This article will cover and discuss when mortgage lenders require two appraisals. In general, only one appraisal is required—however, there are cases where lenders require two appraisals. Two appraisals are required because the lender does not feel comfortable with the security of the property. Lenders are not real estate investors. They have no interest in holding the property in their portfolio. Lenders want to get paid on their notes. The following paragraphs will cover why mortgage lenders require two appraisals.

Typically, the lender is responsible for scheduling the appraisal. This is because the lender wants to ensure that the property is worth the amount they are lending. The lender will hire a licensed and certified appraiser to perform appraisals in the state where the property is located.

In summary, appraisals are critical in making an informed home-buying decision. They provide buyers with an unbiased, professional evaluation of a property’s value and help ensure they pay a fair price. As such, buyers should carefully review and use the appraisal report to inform their decision-making process. Doing so can avoid overpaying for a property and protect themselves and their lender from potential losses.

The Importance of Home Appraisals

What Should Buyers Do with an Appraisal Report? Buyers should carefully review the appraisal report to ensure they are comfortable with the property’s value. If the property is overvalued, buyers may want to negotiate a lower price or reconsider purchasing.

If the appraisal report identifies any property issues, buyers may request that the seller make repairs or offer a credit to cover the costs. Who Schedules the Appraisal? Typically, the lender is responsible for scheduling the appraisal.

This is because the lender wants to ensure that the property is worth the amount they are lending. However, the buyer may also schedule an inspection if they are paying cash or want to ensure they make a sound investment. Regardless of who prepares the review, it is vital to ensure that the appraiser is licensed and experienced.

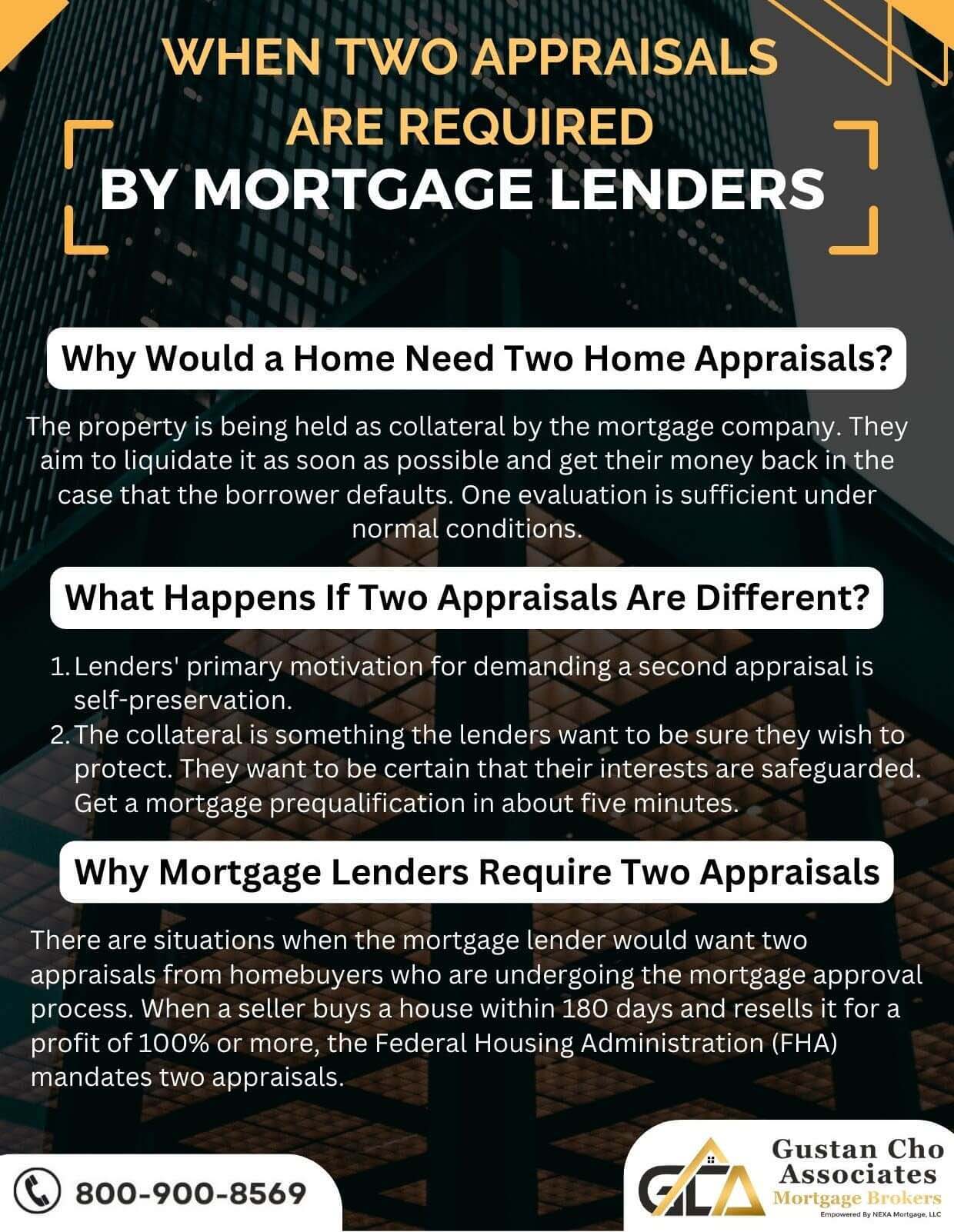

Why Would a Home Need Two Appraisals?

Mortgage companies are holding the property as security. If the borrower defaults, they want to liquidate it quickly and get their money back. Under normal circumstances, one appraisal is just fine. However, a second appraisal may be required if the property is out of the ordinary. In this article, we will cover the following topics:

- Why lenders require two appraisals.

- High-End homes with little to no comparable sales normally require two appraisals.

- Unique homes require two appraisals.

The appraisal is ordered once the borrower has completed the loan application and provided the lender with the property details. While the lender is responsible for scheduling the appraisal, neither the lender nor the borrower can speak with the appraiser during the appraisal process. The appraiser must remain unbiased in assessing the property’s value. Any attempt to influence the appraiser’s opinion could result in an inaccurate appraisal, which could have serious consequences for all parties involved.

What Happens If Two Appraisals Are Different?

The bottom line of lenders requiring a second appraisal is that they want to protect themselves. Lenders want to make sure they want to protect their collateral. They want to make sure their interests are protected.

Why Mortgage Lenders Require Two Appraisals

Another frequently asked question at Gustan Cho Associates is why would a mortgage underwriter request two appraisals. Sometimes, the mortgage lender will require two appraisals in the approval process. HUD, the parent of FHA, requires two FHA appraisals on property flips, explains John Strange of Gustan Cho Associates:

The Federal Housing Administration (FHA)requires two mandatory appraisals for a home that a seller has purchased within 180 days and has resold it for a profit of 100% or more. This mandatory two appraisal requirement has been implemented as a safeguard to house flipping and ensure no mortgage fraud is involved.

Can My Lender, My Realtor, or Myself Speak with the Appraiser? When a property is being sold or refinanced, an appraisal is necessary. The appraisal provides an unbiased estimate of the property’s value, which the lender uses to determine the loan amount and the buyer to decide whether or not to proceed with the purchase. However, who schedules the appraisal and who can speak with the appraiser is often a question that arises.

What Triggers a Second Appraisal From The Mortgage Underwriter?

It is legal for a home seller to have purchased a foreclosure or REO for $100,000, invested $50,000, renovated it, and resold it for $200,000. However, the home buyer must have two FHA appraisals done if the sale is made within a 180-day window and the gross profit is at 100% or greater. The two FHA appraisals must come from two different FHA-approved/certified appraisal companies. Alex Carlucci of Gustan Cho Associates explains the importance of getting a solid home appraisal from an experienced appraiser:

Appraisals are a critical step in the home-buying process. While they can be time-consuming, the information they provide is invaluable. Buyers can use the appraisal report to make informed decisions about their purchase, while lenders can use it to determine property value.

If you should decide to buy, before you begin looking for a home and during the process, we have vast experience working with buyers to get them ready to purchase their dream home. We can take you through the entire financing process for your home loan. We also can connect you to title companies/attorneys and real estate agents in your area that can help as needed.

Property Home Inspection Might Be Required

Lenders may also require a home inspection for those homes sold within the 180-day time frame. All renovations that require permits, such as room additions or structural changes of the home, require proper permits from the city’s building department. There are home developers who purchase REOs and foreclosures at a discount. These real estate investors are professional property fixes and flippers. They gut, renovate, and resell them for profit. HUD wants to ensure that the sale, house flipping, is legitimate. HUD wants to make sure there is no mortgage fraud involved where it involves no work done to the home, and the home buyer is a straw buyer.

Other Cases Where Two Appraisals Are Required

For those homebuyers who get an FHA 203k loan, FHA will require two appraisals. But the appraisal can be from the same appraiser and appraisal management company. With FHA 203k loans, two appraisals are ordered at the same time. All construction and renovation mortgage loans will require an as-is and as-complete appraisal. The as-is appraisal is the appraisal that will be given a value before the renovation of the work. The as-is appraisal is the appraisal value that will be rendered after the completion of the renovations.

FHA Two Appraisal Requirement

The Federal Housing Administration has strict FHA appraisal guidelines, which include not just the value of the subject property. It also has minimum requirements concerning the property’s condition with safety and security. A home with broken glass, peeling paint, non-working electrical, plumbing, HVAC, and other safety and security issues will not pass the FHA appraisal inspection.

Confused Why Your Lender Ordered Two Appraisals?

High-value homes, jumbo loans, or flips can trigger extra rules

Two Appraisals on Fix Rehabbed And Flipped Properties

Homes that have been rehabbed and bought and sold by a home developer within 180 days and the new sales price is over 100% of the original sales price bought by the seller require two appraisals. The property might also require a home inspection. The home buyer cannot pay the second appraisal. The mortgage lender or the home seller normally pays for it.

Getting Qualified For a Mortgage and Getting Pre-Approved Today

Home Buyers who need to qualify for a mortgage with a mortgage company licensed in 48 states, including Puerto Rico, Washington, DC, and the U.S. Virgin Islands with no overlays, contact at Gustan Cho Associates at 800-900-8569 or email at alex@gustancho.com for more information and further assistance.

Sonny Walton is an experienced, dually licensed real estate agent and mortgage originator. Sonny Walton has successfully guided many homeowners through obtaining a home on both the lending and real estate side. Sonny Walton does not represent buyers or sellers but offers free consultation in 48 states at Gustan Cho Associates by connecting homeowners, buyers, and sellers to the needed sources. Sonny Walton and The team at Gustan Cho Associates are available 7 days a week, evenings, weekends, and holidays.

Frequently Asked Questions (FAQs)

- Why do mortgage lenders sometimes require two appraisals?

Mortgage lenders may require two appraisals to ensure the accuracy and reliability of the property’s valuation, especially in cases where the initial appraisal is deemed questionable or when dealing with high-value properties. - When do mortgage lenders typically require two appraisals?

Two appraisals are commonly required when the property is considered high-risk, such as when it’s a jumbo loan, the property value is exceptionally high, or if there are discrepancies or concerns with the initial appraisal. - Do borrowers have to pay for both appraisals?

Generally, borrowers are responsible for the cost of the initial appraisal. However, in cases where the lender requires a second appraisal, they may cover the expense, especially if it’s due to their internal policies or specific loan requirements. - What happens if the two appraisals yield significantly different values?

If there’s a substantial variance between the two appraisals, lenders may request a review or reconcile the differences. This could involve ordering a third appraisal, conducting further investigation into the property, or re-evaluating the appraisal reports to determine the most accurate valuation. - Can borrowers choose their appraisers for the second appraisal?

Typically, mortgage lenders select and order the second appraisal to ensure impartiality and adherence to their standards. Borrowers usually need the option to choose appraisers for lender-required appraisals. - How long does it take to complete two separate appraisals?

The timeframe for completing two separate appraisals may fluctuate based on elements like the accessibility of proficient appraisers, the complexity of the property, and the lender’s processing time. Generally, it may add a few days to the loan approval timeline. - Are there specific regulations governing when two appraisals are required?

While there are no universal regulations mandating two appraisals, some lenders may have internal policies or loan programs that necessitate multiple appraisals under certain circumstances. These policies are often designed to mitigate risks associated with property valuation. - Can borrowers contest the need for a second appraisal?

Borrowers can discuss concerns or discrepancies with their lender regarding needing a second appraisal. However, it’s typically at the lender’s discretion based on their risk assessment and internal policies. - Are there any alternatives to requiring two separate appraisals?

Sometimes, lenders may accept alternative valuation methods, such as broker price opinions (BPOs) or automated valuation models (AVMs), as supplements or alternatives to a second traditional appraisal. However, this depends on the lender’s policies and the specific loan scenario. - How can borrowers prepare for the possibility of needing two appraisals?

Borrowers can assist in expediting the appraisal procedure by furnishing precise and current details regarding the property, ensuring access for appraisers, and promptly addressing any lender inquiries or requests related to the appraisal process.