This article examines and clarifies the criteria for FHA Appraisals Versus Conventional Appraisals. There are significant differences in the guidelines governing FHA appraisals versus conventional appraisals.

Whenever individuals seek home financing, they must undergo a home appraisal according to their lenders’ requirements. The mortgage offered by lenders to borrowers is dependent on the results of the home appraisal, serving as a safeguard for the loan.

The necessity for home appraisals is universal and mandatory across all lenders. These appraisals play a crucial role in enabling lenders to evaluate the property’s value against which they are providing the loan. Join us as we embark on a journey of discovery, where we will explore the distinctions between FHA appraisals versus conventional appraisals in profound depth.

Why Would Someone Get a Home Appraisal?

One common query often centers on the necessity of house appraisals. In mortgage lending, it’s customary for lenders to require an appraisal for all properties being financed. The main goal is to ensure that the property’s assessed value corresponds to its purchase price. The appraisal of a home is vital in assessing the property’s worth.

If the borrower defaults on the home, the lender aims to ensure that selling the collateral would yield enough funds to cover potential losses. Understanding these principles becomes particularly relevant when comparing FHA appraisals versus conventional appraisals.

How Do Appraisals Work With Mortgage Lenders?

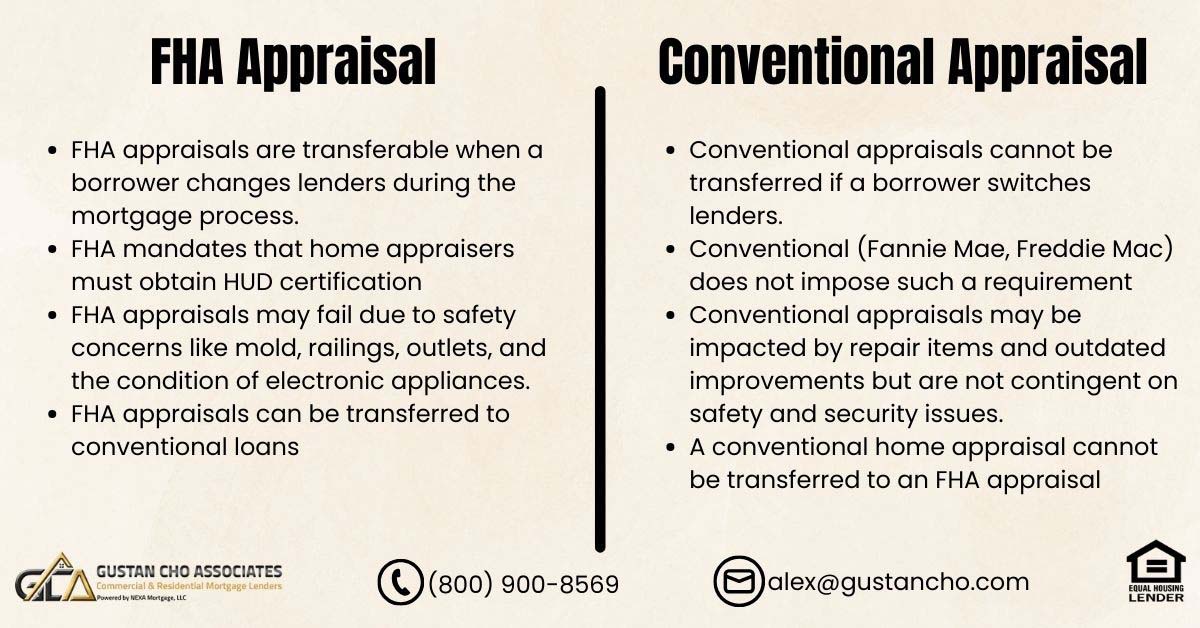

Lenders employ appraisals to assess the value of properties and safeguard their and the homeowner’s investments. Various home appraisals exist, contingent upon the chosen loan program by homebuyers. These include FHA Appraisals and Conventional Mortgage Appraisals, each with its distinctions. FHA Appraisals may be utilized when borrowers switch from an FHA to a conventional loan. Conversely, a conventional loan cannot be converted if the borrower transitions to an FHA loan.

What Do They Look For In An FHA Home Appraisal?

Lenders will require a home appraisal depending on the home mortgage program for homebuyers seeking a home mortgage. If it is an FHA loan the borrower is applying for, the lender will order an FHA appraisal; if it is a conventional loan, the borrower will order a conventional loan appraisal. A VA home appraisal will be ordered if it is a VA loan.

Contact Us For An FHA Home Appraisal, Click Here

What Is The Purpose of an Appraisal Management Company?

Lenders initiate appraisals through the engagement of an Appraisal Management Company. The key difference between FHA appraisals and conventional appraisals is the focus on safety and security in FHA assessments and evaluating the property’s value. FHA home appraisals are valid across the nation. If a borrower chooses to change lenders during the mortgage process, they have the flexibility to do so, and the FHA appraisal seamlessly transfers along with the FHA Case Number.

Do All Mortgage Lenders Require an Appraisal?

In the process of applying for a mortgage on a particular property, each lender requires a home appraisal. The assessment’s primary aim is to assess and appraise the property’s value according to the lender’s perspective.

Comparing the property to other similar properties is a reliable way to determine its value in the surrounding area. The key factor that significantly affects the appraiser’s evaluation of the property’s worth is the comparison with the sales of similar properties situated within a half-mile to a mile radius. This holds true for both FHA appraisals versus conventional appraisals.

How Do Appraisers Determine Pricing Adjustments?

The valuation expert will modify the valuation of the property under consideration, considering positive or negative elements to determine its worth. A property appraisal offers a degree of confidence to the lender, acting as the primary tool to protect the interests of both the lender and the homeowner.

FHA appraisals are designed for individuals seeking FHA loans, whereas conventional appraisals are tailored for those applying for conventional loans. Although most property appraisals have common features, there are subtle differences between FHA appraisals versus conventional appraisals.

What Do Conventional Appraisals Look For?

Fannie Mae and Freddie Mac, the twin pillars of the mortgage industry, establish the benchmarks for Conventional loans. These loans, also known as Conforming loans, are mandated to adhere to the guidelines set forth by Fannie Mae or Freddie Mac. In contrast to FHA, VA, and USDA loans, which are government-backed, Conventional loans lack such guarantees.

Consequently, conventional lenders necessitate a specific type of appraisal for these loans. A conventional appraisal’s primary objective remains to assess the property’s value and condition.

Difference Between FHA Appraisals Versus Conventional Appraisals

The parent organization of FHA, known as HUD, mandates home appraisers to obtain HUD certification to conduct property appraisals for FHA loans. HUD maintains a roster of home appraisers who have received HUD certification. Unlike HUD, Fannie Mae and Freddie Mac do not impose this requirement. It’s worth noting that HUD has more extensive and detailed property checklist standards for its appraisals compared to conventional loans.

FHA Appraisals Versus Conventional Appraisals Property Standards Requirements

Both Fannie Mae and HUD require safety standards for the property. Besides property standards, there is not much difference between FHA and Conventional appraisals. The main difference between FHA and conventional appraisals is that FHA is more strict with the property’s condition. There are more restrictions on the property’s condition on FHA appraisals versus conventional appraisals.

Qualify For FHA Appraisal and FHA Conventional Appraisal Property Loans

Are FHA Appraisals Hard To Pass?

FHA appraisals present a more rigorous assessment compared to conventional loan appraisals. When conducting FHA home appraisals, home appraisers must adhere to a specific checklist provided by HUD to pass the appraisal for FHA loans successfully.

In contrast, conventional home appraisals typically focus on determining the property’s value, assuming the property is suitable for habitation. Meeting this value requirement is generally sufficient for passing home appraisals on conventional loans.

On the other hand, FHA loan home appraisals demand a higher standard for property condition, necessitating that it be above average. Conditions such as broken glass, peeling paint, and a roof with fewer than three years of life are not acceptable for passing FHA home appraisals. Conventional loan appraisals are generally less restrictive than their FHA counterparts.

What Things Will Fail An FHA Appraisal?

FHA appraisals are much stricter with the safety of property such as the following:

- Mold

- Railings

- Outlets

- The function of electronic appliances

- Peeling paint

What Do They Look For In An FHA Appraisal?

The Federal Housing Administration (FHA) does not directly originate loans; instead, it provides insurance for residential mortgage loans issued by private mortgage lenders, subject to adherence to its established guidelines and rules.

The Department of Housing and Urban Development (HUD) oversees the insurance of these mortgages on behalf of approved borrowers and lenders, setting its guidelines and rules, particularly about appraisals. FHA and its affiliated lenders commission appraisals to verify that the subject property’s value aligns with the purchase price, emphasizing the property is secure and free from hazards or building violations.

Are FHA Appraisals More Strict Than Conventional Appraisals?

The difference between FHA appraisals and Conventional loan appraisals is that FHA-insured mortgage loan appraisals focus on how they view all FHA-insured mortgage loans need homes that meet the minimum living standards. HUD requires that the home have minimum standards of living, which involve the homeowner’s and its occupants’ overall safety and security. HUD requires that the home be free of the following:

- Peeling paint

- Broken windows

- Unsafe plumbing

- HVAC

- Electrical items

- No pending building violations that can affect the safety and security of the homeowner and its occupants

- During the FHA appraisal, the electrical, plumbing, and HVAC systems must be in working order.

Any FHA violations must be addressed and corrected before an FHA appraiser can approve and sign off the appraisal.

Speak With Our Expert For FHA Appraiser Approval, click Here

What Fails a Conventional Appraisal?

In traditional loan assessments, the value of a home appraisal can be impacted by repair items and outdated improvements on the property. Unlike FHA appraisals, conventional loan approvals are not contingent on safety and security issues.

While FHA appraisals may consider the property’s overall value, the presence of certain unsafe items can result in the property failing the appraisal. Consequently, borrowers may face challenges obtaining approval for an FHA-insured mortgage on the subject property if it does not meet the safety standards outlined in the appraisal.

Why Would an Appraisal Be Sent Back For Revisions?

A common inquiry pertains to the reasons behind the return of an appraisal for revisions. An appraiser is unable to approve a home appraisal if the property fails to meet the checklist criteria outlined in HUD property standards or if there are safety and security concerns with the house. In such cases, the homebuyer or seller is granted the opportunity to address and rectify the identified issues.

Options For Homebuyers If The Property Does Not Pass Property Inspection

Should the seller cannot address the issue or if the expenses are deemed excessive, both parties can reconvene at the negotiation table. During this renegotiation, they can discuss the possibility of lowering the price.

Alternatively, the buyer can pursue an FHA 203k renovation loan. It’s noteworthy that even if the property initially fails to meet FHA safety and security guidelines, sellers are granted an opportunity to rectify these concerns. The FHA appraiser is permitted to conduct a re-inspection, though it is important to note that a re-inspection fee is applicable.

Can FHA and Conventional Appraisals Be Transferred?

If a home buyer obtains a home appraisal and seeks to switch their loan to a different lender, can the home appraisal be transferred? In the mortgage process, an FHA home appraisal is transferable when a borrower changes lenders.

Conversely, in the home process, a conventional home appraisal cannot be transferred when a borrower switches lenders. It is feasible to transfer an FHA appraisal to a conventional home appraisal; nevertheless, if the mortgage borrower transitions from a conventional loan to an FHA loan, a conventional home appraisal cannot be transferred to an FHA appraisal.

If you have any questions about FHA appraisals versus conditional appraisals, please contact us at Gustan Cho Associates at 800-900-8569. Text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

FAQs about FHA Appraisals Versus Conventional Appraisals Guidelines

Why do lenders require home appraisals? Lenders mandate home appraisals to ensure that the property’s assessed value aligns with its purchase price, serving as a safeguard for both the lender and the borrower in case of default.

What are FHA and conventional appraisals? FHA and conventional appraisals are types of property assessments conducted based on the homebuyer’s chosen loan program. FHA appraisals are required for FHA loans, while conventional appraisals are for conventional loans.

How do FHA and conventional appraisals differ? FHA appraisals are typically stricter in assessing the property’s condition, focusing on safety and security standards set by HUD. Conventional appraisals, while still evaluating the property’s value, may have fewer restrictions on the property’s condition.

What safety standards do FHA appraisals emphasize? FHA appraisals prioritize the property’s safety and security, requiring it to be free from issues such as peeling paint, broken windows, unsafe plumbing, HVAC malfunctions, and other potential hazards.

Can appraisals be transferred between lenders? In the mortgage process, FHA appraisals are transferable when switching lenders. However, conventional appraisals typically cannot be transferred between lenders.

What happens if a property fails an appraisal? If a property fails an appraisal due to safety or condition concerns, the buyer and seller can negotiate repairs or adjustments to the sale price. Alternatively, buyers may explore renovation loan options, such as FHA 203k, to address the issues.

This article on FHA appraisals versus conventional appraisals was updated on January 30th, 2024.

I hope Gustan was able to help you and salvage your earnest money deposit. Also, your buyer’s agent should have added a financial contingency for protection so you get your deposit back in case financing falls through. Unfortunately, this happens way too often with loan officers and brokers not properly qualifying the borrower.

Gustan Cho has a really good model for issuing pre-approvals. It took me 3 different lenders and 6 months to buy my first property back in 2013. Don’t give up, stay persistent, and stay resilient. When you close come back and tell us your success story.

Cheers!

What is the time frame that an appraiser can convert a FHA appraisal into a conventional appraisal without re-visting the property and just remove the FHA verbiage?

You do not need to convert an FHA to a conventional appraisal. Lenders can use FHA appraisals on conventional loans. However, you do need to convert a conventional appraisal to an FHA appraisal.

The sellers of the home i am attempting to buy are trying to make it to where we pay an extra 5000.00 if the FHA appraisal is to low. My real estate agent said that it was because FHA tends to appraise the home lower than a conventional loan appraisal. She said no way and to not worry about it but I am worried. Why would FHA appraisal come in lower than conventional?

That is not true, Jennifer. All appraisals are independent from the loan program you have.

hello, Gustan

regarding selling home-so, if FHA appraisal comes in at $200k effective 12/1/21 & I reject that buyer’s counteroffer at 195k; then, anyway, that 200k FHA appraisal amount stays the same for 6 months-correct? Their original offer was 210k.

So, if I get another FHA buyer & they offer 200k within the 6 month period & since the FHA appraisal stays with the house for 6 months-does new buyer need to get FHA appraisal?

please add anything else you think would be pertinent?

Thanks, happy holidays & have a great New Year!

The appraisal is good for four months and yes, it stays with the house if the buyer offers to purchase your house. If you disagree with the price and have documentation proving there are comparable homes that sold higher, you can either request an appraisal rebuttal or have the loan officer get a new FHA appraisal. Or get a buyer that will do a conventional loans where they can get a conventional appraisal if you think the home is valued higher.

Please help I am experiencing the same issue

Please reach out to us at gcho@gustancho.com

if transferring an FHA appraisal to another lender and going conventional with the other lender who cancels the fha case number on FHA connection or do you not cancel it

You do not need to cancel it.

Are there repair issues that could be found in a home that would prevent a lender from financing through a conventional mortgage? For example, even if the value is lowered, could the loan be denied based on a home having a serious flaw such as busted out windows?

The property needs to be habitable and no broken glass, faulty electric, or plumbing.