This ARTICLE On Appraisals Will No Longer Be Required On Homes Under $400,000 Was PUBLISHED On September 29th, 2019

Appraisals Will No Longer Be Required On Homes Under $400,000 once the Federal Reserve Board signs off on this bill.

- The news of Appraisals Will No Longer Be Required On Homes Under $400,000 will come into effect once the Feds sign off on the proposal by federal regulators in increasing the value where home purchase sales have required an appraisal

- In November of 2018, the FDIC, Office of the Comptroller of the Currency (OCC), and the Federal Reserve Board proposed the mandatory requirement of having an appraisal in residential home sales from $250,000 to $400,000

- What this means is that residential home sales under the $400,000 threshold no longer will require a home appraisal

- It took the federal agencies almost 12 months in deciding Appraisals Will No Longer Be Required On Homes Under $400,000

- The Federal Deposit Insurance Corporation (FDIC) and Office of the Comptroller of the Currency (OCC) have signed off on Appraisals Will No Longer Be Required On Homes Under $400,000

- The rule is waiting for the Federal Reserve Board to sign off to become officially effective

- The Feds already gave its blessing verbally so the rule is pretty much a done deal

In this article, we will cover and discuss Appraisals Will No Longer Be Required On Homes Under $400,000.

Appraisals Will No Longer Be Required On Homes Under $400,000 Will Be Going Into Effect Soon

With the Feds giving the go-ahead stamp of approval, Appraisals Will No Longer Be Required On Homes Under $400,000 in the coming weeks.

- The last time the appraisal threshold rule was modified was back in 1994

- Real estate values have greatly appreciated since 1994 so the increase of the appraisal threshold will not jeopardize the risk factor and safety of lending institutions

- Appraisals Will No Longer Be Required On Homes Under $400,000 once the rule becomes finalized and recorded in the Federal Register

- According to sources at the Federal Deposit Insurance Corporation, this rule should be taken into effect once the rule is officially published which is in the coming days

Once this rule is recorded and published, Appraisals Will No Longer Be Required On Homes Under $400,000.

What Does Appraisals Will No Longer Be Required On Homes Under $400,000 Mean To Government And Conforming Loans

This rule on Appraisals Will No Longer Be Required On Homes Under $400,000 does not apply for government and conforming loans that are insured by a government agency and/or government-sponsored enterprises (GSE). Therefore, FHA, VA, USDA, Conventional Loans will not be under the new guidelines on Appraisals Will No Longer Be Required On Homes Under $400,000. FHA, USDA, VA, Fannie Mae, Freddie Mac guaranteed and/or backed loans will still require appraisals as required by agency guidelines.

Evaluations Versus Appraisals

Residential home evaluations have been required for the past 30 years.

- Home evaluations are less costly and more timely than a full home appraisal

- Evaluations have been mandatory since the early 1990s

- This change will have a positive impact on the housing market

- The OCC estimates the new changes on exempting appraisals for homes under $400,000 will impact over 40% of the residential home sales

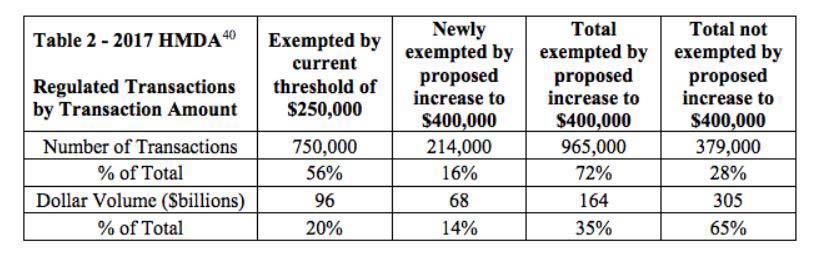

Read the chart below: