This blog covers the best Arizona mortgage lenders for bad credit with low FICO credit scores. It is an important question for anyone who is a first-time homebuyer or refinancing a home in Arizona to understand if they can afford an Arizona mortgage loan. Not all mortgage lenders in Arizona have the same guidelines for government and conventional loans.

What Is Bad Credit?

The best Arizona mortgage lenders for bad credit borrowers with low credit scores are those with years of experience and no lender overlays. Over 75% of our borrowers could not qualify at other mortgage companies. Gustan Cho Associates (Gustan Cho Associates) has a national reputation for being able to do loans other lenders cannot do. Gustan Cho Associates. The best Arizona mortgage lenders for bad credit are mortgage brokers who have relationships with many wholesale lenders for poor credit borrowers.

What Is Bad Credit?

Has a lender in Arizona denied you a mortgage due to bad credit? Have you studied the agency mortgage guidelines and met the guidelines, but the lender denied you regardless? For example, you had bad credit two years ago but have been timely with a good income and a low debt-to-income ratio. However, you got denied a credit score on a VA loan. The lender who denied you said you do not have a 620 credit score, which is why you got denied.

Get quote for 620 credit score

Are All Mortgage Lenders The Same in Arizona?

Many borrowers believe that the FHA, VA, USDA, and conventional loan requirements are all the same, no matter which lender you choose. Borrowers believe all lenders are the same in Arizona because they are government-backed loans, and conventional loans must conform to Fannie Mae or Freddie Mac GSE agency guidelines. That is not the case. The next paragraph will discuss why not all lenders are identical.

Bad Credit Mortgage Loans Approval Guaranteed Approval

Not all lenders are the same. Not all FHA-approved lenders will approve borrowers with bad credit and lower credit scores. Not all VA-approved lenders will approve borrowers who meet the VA guidelines.

Government and conventional loan lenders need to meet the FHA, VA, USDA, Fannie Mae, and Freddie Mac agency guidelines.

Lenders can have higher lending requirements, referred to as lender overlays, than the minimum agency guidelines of HUD, VA, USDA, Fannie Mae, and Freddie Mac. We will detail typical lender overlays on government and conventional loans.

What Credit Score Will Guarantee Mortgage Approval?

Can a lender guarantee mortgage approval for bad credit? You cannot ever guarantee mortgage approval. You can come close to a guarantee if you meet the mortgage lender’s guidelines. However, if a lender guarantees bad credit mortgage loan approval, they falsely advertise.

There is no reason why pre-approved homebuyers should stress during the mortgage process, or get a last-minute mortgage denial.

Over 80% of our borrowers at Gustan Cho Associates could not qualify at other mortgage companies due to last-minute mortgage loan denial. Gustan Cho Associates closes all of its pre-approved borrowers. However, what happens if the borrower loses their job before closing? What happens if the borrower has a medical condition or other extenuating circumstances before closing. There is no such thing as a guarantee.

Get approval for bad credit by fill up form , Click here

What are The Best Types of Bad Credit Mortgages in Arizona

Every loan program in Arizona has its lending requirements. Government and conforming loans have two sets of guidelines. The first type of guidelines on government and conventional loans are the agency guidelines of FHA, VA, USDA, Fannie Mae, and Freddie Mac. The second type of guideline lenders have are lender overlays.

Lender overlays are each lending requirement higher than the agency minimum guidelines.

The best Arizona mortgage lenders for bad credit are mortgage brokers who have no lender overlays on government and conventional loans. This means the lender will only go by the minimum agency guidelines and will not add another tier of lending requirements. There are also non-QM and non-prime mortgages in Arizona. We will also discuss non-QM and non-prime mortgages for bad credit. The best Arizona mortgage lenders for bad credit are mortgage brokers with wholesale lending partnerships with no overlay, wholesale lenders, and non-QM mortgages.

VA Loans With 500 Credit Scores in Arizona

BREAKING NEWS, folks!!! The VA does not have a minimum credit score requirement or a maximum debt-to-income ratio. You should have gotten approved. Over 80% of our borrowers at Gustan Cho Associates could not qualify at other lenders due to lender overlays. Yes, you can get mortgage approval after being denied by a lender.

Bad Credit FHA Loan Requirements in Arizona

FHA loans are the most popular loan program for borrowers with bad credit and low credit scores. There are ways the best Arizona mortgage lenders for bad credit can qualify homebuyers in Arizona. Lenders do not take into account the personal expenses of borrowers, such as the following:

- What are the automated underwriting system findings?

- If refer/eligible per the automated underwriting system, does the borrower qualify for manual underwriting?

- What is the debt-to-income ratio?

- Has the borrower been timely in the past 12 months on all the monthly debt payments?

- Does the borrower have credit disputes on non-medical collections, charged-off accounts, or derogatory tradelines?

- What is the debt-to-income ratio?

- Are there any judgments or public records not showing on credit reports?

How Much House Can I Afford in Arizona With Bad Credit?

Homebuyers in Arizona need to consider how much home they can afford versus how much home they can qualify for. There are certain debts that lenders do not take into account. Lenders only use monthly debts that are reported on credit reports. You do not want to be house-rich and cash-poor. The following debts are not included by lenders when qualifying borrowers:

- Utilities

- Cell phone

- Medical insurance

- Childcare

- Educational expenses

- Home improvement and repairs

- Gas and transportation costs

- Vacation and travel

- Groceries and living expenses

- Landscaping

- Other expenses

Borrowers need to analyze whether mortgage payments will be affordable and safe. Not what they qualify for. Borrowers should go over other expenses besides interest, principal repayments, and other monthly expenses like taxes on real estate and homeowners insurance.

Check here how much can you afford with bad credit

What Are The Associated Costs of Buying a Home in Arizona

There are additional costs in becoming a homeowner and the costs associated with buying a home. Here are some basic costs on home purchase:

- Down Payment

- Closing Costs

- Moving Costs

- Repair and maintenance costs

- Furniture and furnishings for a new home

Non-QM Loans For Bad Credit in Arizona

You can qualify for several mortgage loan programs to purchase a home in Arizona with bad credit. Government and conventional loans are the best mortgage programs with low down payment requirements. Non-QM mortgages are non-prime loans with lenient mortgage requirements for bad credit. However, non-QM loans require a 20% down payment and have higher rates and costs. Non-QM mortgage rates depend on the borrower’s credit scores, and the down payment can go as high as 10%.

Benefits of a Bad Credit FHA Loan in Arizona

FHA loans are the best mortgage loan program for bad-credit borrowers in Arizona. FHA loans are the most popular mortgage loan programs recommended by the best Arizona mortgage lenders for bad credit. HUD, the parent of FHA, has created lenient lending requirements for FHA loans. The minimum credit score required on FHA loans in Arizona is 500 FICO. Collections and charged-off accounts do not have to be paid to qualify for FHA loans. We will cover why FHA loans are the best loan programs for borrowers with certain types of bad credit.

What Is The Best Mortgage For Homebuyers With Collections in Arizona?

Best Arizona Mortgage Lenders For Bad Credit Borrowers With Lenient Guidelines

The best Arizona mortgage lenders for bad credit and low credit scores are lenders with no lender overlays on government and conventional loans. We will go over how to choose the best Arizona mortgage lenders for bad credit and the types of mortgage programs they should offer. The best Arizona mortgage lenders for bad-credit borrowers should be able to offer FHA and VA loans with credit scores down to 500 FICO.

Best Arizona Mortgage Lenders For Non-QM Loans in Arizona

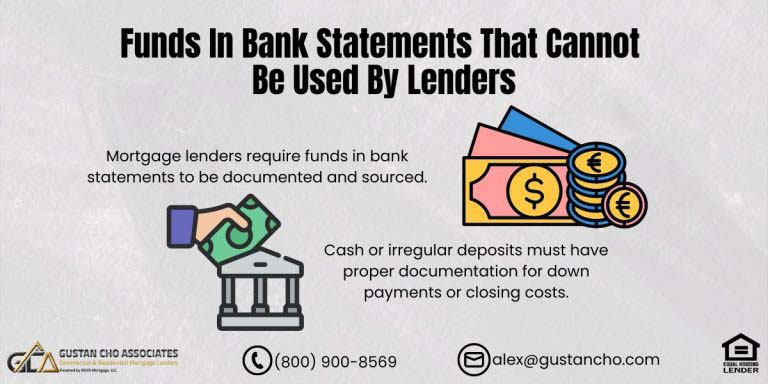

Outstanding collections and charged-off accounts do not have to be paid to qualify for FHA, VA, USDA, and conventional loans. Credit and income are two main factors in qualifying for a home loan. There are minimum credit score requirements and debt-to-income ratio requirements to qualify for home loans.

Gustan Cho Associates has a large network of non-QM wholesale mortgage lenders.

Some popular non-QM loan programs we offer are bank-statement loans with no income docs required, asset-depletion mortgages, non-QM loans one day out of bankruptcy and foreclosure, and non-QM loans with mortgage rates in the past 12 months.

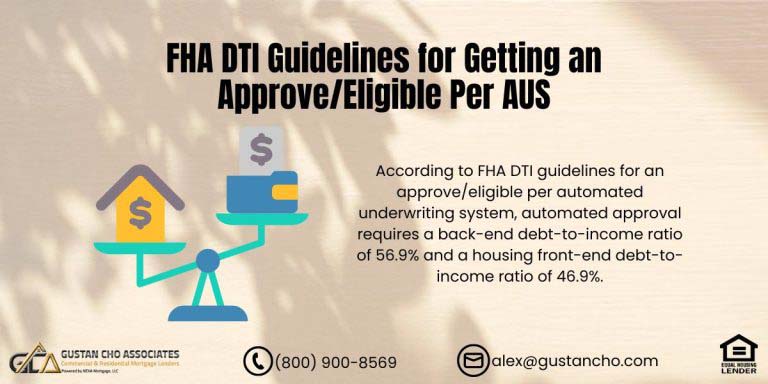

FHA Loans With 500 FICO in Arizona

HUD, the parent of FHA, allows home buyers with credit scores down to 500 FICO to qualify for FHA loans. The down payment for borrowers with under 580 credit scores down to 500 FICO is 10%. To qualify for a 3.5% down payment FHA loan in Arizona, the minimum credit required is 580 FICO. A 3.5% down payment is required on a home purchase for FHA Jumbo high-balance loans in Arizona. Debt-to-income ratio requirements on FHA loans are 46.9% front-end and 56.9%.

VA Loans For Bad Credit in Arizona

VA has no credit score requirements—most lenders in Arizona like to see 580 credit scores by veteran borrowers. VA loans do not have maximum debt-to-income ratio requirements. Gustan Cho Associates can do VA loans with credit scores down to 500 FICO and a debt-to-income ratio over 60% DTI.

Conventional Loans With Bad Credit Arizona

Conventional Loans require 620 FICO credit scores. Fannie Mae and Freddie Mac allow debt-to-income ratios up to 50% DTI if your credit scores. Private mortgage insurance companies will normally not insure conventional loans with lower than 680 FICO at 50% DTI. Borrowers with credit scores under 680 can get private mortgage insurance with a maximum of 45% debt-to-income ratio.

Non-QM Mortgage Lenders in Arizona

Non-QM loans or non-prime mortgages are home loans that do not conform to traditional conforming agency lending requirements and guidelines of the Consumer Financial Protection Bureau (CFPB). Non-QM loans are nontraditional mortgage programs. There are hundreds of types of non-QM loan programs. Non-QM loans normally require a 20% to 30% down payment. Best Arizona mortgage lenders for bad credit are lenders with no lender overlays on FHA, VA, USDA, and Conventional loans.

Non-QM Mortgages in Arizona

Examples of non-QM loans are non-QM jumbo loans for self-employed borrowers, non-QM mortgages one day out of bankruptcy or foreclosure, asset depletion, no-doc loans, homes on acreages, hobby farms, fix and flip loans, mortgages with late payments in the past 12 months, bank statement mortgages, no income verification loans, stated income mortgages, P and L statement mortgages. Non-QM mortgages are for owner-occupant homes, second and vacation homes, and investment properties. Non-QM loans are alternative financing mortgage programs for self-employed borrowers or borrowers with less-than-perfect credit and lower credit scores.

Contact with us about get quote related to Non-Qm Mortgage

Adjustable-Rate versus Fixed-Rate Mortgages

It’s a very valid possibility to take out a mortgage with an adjustable rate that adjusts as your level of income changes over the years. With an adjustable-rate mortgage, mortgage rates are generally lower than fixed-rate mortgages. ARMs are recommended for homebuyers of starter homes or if the homeowner does not plan to live at the property for more than five years.

Best Arizona Mortgage Lenders For Bad Credit With No Overlays on DTI

Why are Discount Points Charged by Mortgage Lenders?

Mortgage lenders can charge Discount points as loan level pricing adjustments (LLPAs) for borrowers with under 620 credit scores. Borrowers can also use discount points to buy down mortgage rates. Homebuyers can get reduced interest rates by buying down the rate with discount points. Any leftover funds on seller concessions are used to buy discount points for reduced rates. To make it simple, one point is 1% of the loan. One point for homebuyers who borrow $50k to purchase a new home will be $500.

Discount Points Used To Buy Down Mortgage Rates

Mortgage Points are fantastic for reducing mortgage rates. Borrowers who utilized the same $500 spent on one mortgage point as an additional down payment would only save roughly $20 a year at a 4% mortgage rate. Thus, once borrowers have paid the down payment, any extra money they may have available would likely be best spent buying mortgage points instead of adding more money to the original deposit.

Best Arizona Mortgage Lenders For Bad Credit on Cash-Out Refinance

Homeowners who purchased a home in Arizona several years ago have seen their home values skyrocket by double. If you have equity in your home, you are eligible to do a cash-out refinance mortgage. The proceeds from a cash-out refinance are tax-free. Homeowners can use the proceeds from cash-out refinance for any purpose they like.

Gustan Cho Associates is one of the best Arizona mortgage lenders for bad credit for cash-out refinance.

The team at Gustan Cho Associates can help homeowners get a cash-out refinance mortgage with credit scores down to 500 FICO on FHA, VA, and non-QM loans. Many homeowners pay off credit cards and other debts with the proceeds from their cash-out refinance. Gustan Cho Associates is a mortgage broker licensed in 48 states with no lender overlays on government and conventional loans. We can help you qualify for a mortgage loan in Arizona and other states. Please get in touch with us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com.