Debt-To-Income Ratio Mortgage Calculator

Powered by Alex Carlucci of Gustan Cho Associates

The debt-to-income ratio mortgage calculator powered by Alex Carlucci of Gustan Cho Associates has been designed for users to compute their own DTI in seconds. Gustan Cho Associates created the debt-to-income ratio mortgage calculator after noticing there is no other debt-to-income ratio mortgage calculator out there that gives you the most accurate data. Every mortgage loan program has its own front-end and back-end debt-to-income ratio guidelines. Borrowers need to realize that debt-to-income ratios can greatly be affected by how much the property taxes for the same dollar amount home.

- Conv

- FHA

- VA

- Jum/Non

- USDA

How Property Taxes Affect DTI For Mortgage

Property taxes can vary widely not just from state to state but also from county to county, and town to town. In this guide, we will go over the minimum debt-to-income ratio guidelines of FHA loans, VA loans, USDA loans, and Conventional mortgages.

Discover how a Debt-To-Income Ratio Mortgage Calculator simplifies assessing your mortgage eligibility with PITI, PMI, and HOA fees. Get expert tips from Gustan Cho Associates to improve your DTI ratio and secure home financing today.

All mortgage lenders need to make sure their borrowers meet the minimum agency DTI guidelines. However, lenders can have their own lending guidelines on debt-to-income ratios called lender overlays. We will talk more about lender overlays later in this guide. In the following paragraphs, we will cover the debt-to-income ratio mortgage calculator, powered by Gustan Cho Associates.

Start Your Process Towards Buying A Home

Find out the importance of a Debt-To-Income Ratio Mortgage Calculator when determining your mortgage eligibility’s PITI, PMI, and HOA fees, and expert suggestions from Gustan Cho Associates to get your home financing by enhancing your DTI ratio.

Do All Lenders Have The Same DTI Requirements?

Individual lenders do not have the same mortgage guidelines on the same home loan programs. A borrower may not qualify for an FHA and/or a VA loan with one lender but may qualify at a different lender. Lenders can have higher debt-to-income ratio requirements that are higher than the minimum FHA, VA, USDA, Fannie Mae, and Freddie Mac DTI requirements.

Not All Lenders Have the Same DTI Requirements on the Same Mortgage Program

Just because you cannot qualify for a home mortgage with one lender, it does not mean you cannot qualify with a different lender. It is very important for homebuyers with bad credit to understand and know the basic agency mortgage guidelines on the type of home loan program. By knowing the basic agency guidelines, you will know whether or not you get denied for a mortgage because you do not meet the agency guidelines or because of the lender overlays of the mortgage company.

What Is An Acceptable DTI For A Mortgage?

As long as you meet the minimum agency guidelines, of FHA, VA, USDA, Fannie Mae, and/or Freddie Mac you will qualify for a mortgage. Lenders can have higher lending requirements above and beyond the minimum agency mortgage guidelines. The higher lending requirements by lenders are called lender overlays on debt-to-income ratios.

How To Get a Home Loan With High Debt-To-Income Ratio?

If your lender has lender overlays on debt-to-income ratios, ask your loan officer what the maximum debt-to-income ratio is. Once you know your lender’s DTI ratio overlay, you can calculate the DTI yourself when shopping for a home.

There is no need to keep contacting your loan officer whenever there is a change in numbers while shopping for a home.

In this guide on the best debt-to-income ratio mortgage calculator powered by Alex Carlucci of Gustan Cho Associates, we will cover the debt-to-income ratio requirements on government, conventional, jumbo, and non-prime mortgages. The higher the debt-to-income ratio, the higher the layered risk level for lenders.

Compute Your DTI Using Debt-To-Income Ratio Mortgage Calculator

Using the debt-to-income ratio mortgage calculator, you can get the exact front-end and back-end DTI as the mortgage underwriter. Sometimes it is very convenient for you to calculate the DTI yourself when you are shopping for multiple homes to check if you still qualify for a home mortgage than contacting your loan officer. You may be shopping for over a dozen homes with very different property tax numbers. This can affect your debt-to-income ratio.

The Best Mortgage Lenders For High DTI Borrowers

The debt-to-income ratio mortgage calculator will come in very handy for borrowers with high DTI. In the following paragraphs, we will go over every loan program’s debt-to-income ratio agency mortgage guidelines. If you are a homebuyer with a high debt-to-income ratio, we highly suggest asking your loan officer about the debt-to-income ratio overlays of his mortgage company. Gustan Cho Associates has zero lender overlays on government and conventional loans.

Calculate your true DTI with PITI, PMI, and HOA included.

Get a precise front-end/back-end DTI using real taxes, insurance, and fees—then see loan options.

Compute Your Front-End and Back-End DTI in Seconds Using DTI Mortgage Calculator

The debt-to-income ratio mortgage calculator at Gustan Cho Associates has been custom designed to get the most accurate front-end and a back-end DTI used by mortgage underwriters. There is no other DTI mortgage calculator in the nation that compares to the debt-to-income ratio mortgage calculator powered by Gustan Cho Associates. Every mortgage loan program has its own debt-to-income ratio requirements,

Compute How Much Home Can You Can Afford With Property Taxes Using DTI Mortgage Calculator

Many homebuyers focus believe how much home they qualify for is based on the price of the home. This is not true. The price of the home will get you the principal and interest portion of the housing payment. This is what most online mortgage calculators give users of their calculators. Later in this guide, we will show you step-by-step instructions in computing your front-end and back-end DTI using the debt-to-income ratio using the debt-to-income ratio mortgage calculator.

Debt-To-Income Ratio To Buy a House

One of the most frequently asked questions at Gustan Cho Associates from our clients is what is the requirements of the debt-to-income ratio to buy a house. The answer to this question is it depends on the particular loan program you choose. Every loan program has its own debt-to-income ratio to buy house requirements. We will go over the debt-to-income ratio to buy a house on FHA, VA, USDA, and conventional loans. There are two types of debt-to-income ratio guidelines.

Understanding Agency DTI Guidelines Versus Overlays By Lenders

The first type is the agency mortgage DTI guidelines from FHA, VA, USDA, Fannie Mae, and Freddie Mac. The second type of DTI guidelines is the lender’s own DTI requirements called lender overlays.

Gustan Cho Associates does not have any lender overlays on FHA, VA, USDA, and conventional loans. We just go off the minimum agency guidelines of FHA, VA, USDA, Fannie Mae, and Freddie Mac.

Jumbo loans and non-QM mortgages are non-conforming loans and do not have a uniform debt-to-income ratio agency requirement. Each Jumbo mortgage lender and non-QM lender sets its own DTI requirements on its loan program.

DTI Home Loan Calculator

The debt-to-income ratio mortgage calculator powered by Gustan Cho Associates will give you the most accurate debt-to-income ratio based on the most accurate housing payment. Our best mortgage calculator will give you the PITI, PMI and/or MIP, and HOA. All of these components play a key part in the final housing payment to calculate your front-end and back-end debt-to-income ratio.

FHA, VA, USDA, Fannie Mae, and Freddie Mac DTI Mortgage Guidelines

Each individual loan program has its own front-end and back-end debt-to-income ratio requirements. We have created and developed a user-friendly mortgage calculator to calculate your monthly housing payment which includes PITI, PMI, MIP, and HOA on FHA, VA, USDA, and conventional loans as well as your front-end and back-end debt-to-income ratio. In the next paragraph, we will cover the minimum agency mortgage guidelines on debt-to-income ratio caps.

Getting Approved With Lender After Denied For High DTI

The best mortgage lenders for high debt-to-income ratios are mortgage advisors with a network of wholesale lenders with no lender overlays. Mortgage Advisors have licensed loan officers with access to wholesale specialty niche market financial institutions. Gustan Cho Associates are mortgage advisors licensed in 49 states (not licensed in NY, MA) with over 170 wholesale lending partners. Over 75% of our clients are borrowers who could not qualify elsewhere but we qualify them and close their loans.

Mortgage Options For High-DTI Homebuyers

Gustan Cho Associates has a no-lender overlays business platform. Government and conventional loans have a set maximum DTI cap on their mortgage loan program. Mortgage lenders usually have lower debt-to-income ratio requirements than the agency DTI requirements. The lower the debt-to-income ratio, the better. Low DTI means the borrower has low monthly debts compared to his income. In the following paragraphs, we will cover and discuss the agency debt-to-income ratio guidelines.

USEFUL LINK: Mortgage Agency Guidelines Versus Lender Overlays

HUD DTI Guidelines on FHA Loans

HUD, the parent of FHA, sets the guidelines for FHA loans. FHA loans are the most popular home loan programs for homebuyers with higher debt-to-income ratios. FHA loans have several tiers on debt-to-income ratio requirements. We will go over each tier on what the maximum cap on front-end and back-end debt-to-income ratio limits on FHA loans.

How To Get Approved For Mortgage With High DTI

To get approve/eligible per the automated underwriting system (AUS), the borrower needs to have been timely in the past 12 months. Borrowers who cannot get an AUS approval and get a refer/eligible per AUS findings may be eligible for manual underwriting. Manual underwriting requires borrowers to have been timely on all payments for the past 24 months. Verification of rent is required on manual underwriting. We will cover the debt-to-income ratio manual underwriting guidelines in the following paragraphs.

FHA DTI Guidelines on 580 FICO Borrowers

FHA loans have different front-end and back-end debt-to-income ratio caps based on the borrower’s credit scores, and whether the file is manual underwriting or an automated underwriting system approved file. Borrowers with a 580 FICO and higher can get an approve/eligible per automated underwriting system on FHA loans with a 46.9% front-end and 56.9% back-end debt-to-income ratio.

FHA DTI Guidelines For Borrowers With 500 to 579 FICO

For borrowers with credit scores below 580 FICO and down to 500 credit scores, the maximum front-end debt-to-income ratio is 31% front-end and 43% back-end debt-to-income ratios. This is with approve/eligible per the automated underwriting system (AUS). The above only holds true if the borrower has an AUS- approval.

How To Get AUS Approval With Bad Credit?

The key to getting an automated findings approval, the borrower needs to be timely on all their payments in the past 12 months. If the borrower can’t get an automated findings approval and get a refer/eligible per AUS approval, the borrower may be eligible for a manual underwrite. You can use the debt-to-income ratio mortgage calculator to compute the front-end and back-end DTI on FHA loans in a matter of seconds.

FHA DTI Guidelines on Manual Underwriting

If a borrower cannot get approve/eligible per the automated underwriting system, and get a refer/eligible AUS findings, the borrower may be eligible for manual underwriting on FHA loans. The only major difference between automated and manual underwriting is the lower debt-to-income ratio requirements on manual underwrites.

Compensating Factors For Borrowers With High Debt-To-Income Factors

The maximum front-end and back-end DTI requirements with no compensating factors are 31%/43%. The maximum front-end debt-to-income ratio is 37% and the back-end is 47% DTI with one compensating factor. With two compensating factors, the maximum front-end DTI is 40% and the back-end DTI is 50% DTI. Compensating factors are positive factors that reduce the risk for the lender. Since compensating factors lowers layered risk for the lender under the eyes of the lender, they can increase the debt-to-income ratio cap on manual underwrites.

What To Do After Denied For A VA Loan Due To High DTI?

Most first-time homebuyers believe all mortgage lenders have the same lending requirements on VA loans since they are government-backed loans. This is not true. All lenders must make sure their borrowers meet the minimum agency guidelines of the VA. However, lenders can have higher requirements for VA loans. VA loans have one of the most lenient mortgage guidelines of any other home loan program. The VA created VA loans to reward our servicemen and servicewomen for their service.

Why Do Borrowers Get Denied For a Mortgage After Being Pre-Approved?

The main reason why borrowers get denied after they have been pre-approved is that the loan officer did not properly qualify borrowers.

For example, a borrower with a 550 got an approve/eligible per automated underwriting system (AUS) approval and meets the VA agency guidelines.

However, through the mortgage process, the mortgage underwriter catches the 550 FICO and denies the loan because the lender has a 620 FICO requirement. The loan officer should have known the overlays of his employer. The borrower will qualify for a VA loan with a lender with no lender overlays on credit scores. Mortgage lenders can have lender overlays on everything.

VA Loans With Poor Credit

Homebuyers can get approved for VA loans with poor credit. As long as you have been timely in the past 12 months, you can qualify for a VA loan with unpaid collections, charge-offs, late payments, and other derogatory credit tradelines. Check to see the reason why you got denied. There are lenders that deny borrowers even with an approve/eligible per automated underwriting system (AUS) approval because the lender has overlays. Many times, borrowers with an approve/eligible get downgraded to a manual underwrite because of poor credit.

What Happens If I Got Denied For a VA Loan After Being AUS Approved?

If you got approve/eligible per AUS but got denied due to overlays, you are all set to get loan approval with a lender with no overlays. If you did not get an AUS approval, did you get a refer/eligible? With refer/eligible findings, you are eligible for manual underwriting. Do you qualify for a manual underwrite? Have you been timely with all of your payments for the past 24 months? Instead of applying to every lender you talk to, do a self-evaluation and qualification. We will show you how to do this in this guide.

Getting Pre-Approved For a VA Loan After Getting Denied

Data suggests veterans have lower credit scores and credit profiles than their civilian counterparts. This is mainly because members of the military get transferred from one base to another or get deployed overseas. However, data suggest the default rate on VA loans is substantially lower than the defaults of civilians.

Steps For Mortgage Approval After Getting Denied By Lender

If you get denied a VA loan from one lender, you may qualify with a different lender. As long as you meet the minimum VA guidelines and have been timely in the past 12 months and can get an approve/eligible per the automated underwriting system, there is no reason why you should get denied for a VA loan. In the next paragraph, we will cover and discuss a case scenario on VA lenders with overlays on debt-to-income ratios.

What Is An Acceptable DTI For a Mortgage Approval For Lenders?

Let’s go over a case scenario on what an acceptable debt-to-income ratio for mortgage approval for lenders is. The VA has no maximum debt-to-income ratio cap on VA loans.

Many homebuyers with high DTI are getting turned down by all of these lenders. Many of these lenders have names starting with VA and claim that VA loans are all they do.

Then why are they turning down borrowers who have an approve/eligible per the automated underwriting system?

VA Credit Score Requirements on VA Home Loans

Why are they mandating a 31% front-end and 43% back-end DTI when VA does not have a debt-to-income ratio cap? Lenders who have minimum DTI requirements are lenders who have overlays on VA loans. Let’s say Borrower A is a borrower who got an approve/eligible per AUS on a VA loan with a 550 credit score and 64% DTI. Gustan Cho Associates has no lender overlays and can qualify and approve Borrower A for a VA loan.

USEFUL LINK: VA Lender Overlays

VA Loan DTI Guidelines

Gustan Cho Associates has no lender overlays on VA loans. What this means is as long as the borrower meets the minimum VA guidelines and gets automated approval per AUS, the borrower is solid.

Gustan Cho Associates has no lender overlays on VA loans. We only go off the automated findings of the automated underwriting system and have zero lender overlays on VA loans.

The Department of Veterans Affairs has no maximum debt-to-income ratio on VA loans. Gustan Cho Associates has done countless VA loans with over 65% DTI approve/eligible borrowers.

Can I Get Approved For VA Loans With High DTI?

As long as borrowers have strong residual income and have not been late in the past 12 months, you should get an AUS approval on VA loans. In cases where the borrower cannot get an AUS approval but get a refer/eligible per AUS, the borrower may be eligible for manual underwriting. The main difference between automated and manual underwriting is the debt-to-income ratio is lower in manual underwrites. We will discuss the debt-to-income ratio requirements on VA loans in the next paragraph.

Get Approvable For VA Loans With Hight DTI

Apply Online And Get recommendations From Loan Experts

VA Loan DTI Manual Underwriting Guidelines

If the borrower does not get an AUS approval and gets a refer/eligible per AUS, Gustan Cho Associates will see if the borrower qualifies for VA manual underwriting guidelines. We will discuss the basic VA DTI guidelines on VA AUS Approvals versus Manual Underwriting.

The Department of Veterans Administration (VA), the federal agency that administers VA agency guidelines and the VA loan program, which has no maximum VA maximum debt-to-income ratio cap.

The Department of Veterans Affairs has no maximum debt-to-income ratio caps for borrowers as long as borrowers meet the minimum residual income requirements. Most lenders will require a debt-to-income ratio not to exceed 41% to 45%. Why does this happen? Why will a lender not qualify borrowers? It is because the lender has overlays on VA loans.

VA DTI Guidelines on Manual Underwriting Versus AUS Approved Borrowers

As mentioned earlier, the VA does not have a maximum DTI cap on AUS-approved borrowers. Manual underwriting does have debt-to-income ratio caps. The debt-to-income ratio depends on the number of compensating factors. The maximum debt-to-income ratio with zero compensating factors is 31% front-end and 43% back-end DTI.

Maximum Debt To Income Ratio on Manual Underwrites

The maximum debt-to-income ratio with one compensating factor is 37% front-end and 47% back-end DTI. The maximum debt-to-income ratio with two compensating factors is 40% front-end and 50% back-end DTI. You can use the debt-to-income ratio mortgage calculator to compute the front-end and back-end debt-to-income ratio on VA manual underwrites.

USEFUL LINK: VA DTI Manual Underwriting Guidelines

USDA DTI Guidelines on USDA Home Loans

USDA loans is a very popular mortgage loan program for homebuyers looking to purchase a home in rural America. Only designated areas by the USDA Rural Development are eligible for USDA loans. Great features about USDA home loans is homebuyers can get 100% financing at competitive rates.

One of the frequently asked question we get at Gustan Cho Associates is what is the maximum debt-to-income ratio for a USDA loan?

USDA maximum front-end debt-to-income ratio is 29% and maximum debt-to-income ratio is capped at 41% DTI. Borrowers of USDA loans can compute their front-end and back-end debt-to-income ratio using the debt-to-income ratio mortgage calculator powered by Alex Carlucci of Gustan Cho Associates

Conventional Loan Debt-To-Income Ratio Guidelines

Conventional loans are the most popular home loan program in the United States. The maximum debt-to-income ratio on conventional loans is 45% to 50% DTI. You can get approve/eligible for conventional loans with a debt-to-income ratio of up to 50% DTI. The problem that comes up with someone who gets an approve/eligible with a 50% DTI is if the borrower has credit scores under 680 FICO, there is no private mortgage insurance company that will insure the borrower.

Private mortgage insurance companies only want to insure borrowers with at least 680 credit scores and higher. There is no private mortgage insurance requirement on conventional loans with a 20% down payment and/or 80% or lower loan-to-value. There is no front-end debt-to-ratio requirement on conventional loans. Conventional loans only have a back-end debt-to-income ratio requirement.

High DTI Mortgage Lenders

Again, if you meet the minimum agency guidelines of FHA, VA, USDA, Fannie Mae, and Freddie Mac and get approve/eligible per the automated underwriting system (AUS), you are eligible and qualified. If a lender denies you after you get an automated underwriting system approval, it is because the lender has overlays and you can go to a lender with no overlays.

A lender with no lender overlays that just go off agency guidelines will have no problem getting you approved and closed. However, lenders can have higher lending guidelines and you may not qualify with a particular lender. Gustan Cho Associates has no lender overlays on government and conventional loans. We will cover and discuss lender overlays in the following paragraph.

USEFUL LINK: VA Loans With High DTI

Debt-to-Income Ratio Overlays By Mortgage Lenders

The debt-to-income ratio mortgage calculator powered by Gustan Cho Associates is a powerful tool for borrowers. Debt-to-income ratio is one of the most important factors for borrowers to understand prior to applying for a mortgage. The debt-to-income ratio mortgage calculator allows you to calculate how much your monthly debt payments are, including your proposed new mortgage payment, divided by your monthly gross income.

How Do Lenders Calculate Qualified Income For Mortgage?

The key to why many people feel they qualify but do not is that lenders can only use qualified income. Qualified income is not as easy as computing the salary-to-mortgage ratio. Qualified verified income is the salary minus the deduction.

The qualified income that lenders can use is income that has been verified via verification of employment with the borrower’s human resources department.

Other income that can be used are part-time income, bonus income, income from a second job, and other types of income if and only if the borrower had a two-year history of making such income and the income is likely to continue for the next three years.

How To Use The DTI Mortgage Calculator

Created and launched by Gustan Cho Associates, after months of research and development, the debt-to-income ratio mortgage calculator along with the Best Mortgage Calculator powered by Alex Carlucci, are hands down the two best calculators for everyone to use and navigate to get accurate numbers.

The Best Mortgage Calculator and the Debt-to-Income Ratio Mortgage Calculator are the two most powerful mortgage tools for homebuyers and loan officers during a mortgage transaction.

The Best Mortgage Calculator and debt-to-income ratio mortgage calculators are the nation’s most accurate user-friendly mortgage calculators used by loan officers, and mortgage borrowers.

Steps To Using The Best Mortgage Calculator For PITI, PMI, HOA

The debt-to-income ratio mortgage calculator is user-friendly and the nation’s most accurate online mortgage calculator. Here is the step-by-step instructions on how to use the debt-to-income ratio mortgage calculator powered by Gustan Cho Associates:

- The first step to computing your front-end and back-end debt-to-income ratio is to calculate your housing payment (PITI, MIP, PMI, HOA)

- Enter the loan program you are applying for (FHA, VA, Conventional Loans, JUMBO/NON-QM Mortgages)

- For USDA loans, click the Jumbo/Non-QM for USDA loans

- The PMI and MIP will be automatically populated per the home loan program you choose: You can manually populate a different number.

- Enter the purchase price on the box that says HOME PURCHASE/VALUE.

- Enter the down payment you are going to make on your home purchase

- Enter the interest rate

- On TERM, the 30-year fixed-rate mortgage term is populated but you can manually change it to 5, 10, 15, 20, or 25 years)

You will now get the principal and interest payment of your home mortgage. Let’s continue to the next steps to get your total monthly housing payment.

- Enter the Property Tax of the subject property

- Then enter the homeowners’ insurance

- Enter HOA dues if applicable

You will get the total monthly housing payment. You will also get a breakdown of the principal and interest portion number, the PMI, and the homeowners’ insurance/HOA dues/other. Now since you have the total monthly housing payment we can continue to the debt-to-income ratio mortgage calculator.

Steps To Using The Debt-To-Income Ratio Mortgage Calculator

Once you have calculated the total housing payment, you are ready to calculate the front-end and back-end debt-to-income ratio. The total housing monthly payment is already calculated. Total the sum of all of your minimum debts. On credit cards and revolving credit accounts, just add all the minimum monthly payments due.

Only total the monthly minimum payments on credit tradelines that report to the three credit bureaus such as mortgage payments, auto, student loans, installment loans, and revolving accounts.

Non-traditional credit tradelines such as utility bills, car insurance, medical insurance, cable, internet, medical, and other non-traditional tradelines that do not report on the credit bureaus are not counted for debt-to-income ratio calculations. You can now use the debt-to-income ratio mortgage calculator to calculate the front-end and back-end DTI for FHA, VA, USDA, Conventional, Non-QM, and Jumbo Mortgages.

Frequently Asked Questions About Debt-to-Income Ratio Mortgage Calculator:

Debt-To-Income Ratio Mortgage Calculator | PITI, PMI, HOA

Focusing on paying for a home and home financing requires prioritizing the understanding of your financial health while knowing a custom mortgage financing strategy for your budget.

A Debt-To-Income Ratio Mortgage Calculator can help prospective homeowners understand their borrowing potential by considering PITI (Principal, Interest, Taxes, and Insurance), Private Mortgage Insurance (PMI), and Home Owners Association (HOA) dues.

Gustan Cho Associates helps clients navigate these intricate calculations for optimal mortgage terms. First-time home buyers and folks refinancing an existing mortgage know that bettering their debt-to-income (DTI) ratio improves their approval chances. This guide explains everything you need to know about using a Debt-To-Income Ratio Mortgage Calculator, targeting the phrases DTI mortgage calculator, PITI calculator, PMI impact DTI, and HOA fees in mortgage ratios.

What Are Debt-to-Income (DTI) Ratios in Mortgages?

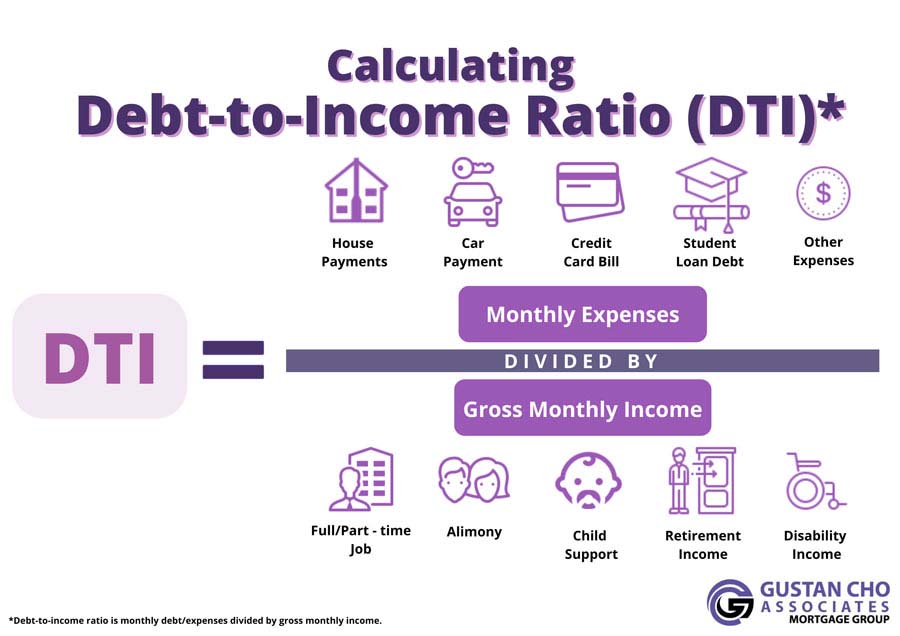

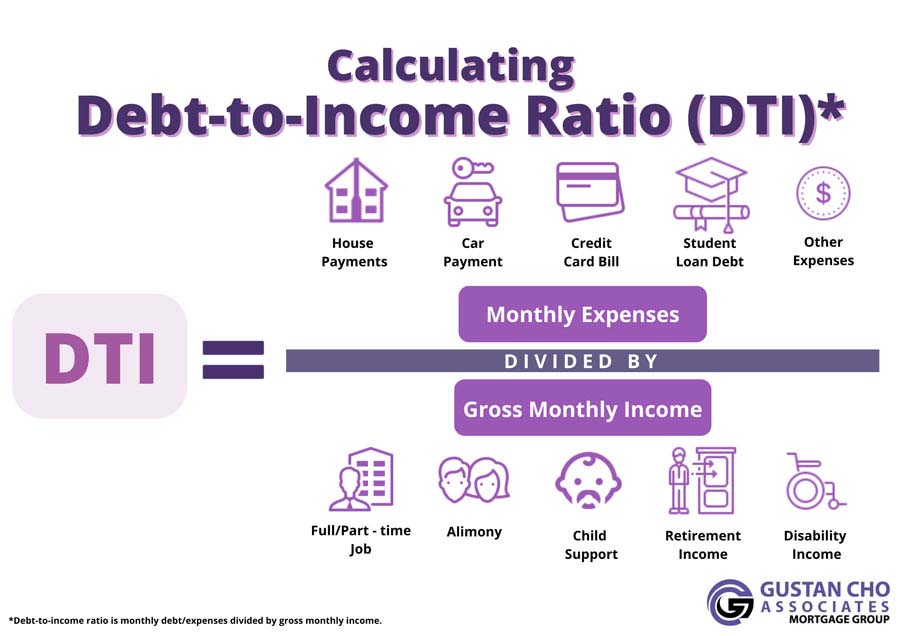

Debt-to-income ratios determine how much a borrower can pay in new monthly obligations on top of existing monthly debt obligations concerning the mortgage they are borrowing. DTI ratios are very important in mortgage applications.

A low DTI ratio indicates financial stability. It is very likely to help the borrower secure the loan. In contrast, a high DTI ratio may lead to a heavier financial burden and even loan application denial.

Based on DTI ratios, Gustan Cho Associates points out DTI ratios of 43% or less are ideal for most conventional loans. In contrast, most FHA loans can exceed 50% DTI ratios. Using a DTI ratio mortgage calculator, you can gauge your financial standing and identify potential issues before underwriting.

Why DTI is important to Homebuyers and Refinancers

For homebuyers, the DTI ratio acts as a marker against the rest of their financial obligations to ensure they do not spend too much of their income on housing and servicing the loan.

Conversely, refinancers use the DTI to assess possible savings with lower rates or cash-out options. Lenders analyze the front and back DTI ratios to get a complete financial view of the individual.

At Gustan Cho Associates, our mortgage professionals work with borrowers who do not realize how student loans, credit cards, or auto loans add to their back DTI. A Debt-To-Income Ratio Mortgage Calculator is necessary to get a clear projection.

How to Calculate Debt-to-Income Ratio Manually and with Tools

Let’s start calculating the DTI ratio by determining the monthly debts and income cash flows. Start by calculating all the monthly obligations, such as credit cards, car payments, student loans, and the anticipated monthly mortgage payments with PITI, PMI, and HOA. You then divide the total amount by the gross monthly income and multiply by 100 to get the percentage.

Although manual math is good for basic calculations, a Debt-To-Income Ratio Mortgage Calculator makes a mortgage DTI calculation easier when the DTI inputs are automated.

Gustan Cho Associates recommends that lenders use online tools, such as how a $300,000 mortgage at 6.5% interest affects your DTI ratio, to simulate various loan scenarios better and understand the DTI mortgage ratio.

Front-End DTI vs. Back-End DTI Explained

Lenders focus on the front DTI, which calculates the borrower’s income to housing payments PITI ratio. Front DTI is traditionally under 28%. The back DTI, on the other hand, includes all monthly debts, and the goal is to have a back DTI of no more than 36%.

These terms are critical when using a DTI mortgage calculator, as they impact the type of loans available to the borrower.

For example, VA loans usually will accept higher back-end ratios. This is a specialty that Gustan Cho Associates proudly boasts to be able to help our clients find the right programs.

How to Add PITI to Your DTI Calculations

PITI is the monthly core of your mortgage payment. Principal covers the new loan balance, and interest is the lender’s fee. Property taxes change depending on where you live, and homeowners’ insurance provides insurance coverage by managing risk. While using a Debt-To-Income Ratio Mortgage Calculator, being unable to estimate under housing costs leads to being unable to cover your housing costs. Gustan Cho Associates recommends including the amounts held in escrow by the lender and disbursed evenly each month, which are required annually to maintain a DTI that is not under or over realism.

The Fundamentals of PITI with Respect to the Ability to Pay the Mortgage

PITI is not merely obscure words—it’s a crucial element in having a home. On a $1,200 mortgage, monthly PITI might consist of $1,200 principal and interest payments over a 30-year loan, $300 in taxes, and $100 in insurance. Your DTI is highly sensitive to changes in your DTI, so having a PITI calculator is very useful. Gustan Cho Associates helps employ the PITI and DTI tools and construct realistic budgets.

Breaking Down Principal and Interest Components

In the early months, the principal plus interest repayment tends to be high and diminishes over time. The interest charged also reflects credit score and prevailing interest rates (current banking market).

For example, the Debt-To-Income Ratio Mortgage Calculator shows interest rate sensitivities as one of the biggest levers.

A 1% decrease from 7% to 6% interest rate could help you save hundreds on your monthly PITI payment and improve your DTI by multiple points.

Property Taxes and Homeowners Insurance in PITI

A portion of your monthly mortgage payment is allocated to local property taxes, which help pay for local services. Insurance policies for homeowners cover the dwelling and liability, and, on average, cost about $1,500 per year in the U.S. Both increase the PITI, and insurance on homes in coastal areas tends to be higher due to the increased risk of flooding. The DTI tools from Gustan Cho Associates let you customize these inputs to arrive at a payment that reflects the market.

Understanding Private Mortgage Insurance (PMI) And Its Impact on DTI

Private Mortgage Insurance (PMI) protects lenders on loans where the down payment is less than 20% on conventional loans. It is usually 0.5% to 1% annually of the loan amount and is charged monthly as part of the PITI.

Although PMI serves an important purpose, it also increases the DTI. It could contribute to disqualifying those on the borderline of approval.

A DTI Mortgage Calculator, including PMI, mitigates these. PMI can be removed once 20% equity is reached, and it can reduce payments as much as $100. Gustan Cho Associates continues to develop methods to avoid PMI, increasing the borrower’s purchasing power.

When and Why PMI is Required in Mortgages

PMI begins on loans above an 80% loan-to-value (LTV) ratio and disappears at 78% LTV, whether paid down or appreciated. It is also nonrefundable, but can be purchased at a better rate from other lenders. A similar upfront MIP applies to all down payments with FHA loans and adds to the DTI. The professionals at Gustan Cho Associates help borrowers with PMI to optimize the DTI ratio.

Compare FHA, VA, Conventional, USDA in seconds

Toggle programs to view differing DTI tolerances and payment impacts before you apply

Homeowners Association (HOA) Fees: Concealed DTI Multipliers

HOA fees cover shared facilities within the condominiums or in a planned community and range between $100 $500 per month. Although not part of PITI, HOA fees contribute to the back-end DTI as monthly housing expenses. Not including HOA fees can significantly alter the chances of securing a loan.

HOA fees should also be included in the Debt-To-Income Ratio Mortgage Calculator to determine the actual debt-to-income ratio— a $400 HOA fee adds 5 to 10 percent DTI for lower-end earners.

Gustan Cho Associates examines HOA documents during the pre-approval stage to determine the possible effects of charges on the borrower’s DTI.

Effect of HOA Fees on Eligibility for Mortgage

Excessive fees signal luxury properties and expenditures, meaning HOA fees strain your budget. This frequently leads to the need for compensating factors, such as additional cash reserves. Loan limits are set for total housing expenses, with HOA fees being the tipping point. Gustan Cho Associates provides DTI ratio calculators to help with HOA fee negotiations or other properties for gated communities and others with high demand.

How to Use the Debt-To-Income Ratio Mortgage Calculator: A Personalized Guide

Begin with the free Debt-To-Income Ratio Mortgage Calculator hosted at Gustan Cho Associates and input your gross monthly income. Then, you can enter any existing debts, like minimum credit card payments and loans. Also, enter your PITI estimates. For estimates, use the quotes, loan amount, term, and rate for principal/interest, and then the tax + insurance. If the down payment is less than 20%, toggle on PMI, and add HOA where appropriate. Click calculate to see front and back-end ratios and suggestions for modifying them. This tool allows users to make site-by-site decisions, fully customized by our mortgage experts.

Advantages of Using Gustan Cho Associates’ Mortgage DTI Calculator

Our DTI calculator differs from other industry-standard generic tools because of the customized loan offers associated with the DTI figure crafted through Gustan Cho Associates. It does not have ads, is mobile optimized, and is updated for current rates to make the process quicker and more accurate without continuous changes. Clients love how it streamlines the approval processes for loans, such as FHA and jumbo loans.

Safe Techniques to Lower Your DTI Ratio For More Favorable Loan Terms

Start with the most expensive debts with the highest interest rates to narrow the monthly obligations. Additional income from a raise or a side job can be proven to a lender. Lower relative payments on existing loans by refinancing or consolidating them into a single loan. Avoid unnecessary spending until after the application. GCT’s counselors have personalized DTI reduction plans demonstrating a 5% to 10% reduction with the right approach.

Most Common Questions on Mortgage DTI Ratio Calculators

What is a Good DTI Ratio For Mortgages?

- 35% is the target ratio to stand a chance for a loan, while most can exceed up to 43%

Does PMI Affect My DTI Calculation?

- Yes, because it is part of the housing costs, it increases the DTI ratios.

How Do HOA Fees Factor Into DTI?

- HOA payments are considered housing costs, and the back-end DTI is increased with the PITI and PMI.

Can Gustan Cho Associates Help Improve My DTI?

- Yes.

- You can contact any of our DTI reducer team members to learn about plans designed for complementary debt consultations and to use the DTI calculator.

What is a Debt-to-Income Ratio Mortgage Calculator?

- A debt-to-income (DTI) ratio mortgage calculator helps you determine your DTI ratio.

- The DTi ratio measures your monthly debt obligations against your monthly earnings.

- Lenders use this information to decide if you can afford a new home loan.

How Do I Use The Debt-to-Income Ratio Mortgage Calculator?

- To get started, simply input your monthly income and debt payments into the calculator.

- It will quickly display your DTI ratio, giving you valuable insights into the proportion of your income allocated to paying off debts.

- This tool empowers you with the knowledge needed to make informed financial decisions.

Why Do I Need to Calculate My Debt-to-Income Ratio?

- Calculating your DTI ratio is crucial because it determines whether you qualify for a mortgage.

- Lenders use this number to ensure you’re not taking on more debt than you can handle alongside a new house payment.

Can The Debt-to-Income Ratio Mortgage Calculator Handle Different Types of Loans?

- Yes, this calculator can adjust the calculation based on the type of mortgage you’re considering, whether it’s an FHA, VA, USDA, or conventional loan.

What Are The Acceptable DTI Ratios For a Mortgage?

- It varies by loan type, but a lower DTI ratio is generally better.

- The calculator can help you see if your DTI ratio fits within the guidelines for the specific mortgage you’re applying for.

What Should I Do if My DTI Ratio is Too High?

- If the debt-to-income ratio mortgage calculator shows your DTI is too high, consider paying down some debts before applying for a mortgage or looking for a cheaper property.

Does DTI Mortgage Calculator Show Both Front-End and Back-End DTI Ratios?

- Yes, the debt-to-income ratio mortgage calculator provides both front-end (housing-related debts only) and back-end (all debts) ratios, giving you a complete view of your financial situation.

What’s The Difference Between Using This Calculator and Talking to My Loan Officer?

- Using the debt-to-income ratio mortgage calculator gives you a quick, private way to estimate your DTI ratio anytime.

- Before discussing your options with a loan officer, it’s a good first step.

Can I Use The DTI Mortgage Calculator to Adjust My Budget When Looking at Different Homes?

- Absolutely!

- As you consider different homes with varying prices and taxes, you can update the information in the calculator to see how each option affects your DTI ratio.

Where Can I Find The Debt-to-Income Ratio Mortgage Calculator?

- The calculator is available online through Gustan Cho Associates’ website.

- Look for the debt-to-income ratio mortgage calculator section and use it for free.

This guide about “Debt-To-Income Ratio Mortgage Calculator | PITI, PMI, HOA” was updated on October 17th, 2025