This guide covers home maintenance for first time home buyers and homeowners. A home purchase is a life-changing event for most American Families. Buying a home is most people’s single largest investment in their life. Anyone who has accomplished becoming a homeowner, hands down they should be proud to have accomplished this goal. Not every person can qualify to be able to purchase a home. The mortgage process is extremely strict in having minimum requirements to qualify for a home loan. In this article, we will cover and discuss home maintenance responsibilities for first-time homebuyers.

Mortgage Guidelines And Requirements

Here are the basic requirements to qualify for a mortgage loan: Meet minimum credit score requirements of 580 FICO for FHA and 620 for Conventional loans, No late payments on any of their credit obligations for the past 12 months. Mandatory minimum waiting periods after bankruptcy, foreclosure, deed-in-lieu of foreclosure, short sale.

No outstanding bad debt on government loans. No judgments or tax liens without a written payment agreement that has been seasoned for at least three months.

Have stable full-time employment or income source that is likely to continue for the next three years. Part-time income, bonus income, overtime income, self-employed income needs to have been seasoned for at least two years. Likelihood to continue for the next three years. Meet the necessary debt-to-income ratios. Debts of spouse included on community property states. Late payments after bankruptcy or foreclosure are generally not allowed.

Speak With Our Loan Officer for Mortgage Loans

How Mortgage Lenders Qualify Borrowers

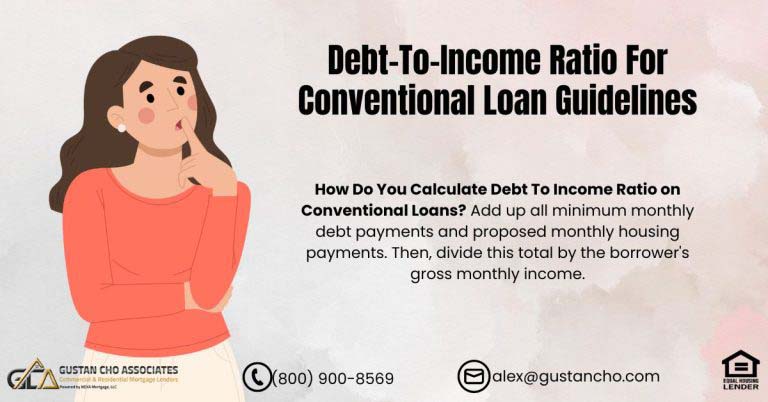

Lenders have their own way of qualifying borrowers and deciding whether or not they can afford their mortgage payments. That is by making sure that they meet the debt-to-income ratio requirements stated on the loan program they are applying for. Lenders do not take home maintenance for first-time homebuyers into consideration when calculating debt-to-income ratios.

- cable bills

- internet bills

- medical insurance

- most importantly, maintenance expenses every homeowner incurs when purchasing a new home

Debt-to-income ratios are calculated by taking the sum of the borrowers total minimum monthly payments including the proposed principal, interest, taxes, and insurance ( PITI ) and dividing it by the borrowers’ monthly income. One thing lenders do not take into consideration are other monthly payments borrowers may or may not have such as the following:

Renting Versus Home Maintenance For First-Time Home Buyers

Renters did not have scavenger service, water bills, landscaping bills, snow shoveling bills, and other maintenance bills that can become quite costly: Even without hiring a maintenance company or handyman and doing the work yourself, there are costs involved. Whether it is buying a lawn tractor, lawnmower, snow blower, tools, or other expensive lawn or yard maintenance equipment plus the cost of fuel, oil, and parts.

Maintenance Essentials For Every Homeowner

Every homeowner will need maintenance essentials for their new home. Many homeowners are clueless about how much some of these tools and equipment will put a dent in their budget.

As a homeowner, you will not have a landlord or landlord’s maintenance guy to call and either have to do the work yourself. Or hire a handyman or maintenance company that can become quite costly. Most homebuyers learn how to do the basic repairs themselves through the many do-it-yourself guides and manuals out on the internet. However, even if you are your own handyman, you will still need the basic tools needed to do the repairs yourself.

Purchase your dream home with Gustancho Associates

Additional Home Maintenance For First Time Home Buyers And Costs Versus Renters

Here are the basic tools needed as a homeowner. If you do not have the budget to purchase it all at once, you can get them piecemeal. Or go to your local garage sales or aftermarket stores to look for used tools and equipment:’ Lawnmower or lawn tractor plus leaf and lawn bags:

- Rake

- Garden hose

- Trimmers, weed trimmers, snow shovel, regular shovel

- Snowblower for winter plus packages of salt in inventory

- Screwdrivers (both Phillips and flat head)

- Pliers (needle nose and channel lock)

- Flashlight and candles in the event of a power outage

- Generator in the event of a power outage

- Socket wrench set

- Hammer

- Basic nails, screws, electrical tape, masking tape, five-gallon fuel tank and fuel for lawn mower, snow blower, trimmers, and oil

- Jumper cables

- Wall anchors

- Stud sensor

- Ladder

- Work gloves

Smoke detectors, carbon monoxide detectors, radon detectors, and fire extinguishers are lifesaving items that should be present in all sections of the home.

Rewards of Home Ownership Versus Being a Renter

Is the cost of home maintenance for first-time home buyers worth being a homeowner? 10 out of 10 homeowners will tell you that the cost of home maintenance for first-time home buyers is a very little price to pay in being a homeowner versus a renter.

Rewards Versus Home Maintenance For First Time Home Buyers

In this section, we will cover the pros and cons of being a homeowner versus a renter. Security of not being asked lease is up if you are a renter and for you to find a new place to move. Housing payment is the same year after year if you are a homeowner unless property taxes and homeowners insurance increase. If you are a renter, a landlord can increase rent by 10% or more or even ask you to leave.

The ability to do what you want to property without having to ask the landlord for permission like to be able to paint home a certain color. Ability to have dogs and cats without asking the landlord for permission.

Or having to come up with an additional security deposit. Having the ability to invite friends and family for extended stays or live with you without having to ask the landlord for permission or having to cough up additional security deposits. If you are currently renting and see if you can qualify for a home loan and see how much your monthly mortgage payment will be as a homeowner versus what you are paying for rent currently, feel free to contact us at Gustan Cho Associates at 800-900-8569. Text us for a faster response or feel free to email us at gcho@gustancho.com. We are available 7 days a week, evenings, weekends, and holidays.