Understanding FHA 203i Loans: Exploring Your Options with Gustan Cho Associates

Are you considering purchasing a home in a rural area? Understanding your financing options is crucial. In this article, we will delve into FHA 203i loans, their current relevance, and alternative mortgage solutions that better suit your needs.

What Are FHA 203i Loans?

The FHA 203i loans are unique mortgage programs the Federal Housing Administration (FHA) created. They are meant for people buying homes in rural or outlying areas. These loans aim to help people find home financing in places where selling a home can be challenging because there aren’t many buyers. This program encourages lenders to provide loans in areas where the real estate market is not as busy.

FHA 203i loans allow more people to become homeowners in these less populated regions. This makes it easier for families to buy homes even if they are not near big cities. The FHA hopes that by offering these loans, it can help improve these areas and make them more attractive for potential buyers and sellers.

Get started with as little as 3.5% down, preserving your cash for what matters most

Apply Now And Get recommendations From Loan Experts

Key Features of FHA 203i Loans:

- Low Down Payment: With FHA 203i loans, borrowers can get money for a home with a small down payment. This is like other FHA loan programs, making it easier for people to buy homes.

- Mortgage Insurance: Borrowers using FHA 203i loans must pay for mortgage insurance. This insurance helps protect lenders if the borrower cannot repay the loan.

- Property Eligibility: FHA 203i loans are meant for homes with one to four units. These homes should be for people who will live in them, especially in rural areas, and can include some farm housing, too.

Current Relevance of FHA 203i Loans:

While the FHA 203i loan program was established to support rural homebuyers, it’s important to note that it has seen minimal usage in recent decades. For instance, only three mortgages were insured under Section 203(i) in Fiscal Year 1996. This decline suggests that the program is rarely utilized today, and other loan options have become more prominent for rural home financing.

HUD Guidelines On 203i Loans

HUD Section 203(i) provides government mortgage insurance for lenders who originate home loans for buyers purchasing owner-occupant properties in rural areas of the United States. FHA is not a mortgage lender. FHA has nothing to do with the origination and/or funding or servicing of FHA Loans.

Who Originates And Fund FHA Home Mortgages

ALL FHA LOANS are originated and funded by the following institutions:

- Mortgage companies

- FDIC Bank who are HUD Approved

- Savings And Loan Associations that are HUD Approved

Mortgage Brokers only originate FHA Loans:

- Mortgage Brokersare not lenders

- They are the middleman who refers borrowers to lenders

- Mortgage Brokers need to have direct and/or indirect relationships with HUD-approved lenders

- Mortgage Brokers gets a commission for referring files to actual lenders

Any other mortgage banking companies who are HUD-approved.

Sellers Concessions And Lender Credit For Closing Costs

How lender credit works are borrowers accept a higher interest rate in return for a concession by the lender to cover closing costs. HUD allows up to 6% in sellers concessions by home sellers to offer home buyers to cover their closing costs. Closing costs include title charges, tax stamps, transfer stamps, attorney fees, loan origination fees, appraisal fees, and other fees associated with closing the mortgage loan.

Prepaid tax and insurance escrow can be also be included as part of the closing costs. The borrower can get concessions towards it. The borrower will also be responsible for paying an annual premium. Eligible properties are one to four-unit owner occupant properties. This is including farm housing located on 2 acres or more of land adjacent to an all-weather road.

Alternative Mortgage Options for Rural Homebuyers:

If you’re exploring financing options for purchasing a home in a rural area other than FHA 203i loans, several other loan programs might better suit your needs:

1. USDA Loans:

-

- No Down Payment: The U.S. Department of Agriculture (USDA) provides loans that do not require a down payment, which makes it easier for people to attain homeownership.

- Income Eligibility: These loans are designed for low- to moderate-income borrowers with specific income limits based on the area.

- Property Location: The property must be in a rural region that fulfills the eligibility requirements set by the USDA.

- Mortgage Insurance:USDA loans require a single upfront guarantee fee and an annual fee, both of which are usually lower than the costs linked to FHA mortgage insurance.

2. FHA 203(b) Loans:

-

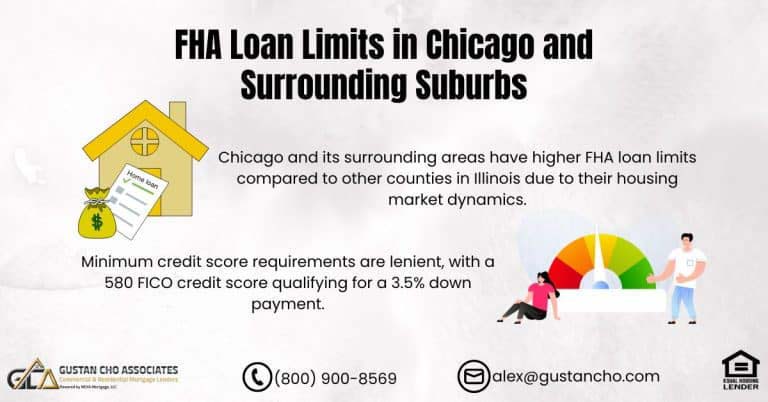

- Low Down Payment: A down payment of at least 3.5% is needed for borrowers who have credit scores of 580 or higher.

- Flexible Credit Requirements: Less stringent credit score requirements compared to traditional loans.

- Property Eligibility: Applicable for one- to four-unit owner-occupied properties, not limited to rural areas.

3. FHA 203(k) Rehabilitation Loans:

-

- Purchase and Renovate: Enables borrowers to fund both the acquisition and renovation of a home with a single mortgage.

- Standard and Limited Options: The standard 203(k) is for major renovations, while the limited 203(k) covers non-structural repairs up to $35,000.

Our FHA experts will guide you through a simplified process tailored to rural property financing

Apply Now And Get recommendations From Loan Experts

Why Consider Alternative Loan Programs?

Given the limited use and availability of FHA 203i loans, exploring other loan programs can provide more accessible and flexible financing options. Programs like USDA and FHA loans have become more prominent, offering benefits such as lower down payments, flexible credit requirements, and broader property eligibility.

How Gustan Cho Associates Can Assist You:

At Gustan Cho Associates, we understand that navigating the myriad of mortgage options can be overwhelming. Our team of experienced professionals is committed to guiding you through the process, ensuring you find the loan program that best fits your unique situation. Here’s how we can assist:

- Personalized Consultation: We will evaluate your financial circumstances and homeownership objectives to suggest the best loan options.

- Expertise in Various Loan Programs: Whether it’s USDA, FHA 203i loans, or other mortgage products, our extensive knowledge ensures you receive accurate and up-to-date information.

- Streamlined Application Process: We’ll walk you through each step of the application, making the process as smooth and stress-free as possible.

- Ongoing Support: From pre-approval to closing, and even after you’ve settled into your new home, we’re here to answer your questions and provide support.

Conclusion:

While FHA 203i loans were initially created to assist rural homebuyers, their limited use in recent years indicates that alternative loan programs may offer more viable solutions. Exploring options like USDA and FHA loans can provide the flexibility and benefits that align with your homeownership aspirations. Working with a knowledgeable and dedicated team like Gustan Cho Associates gives you the support you need to confidently navigate the mortgage process.

If you have any questions about FHA 203i loans or borrowers who need to qualify for loans with a lender with no overlays, please call or text us at 800-900-8569 or email alex@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

Frequently Asked Questions About FHA 203i Loans:

Q: What are FHA 203i Loans?

A: FHA 203i loans are special government-backed home loans for people buying houses in rural or out-of-the-way areas. They help buyers get approved for a mortgage where homes are harder to sell.

Q: Can I Still Get an FHA 203i Loan Today?

A: FHA 203i loans are rarely used today. The program still exists, but it’s not common. Most people in rural areas use USDA loans or other FHA options that are easier to get.

Q: What Types of Homes Qualify for FHA 203i Loans?

A: FHA 203i loans are for homes with 1 to 4 units in which the buyer plans to live. This includes houses in rural areas or farm homes on at least 2 acres near an all-weather road.

Q: How Much do I Need for a Down Payment on FHA 203i Loans?

A: Like regular FHA loans, FHA 203i loans let you buy a home with a low down payment—around 3% of the purchase price. That makes them great for buyers with little savings.

Q: Do I Need Mortgage Insurance with FHA 203i Loans?

A: Yes. FHA 203i loans require mortgage insurance. This protects the lender in case you stop making payments. The cost is added to your monthly mortgage.

Q: Can the Seller Help Me Pay Closing Costs on FHA 203i Loans?

A: Yes. Home sellers can contribute as much as 6% of the purchase price to assist with closing costs, reducing the amount of cash you need at closing.

Q: Who Gives Out FHA 203i Loans?

A: FHA doesn’t lend money. FHA 203i loans are given out by HUD-approved lenders like mortgage companies and banks. You can also go through a mortgage broker who works with those lenders.

Q: What are Other Options if I Can’t Get FHA 203i Loans?

A: If FHA 203i loans don’t work for you, you might qualify for USDA, FHA 203(b), or FHA 203(k) rehab loans. These are more common and often easier to get.

Q: What Makes FHA 203i Loans Different from Other FHA Loans?

A: FHA 203i loans are meant only for rural homes where reselling the property is harder. Other FHA loans, like 203(b) or 203(k), are for homes in any area, even cities or suburbs.

Q: How Can Gustan Cho Associates Help Me with FHA 203i Loans?

A: Gustan Cho Associates can help you understand FHA 203i loans and all your loan options. Our group will assist you throughout the process and identify the most suitable loan program for your requirements—even if it’s not a 203i.

This blog about “FHA 203i Loans Mortgage Lending Guidelines For Borrowers” was updated on March 21st, 2025.

FHA 203(i) Loans – Your Gateway to Rural Homeownership

Apply Now And Get recommendations From Loan Experts