This guide cover the struggle of car loans during the mortgage process. Looking to buy a new car? Like most of us, you’ll need financing, so, which is more beneficial, getting a loan from your local bank or your dealer? Eighty percent of loans are arranged by the dealers and for good reason. The obvious is a convenience for one.

You drive to a dealer with your old car, find your new car, test drive it and a few hours later drive away with your new car and park it your driveway. Sound good right? Ah, but such benefits all too often come with a price.

Dealers work with lenders who finance buyers with poor credit as well as those with good credit and rates vary. In this article, we will discuss and cover the struggle of car loans during the mortgage process. Getting approved for a mortgage and having an existing car loan can present some challenges during the mortgage process. In the following paragraphs, we will cover key considerations and potential struggles.

Struggle of Car Loans on Debt-to-Income Ratio (DTI) During the Mortgage Process

Car loans are recurring debt obligations that factor into your debt-to-income ratio (DTI) calculation. A high DTI, including the car loan payment, can make it more difficult to qualify for a mortgage or may limit the loan amount you can borrow. Lenders typically prefer a DTI below 43% for qualified mortgages, although some may allow higher ratios for non-qualified mortgages.

Car Payment Crushing Your Mortgage Approval?

Learn how to handle the struggle of car loans during mortgage process without killing your home loan

The Struggle of Car Loans on Credit Utilization Ratio

A large car loan balance can increase your credit utilization ratio, which is the amount of credit you use compared to your total available credit. High credit utilization can negatively impact your credit score, making it harder to secure favorable mortgage rates or loan approval.

Timing of Car Loan

Lenders may be concerned about your ability to manage additional debt if you recently took out a car loan. Lenders prefer a consistent payment history on existing debt before approving a new loan.

Lender Overlays

Some lenders may have additional overlays or guidelines that place restrictions on the maximum debt load, including car loans, that they will allow for mortgage applicants.

The Struggle of Car Loans on Income and Asset Verification

Lenders will scrutinize your income and assets to ensure you have sufficient reserves and cash flow to cover all your debt obligations, including the car loan payment. If your income or assets are borderline, the car loan payment may make qualifying harder.

How Auto Loans Financing Works at Dealerships

Dealers have what’s called F&I (finance and insurance) departments. They typically arrange loans with various banks and or other lenders and some states even allow the dealers to tack on an additional 2.5 percent for themselves (check your states bill of rights). Arranging your own financing from your bank, credit union or peer to peer lending may be more beneficial. Still, it’s best to do your homework and weigh out your options. Below are some basic tips that can help you get the best rate and some insight in dealing with dealer financing.

The Struggle of Car Loans and Financing a Vehicle

Make sure your credit is up to or above par, get a copy of your credit report. If you see any discrepancies or incorrect information dispute them with the reporting agencies immediately. Your credit score is critical to a competitive and low-interest rate. A dealer or lender of your choice will systemically run your credit and look for any negative information that could hinder your rate.

Typically scores of 700 and above qualify for good and competitive interest rates were as scores of 600 and below are a sign of higher rates and could be ugly.

Do your due diligence and compare rates, get quotes from banks and other lenders who don’t have a vested interest in whether or not you’re buying a particular car. Knowing the amount of interest rate you qualify for gives you a benchmark to compare with a dealer’s offer. Once you have your rate asking the dealer’s F&I person to beat your bank’s rate is encouraged and to your benefit in lowering your overall costs.

The Struggle of Car Loans and Being Careful With Sales People

Avoid talking monthly payment, this is often used as a ploy to reel you in and get you excited with a low monthly payment. Stick to the facts; negotiate only the price of the new vehicle, the loan interest rate and term. The dealer can cut the monthly payment by increasing the length of the loan- thus increasing the overall interest costs and the likelihood that you’ll owe more on the car than its worth at the end of the term.

Typically, 60 months or (five years) is the standard term and longest you’ll want to have a car loan for. Any longer than that and you start to loose additional residual value.

Try to stay with a vehicle that fits your budget as opposed to your style. If you have a trade-in, negotiate that amount separately. Dealers will quickly ask if you have a trade-in. This gives them another tool and advantage to play with the number. They give you the impression that they will give you a healthy amount for your car if as a trade-in where in fact they can incorporate any overage in your new car contract.

Thinking About a New Car While House Hunting? Stop

Talk to us first so you don’t tank your approval

Additional Accessories on Top of Auto Loan Balance

Be advised of the costly add-ons dealers try to sell you, i.e insurance coverage, protection plans etc…. All must clearly be disclosed in the contract, and the dealer cannot require you to buy them as a condition of the loan. Although I advise of costly add-ons. Depending on the type of vehicle you are purchasing and how long you are keeping the vehicle, some extended warranty plans could actually be beneficial.

Extended warranties are benefiial in the event your vehicle suffers a major mechanical and drive train or electrical failure outside of the factory’s warranty which could add up to costly repairs otherwise.

Study the various plans offered thru literature offered from your dealer. Also, be advised that you don’t have to make a decision and purchase the extended warranty program at the same time you sign the contract. Your call will be fully covered by the factory warranty for quite a while and rushing into an extended warranty plan is not advised or necessary.

The Struggle of Car Loans and Signing The Dotted Line

Study the contract as if your financial life depends on it- because it might. Make sure all the dates and information are correct before your sign. Dealers have been known to inflate down payment amounts and buyer’s incomes to put buyers into loans they can’t afford. One more thing: the CFPB (Consumer Financial Protection Bureau) regulates car loan lending activity by banks and other financial institutions and services. But congress exempted dealers from such oversight- another reason for caution. So, dealer arranged financing or self-arranged financing? You can be the judge.

The Struggle of Car Loans When Buying a Home

To mitigate these struggles, having a debt-to-income ratio, a strong credit score, and a stable employment history is generally advisable for applying for a mortgage. Additionally, providing explanations and documentation to the lender regarding your ability to manage the car loan and mortgage payments can help strengthen your application. In some cases, it may be beneficial to pay off or refinance an existing car loan to reduce your overall debt burden before applying for a mortgage. However, this decision should be carefully evaluated based on your financial situation and goals.

FAQ: The Struggle of Car Loans During Mortgage Process

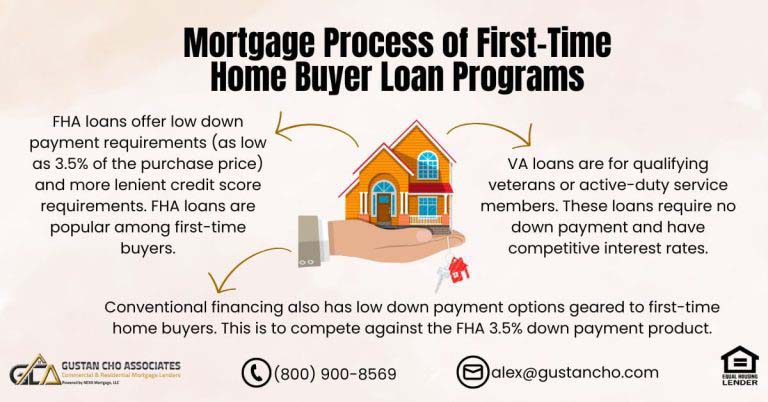

- 1. What are the main challenges of having a car loan during the mortgage process? Car loans affect your debt-to-income ratio (DTI) and credit utilization ratio and complicate income and asset verification for mortgage lenders. These factors may impact your ability to qualify for a mortgage or affect the loan amount you can borrow.

- 2. How does a car loan impact the debt-to-income ratio (DTI) during the mortgage process? Car loans are recurring debt obligations that contribute to your DTI calculation. A high DTI, including the car loan payment, can make it harder to qualify for a mortgage or may limit the loan amount you can borrow.

- 3. How does a car loan affect the credit utilization ratio? A high car loan balance can lead to a higher credit utilization ratio. This, in turn, could negatively affect your credit score, which may make it harder to qualify for favorable loan rates or secure mortgage approval.

- 4. What is the significance of timing for car loans and mortgages? Lenders may be concerned about your recent acquisition of a car loan, as it may raise questions about your ability to manage additional debt. Lenders typically prefer a consistent payment history on existing debt before approving new loans.

- 5. Are there specific lender requirements or restrictions regarding car loans and mortgages? Some lenders may have additional guidelines, overlays, which restrict the maximum debt load allowed for mortgage applicants, including car loans.

- 6. What are the benefits of arranging financing outside of the dealership? Arranging financing from your bank, credit union, or other lenders may offer more favorable terms and lower interest rates than dealer financing. It’s essential to compare rates and terms to ensure you’re getting the best deal.

- 7. How can I negotiate effectively when dealing with dealer financing? It’s important to consider negotiating the price of the vehicle, loan interest rate, and term rather than just the monthly payment. Be cautious of extended loan terms, which can increase overall interest costs.

- 8. What should I be aware of when considering additional accessories or add-ons dealers offer? Dealers may try to sell costly add-ons such as insurance coverage or protection plans. While some extended warranty plans may be beneficial, it’s crucial to carefully review and consider whether they’re necessary for your situation.

- 9. What precautions should I take when signing the loan contract? Carefully review all terms and ensure the information is accurate before signing. Be cautious of inflated down payment amounts or misrepresented buyer information. Remember that dealer financing is not subject to the same regulatory oversight as bank financing.

- 10. How can I mitigate the challenges of having a car loan when buying a home? To improve your chances of getting a mortgage, having a good credit score and consistent employment history is important. Additionally, providing documentation that shows you’re capable of managing car loans and mortgage payments can strengthen your application. Sometimes, paying off or refinancing an existing car loan before applying for a mortgage may be beneficial.

This blog article post on the struggle of car loans was updated on March 18th, 2024.

First-Time Buyer Learning the Hard Way About Car Loans?

Get a First-Time Buyer Debt Checklist