This guide covers the updated non-QM guidelines post-coronavirus outbreak and political scare. Non-QM guidelines are not uniform agency lending guidelines like government and conventional loans. The individual wholesale lender sets Non-QM guidelines. Just because one lender has a set of non-QM guidelines does not mean another will have the same lending requirements. The post-coronavirus updated Non-QM guidelines constantly change as the weeks pass. Non-QM loans were one of the hottest home mortgage programs in the housing market before the coronavirus outbreak.

Non-QM loans are alternative home financing for borrowers who do not qualify for government and conventional loans. They are not just for homebuyers or homeowners with bad credit.

Borrowers with great credit and credit profiles benefit from non-QM loans. The rumors that non-QM loans were dead and would never come back proved false. The team at Gustan Cho Associates is thriving with the flood of non-QM mortgage loan applications. Not all of the mortgage products are back. However, our wholesale non-QM investors are lifting the restrictions as time passes. The non-QM lending programs at Gustan Cho Associates are expected to return in full force in the coming weeks. The following paragraphs will cover updated non-QM guidelines post-COVID-19 ERA.

2025 Living on the Edge of the Possible

Non-QM loans are famous for giving great ideas to people who typically get shut out of traditional home financing. Think of them as backup plans that let buyers hop on the homeowner train. Here’s how they ramp up the “yes.” In the following paragraphs, we will cover the latest updates on Non-QM guidelines and mortgage rules for 2025 to show how they’re helping families get home loans. The idea is to gather specific info on how these loans widen access and then explain it clearly.

Fair Rules, Fresh Paperwork

One big change is in paperwork. Regular mortgages often demand enough documents to fill a binder: two years of tax files, dozens of pay stubs, and W-2s. On the other hand, non-QM options happily accept bank statements, simple profit-and-loss docs, or the 1099 earnings summary. This is a game-changer for self-employed buyers who sometimes get ghosted by the usual process.

Bank Statement Programs

If you’re self-employed and pursuing a mortgage, bank statement programs streamline the approval process. They let you show 12 to 24 months of deposits to prove cash flow—no arbitrating the income the IRS sees. Hand over the promised: Bank Statements—12 to 24 months of personal or business account history, and you’re on your way.

Higher Loan-to-Value Options

With home prices soaring to record levels, buyers crave mortgage designs that let the dollars stretch farther without converting the process into a paperwork marathon. Non-QM programs accommodate that by offering high loan-to-value ratios and accepting creative income documentation.

Don’t Wait—Start Your Non-QM Mortgage Journey

Every borrower’s story is different. With Non-QM loans, your unique situation can still lead to approval.

Who Benefits from Non-QM Loans?

Self-Employed Borrowers

Non-QM (Non-Qualified Mortgage) loans were built for the self-employed, the gradual-commission crowd, and the flexible gig economy worker. They let entrepreneurs, freelancers, and part-time business owners document income that tax write-offs often mask.

Borrowers with Credit Challenges

Non-QM programs also welcome individuals with credit blemishes. Bankruptcies, foreclosures, or short sales that happened a year or three back will still enter the picture, allowing a sensible second chance and the chance to own again.

Unique Financial Situations

The final category deserves the broadest gaze. Whether retirees relying on managed-income portfolios, part-time property owners filing 1099s, or any shopping-pattern person under a standard-1099 structure, Non-QM loans account for income your standard mortgage calculator will miss.

Growing Market Demand

Interest in non-QM home loans is skyrocketing, with 2025 being a record year. Right now, about one in 20 home loans is non-QM, and that share is climbing, which shows that both lenders and buyers are warming up to these more adaptable mortgage options. Major banks and insurers are stepping up investment in non-QM in 2025, driven in part by the search for alternative investments that perform well in today’s market.

Key Considerations on Non-QM Loans

Non-QM loans are marketed as flexible, but the upside comes with some strings attached. They cater to home buyers who don’t check every box on a conventional lender’s list. In return, buyers might face a bigger down payment and a higher interest rate. Dale Elenteny, a senior mortgage loan originator at Gustan Cho Associates says the following about the relaxed non-QM guidelines:

The relaxed non-QM guidelines allow freelancers, gig-workers, and those with less-documented incomes to prove creditworthiness and secure the keys to a new home.

Recent updates to Non-QM guidelines show lenders are shifting gears, broadening the definition of creditworthy in a way that mirrors the gig and self-employed economy. Home buyers with pay stubs, tips, commissions, crypto gains, or variable incomes now find more pathways to mortgage approval, reflecting a cultural and economic change: lenders are meeting prosperous, but unconventional, financial profiles where they are.

UPDATED Non-QM Guidelines POST Coronavirus Outbreak

Alternative home mortgages offer many benefits. Non-QM mortgages give mortgage borrowers who need alternative financing the chance of becoming homeowners sooner rather than later. This section covers mortgage borrowers who benefit from non-QM financing: borrowers who cannot meet the mandatory waiting period after bankruptcy or a housing event such as a foreclosure, deed-in-lieu of foreclosure, or short sale.

Non-QM lenders generally do not have a minimum waiting period after bankruptcy or a housing event. Bank statement mortgage loans for self-employed borrowers with no income tax returns required.

Late payments, including late mortgage payments, in the past 12 months. Borrowers who exceed the maximum government or conventional loan limits. There is no maximum loan limit on non-QM mortgages. There is no private mortgage insurance. Non-QM mortgages exempt deferred student loans for longer than 12 months. Borrowers with credit scores as low as 500 FICO. Jumbo loans with lower credit scores and bad credit.

Non-QM Guidelines After Bankruptcy and Foreclosure

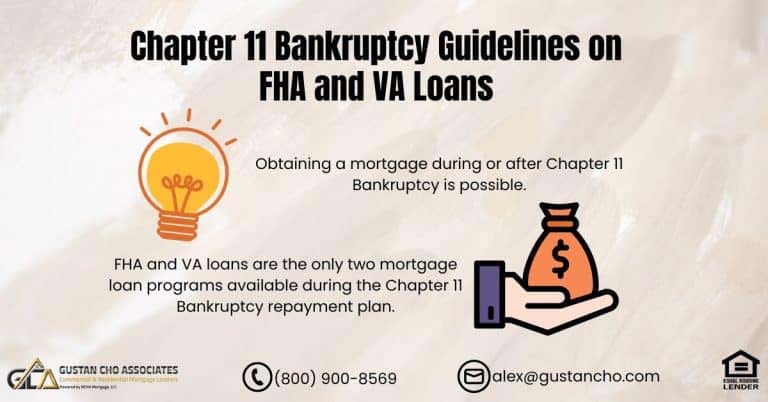

If you’ve recently filed for bankruptcy, you might again wonder if you’ll ever be able to get a loan. The amazing news is that getting approved for a mortgage after bankruptcy or a housing event is not impossible.

Since non-QM mortgages are portfolio loans, each lender has its own guidelines. Most lenders will negotiate or make exceptions on a case-by-case basis. Lenders can and are willing to make exceptions if the deal makes sense.

Here are some solid tips on improving your chances of getting approved. One of the best ways to increase your odds of getting approved for a mortgage after bankruptcy is to meet the minimum waiting period requirements of the government or conventional loans. Or find someone without a prior bankruptcy or foreclosure to be on the loan, and you will be on title together with the main borrower.

Traditional versus Non-QM Guidelines on Waiting Period After Bankruptcy and Foreclosure

FHA, VA, USDA, and conventional loans require a two—to four-year waiting period after bankruptcy. Non-QM loans allow borrowers one year out of bankruptcy or foreclosure to qualify for them. Dale Elenteny, a senior mortgage loan originator

Many lenders no longer offer non-QM loans one day after bankruptcy and foreclosure. The longer the bankruptcy discharge date or the longer the foreclosure recorded date, the lower the rate and risk tolerance for the wholesale non-QM lenders.

The one-day waiting period after bankruptcy and foreclosure has been changed to a one-year waiting period after bankruptcy or foreclosure on non-QM loans, explains John Strange of Gustan Cho Associates. The updated non-QM guidelines post-COVID-19 ERA changed for the worse, especially for non-QM loans one day after bankruptcy and foreclosure.

The Latest Updates on Non-QM Guidelines

The no-waiting period after bankruptcy and foreclosure non-QM guidelines have been changed to one year after bankruptcy and foreclosure by most non-QM wholesale mortgage lenders. The updated non-QM guidelines on non-QM loans after bankruptcy or a housing event may return someday with no waiting period. However, most wholesale lenders now have a one-year waiting period after bankruptcy or a housing event. A housing event is a foreclosure, a deed-in-lieu of foreclosure, or a short sale.

Open Doors With Non-QM Loans

Don’t let strict conventional guidelines stop you. Our Non-QM programs make homeownership possible for more buyers.

Non-QM Mortgage Post Coronavirus Pandemic

The coronavirus pandemic has devastated the mortgage markets. At least temporarily. Non-QM mortgages have been halted until further notice by all lenders. Many borrowers who locked their non-QM mortgage rates and were set to close have seen their dream of homeownership halted until further notice. John Strange, a senior loan officer at Gustan Cho Associates, shares his thoughts about the updated non-QM guidelines on non-prime loans after the coronavirus outbreak and scare as follows:

The team at Gustan Cho Associates had over 40% of its pipeline canceled due to the coronavirus pandemic crisis. A handful of non-QM lenders either closed their doors or went bankrupt.

The future of alternative financing seemed gloomy and not too promising. As time passed, the good news is that non-QM lending returned. Lending guidelines have been easing up as time has passed. If the deal makes sense, non-QM lenders are willing to make an exception to make the deal work. Gustan Cho Associates is an aggressive mortgage broker of non-traditional mortgages. Gustan Cho Associates has recently launched home mortgages with one day out of bankruptcy or foreclosure.

Best Non-Traditional Lenders With Lenient Non-QM Guidelines

Over 80% of our borrowers at Gustan Cho Associates could not qualify at other lenders due to their lender overlays. Gustan Cho Associates has no lender overlays on government and conventional loans. We are also experts in originating and funding non-QM mortgages and alternative portfolio lenders.

Non-QM lenders anticipated skyrocketing growth in the years to come. However, the COVID-19 pandemic completely shut down the mortgage markets for non-QM and alternative portfolio financing.

The great news is that non-QM loans have been making a resurgence in the past couple of months. To qualify for a mortgage with a lender with no lender overlays and experts in alternative financing, please contact us at Gustan Cho Associates at 800-900-8569, text us for a faster response, or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays.

Non-QM Mortgage Experts: Gustan Cho Associates

Gustan Cho Associates are experts in NON-QM mortgage lending.

- We have numerous investors who offer different programs for these types of loans

- In this blog, we will detail what a NON-QM mortgage is and how to apply for one

- You will also update you on some recent document changes to NON-QM lending after the COVID-19 Coronavirus outbreak

Non-QM Mortgage Guidelines UPDATE: Non-QM Loans Defined

A NON-QM mortgage loan is a special mortgage product that does not follow federal lending guidelines by Fannie Mae, Freddie Mac, and HUD.

- Non-QM wholesale mortgage lenders are private investors who can lend their own money, allowing them to create their own mortgage products and guidelines.

- QM stands for qualified mortgage.

- NON-QM means non-qualified mortgage.

- Since they do not follow the federal guidelines, thousands of Americans can buy or refinance homes with these products.

- At the beginning of the COVID-19 coronavirus outbreak, NON-QM mortgage products disappeared.

- Investors were not honoring their loan products due to uncertainty in the market.

- However, non-QM loans have returned and are one of the most popular mortgage loan options today for homebuyers.

Even individuals already in the loan process were not able to close on their transactions. Recently, NON-QM mortgage lending has made a comeback.

2025 Non-QM Mortgage Guidelines UPDATE On Relaunched Loan Programs

Popular non-QM mortgage products after the COVID-19 coronavirus outbreak

- Bank statement mortgages for self-employed borrowers

- Most self-employed borrowers use tax write-offs to increase take-home pay

- Tax code for self-employed individuals allows for many legitimate write-offs

- These write-offs count against your debt-to-income ratio when you attempt to buy a home

- Federal guidelines outline exactly how mortgage companies can calculate self-employed income

- Many write-offs will count against your qualifications

- If that is your scenario, a bank statement loan may be a great alternative for you

- A bank statement loan will calculate your income based on business-related deposits

- Typically, 50% of your business-related deposits will be counted as qualifying income

Depending on credit score, these mortgages require at least a 15% down payment. Lower credit scores will require a larger down payment.

Asset Depletion Mortgage Loan Programs

Asset depletion mortgages. While Freddie Mac does offer an asset depletion program, it is nowhere near as forgiving as a NON-QM asset depletion loan.

- Many borrowers, especially retired borrowers, may have a large nest egg of liquid assets but low take-home pay

- This mortgage product allows you to use your liquid assets as qualifying income

- You may even count other income, such as pension or Social Security income

- They will take your total assets and divide them by 60 months

That figure will be added as qualifying income to your mortgage file. Adding the assets will dramatically increase a borrower’s purchasing power.

Discover Flexible Non-QM Mortgage Options

If traditional lenders turned you away, Non-QM guidelines may be your path to homeownership. At Gustan Cho Associates, we specialize in these alternative programs with no overlays.

Qualifying For Non-QM Home Mortgages

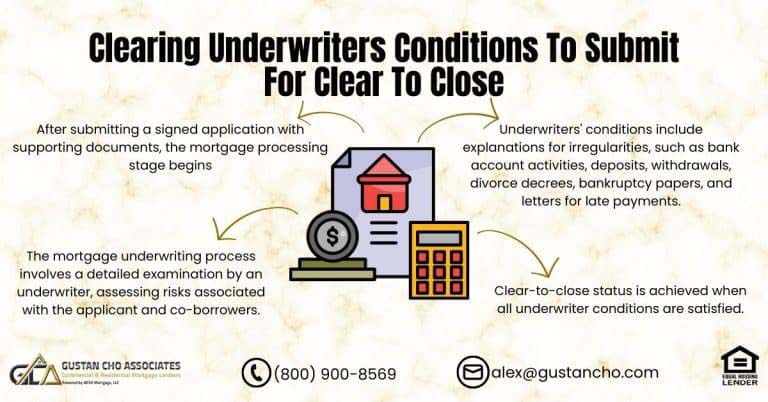

Applying for a NON-QM mortgage loan with Gustan Cho Associates is similar to applying for a QM mortgage.

- Your first call should be to Mike Gracz at (800) 900-8569 to discuss your mortgage qualifications. Mike is the NON-QM expert!

- From there, Mike will fit you into the best NON-QM mortgage product available

- You will be paired with a licensed loan officer in your state

- You will complete your application with an online link that will give your loan officer permission to verify your credit report

- Just like a QM mortgage, you will go through the preapproval process

Depending on the loan program, your loan officer will need certain documentation, such as bank statements, pay stubs, tax returns, a driver’s license or state ID, and more. Once you send these items, your loan officer will complete the preapproval process.

2025 Non-QM Mortgage Guidelines UPDATE: Gustan Cho Associates Relaunched Non-QM Loans

As you can see from this blog, non-QM mortgage lending has returned post-COVID-19. Gustan Cho Associates are experts when it comes to non-QM guidelines and non-QM qualified mortgage loans. While new non-QM loan programs are slowly returning to the market, it is unlikely that they will be as aggressive as before the COVID-19 outbreak.

Since non-QM loans differ from traditional mortgages, your loan officer will often need to gather all income and credit documentation for the non-QM investor.

For example, the 5% down jumbo mortgage product is currently unavailable. This product was incredibly popular before the pandemic. We hope to see NON-QM mortgage lending expand even further soon. For mortgage-related questions, please call Mike Gracz at (800) 900-8569. Mike can also be reached via email at gcho@gustancho.com. We look forward to helping you buy or refinance your next home.