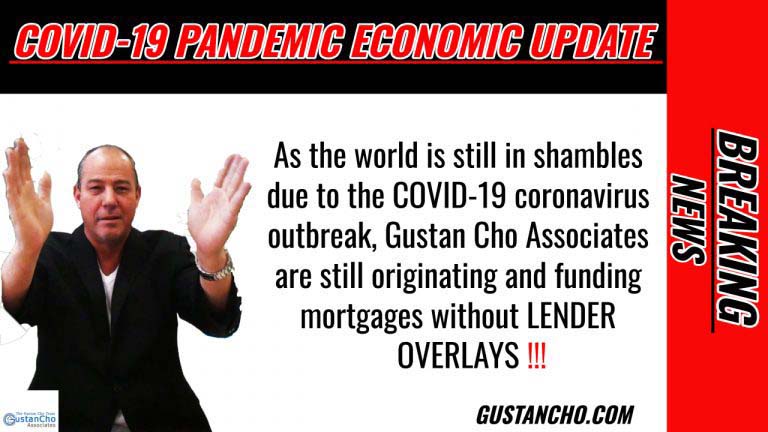

BREAKING NEWS: The Dow Surges 1200 Points On Hopes Of Central Bank Lowering Rates

The Dow Surges 1200 Points on Monday after the biggest market selloff last week since the 2008 financial crisis.

- The bullish buying started as soon as the equity markets opened

- There was a total of six deaths in Washington State due to the coronavirus

- The Trump Administration has a power meeting with the leaders of major pharmaceutical companies at 3 PM EST

- Although there was bad news with regards to the coronavirus, the market had a powerful buying spree throughout the trading day

- Major buying started last Friday after Fed Chairman Jerome Powell announced the Central Bank is closely monitoring the markets and will do everything possible to stabilize it during the coronavirus scare

In this article, we will discuss the breaking news of the Dow Jones Industrial Average closing more than 5% today. The Dow finished off the day closing up 1290, the largest point increase in one trading day.

Dow Surges 1200 Points On Hopes For The Federal Reserve Board Lowering Rates To Help Economy

All major equity markets in Asia rose overnight. The Dow Jones Futures were trading on positive territory. The Dow Jones and all other markets opened higher this morning. Wall Street took the emergency Fed cut announcement positively since last week’s 3,500 market selloff. The 1290 point close today marks a 5% increase. Investors are feeling very positive about the action the Trump Administration and the Feds are taking in sheltering the global economy from the effects of the coronavirus outbreak. Technology companies led the gains. The Dow Jones Industrial Average skyrocketed 5% in a single day to end the day at 26,703. This marks the biggest-ever point gain for the Dow Jones Industrial Average and the single largest percentage gain since March 2009. The S&P 500 index rose 135 points. This marks a 4.6% increase, finishing off the day to 3,089. The Nasdaq skyrocketed 384 points. This marks a gain of 4.5%, to 8,952. The bond market skyrocketed again which sent yields lower.

Mortgage And Housing Market

The 2020 Housing Market Forecast remains strong. Mortgage rates are tumbling to a historic low. Although mortgage rates are different than the Feds interest rates, mortgage rates follow the direction of the Fed interest rates. Lenders are analyzing all this. Mortgage lenders still need to analyze the risk factors with historic low mortgage rates. It seems the actions of the Trump Administration and the Federal Reserve Board are putting more confidence. We will see how the markets develop tomorrow and the rest of this week. Expect the markets to be very volatile. Expect more cases and death from the coronavirus to hit the media. All the experts are warning the public not to panic and fear is the public’s worst enemy. We will keep our viewers at Gustan Cho Associates Mortgage News updated as more news updates.