This guide covers choosing the right mortgage company for loan officers. Choosing the right mortgage company for loan officers is one of the most important decisions a mortgage loan originator needs to make. John Strange, a senior loan officer at Gustan Cho Associates, explains choosing the right mortgage company for loan officers to start their careers.

Loan officers can choose to work at banks, credit unions, mortgage brokers, correspondent lenders, or mortgage bankers. Compensation plans differ from lender to lender.

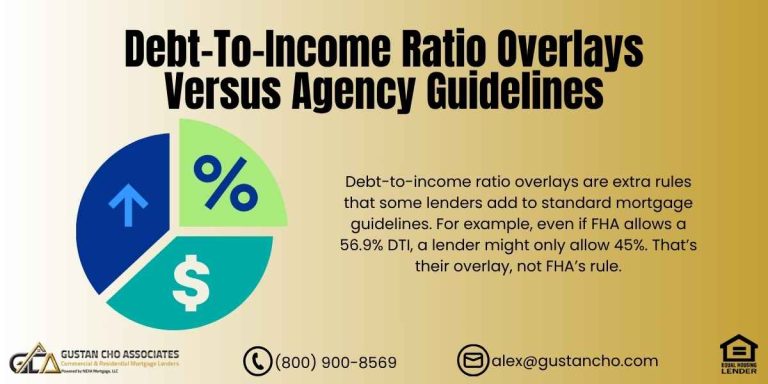

Besides the compensation plan, the mortgage loan officer should take other important factors into consideration when choosing the right mortgage company. Types of mortgage loan options the employer (the lender) offers and if the lender does not offer a loan product, can the lender develop a broker or correspondent lending partnership, the lender overlays, the number of licensed states they are approved to originate, the support and operations team, and the rates.

How The Mortgage Industry Works

Experienced mortgage loan officers with their book of business are highly sought after by lenders. Mortgage companies’ rates differ from lender to lender. There are thousands of mortgage companies in the United States. Often times, mortgage loan originators often get recruited with large compensation and benefit agreements from aggressive head-hunters and recruiters.

The compensation and benefit employment agreements is so generous that even the most experienced mortgage loan originator often overlook the fact that there is no such thing as “GENEROUS or FREE” in the mortgage industry.

Ready to Get Pre-Approved for Your Mortgage? Let’s Start with a TBD Pre-Approval!

Contact us today to find out how we can help you get pre-approved and secure the best loan for your needs.

Choosing The Right Mortgage Company: Working For a FDIC Bank

Choosing The Right Mortgage Company is very important. Working at an FDIC chartered bank versus a mortgage company has pros and cons. Mortgage loan originators at banks do not have to get licensed and are exempt from NMLS licensing requirements.

Loan officers do not have to take and pass the NMLS exam to become mortgage loan originators at an FDIC-chartered bank. Loan officers who work at FDIC-chartered banks can originate loans in all 50 states without being licensed.

Many loan officers who cannot pass the national NMLS exam often seek bank employment. We will explain this later in this article. Just mortgage companies are much stricter on compliance issues than others. This article will discuss Choosing The Right Mortgage Company For loan officers.

NMLS Licensing Exemptions By FDIC Banks Versus Mortgage Companies

Others who cannot get an NMLS state license due to being unable to pass a federal and state criminal background check or credit check due to bad credit can seek employment at an FDIC chartered bank. Every bank has its employment requirements for its mortgage loan originator’s position.

Banks often do a background check on every loan officer candidate. They will often do a credit check but may be lenient and not as strict as getting licensed with the individual states.

For example, suppose a mortgage loan originator candidate had a non-fraud-related felony within the past seven years. In that case, it will be impossible for them to get their NMLS license from any state. So they would not be able to seek employment at any mortgage company.

Choosing The Right Mortgage Company and Getting Hired

However, they can seek employment as a mortgage loan originator at an FDIC Bank if the bank is willing to hire them: Another example is bad and derogatory credit. Certain states have higher credit requirements for loan officers than others. The states of Texas and Wisconsin will not issue a Mortgage Loan Originator’s license if a loan originator candidate has a judgment or charge-off.

Choosing a Small Mortgage Broker Shop

Mortgage brokers do not fund the loans they originate and are middlemen between the borrowers and the actual mortgage lenders. Mortgage brokers need to have relationships with actual mortgage lenders. The commission paid to mortgage brokers is called a yield spread premium. The maximum commission a mortgage broker is allowed to get by law is no greater than a 3% commission.

Most mortgage brokers will agree to a 2.5% to 2.75% commission plan with the wholesale lender so they do not go over the 3% maximum threshold.

The mortgage broker then needs to pay the mortgage loan originator who originated the mortgage loan under the mortgage broker a percentage. The percentage is between 2.5% and 2.75% of brokers make from transactions. Most mortgage brokers will have a split of 50/50 from the commission that the mortgage broker gets from the wholesale mortgage lender.

Looking for a TBD Pre-Approval Mortgage? We Can Help You Get the Process Started!

Reach out now to start your mortgage application and get the approval you need to buy your dream home.

Advantages of Small Mom & Pop Mortgage Broker Shop

When choosing the right mortgage company for loan officers, a mortgage broker shop may be the right fit for a brand new mortgage loan originator: Most mortgage broker shops are small.

New loan officers can get one-on-one training and see how the mortgage business works. Mortgage brokers need to be licensed like any other mortgage banker.

All mortgage loan originators who work under the mortgage broker must have their NMLS licenses in the states where they intend to originate loans. For the mortgage loan officer to get an out-of-state license, the mortgage broker shop must also be licensed. When they refer a mortgage borrower to a particular lender, the lender will pay the mortgage broker a commission.

Disadvantages of Working For Mortgage Brokers

The disadvantage of working for a mortgage broker is that you do not have control because the company does not underwrite the loans you originate. Most mortgage broker shops are only licensed in one of only a few states.

Many states who have never cracked down on bad credit for loan origination NMLS licenses are now putting the breaks on them. f they do not have entered into a payment plan.

They cannot seek employment at any mortgage company if they need to originate loans in those states. However, they can seek employment at an FDIC chartered bank. So if you want to get licensed in multiple states, you may be limited to getting licensed in other states.

Limited Growth and Advancement Opportunities In Working at Mortgage Broker Shops

Growth and advancement opportunities working under a mortgage broker may be limited: Just being a loan officer may be your only position working for a mortgage broker.

Support such as marketing support, leads, and training may be limited to working for a mortgage broker versus working for a national mortgage lender.

Commissions, or the yield spread premium the mortgage broker makes, must be disclosed if you work for a mortgage broker. Mortgage bankers do not have to disclose the comp the mortgage banker or loan officer makes on the file. Since mortgage brokers are limited on commissions from wholesale lenders, you may be limited on a small commission plan versus working as a mortgage banker.

Choosing a Small Correspondent Lender To Work For as a Loan Officer

After the implementation of QM, Quality Mortgage, many small mortgage broker shops turned into mini-correspondent mortgage lenders: They are somewhere between a mortgage broker and full eagle mortgage banker. A mini correspondent lender is a mortgage broker that is not a full eagle lender.

Looking forward to our conference call together. After our meeting, I will brief Elbert and others and discuss the next step for our restructuring.

But has developed a line of warehouse line of credit with wholesale mortgage lenders. They use that line of credit to fund loans and resell them to the wholesale mortgage lender once the loan funds. Mini correspondent lenders can also broker out loans to wholesale lenders.

Choosing The Right Mortgage Company: A National Lender

Choosing a national full-eagle mortgage lender offers many opportunities for loan officers who need to be licensed in multiple states and need name recognition. Consumers are very leery when choosing financial services companies from the internet. Smaller broker shops with a no-name brand tend to be scrutinized by consumers who are internet shoppers for home loans.

Many small mom-and-pop mortgage broker shops have the broker’s names, such as Jimmy Smith Mortgages or Mike Jones Financial.

Nothing is wrong with it, but you may encounter leery borrowers. Choosing a national mortgage lender also provides room for advancement for the loan officer if the officer becomes a top producer. It is up to the mortgage broker and the loan officer to agree on a comp plan.

Potential Advancement To Management

For example, with loan officers under my umbrella, I allow every mortgage loan officer to become the assistant sales manager, sales manager, branch manager, area manager, and regional manager.

Whenever the website is down, has broken links, or has tons of SPAM, The Smart App gets shut down often, and either Alex or I discover it. NOT HIM. It is supposed to be his job to maintain the website.

His mind is not on GCA but on some other tasks: EXAMPLE: In 2018, our unique daily traffic went from 2,500 unique visitors to 1,200. This holds true as long as they are willing and able to proceed and have proven themselves. Every loan officer under my watch has an opportunity to start their own net branch office and have a team of loan officers under their wing.

Career Opportunities at NEXA Mortgage

Why NEXA Mortgage is the righ choice when choosing the right mortgage company for loan officers. NEXA Mortgage just announced 100% compensation payout for mortgage loan officers.

If you are a new or experienced loan officer interested in finding a home where you can grow and advance with your career, contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com.

All of my loan officers do not have to worry about cold calling. We have more mortgage loan applicants than we do borrowers. Never have to worry about not closing a loan in any given month.

I am preparing this email before our Monday morning meeting with my national team. This section will cover the kind of scumbags and unethical people the mortgage industry draws in. I have never met one industry like the mortgage industry where there are so many unethical, greedy crooks.

Need a TBD Pre-Approval for Your Mortgage? We’ve Got You Covered!

Contact us now to learn how this pre-approval can help streamline your mortgage process.

How Gustan Cho Associates Works

I will describe how Gustan Cho Associates (REFERRED TO AS GCA) was created, started, and developed. I want to explain the history of www.gustancho.com and the direction I want to head. Hopefully, Sapna Sharma and Ravinder Sharma and their IT company, Viral Website Developers, can be our general independent administrator/consultant going forward.

All of my loan officers are allowed to become sales managers and will be allowed to open up their net branches. I will provide the initial financial and emotional support in growing your business.

I have my attorney and friend Elbert Reniva included, in this email because he is the general counsel for Gustan Cho Associates, which will be formed asap as a Corporation. If you have any questions or concerns about legal, business, or corporate matters, feel free to contact Attorney Elbert Reniva.

General Overview of How Gustan Cho Associates Works

I got my NMLS mortgage license in April 2012. After losing 3,000 residential housing units in 2009 ($100 million equity), I needed to start a new business with potential where I could grow it, like the real estate business. Since real estate and lending are the two things I knew, I decided to get my license, get into the mortgage business, and grow it as I did in the real estate business.

When I started as a loan officer in 2012, I bought leads, hustled to get referrals, and contacted hundreds of realtors. Did not take me long to realize getting leads of potential borrowers took longer than originally thought.

I got yelled at by the leads of the people I called. They were telling me you are the 10th loan officer who called me.

These low credit score people with crappy credit called me a loser, got a real job, and depressed me. I could not afford the $1,500 per name premium leads, so I wanted to create my own Zillow-like website.

Due to the losses of my real estate holdings, if you Googled Gustan Cho, my reputation was not good. Who will apply for a mortgage with a deadbeat who has a bad reputation as a slumlord and has foreclosures on all search engines? So, I decided to clean my name and bought the domain name in January 2013.

When Gustan Cho Associates Website Was Founded and Launched

I then bought a website with WordPress and started working on content to brand my name and get exclusive leads so I could be the next Donald Trump in the mortgage industry. I knew it would be hard, if not impossible, due to my lack of knowledge in technology and SEO/Websites. However, I knew the content was key and hired Web developers and consultants.

The Truth Always Comes Out

The straw that broke the camel’s back was a week from last Friday. When we were both at the office, he asked if he could take a week off with Martina to take a trip to Florida and study for his NMLS MLO exam. Due to the losses of my real estate holdings, if you Googled Gustan Cho, I did not have mortgage loan origination experience.

When I got my NMLS license in 2012, I owned, and managed 3,000 residential housing units (consisting of seven apartment complex) nearing the end of my career as a real estate investor. It did not take me long to learn that your name and reputation is everything if you want to become a successful mortgage loan originator. So, I decided to clean my name and bought the domain Gustan Cho Associates in January 2013.

General Overview of How Gustan Cho Associates Was Created and Launched:

I got my NMLS mortgage license in April 2012. After losing 3,000 residential housing units in 2009 ($100 million equity), I needed to start a new business with potential where I could grow it, like the real estate business. Since real estate and lending are the two things I knew, I decided to get my license, get into the mortgage business, and grow it as I did in the real estate business.

When I started as a loan officer in 2012, I bought leads, hustled to get referrals, and contacted hundreds of realtors, but the results were very disappointing. I got yelled at by the leads of the people I called.

The leads I bought that I called were telling me you are the 10th loan officer who called me. These low credit score people with crappy credit called me a loser, got a real job, and depressed me. I could not afford the $1,500 per name premium leads, so I wanted to create my own Zillow-like website.

I then bought a website with WordPress and started working on content to brand my name and get exclusive leads so I could be the next Donald Trump in the mortgage industry. I knew it would be hard, if not impossible, due to my lack of knowledge in technology and SEO/Websites. However, I knew the content was key and hired Web developers and consultants.

FAQs: Choosing The Right Mortgage Company For Loan Officers

- 1. Why is choosing the right mortgage company important for loan officers? Choosing the right mortgage company is crucial because it can significantly impact a loan officer’s career development, compensation, work environment, and ability to offer diverse loan products to clients.

- 2. What types of employers can mortgage loan officers work for? Mortgage loan officers can work for banks, credit unions, mortgage brokers, correspondent lenders, or mortgage bankers. Each type of employer offers different benefits and compensation structures.

- 3. What factors should loan officers consider when choosing a mortgage company? When choosing a mortgage company, loan officers should consider compensation plans, available mortgage loan options, the lender’s ability to develop lending partnerships, lender overlays, licensed origination states, the support team, the operations team, and interest rates.

- 4. How does working for an FDIC bank differ from a mortgage company? Employment at an FDIC bank comes with certain benefits, including not needing NMLS licensing and being able to initiate loans in every state. However, banks may be stricter on compliance issues and may perform background and credit checks.

- 5. Can a loan officer who fails the NMLS exam work at an FDIC bank? Yes, loan officers who cannot pass the NMLS exam or fail federal and state background checks can seek employment at an FDIC-chartered bank, which may have more lenient hiring requirements.

- 6. What are the pros and cons of working for a mortgage broker? Working for a mortgage broker has benefits, such as one-on-one training for new loan officers and the ability to refer borrowers to different lenders. However, drawbacks include limited control over the underwriting process and potential limitations on growth and advancement opportunities.

- 7. How do mini-correspondent lenders differ from mortgage brokers? Mini-correspondent lenders are mortgage brokers with a line of credit that funds loans, which are then sold to wholesale lenders. Compared to traditional brokers, mini-correspondent lenders have more control over the funding process but are not full eagle lenders.

- 8. What advantages do national mortgage lenders offer? National mortgage lenders offer several advantages, including the opportunity to be licensed in multiple states, the benefit of brand recognition, which can help build consumer trust, the potential for career advancement and management positions, and more extensive support structures for marketing, leads, and training.

- 9. What should loan officers look for in compensation plans? Loan officers should look for competitive commission structures, a clear understanding of yield spread premiums, transparent compensation agreements, and opportunities for bonuses or additional financial incentives.

- 10. Why might a loan officer choose a small mortgage broker shop? A small mortgage broker shop can provide personalized training, a closer look at the mortgage business operations, and potentially more flexible working conditions. This setting can be ideal for new loan officers looking to gain experience.

- 11. What career opportunities are available at companies like NEXA Mortgage? NEXA Mortgage offers opportunities for growth, including a 100% compensation payout for loan officers. Loan officers can advance to sales, branch, area, and regional manager positions, possibly opening their own net branch office.

For further inquiries or to explore career opportunities at Gustan Cho Associates, contact 800-900-8569 or email gcho@gustancho.com.

If you have any questions about Choosing The Right Mortgage Company For Loan Officers or you need to qualify for loans with a lender with no overlays, please contact us at 800-900-8569. Text us for a faster response. Or email us at alex@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

This blog about Choosing The Right Mortgage Company For Loan Officers was updated on June 6th, 2024.

Ready for Your Home Loan Pre-Approval? Let’s Begin with a TBD Pre-Approval!

Reach out today to get started on your pre-approval and take the next step toward homeownership.

Thank you for all this great information about choosing a loan officer! One thing that really stood out to me is that you say to look for someone that is highly experienced, and has their own book of business, Since we were looking into getting a mortgage, it would be nice to have them at our backs.