In this blog, we will cover and discuss using non-QM versus jumbo mortgages to purchase high-end homes. Using non-QM versus jumbo mortgages to buy high-end homes is becoming increasingly popular. Traditional jumbo loans have strict lending guidelines due to the risk layer lenders need to take. Most traditional jumbo lenders may require a 740 credit score, debt to income ratios not greater than 40% DTI, no bankruptcies or foreclosure in the past 7 to 10 years, and very high mortgage rates. In the following paragraphs, we will be covering using non-QM versus jumbo mortgages to buy high-end homes.

Why Would Somebody Need a Jumbo Loan?

Many homebuyers of higher-end homes are business owners and/or self-employed wage earners. Self-employed wage earners and/or business owners normally take substantial unreimbursed business expenses. Unreimbursed business expenses are a great benefit and tool for business owners and self-employed wage earners because they get to deduct substantial expenses which lower the adjusted gross income. Lower adjusted gross income means fewer income taxes to pay. However, lower adjusted gross income is bad when qualifying for a mortgage.

Not Sure If You Need Non-QM or a Jumbo Mortgage?

We’ll compare both side by side based on your real numbersAre Jumbo Loans Harder To Qualify?

Jumbo loans are substantially harder to qualify than traditional conforming loans. Many self-employed and/or business owners who can easily afford to purchase and own a higher-end home could not qualify for a traditional jumbo home mortgage. However, business owners or self-employed wage earners can now use our non-QM Jumbo Mortgages to qualify for a mortgage with fewer restrictions than traditional jumbo mortgages. Traditional jumbo loans require full documentation, low debt to income ratio, high credit scores, clean credit in the past seven years, and no bankruptcy in the past 7 years.

What ARe Non-QM Jumbo Loans

Non-QM (Non-Qualified Mortgage) jumbo loans are a type of mortgage that exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA). These loans do not meet the guidelines set by government-sponsored enterprises (GSEs) such as Fannie Mae or Freddie Mac. In the following paragraphs, we will cover some key features of non-QM jumbo loans:

Non-QM Jumbo Mortgage Loan Limits

Jumbo loans exceed the maximum loan limits set by the FHFA for conforming loans. These limits vary by location but typically start at $776,550 (as of 2024) and can go much higher in high-cost areas.

Non-QM Jumbo Loans Credit Requirements

Non-QM jumbo loans often have more flexible credit requirements than conventional conforming loans. Borrowers can qualify with lower credit scores or higher debt-to-income ratios.

Documentation

While traditional mortgages typically require extensive documentation to verify income and assets, non-QM jumbo loans may allow for alternative forms of documentation, such as bank statements or asset depletion.

Using Non-QM Versus Jumbo Mortgages Interest Rates

Interest rates for non-QM jumbo loans may be higher than those for conforming loans, reflecting the increased risk to lenders due to larger loan amounts and potentially less stringent borrower qualifications.

Using Non-QM Versus Jumbo Mortgages Underwriting Flexibility

Non-QM loans provide lenders with more flexibility in underwriting criteria. This allows them to consider factors beyond traditional income and credit requirements, such as self-employment income, investment income, or complex financial situations.

Down Payment Using Non-QM Versus Jumbo Mortgages

Borrowers may need a larger down payment for a non-QM jumbo loan than a loan. Down payment requirements can vary but are often higher to mitigate the risk for lenders.

Terms and Options

Non-QM jumbo loans may offer a variety of terms and options, including adjustable-rate mortgages (ARMs), interest-only payments, or longer loan terms.

Portfolio Loans

Non-QM jumbo loans are often held in the lender’s portfolio rather than being sold to investors in the secondary mortgage market. This allows lenders more discretion in setting their lending standards. Overall, non-QM jumbo loans provide an alternative financing option for borrowers who may not qualify for conventional conforming loans due to high loan amounts, non-traditional income sources, or unique financial situations. However, it’s essential for borrowers to carefully consider the terms, rates, and risks associated with these loans before proceeding.

What If You Buy a Home at The Top of The Housing Market?

Home prices are not cheap. Home values have been increasing year after year since 2012. The Federal Housing Finance Agency (FHFA), the federal agency that is in charge of loan limits on Conventional loans, has raised conforming loan limits for the six three years. The conforming loan limit for 2024 is $776,550 for single-family homes in average-priced areas. In high-cost areas, conforming loan limits are capped at $1,149,825 for single-family homes. HUD, the parent federal agency of the Federal Housing Administration (The FHA) followed FHFA’s lead and increased FHA Loan Limits for 2024 is $776,550. FHA jumbo loans in high-cost counties in the United States is $1,149,825. This is HUD’s sixth FHA Loan Limit increase in the past eight years.

Bank Statements, 1099, or W-2? Pick the Right Path

We’ll show when Non-QM makes sense and when jumbo is betterConforming Loan Limit Increases To Record High

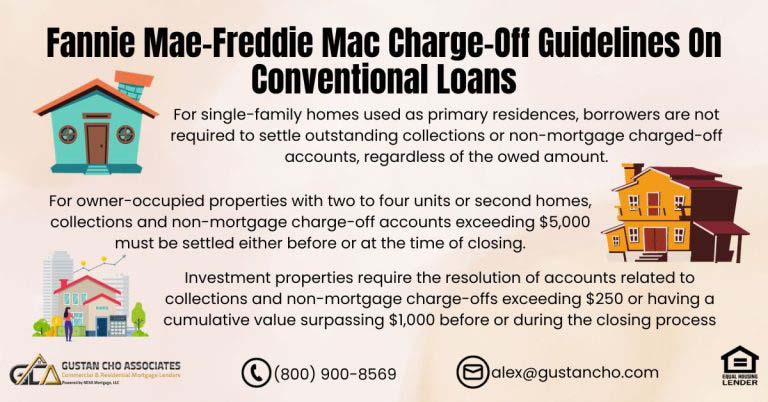

Both FHFA and HUD increased loan limits due to increasing home prices nationwide. High-balance conforming limit has increased to $1,149,825. Many counties in areas where home prices are above the national median are considered high-cost areas. Any loans that do not conform to Fannie Mae or Freddie Mac mortgage guidelines are called non-conforming or jumbo loans. Conforming loans are conventional loans that conform to Fannie Mae or Freddie Mac guidelines. If loans do not meet Fannie Mae and Freddie Mac lending requirements, it is called non-conforming loans. Jumbo loans are not conforming loans because they exceed Fannie Mae and Freddie Mac’s maximum $1,149,825 conforming loan limits.

What Are The Benefits Of Using Non-QM Versus Jumbo Mortgages

There are cases where Using Non-QM versus jumbo mortgages is necessary when buying high-end homes. Traditional jumbo loans normally require the following:

- 720 credit scores or higher

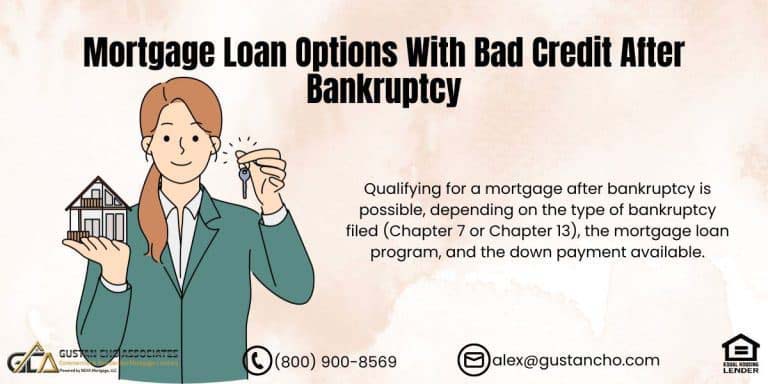

- A mandatory waiting period of 7 or more years after bankruptcy, foreclosure, deed in lieu of foreclosure, short sale

- Most lenders will require a maximum debt-to-income ratio of 41% DTI or less

- 20% to 30% down payment

- Perfect credit with no late payments in the past 2 years

- No collections or charge-off accounts

- Income tax returns are required by self-employed borrowers

- Non-Occupant borrowers are not allowed

Traditional Jumbo Loans are considered higher-risk loans by lenders. This is why they have tougher mortgage guidelines than government and conventional loans. Many self-employed borrowers often had a difficult time qualifying for traditional Jumbo Mortgages due to them taking advantage of unreimbursed expenses and tax write-offs allowed by the IRS.

Benefits Using Non-QM Versus Jumbo Loans To Purchase High-End Homes

There are many benefits of Using Non-QM Versus Jumbo Mortgages to purchase higher-end homes. Here are the Using Non-QM Versus Jumbo mortgages:

- Minimum credit scores down to 500 FICO

- No maximum loan limit on Non-QM Jumbo Loans

- Maximum debt to income ratio up to 50% DTI with compensating factors

- No private mortgage insurance required

- 5% to 25% down payment

- 5% down payment Non-QM Jumbo Loans require a 720 FICO

- Down payment requirements depends on the borrower’s credit scores and the type of property

- No waiting period requirements after bankruptcy, foreclosure, deed in lieu of foreclosure, short sale

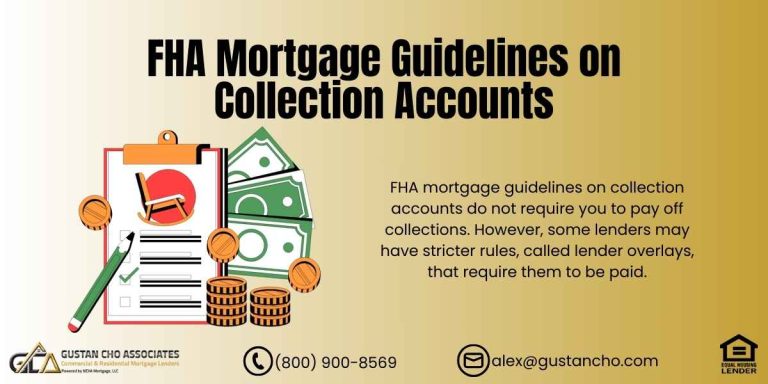

- Bank statement loan program for self-employed borrowers where no income tax returns are required

- Non-Occupant Co-Borrowers allowed

- Late payments in the past 12 months allowed

- Non-QM loans are allowed for primary, second homes, and investment property financing

- Asset Depletion Loan Programs for borrowers with no income but with substantial assets

Gustan Cho Associates have multiple Non-QM Jumbo Investors. If a borrower does not meet particular investor mortgage guidelines, exceptions can be made in a case-by-case scenario. For more information on this blog or other mortgage-related topics, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

FAQs: Using Non-QM Versus Jumbo Mortgages

-

1. What do we mean by Non-QM and jumbo loans? Non-conforming mortgage (non-QM) loans are ideal for buying expensive homes, whereas jumbo loans surpass the loan limits set by the Federal Housing Finance Agency (FHFA). Unlike non-QM loans, they do not abide by the stringent regulations that are imposed by government sponsored entities such as Freddie Mac or Fannie Mae.

-

2. Why would someone need to take out a jumbo loan? Jumbo loans are often necessary when buying expensive homes since normal standard loan limits can be broken by these kinds of loans. This category of home buyers consists primarily of entrepreneurs or self-employed professionals who take advantage of unreimbursed business expenses to lower reported income making it harder for them to be approved for traditional mortgage products.

-

3. Is It Harder To Get Jumbo Loans? Yes, typically qualifying for jumbo loans is harder than most other types of mortgages. Borrowers usually have to meet certain criteria including minimum credit scores of 740, debt-to-income ratios not exceeding 40%, no bankruptcies or foreclosures reported within seven to ten years and slightly higher interest rates compared with other types of mortgage products.

-

4. What are Non-QM Jumbo Loans? The typical borrower may not qualify for conventional jumbo mortgages but would qualify for non qualified jumbo mortgage options. This type comes with less stringent conditions and may require only alternative documentation as proof of income like bank statements.

-

5. What are the Loan Limits on Non-QM Jumbos? Conforming loan limits start at $776,550 in 2024 for most areas and can be even higher in high-cost areas while non-qm jumbos exceed this limit.

-

6. What Are the Credit Requirements on Non-Qualified Mortgages and Jumbos? Compared to traditional jumbo mortgages, non-qualified jumbos usually have more flexible credit requirements. Individuals with lower credit scores or higher DTI ratios can still qualify.

-

7. What Kind of Documentation is Required? Non-QM jumbo loans may not need all the traditional documentations for loans but they may require non-traditional documentations such as bank statements to prove income or assets.

-

8. How does the interest rate compare? Interest rates on non-QM jumbo loans might be higher than those for conforming loans because these types of loan are riskier for lenders.

-

9. What is Non-QM Underwriting Like? Non-QM mortgages present a more amenable underwriting environment. There are no limits to how a lender may consider things like self-employed income, or complicated financial situations beyond normal income and credit aspects of lending.

-

10. What are the Down Payment Requirements? The down payment required on non-qualified mortgage jumbos can vary widely but could be set at a higher level in some cases. Typically, a larger down payment will help reduce risks that lenders face.

-

11. What Loan Terms and Options Are Available? Non-QM jumbos have various options and terms including ARMs, interest only payments, longer terms etc.

12. What do we mean by portfolio loans? Instead of selling them off into the secondary market, these jumbo non QM mortgages are often held in the portfolios of their originating institutions. This gives lenders more flexibility in terms of their lending standards.

-

13. Benefits of Non -QM vs Jumbo Mortgages? When considering Non QM versus Jumbo Mortgages, there are several advantages associated with choosing the former including providing financing for properties even if borrowers have credit scores as low as 500, not having any maximum loan amount limitation constraints; allowing borrowers to go up to 55% debt to income ratio (DTI), no need for private mortgage insurance (PMI), flexible down payment options and being available for primary residences, second homes and investment properties.

-

14. For More Information or to Apply, How can I get them? If you would like more details on non-QM vs jumbo mortgages, or applying for one, please call Gustan Cho Associates at 800-900-8569, text for a quicker response or email gcho@gustancho.com. The company’s working hours are seven days a week and include evenings weekends and holidays.