This guide cover the cost of college and how it affects qualifying for a mortgage. Parents should be prepared and aware what the cost of college will do to your debt-to-income ratio when you will be paying for your children’s college education when buying a new home or refinance your home. The cost of college education for parents can be overwhelming. The cost of college has escalated throughout the years.

Many parents with children approaching college need to start thinking about the cost of college and the means of helping their children. A college education can cost as much as $50,000 per year if the student plans on attending a private out of state college or university.

It can be a combination of student loans (both private and government loans), internship/co-op work programs. Or doing a cash-out refinance on a home which has plenty of equity and paying the cost of college education with the proceeds from the cash-out refinances. In this article, we will discuss the cost of college and how it affects qualifying for a mortgage.

The Cost of College and How It Affects a Mortgage Approval

Parents should plan on understanding all of the costs and expenses that come with a college education years before their child enters college and this should not be done at the last minute. There are options for parents to get their finances in order to help pay for their children’s educations.

Understand how student loan debt impacts mortgage approval. Get smart tips to strengthen your loan application and overcome college-related costs.

A mortgage is often your biggest purchase, but the cost of college hangs like a cloud over the application for many. When student loans pile up, they may linger in your wallet, and those mortgage calculators, too. Your debt-to-income (DTI) ratio, the financial formula lenders use to see if you can handle one more monthly bill, can shoot above the safe line. In this post, we’ll explain how your college costs play into your mortgage fate and give you clear steps to tip the scales in your favor.

From Student Loans to Mortgage Success

Step-by-step roadmap for minimizing debt impact and maximizing your approval odds.

How Student Loans Impact Mortgage Approval for First-Time Buyers

As a first-time homebuyer carrying student loans, the amount you pay each month could be the first number your lender checks. These payments go straight into your debt-to-income ratio (DTI), a main number that underwriters use to decide whether you can afford a mortgage. John Strange, a senior mortgage loan originator at Gustan Cho Associates says the following about the cost of college and how it affects your debt-to-income ratio:

If your DTI is higher than lenders like to see, it raises a red flag. They worry that adding a mortgage might stretch your budget too thin.

You could be the perfect borrower, paying your student loans on time. However, carrying $40,000 in loans can still stand between you and that loan approval. Especially if your salary isn’t keeping pace with your debt.

What DTI Means and Why Student Loans Matter

- DTI is a simple fraction: It divides your monthly debt payments by your pre-tax monthly income.

- Most lenders prefer the number to be under 43%, but FHA loans might go a little higher if you have other strengths, like cash reserves.

- Student loans can push your DTI higher than you’d like.

- Even when you’re not making payments.

- Your loans may be deferred or on forbearance.

- Lenders might guess what you would pay using a standard percentage of the loan amount.

- This rule is common for Fannie Mae, Freddie Mac, FHA, VA, and USDA loans.

Do Deferred or Income-Based Student Loan Payments Count in Mortgage Approval?

Yes, even if your student loans are deferred or you’re on an income-driven repayment (IDR) plan, lenders still consider them when you apply for a mortgage. Here’s how the main loan programs handle your student debt:

- FHA Loans: Lenders must take the larger number, between 0.50% of your total loan balance and the payment reported on your credit report.

They Won’t Use a Payment Amount if Your Income-Driven Payment is Documented as $0.

- Fannie Mae: Lenders can use your actual IDR payment, even if that payment is $0.

- They need the right documentation.

- Freddie Mac: If they can’t find a reported payment anywhere, they can use the documented payment or 0.5% of the loan balance.

- VA Loans: If your student loans are deferred for 12 months or more past the mortgage closing date, lenders won’t count them at all.

- USDA Loans: They usually assume 0.5% of the loan balance if they don’t see a payment.

Knowing how these programs treat your student debt can make a big difference when you’re a borrower with student loans ready to buy a home.

Can You Buy a House With Student Loan Debt?

- Absolutely!

- Many people with student loans become homeowners every year.

- The important part is to keep your debt-to-income (DTI) ratio healthy, maintain a strong credit score, and show steady proof of income.

Lenders Also Like To See Compensating Factors Like:

A big down payment or cash savings on hand.

- A credit score of 700 or higher.

- A long job history in a stable field.

- A smaller housing cost compared to your income.

- Even if you owe over $100,000 in student loans, you can still get a yes if your finances are in good shape.

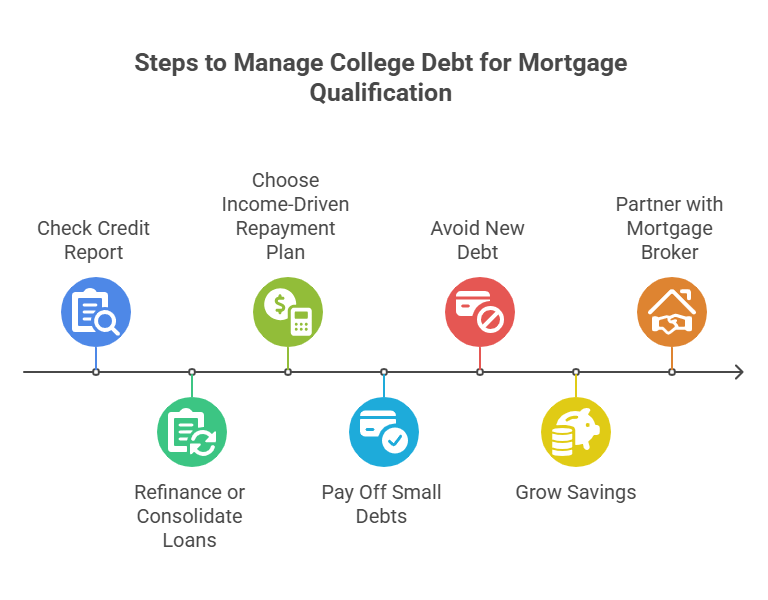

Tips for Managing College Debt to Qualify for a Mortgage

If You Have Student Loans, Do These Things Before You Apply For a Mortgage:

- Check your credit report for mistakes and fix any errors you find.

- Refinance or consolidate your student loans to lower your monthly payment.

- Choose an income-driven repayment plan to lower your debt payment.

- Pay off small debts, like credit cards, to quickly lower your DTI.

- Don’t take on new debt (like car loans or new credit cards) while buying a house.

- Grow your savings to show lenders you’re ready for home ownership.

- Partner with a mortgage broker who can navigate high DTI ratios caused by student loans.

How Student Loan Forgiveness Programs Affect Mortgage Approval

Suppose you’re in Public Service Loan Forgiveness (PSLF) or any other forgiveness program. In that case, you might still need to include the monthly payment in your DTI, even if you expect forgiveness to happen.

That said, if your loans are in a program that counts only a low or $0 payment because you’re on an income-driven plan, that small figure can help your DTI look better. Always provide proof of your program enrollment when filling out your mortgage application.

Credit Scores Matter for Borrowers with College Loan Debt

A strong credit score can balance out high student loan amounts. While most lenders look for a score in the 580 to 640 range, a score above 700 can secure a lower interest rate and make loan approval easier.

If You’ve Had Late Student Loan Payments, You Can Gradually Improve Your Credit Score By:

- Always make your current payments on time.

- Paying down your credit card balances.

- Steering clear of applying for new credit.

- Becoming an authorized user on a responsible credit card account.

- Dispute any mistakes you find on your credit report.

How Co-Signers or Co-Borrowers Lower the Impact of Student Loans Impact

If your student loans hold your mortgage application back, a co-signer or co-borrower can help. They should ideally have:

- Limited or no student loan debt.

- A high, stable income.

- A strong credit score.

- A low debt-to-income (DTI) ratio.

- Remember, co-signers are fully responsible for the mortgage and must meet the lender’s requirements.

Picking the Right Mortgage With Student Loans

Not all loan programs treat student debt the same. Here’s a handy summary:

- FHA Loans: More lenient on credit and debt limits, letting you go higher than most programs.

- VA Loans: VA loans are usually the easiest option for veterans and active duty service members for student loan debt.

- Conventional Loans (Fannie Mae or Freddie Mac): Stricter on DTI, but they can offer better rates if your credit is strong.

- USDA Loans: 100% financing for certain rural areas, but you face strict income and debt limits.

- Partnering with a mortgage broker like Gustan Cho Associates can connect you with loan options that fit your unique student loan situation.

What College Graduates Should Know About Buying a Home After Graduation

Getting your degree and starting work is exciting, but you may not be mortgage-ready. Most lenders prefer two years of steady pay. Yet, there are workarounds for recent grads with job offers, contracts, or degrees in law and medicine.

Here’s What You’ll Need:

- Provide proof of income or a signed job offer letter.

- Student loan paperwork.

- A solid credit history, even if it’s short.

- Down payment savings or a family gift.

- If you begin budgeting and building credit now, you’ll be ahead on the path to your first home.

You Can Buy a Home with Student Loan Debt

- Student loans don’t have to block homeownership.

- Whether you owe $20,000 or $200,000, you can still get a mortgage if you handle your loans smartly, know how lenders see your debt, and team up with a mortgage expert who can steer you right.

- At Gustan Cho Associates, we help homebuyers earn mortgage approvals with high DTI, student loans, and other unique situations.

- We don’t impose lender overlays and say yes to loans others flat-out deny.

Feeling Squeezed by Student Loans?

Learn how college debt lowers your homebuying power—and the proven moves to offset it.

How Much Does a College Education Cost?

The cost of college varies depending on the type of school the student plans on attending. The most expensive cost of college is out of state private colleges and universities which can cost more than $50,000 per year.

Two-year community colleges offer the best bang for the buck where for a few thousand dollars per year, a student can get a great affordable two-year associates degree.

Junior colleges can set the foundation of transferring to a four-year college or university. Students can get most or all of their two years of undergraduate college credits from the community college transferred to their new school.

Cost of College Tuition at Colleges and Universities

There are two-year community colleges, four-year public state universities. Four-year private colleges and universities. The cheapest and most affordable cost of tuition is the two-year community colleges followed by the four-year state universities.

The most expensive is the four-year private colleges and universities where the cost of college can surpass over $50,000 per year. A recent study and statistics of the cost of college by the college board stated that the average cost of tuition at a four-year public state university averaged $19,500 per year.

Out of state residents paid an average of $33,000 per year to attend a public 4-year university. Out of state residents pay a much higher cost of tuition than in-state residents on public schools. Private colleges and universities averaged anywhere between $40,000 to over $60,000 per year intuition.

Cost of College Room and Board

Unless your child attends a local community college or a school that is within commuting distance, your child will incur the cost of room and board expenses. Room and board can easily be more than $20,000 per year.

Room and board cover a dorm room with necessary furnishings such as a bed and desk and a meal plan where at least three meals per day are covered.

Besides the cost of room and board, the student will also need extra money for bedding, linens, dorm furniture, laundry services, snacks. Just spending money which can add up to another several thousand dollars per year.

Cost of College Books and School Supplies

Text books and study aids needed can cost an additional $2,000 annually. Besides textbooks and study aids, the student may need other things such as a computer, laptop, or other supplies that may add to the annual cost of college.

Computers are almost a necessity and a desktop and/or laptop computer plus its accessories can easily cost $1,000 or more dollars. Most students need cell phones and internet services which can easily add up to more than $1,000 per year.

Cost of College: Spending and Entertainment Costs

College is a time where students will get a once in a lifetime experience, not just in learning and earning a college degree, but where they meet lifelong friends and have a great time. College students will need money for entertainment where they will want to go out to restaurants and bars.

Students spend all-nighters studying for midterms and final exams. Students will need money for snacks and coffee. Many students unwind during the weekend and go out to the ballpark, movies, shows, or other places that offer entertainment and this all comes with a cost.

Cost of College: Travel

If you are attending a local community college, there will be the costs of fuel and auto expenses. For those who attend public or private colleges and universities, they may incur flight fares or other transportation costs when they visit home during the holidays and/or during school breaks. These cost of travel need to be taken into account as well.

Other Cost of College Expenses

There are other costs of college expenses. Whether they are for snacks, drinks, cigarettes, dating expenses, or other miscellaneous expenses. These costs need to be taken into account and can easily add to more than $2,000 per year.

Cost of College: Four Year College Education

The cost of a college degree can be enormous and parents need to prepare an overall budget on the cost of college for their children. Many folks have not one but a few children who attend college at the same time where it can be overwhelming on their budget and impact their lifestyle.

Student loans are the most popular way of financing a college education and most parents will need to co-sign on their children student loans.

Co-signing for student loans can affect their ability to obtain a mortgage loan if they are intending in purchasing a new home while their children are in school. If you co-sign for a child’s student loan, that will affect your debt to income ratios which can affect one’s ability to purchase a home.

Deferred Student Loans? You Can Still Qualify!

Learn how lenders treat deferred payments and master the documentation you need for mortgage approval.

Deferred Student Loans and Qualifying for Home Mortgage Mortgage

Deferred student loans are no longer exempt with FHA loans. In the past, if you had a deferred student loan that was deferred by more than 12 months, you were exempt from counting that student loan payment from your debt to income ratio calculations. But now that is no longer the case.

If you have deferred student loans, lenders will require that you get a payment statement that states how much the fully amortized monthly student loan payment will be when it is out of a deferment.

Or the lender will get 0.50% of the student loan balance. That figure is to be used as a hypothetical monthly student loan payment and use that figure to calculate your debt to income ratio. HUD, the parent of FHA, USDA, and Fannie Mae and Freddie Mac do allow Income-Based Repayment (IBR Payments) reporting on all three credit bureaus to be used on conventional loans.

Budgeting for the Cost of College

It is difficult to state a set figure for the cost of a four-year college education. It depends on the type of school and the location you attend.

A combination of going to attending a two-year community college and transferring to a four-year state is probably the best bang for your buck.

Going to a four year out of state private university like Harvard University will probably cost you a total of $200,000 for a four-year college degree. Graduating on time is also key. Many college students do not graduate in four years and extend their graduation to five or more years because they end up dropping courses or take a lighter workload. This will cost much more, not just in tuition, but other college costs associated with going to school.

Cash-Out Refinance Mortgage to Fund Cost of College

All parents love their children and will do anything for them. There are some parents that do not want their children to get burdened with tens of thousands of dollars in student loans and want to pay for the children’s college education. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays.

One popular way of paying for a college education is to do a cash-out refinance mortgage if the parents have equity in their homes. Proceeds from a cash-out refinance mortgage is tax-free.

The maximum amount that a homeowner can take out with an FHA loan is 80% loan-to-value. The maximum amount a homeowner can take out with a Conventional loan is 80% loan-to-value. Homeowners with a VA loan can take out 100% loan-to-value with a VA loan.

Frequently Asked Questions (FAQs)

Can I Qualify For a Mortgage With Student Loan Debt?

- Absolutely.

- Student debt usually won’t hold you back if your DTI stays manageable and your credit is strong.

Does Student Loan Deferment Affect My Mortgage Approval?

- Yes, it usually does.

- Even loans in deferment count, lenders typically calculate a monthly payment of 0.5% of the outstanding balance.

Which Mortgage is Best For Someone With Student Loans?

- FHA and VA loans are usually friendlier to borrowers with high DTIs or lower credit scores.

Can I Buy a Home With $100,000 in Student Loans?

- Yes.

- Colleges and lenders look at your income, credit, and DTI, not just the loan balance.

- If those numbers work, a large loan balance won’t disqualify you.

Do Income-Driven Repayment Plans Help With Mortgage Approval?

- Definitely.

- By lowering your reported monthly payment, they lower your DTI and boost your approval chances.

Feeling Stuck With Student Loans? Concerned About Qualifying For a Mortgage?

- Reach out to Gustan Cho Associates.

- We’ll help you find the right loan with no overlays and no unnecessary roadblocks.

For fast pre-approval, call 800-900-8569 or visit Gustan Cho Associates. We’re ready to help you today!

Qualify for a Home Loan with Deferred Student Debt

Expert tips on verifying deferment status, calculating effective payments, and meeting lender criteria.