Subprime mortgages never really disappeared—they evolved. Today, they live under labels like “non-prime” or “non-QM” (non–qualified mortgage), but the core idea is the same: give higher-risk borrowers a shot at homeownership, usually at a higher cost and with tighter safeguards than in the pre-2008 era.

This updated guide explains what subprime mortgages are today, how they differ from pre-crisis loans, what risks you need to understand, and how Gustan Cho Associates (GCA) helps borrowers find safer alternative financing—without the old predatory tricks that crashed the market.

Key Takeaways

- Subprime mortgages are essentially home loans for individuals with less-than-ideal credit scores, significant debt, or limited financial documentation. They carry higher rates and costs than “prime” loans.

- After the 2008 subprime mortgage crisis, new rules (Ability-to-Repay and Qualified Mortgage standards) require lenders to document income, verify ability to repay, and avoid the worst loan features.

- Today, many “subprime-style” loans fall under the non-QM umbrella, including bank statement mortgages and asset-depletion loans for self-employed and high-asset borrowers.

- Subprime or non-QM financing can sometimes be used as a bridge strategy: buy now, rebuild credit, then refinance into a lower-rate FHA, VA, or conventional loan later.

- Gustan Cho Associates specializes in no-overlay FHA, VA, conventional, and non-QM programs, helping borrowers who were previously turned down find realistic and sustainable mortgage options.

What Are Subprime Mortgages?

In simple terms, subprime mortgages are home loans designed for borrowers who do not meet standard “prime” lending guidelines. These borrowers may have:

- Low or damaged credit scores (often under 620–640)

- High debt-to-income (DTI) ratios

- Limited or thin credit history

- Past derogatory events, like bankruptcies, foreclosures, short sales, or late payments

- Non-traditional income documentation, such as self-employment or gig income that doesn’t show cleanly on tax returns

Because these profiles present a higher risk of default, lenders typically offset that risk with:

- Higher interest rates

- Larger down payment requirements

- Stricter reserves and compensating factors

Today, the industry often avoids the word “subprime” because of its association with the 2008 crisis, but the concept lives on through non-QM and non-prime loans that serve borrowers outside the conventional “box.”

Is a Subprime Mortgage Your Lifesaver or a Debt Trap?

Let an expert review your credit, income, and goals before you sign

How Subprime Mortgages Work in Today’s Market

Higher Rates and Costs for Higher Risk

A subprime or non-prime borrower can expect:

- Higher interest rates than FHA, VA, or prime conventional loans

- Higher closing costs or fees

- Possible rate adjustments based on credit score, LTV (loan-to-value), and property type

Even a small rate bump can add up to tens of thousands of dollars in extra interest over the life of a 30-year loan.

That’s why at Gustan Cho Associates, we rarely treat subprime-style loans as a “forever” product. Instead, we look at them as:

A tool to get someone into a home or unlock equity now, then plan a refinance into a lower-rate program once credit, income, and waiting periods improve.

Who Uses Subprime or Non-QM Loans?

Typical borrower profiles include:

- Self-employed buyers with heavy business write-offs that tank their taxable income

- People who have had recent credit issues, like bankruptcy, foreclosure, or deed-in-lieu, and haven’t hit the waiting time set by lenders yet.

- Investors or high-asset borrowers who prefer to qualify based on assets or rental cash flow rather than W-2 income

- Borrowers with limited or thin credit history, including those new to credit or new to the U.S.

The Subprime Mortgage Crisis: What Went Wrong?

You can’t talk about subprime mortgages without addressing what happened in 2007–2010.

In the early 2000s, lenders aggressively expanded subprime lending to higher-risk borrowers, often using:

- No-doc and low-doc loans (little or no income verification)

- 2/28 and 3/27 ARMs with ultra-low “teaser” rates that reset sharply higher

- Interest-only or negative-amortization loans that didn’t reduce principal

- Minimal or zero down payments combined with weak underwriting

These loans were then bundled into mortgage-backed securities and sold worldwide. When home prices stopped rising and adjustable rates reset, many borrowers:

- Couldn’t refinance

- Couldn’t afford the new, higher payment

- Fell behind, leading to a wave of defaults and foreclosures

The outcome was the subprime mortgage mess, which was a big piece of what led to the global financial crisis back in 2008.

How Regulations Changed Subprime Lending After 2008

The old wild-west version of subprime lending is gone. In its place, we now have tighter rules designed to protect borrowers and stabilize the market.

Ability-to-Repay (ATR) Rule

The Dodd-Frank Act and Regulation Z brought in the Ability-to-Repay (ATR) rule, which means lenders need to honestly figure out if a borrower can actually pay back a mortgage based on documented info.

Lenders must verify:

- Income and employment

- Assets and reserves

- Current debts and obligations

- Credit history

- Debt-to-income ratio (DTI)

Qualified Mortgage (QM) Standards

The law also created Qualified Mortgages (QMs)—a category of loans that meet specific consumer-protection requirements and provide lenders with legal protections. QM standards generally:

- Prohibit risky features like neg-am, balloon payments on most loans, and long interest-only periods

- Limit points and fees

- Require underwriting based on fully amortizing payments

Loans that meet QM criteria are presumed to comply with ATR, and regulators view them as lower risk.

Non-QM Loans: The Modern “Subprime-Style” Option

Loans that don’t meet QM standards are called non-QM. These include:

- Bank statement loans for self-employed borrowers

- Asset-depletion mortgages, where assets are converted to income for qualification

- Certain types of DSCR investor loans and other alternative-documentation products

Critically, non-QM loans must still comply with the ATR rule. Lenders are not allowed to guess or hope that you can make the payment—they must verify and document it.

That’s one of the biggest differences between today’s non-QM/subprime-style lending and pre-crisis subprime.

Bad Credit? Subprime Isn’t Your Only Option

See if FHA, VA, or non-QM makes more sense than a high-cost loan

Subprime vs Non-QM vs FHA/VA/Conventional: What’s the Difference?

Subprime (Non-Prime)

Subprime loans are designed for individuals who are considered high-risk borrowers, typically those with low credit scores, recent credit issues, or high debt-to-income ratios. These loans usually have higher interest rates and require larger down payments. However, they are usually more flexible when it comes to past credit issues and the paperwork needed to apply.

Non-QM

Non-QM loans are often similar to subprime loans, but they primarily differ in the types of paperwork required, rather than solely relying on bad credit. They are popular among self-employed individuals who earn money through commissions or possess a significant amount of assets. Some examples of these loans include bank statement loans, asset-depletion loans, and certain types of jumbo and investment loans.

FHA, VA, and Conventional

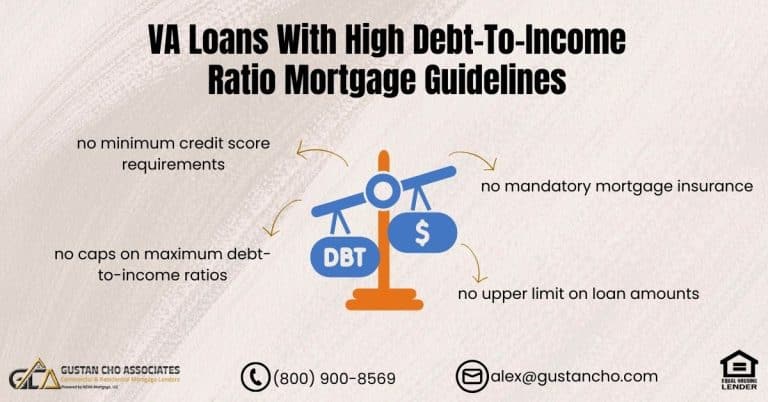

- FHA: Government-insured; flexible credit, low down payment, but requires mortgage insurance

- VA: For eligible veterans and service members, often 0% down with no monthly mortgage insurance

- Conventional: Fannie Mae/Freddie Mac; best rates for strong credit profiles

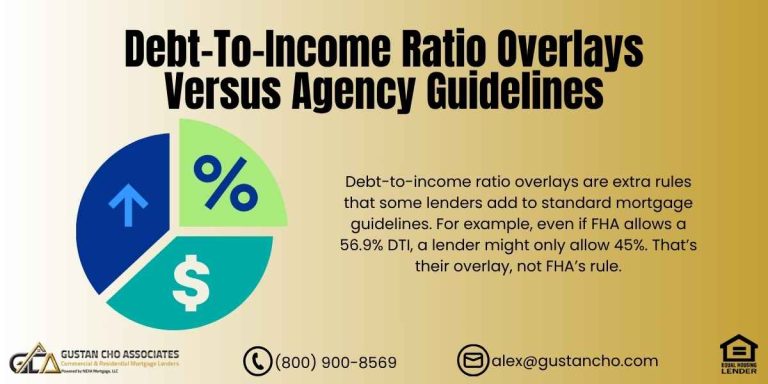

At Gustan Cho Associates, we begin by determining if we can secure a QM loan (FHA, VA, or conventional) with no lender overlays. If that’s not possible, we then explore non-QM or subprime-style options as a carefully planned alternative—not a default choice.

When Subprime or Non-QM Mortgages Can Make Sense

There are situations where taking a higher-rate subprime or non-QM loan can be a rational, strategic move:

1. You’re Coming Out of a Major Credit Event

If you’ve had:

- Chapter 7 or 13 bankruptcy

- Foreclosure

- Deed-in-lieu or short sale

Agency guidelines often require waiting periods before you can qualify for FHA, VA, or conventional loans. A non-QM loan may allow you to buy sooner, provided:

- The payment is affordable

- You understand the higher cost

- You have a realistic plan to refinance later

2. You’re Self-Employed With Heavy Write-Offs

Many self-employed borrowers reduce taxable income with legitimate business write-offs. But those write-offs can make it look like you don’t earn enough to qualify under traditional guidelines.

Here, a bank statement loan—qualifying you based on 12–24 months of business or personal bank deposits instead of tax returns—can be a game changer.

3. You’re Asset-Rich but Income-Light

Retirees or high-net-worth individuals sometimes have:

- Substantial assets (investments, retirement funds, cash)

- Modest or irregular monthly income

An asset-depletion mortgage converts those assets into an income stream for underwriting purposes, allowing you to qualify without traditional W-2 earnings.

Make Subprime a Stepping Stone, Not a Life Sentence

Learn how to refinance out of subprime once your credit improves

The Risks of Subprime Mortgages You Must Respect

Even in today’s more regulated environment, subprime mortgages are not risk-free. Key risks include:

Higher Long-Term Interest Cost

When you borrow money with subprime mortgages or non-QM loans, the interest rate might be 1 to 3% higher than what you’d get with an FHA or conventional loan, based on your situation and the market. Over the course of 30 years, this higher rate can result in significantly more interest being paid and higher monthly payments, making it more challenging to manage your budget.

Limited Refinance Options if the Market Turns

If the market changes, your options for refinancing may be limited. Many borrowers believe they can refinance later when their credit improves. This plan works if interest rates remain reasonable, home values remain stable or increase, and your income is steady. However, if interest rates go up or home values drop, you might not be able to refinance when you want to. This situation could leave you stuck with a more expensive loan for longer than you hoped.

Payment Shock on ARMs

Some adjustable-rate mortgages (ARMs) can result in significantly higher payments once the initial fixed-rate period ends. Even though lots of current non-QM lenders have stepped away from the risky setups used before the crisis. It’s essential to understand when your interest rate might change, how much it could increase, and what your highest possible payment would be.

At Gustan Cho Associates, we walk borrowers through this math in detail so there are no surprises.

Using Alternative Financing as a Bridge Strategy

For many GCA clients, subprime or non-QM loans are temporary tools, not permanent destinations.

Step 1: Buy or Refinance With a Non-QM Loan

- Use a bank statement loan if your tax returns don’t reflect your true cash flow

- Use an asset-depletion loan if you have strong assets but limited traditional income

- Use a recent-event non-QM product if you’re still inside an agency waiting period

Step 2: Rebuild and Season Your Credit

During the first 12–24 months:

- Make every mortgage payment on time

- Keep credit card balances low

- Avoid new collections or late payments

- Consider adding positive tradelines (responsible use of revolving credit)

Lenders and models reward recent, positive behavior even if your past has blemishes.

Step 3: Refinance Into a Lower-Cost QM Loan

Once you:

- Meet the FHA/VA/conventional waiting periods, and

- Have a stronger credit profile and payment history

…we can work on refinancing into a prime or near-prime loan with better terms, lower rates, and lower long-term costs.

How Gustan Cho Associates Approaches Subprime Mortgages and Non-QM Lending

No Overlays on Government and Conventional Loans

First, we always check whether you can qualify for:

- FHA

- VA

- USDA (where applicable)

- Conventional (Fannie Mae/Freddie Mac)

Without overlays means we go strictly off agency guidelines—no extra credit score, DTI, or reserve requirements on top of what HUD, VA, USDA, or the GSEs already require.

If we can secure a QM loan for you, we will. That’s usually your safest, lowest-cost long-term option.

Expertise in Non-QM and Alternative Documentation

If you don’t fit the QM box, we then explore:

- Bank statement mortgages for self-employed borrowers

- Asset-depletion mortgages for retirees and high-asset borrowers

- Non-QM jumbo or investor-focused products

Our job is to match the right product to your real-world situation—not to push you into the most expensive option.

Transparent, Straight Talk About Risk and Cost

Our friendly, borrower-first approach means we:

- Explain rate, payment, and total cost clearly

- Walk through worst-case scenarios (rate resets, income changes, home value drops)

- Help you map out a realistic exit strategy if you’re using a non-QM loan as a bridge

You’ll never hear “don’t worry about it, you can always refinance later” as a throwaway line. We treat that as a plan, not a slogan—and plans get documented.

Should You Consider Subprime Mortgages?

You might consider subprime mortgages or non-QM loans if:

- You can comfortably afford the payment

- You clearly understand the higher cost and risks

- You have a documented game plan to improve your profile and refinance

- Waiting several years to buy would harm your family’s or financial situation more than paying a higher rate now

You probably should not take subprime mortgages or non-QM loans if:

- You’re stretching to the upper limit of what you can pay

- You’re relying on speculative future events (big raise, inheritance, windfall) to make it work

- You’re not sure you’ll stay in the property long enough to justify the cost

This is where talking to an experienced team like Gustan Cho Associates really matters. We’ll run the numbers and tell you honestly if the deal makes sense—or if the smartest move is to wait and work on your credit first.

Use Subprime the Smart Way—If It’s Right for You

Let us check if the loan is a lifesaver or a debt trap for your situation

Ready to Explore Your Options?

If you’ve been turned down by a bank or told your only option is a “subprime loan,” you may have more choices than you think.

At Gustan Cho Associates:

- We offer no-overlay FHA, VA, USDA, and conventional loans

- We specialize in non-QM, bank statement, and asset-depletion mortgages for complex profiles

- We help you build a step-by-step plan to get from where you are now to a more affordable, long-term solution

Borrowers who need a five-star national mortgage company licensed in 50 states with no overlays and who are experts on subprime mortgages, please contact us at 800-900-8569, text us for a faster response, or email us at alex@gustancho.com.

We’ll review your entire profile—credit, income, assets, goals—and help you decide whether a subprime mortgage is a smart bridge for you or whether there’s a better, safer path to homeownership.

Frequently Asked Questions About Subprime Mortgages:

What are Subprime Mortgages?

Subprime mortgages are home loans for people who don’t fit normal lending rules. Perhaps your credit score is low, your debt is high, or your income is difficult to verify. Because you are a higher risk to the lender, subprime mortgages usually come with higher interest rates and stricter terms.

Are Subprime Mortgages the Same as Bad Credit Loans?

Not always, but they often overlap. Subprime mortgages are commonly available to individuals with poor or damaged credit, but they can also be accessed by self-employed borrowers or those with irregular income. The main idea is that you don’t meet regular loan guidelines, so the lender prices the loan higher to cover the risk.

Are Subprime Mortgages Still Around After the 2008 Crash?

Yes, but they are very different from what they used to be. Before 2008, many subprime mortgages had no-doc loans, teaser rates, and risky terms. Today, lenders must verify that you can actually afford the payment, and most subprime mortgages fall under safer non-QM (non-qualified mortgage) rules, which require full documentation.

Who are Subprime Mortgages for?

Subprime mortgages are usually for:

- People with low credit scores

- Borrowers with recent bankruptcy, foreclosure, or late payments

- Self-employed buyers whose tax returns don’t show their real income

- Retirees or investors who have strong assets but not much W-2 income

If you can’t get approved for FHA, VA, or conventional, subprime mortgages may be an option.

What are the Main Downsides of Subprime Mortgages?

The biggest downside of subprime mortgages is cost. You will usually pay:

- A higher interest rate

- More in total interest over the life of the loan

- Sometimes a bigger down payment

If you don’t have a plan to improve your credit and refinance later, subprime mortgages can become very expensive over time.

Can I Use Subprime Mortgages as a Short-Term Bridge?

Yes, many borrowers use subprime mortgages as a bridge loan. They buy the home now with a higher rate, then work on their credit, income, and waiting periods. Once they improve their profile, they refinance into a lower-rate FHA, VA, or conventional loan. This only works if the payment is affordable and you stay on track with your credit.

Are Subprime Mortgages Safe?

Subprime mortgages can be safe if used wisely. Today’s rules require lenders to check your ability to repay and avoid many of the worst loan features from the past. But they are still at a higher risk because the rates and payments are higher. They are safest when:

- The payment fits your budget

- You understand the terms

- You have a real plan to refinance or pay off the loan

What’s the Difference Between Subprime Mortgages and Non-QM Loans?

People often use the words together, but they’re not exactly the same. Subprime mortgages focus on higher-risk borrowers, typically those with lower credit scores. Non-QM loans are any loans that don’t meet “qualified mortgage” rules, and they often help people with non-traditional income, like bank statement loans or asset-depletion loans. Many non-QM loans are used as alternatives to traditional subprime mortgages.

Can I Get Subprime Mortgages if I’m Self-Employed?

Yes. If you are self-employed and your tax returns show a low income due to write-offs, subprime mortgages, and non-QM options, these can help. For example, bank statement loans use your bank deposits as collateral, rather than tax returns. This is a common way self-employed borrowers get approved when regular loans say no.

How Can Gustan Cho Associates Help with Subprime Mortgages?

At Gustan Cho Associates, we first verify whether you qualify for FHA, VA, USDA, or conventional loans with no overlays. If those options don’t work, we explore subprime mortgages and non-QM programs, such as bank statement loans and asset-depletion loans. We explain the rates, the risks, and help you build a plan to refinance into a better loan later if a subprime option is the right short-term solution for you.

This article about “Subprime Mortgages: Lifesaver Or Debt Trap For You?” was updated on November 14th, 2025.

Wondering If Subprime Is Your Only Way In?

Let us explore every option so you don’t overpay for your home loan