This Article Is About The Start Of The Biggest Housing Boom In History

The Start Of The Biggest Housing Boom in the U.S. has begun.

- Many investors invested in real estate prior to the 2008 Real Estate Crash

- However, after the 2008 Great Recession, most real estate investors shied away from real estate

- The reason was two-fold

- The first reason was many lost most of their equity and the second reason was financing was non-existent

- Subprime mortgages are back

- The housing market has been hot since 2011

- Housing prices have been increasing with no sign of a market correction

- Lenders have implemented and launched Non-QM and Alternative Financing mortgage programs for both owner-occupant and investment properties

In this article, we will cover and discuss The Start Of The Biggest Housing Boom in the U.S. since the 2008 Great Recession.

Investing In Real Estate After The 2008 Housing Meltdown

Everyone and their family and friends were investing in real estate prior to the 2008 Housing Meltdown.

- Many become real estate investors as a second job

- I used to flip 10 to 15 homes in the late 1990s and early 2000s

- I had a large full-time construction crew

- Cases of investors buying homes for $200,000 and flipping it for over double that number were not uncommon

- Fix and flips were the best and safest investments in town

- This was nationwide

- Purchase a fixer-upper, renovate it, and sell it for a large profit was a sure thing with guaranteed profit

- After selling the fix and flip property, repeat the same process and make more money

- Over 10% of the homes that were sold in 2005 were a fix and flip home sold by real estate investors

Then the whole real estate and the lending market went crashing on down.

The Collapse Of The Housing And Financial Markets

Many folks with full-time jobs became property flippers.

- Doctors, lawyers, accountants, police officers, firefighters, nurses, pharmacists, loan officers, car salesmen, and others became real estate investors prior to the 2008 Housing Meltdown

- Then the housing crash came like a major category five hurricane

- Average home values tanked over 35%, depending on the area

- Subprime lenders such as Washington Mutual went out of business overnight

- Over 500,000 loan officers in the subprime mortgage market became unemployed overnight

- High-income wage-earners had to settle for new jobs making a fraction of what they were making

- Countless of real estate agents and those in the housing industry went bankrupt and had to settle with other menial jobs to make ends meet

- The foreclosure rate in the U.S. hit historical highs. Fix and flippers were out of their jobs

Most of them went bankrupt and had to foreclose on their properties including their primary homes.

Impact Of 2008 Market Crash

There are no words to describe how devastating the impact of the 2008 Housing and Credit Meltdown was for American families.

- Many experts say the 2008 Great Recession was more like the 2008 Great Depression

- Never in history has an economic event hurt so many families and businesses

- There is not a person that was not affected by the Great Recession of 2008

- Countless lost their job, had to file bankruptcy, lost their homes due to foreclosure

- Most lost the hard-earned equity in their homes

Entire industries like the subprime mortgage markets were eliminated. Lending came to an abrupt halt. Real estate, once thought of as the safest investment, was getting crushed.

What Experts Say About The Start Of The Biggest Housing Boom In History

Housing Industry Today

The housing industry has fully recovered.

- Not only has the housing industry fully recovered, but the entire industry is booming

- Homebuilders cannot keep up with the demand for housing

- The housing market accounts for 20% of the overall economy

- Due to the strong housing market, the economy has not had a recession in the past 11 years

- Low unemployment number, low-interest rates, low mortgage rates, demand for jobs, affordable housing, record housing starts and home sales, low inflation are all attributes for the strong housing market

- Homebuilders’ stocks are skyrocketing

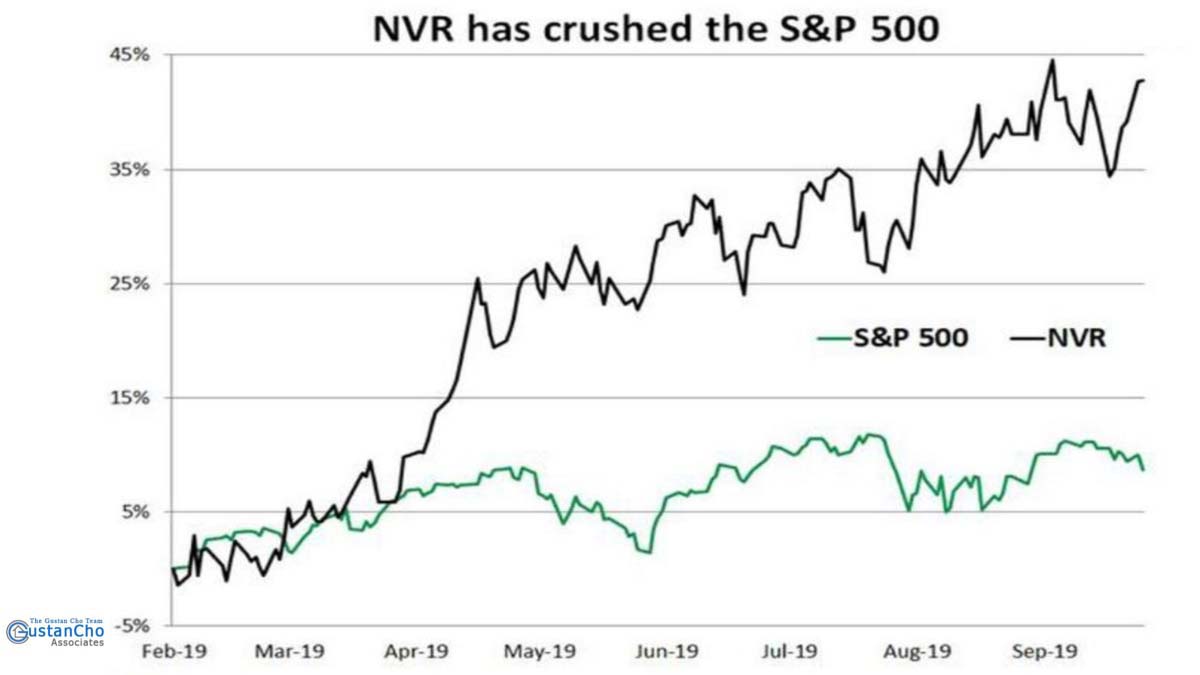

- For example, if you purchased homebuilder NVR stock this past February, you are up 45% versus 10% gain in the S&P 500

Look at the graph below:

Investors who invested in real estate and construction-related stocks, they have hefty capital gains. Securities experts expect housing-related stocks have much more room to grow. There is a major demand for homes. Mortgage lenders have eased financing and introduced and launch non-QM loans.

Strong Housing Demand Becoming Stronger With Inventory Shortage

Starting in 1960, an average of 1.5 million residential homes are built annually.

- However, home construction dropped significantly in 2009 at the start of the Great Recession

- Starting in 2009, an average of 900.000 homes were built annually which are fewer homes built than in the 1950s

- From the current inventory of homes, it would be a maximum of six months to sell every home that is listed in the marketplace

Look at the graph below:

The Start Of The Biggest Housing Boom Is Due To The Increase And Demand For Housing

In many parts of the country, homebuyers are flooding the market.

- Inventory is decreasing as months pass by

- Home prices are rising due to supply versus demand rule

- Mortgage rates are at a three-year low

- Millennials are starting to buy homes and leaving their parents home

- The old rumors of millennials living with parents, not getting married, delaying having children, and not using their full earnings potential are no longer true

Millennials are the biggest generation in the history of the United States. Millennials surpass the Baby Boomer Generation. Millennials make up over 30% of first-time homebuyers.

Hot Housing Industry Has Ripple Effect On Economy

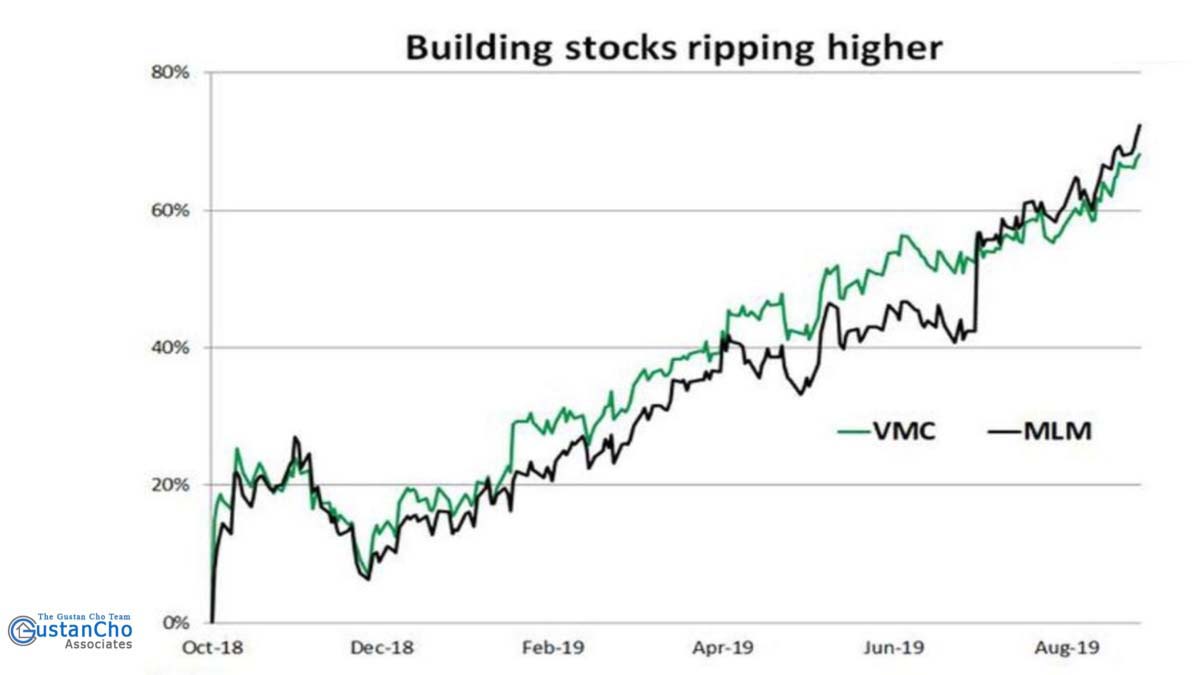

Stocks of building materials are skyrocketing. Look at the chart below of Vulcan Materials (VMC) and Martin Marietta Materials (MLM). These companies are building material providers of concrete and gravel that contractors use for building foundations, public roads, sidewalks, and other construction projects:

These companies do not have sizzle or sexiness like an internet hot stock. However, these building materials companies are generating record revenues and profits. Therefore, stocks are skyrocketing setting new highs. Buying stocks in the housing market sector is a no brainer.

The Start Of The Biggest Housing Boom Is Due To Hot Mortgage Lending Markets

The majority of a primary residence and/or investment homebuyers rely on financing when purchasing a home. Mortgage lending has changed dramatically in the past few years. Non-QM Loans are back. Borrowers can qualify for a primary and/or investment property mortgage with no waiting period requirement after bankruptcy and/or foreclosure. Self-employed borrowers with large deductions can now qualify for bank statement mortgages with no income tax required. Gustan Cho Associates offers asset depletion mortgage loan programs for borrowers with no income but with assets. Fix and flip mortgage loans are becoming more popular with real estate investors. Gustan Cho Associates Mortgage Group also offers blanket lines of credit on investment properties. The housing market is hot and it is here to stay for a while.