly payments for the past 12 months

- All original borrowers and co-borrowers on the current FHA Loan needs to be on the new Streamline Refinance Loan

- There is no cash-out refinances allowed with streamline refinances

- Not all FHA Loan to FHA Refinances are always streamline refinances

FHA Streamline Refinance Guidelines And Mortgage Rates Waiting Period From Original Home Purchase

Credit Scores have a big impact on mortgage interest rates on FHA loans. It is very common for homebuyers to purchase a home with an FHA loan when they have lower credit scores. With lower credit scores, borrowers get a higher mortgage interest rate. After the close they work on their credit so they can refinance with an FHA Streamline Refinance Connecticut at a much lower mortgage rate. Many homeowners wonder what the waiting period is to refinance their original home purchase loan to an FHA Streamline Refinance Connecticut at a much lower mortgage rate.

HUD Guidelines On Waiting Period For FHA Streamline Refinance Connecticut

Here are HUD Guidelines On Waiting Period To Do A FHA Streamline Refinance:

- FHA Loans do not come with pre-payment penalties

- HUD requires homeowners with FHA loans to wait 211 days from the original FHA loan on their home purchase before homeowners are eligible for FHA Streamline Refinance Connecticut (To Lower FHA Mortgage Interest Rates)

- There is no home appraisal required with an FHA Streamline Refinance Connecticut

The Loan To Value on the streamline is based on the calculation on the previous appraisal when the homeowner purchased their home and got their original home purchase FHA loan.

Net Tangible Benefit To Be Able To Do A FHA Streamline Refinance Connecticut

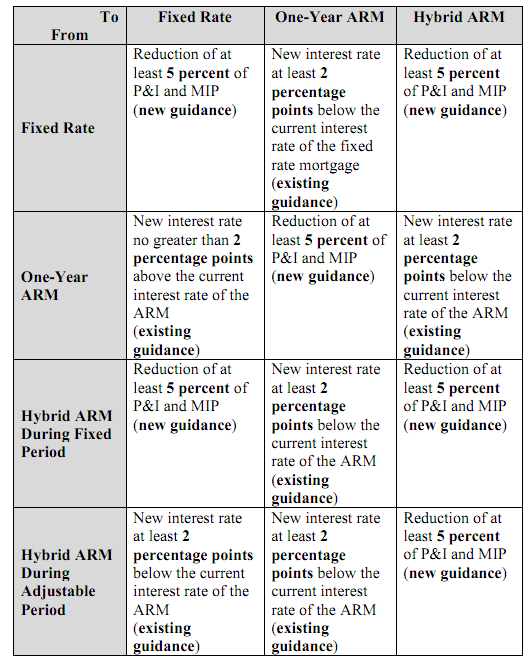

Homeowners cannot do an FHA Streamline Refinance Mortgage for just the sake of doing it. They need to meet the net tangible benefit requirement from HUD in order to qualify for streamline refinancing or need to have other benefiting factors to the homeowner such as going from an adjustable-rate mortgage to a fixed-rate mortgage. Look at the table below on how going from an ARM to a FIXED-RATE MORTGAGE (FRM) can benefit FHA mortgage borrowers:

Homeowners Not Meeting The 5% Net Tangible Benefit Requirement

Homeowners who cannot meet the 5% net tangible benefit requirement are still eligible to refinance their current FHA loan to another FHA loan if there are other benefits for them. Homeowners may be eligible for an upfront mortgage insurance premium refund. A new home appraisal may be required. The LTV cannot exceed the maximum LTV of 97.75% on refinancing mortgages based on a new appraisal.

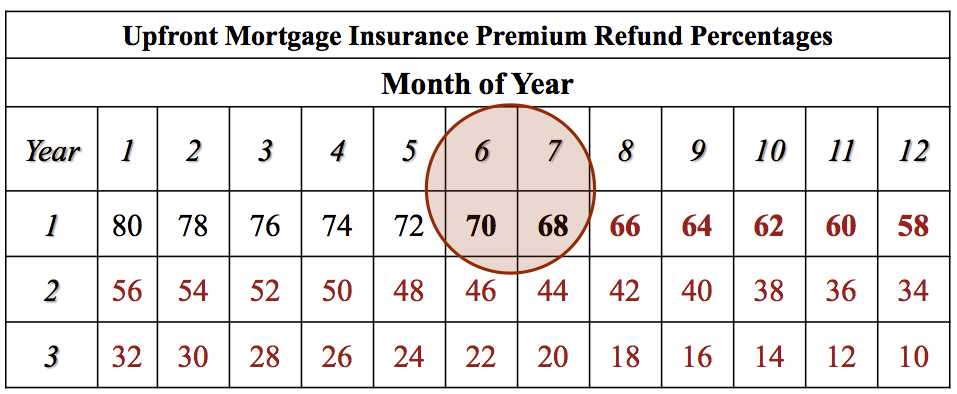

Refund of Costs When Refinancing FHA Loan to Streamline Refinance

When a homeowner was to refinance from one FHA-insured loan to another new FHA loan within a 36-month window time frame, they are entitled to a partial FHA Upfront Mortgage Insurance Premium refund. John Strange, a senior mortgage loan originator at Gustan Cho Associates says the following about FHA streamline refinance Connecticut:

The refund from FHA is a percent of the initial FHA Upfront Mortgage Insurance Premium the home buyer originally paid at the time of home purchase.

The percentage of the FHA UPMIP reduces every month as time passes and finally is zero as month 36 approaches. Below are the FHA Upfront Mortgage Insurance Premium Refund Percentages due to homeowners when they do an FHA Streamline: Refinance:

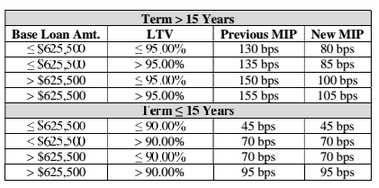

FHA Mortgage Insurance Premium Rate On Streamline Refinance Mortgages

There are two different types of FHA Mortgage Insurance Premiums:

- Upfront Mortgage Insurance Premium or known as FHA UPMIP is a one time upfront fee of 1.75% which can be rolled into the FHA loan balance

- Annual Mortgage Insurance Premium also is known as FHA MIP or 0.85% for a 30 year fixed rate mortgage and is charged for the life of the FHA loan

- The Annual Mortgage Insurance Premium depends on the term of the FHA loan, the amount of the FHA loan balance, and the Loan To Value

For borrowers who had their FHA Loan prior to May 31, 2009, they are eligible for a reduction of their Upfront Mortgage Insurance Premium of 0.01% and an annual MIP of 0.55%.

FHA Streamline Refinance And Mortgage Rates And Closing Costs

There are closing costs on all mortgage loans. However, Gustan Cho Associates offers no closing costs on all Streamline Refinance mortgages. We will cover borrowers closing costs with lender credit and offer the best terms and lowest mortgage interest rates on FHA Streamline Refinances. Here are the benefits of FHA Streamline Refinances with Gustan Cho Associates:

- Low mortgage interest rates where homeowners will save tens of thousands of dollars over the term of the FHA loan with an FHA Streamline Refinance Connecticut

- Homeowners get to skip two monthly mortgage payments right after the FHA Streamline Refinance Connecticut

No closing costs because we offer lender credit to cover all closing costs.

How To Get Started With FHA STREAMLINE REFINANCE?

Start by completing our online secured mortgage loan application on our secure site APPLY NOW!!! Borrowers can also contact us at (262) 716-8151 or text us for a faster response. Or email us at gcho@gustancho.com. Gustan Cho Associates is a one-stop lending shop and has a national reputation for not having any lender overlays on government and conventional loans.

Remove monthly MIP later with equity

Map a future path from FHA to Conventional when your LTV improves