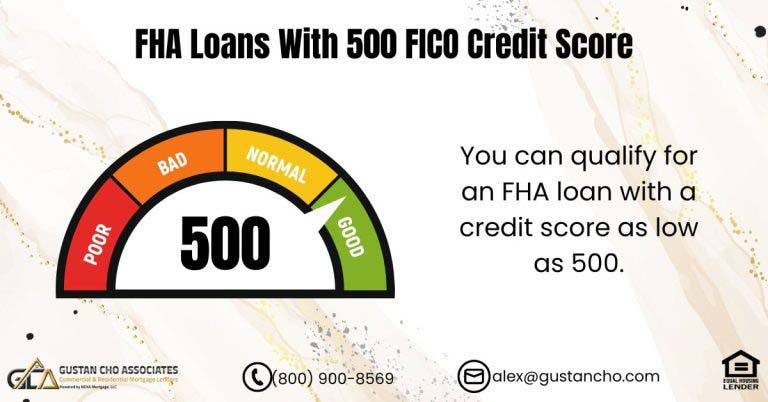

FHA Loans With 500 FICO Credit Score

HUD, the parent of FHA, allows borrowers down to a 500 credit score to qualify for an FHA loan. However, for borrowers with under a 580 credit score, a 10% down payment is required.

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

HUD, the parent of FHA, allows borrowers down to a 500 credit score to qualify for an FHA loan. However, for borrowers with under a 580 credit score, a 10% down payment is required.

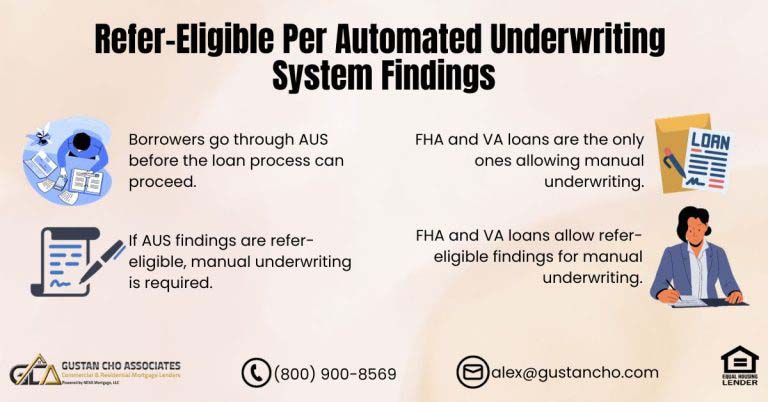

How To Get Refer To Approve-Eligible Per AUS To Qualify For Mortgage: There are ways of trying to get a refer/eligible findings to an approve/eligible per automated underwriting system.

In this blog, we will discuss and cover VA refer-eligible findings versus AUS approval guidelines. The United States Department of…

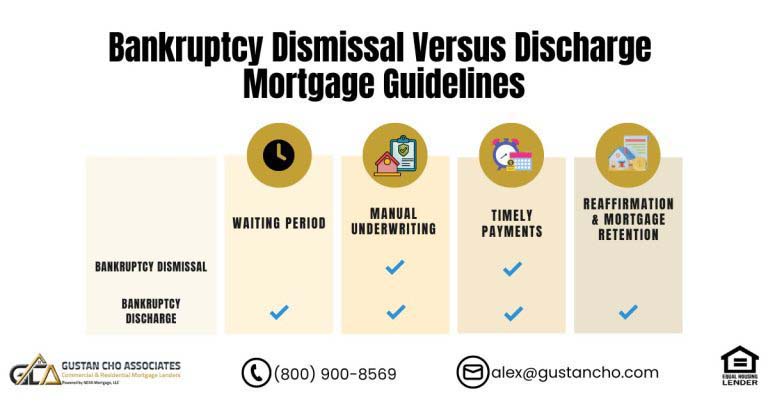

In this blog, we will cover and discuss the difference when qualifying for a mortgage after bankruptcy dismissal versus bankruptcy…

This guide covers manual underwriting versus automated approval. There are two types of Automated Underwriting Systems (AUS): Fannie Mae’s Automated…

Mortgage Underwriters will require one or more compensating factors for borrowers with higher debt to income ratio on manual underwrites to offset the risk of the higher DTI.

This article will cover and discuss refer-eligible per automated underwriting system findings. All mortgage loan applicants need to go through…

Not all Florida VA lenders have the same lending requirements on VA loans. Not all Florida VA lenders do manual…