This ARTICLE On The Nine Illinois Communities Among Top Worst Housing Market Was PUBLISHED On September 16th, 2019

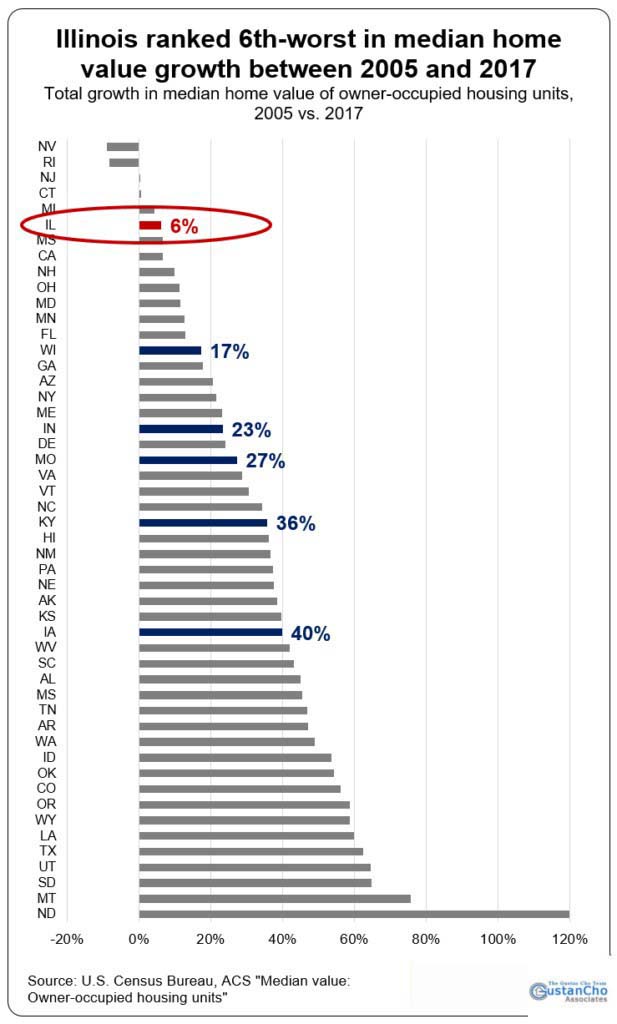

While the housing market is booming nationwide, Nine Illinois Communities Among Top Worst Housing Market in the U.S.

- Many cities nationwide are seeing double-digit housing appreciation year after year

- Illinois homeowners are not enjoying a housing recovery

- There are Nine Illinois Communities Among Top Worst Housing Market in the U.S.

- The whole state of Illinois is suffering from one of the highest housing recoveries in the United States

- With declining real estate values, property taxes in most counties are going up. Breaking News last week was DuPage County home prices dropped 24% while property taxes increase 7%

In this article, we will cover and discuss the Nine Illinois Communities Among Top Worst Housing Market.

Why Home Values In Illinois Not Appreciating?

There are so many beautiful cities and communities in Illinois.

- Chicago is the nation’s second-largest cities

- Downtown Chicago is one of the most beautiful places in the world

- Illinois is the home of top universities like Northwestern University, University of Chicago, and the University of Illinois

- Many taxpayers and homeowners would like to consider Illinois their final permanent home

- However, more and more taxpayers are leaving Illinois to lower-taxed states

See the 50-state chart in the appendix at the end of this article.

Data Released Proves Devastating News About Illinois Housing Market

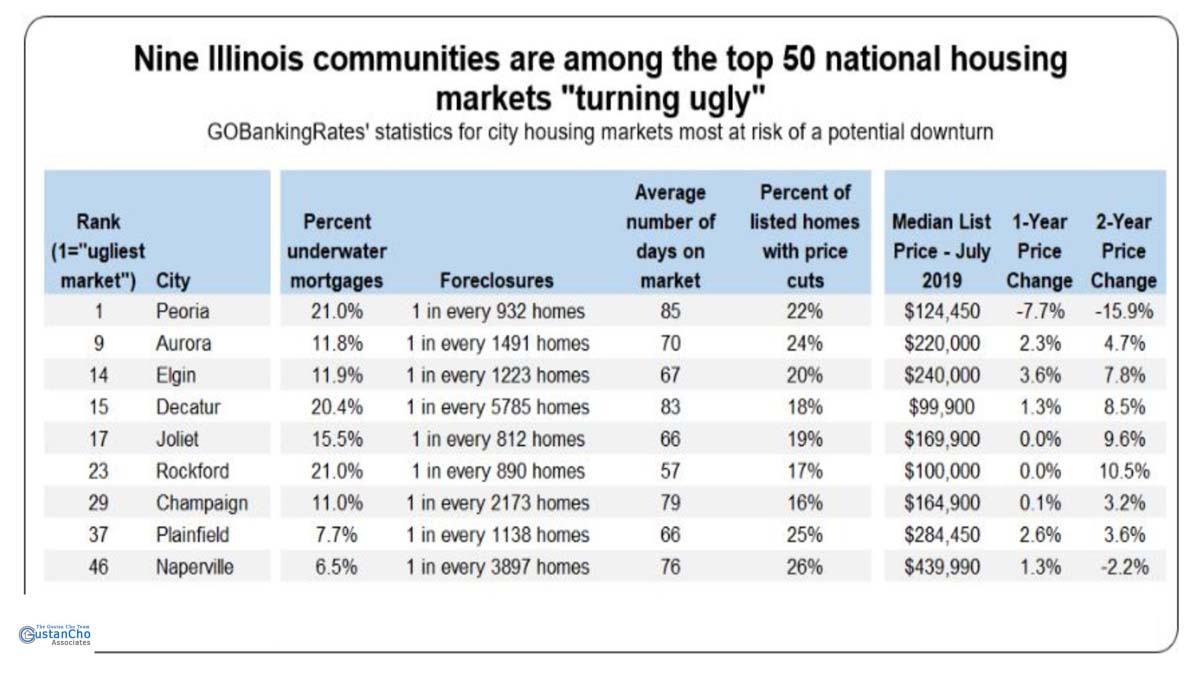

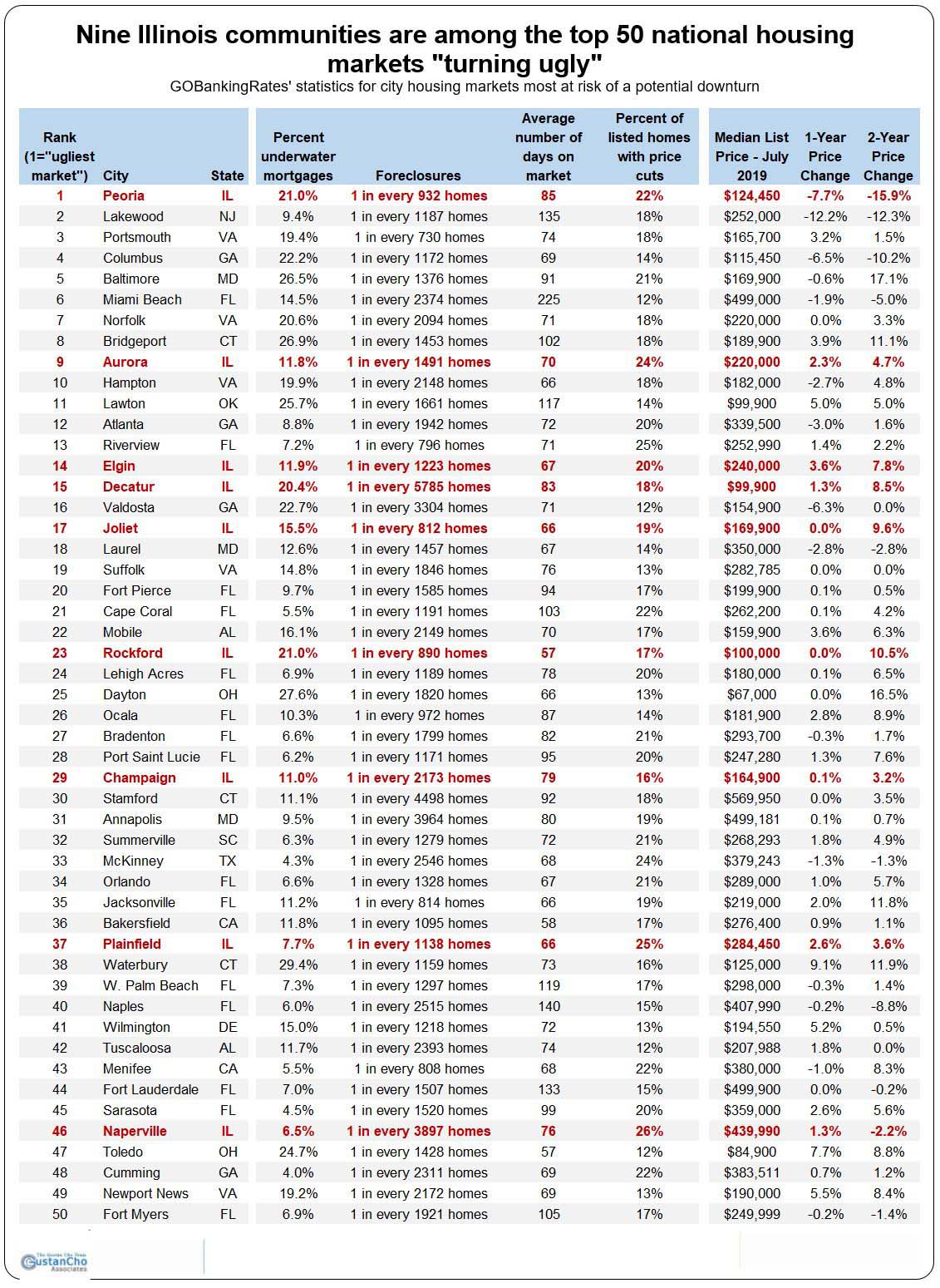

According to Consumer finance company GOBankingRates, Nine Illinois Communities Among Top Worst Housing Market. The report that was titled 50 Housing Markets That Are Turning Ugly, ranked 50 communities across the United States with the most likelihood of a housing market collapse

Nine Illinois Communities Among Top Worst Housing Market made this list.

- Peoria

- Aurora

- Elgin

- Decatur

- Joliet

- Rockford

- Champaign

- Plainfield

- Naperville

The above communities are in a major risk of a housing downturn.

Topping Illinois in the cities with the highest risk of a housing downturn, Florida had more cities than Illinois. Illinois ranked first in having the most cities with the greatest chance of a housing crash. Florida followed in second place with having the number of cities. The data was derived by analyzing the communities’ foreclosure numbers, number of homeowners with underwater mortgages, housing values in the past 24 months.

Cities In Crisis Situations

We will go over charts and graph explaining the Nine Illinois Communities Among Top Worst Housing Market.

Statistics And Data Of The Worst 9 Cities In Illinois On Verge Of Bankruptcy

Statistics And Data Of The Nine Illinois Communities Among Top Worst Housing Market:

Naperville, Illinois is one of the wealthiest suburbs in the Chicago Suburbs. Gustan Cho Associates Mortgage News was surprised that Naperville made the list. The city ranked 46th out of the 50 municipalities.

What Experts Say About Data Released On The Nine Illinois Communities Among Top Worst Housing Market

Besides stagnant home appreciation in Illinois, the state is increasing property taxes.

High Property Taxes Among The Problem In Illinois

It seems like Illinois is deteriorating at a fast speed while other states like Tennessee, Texas, Kentucky, Mississippi, Alabama, Georgia is thriving. Until you have competent politicians run the state like a business, Illinois woes will not get any better. In the meantime, countless of Illinois taxpayers and homeowners are fleeing the state to other lower-taxed states in droves.

Chart Of Nine Illinois Communities Among Top Worst As Risky Cities

How The Data Was Analyzed To Determine The Nine Illinois Communities Among Top Worst Housing Market

The data was gathered by reviewing and studying data of the 500 largest communities in the U.S. Factors that were determined are the following:

- Number of homeowners with negative equity positions

- The number of mortgage delinquencies and foreclosure rates

- How fast homes sold once listed or market time

- Number of listed homes on Zillow with a price drop during every month

- Comparing median home price changes year after year in terms of dollars

Taxpayers And Homeowners Fleeing Illinois To Other Lower-Taxed States

Illinois tops other states in taxpayers fleeing the state to other low-taxed states. Illinois taxpayers recently elected a new governor, JB Pritzker. Unfortunately, JB Pritzker turned out to be incompetent. The first term governor has proven that the only solution he has in turning Illinois around is raising taxes. Pritzker is not only raising taxes, but he also signed a bill giving lawmakers in Illinois a raise. Voter remorse is very common among voters in Illinois. Many wonder whether Illinois can last until the next election to oust JB Pritzker out of office before the state goes bankruptcy. Illinois recently doubled its gas tax. Pritzker does not seem to realize that is is not how much you make but how much you spend. Raising taxes is not the solution to solving a state that is on the verge of bankruptcy.