This guide covers purchase offer rejected by sellers on homes. We will also cover why your purchase offer gets rejected why others get accepted. The housing market has recovered in the past two years and it seems like it will continue to recover. Alex Carlucci, a senior mortgage loan originator and an associate contributing editor at GCA Forums News says the following about home purchase offer rejected by home sellers:

Real estate values have steadily been climbing in most parts of the country. Homeowners who had underwater mortgages are now on the market to sell. Mortgage lenders have lightened up on their mortgage lending guidelines.

Many mortgage bankers like myself now specialize in mortgage loan programs with no overlays. 580 credit scores will qualify a home buyer for a 3.5% down payment FHA home purchase mortgage loan. In the following paragraphs, we will cover how to avoid home purchase offer rejected by home sellers.

Home Purchase Offer Rejected by Home Sellers

Understand why sellers reject offers, discover tips to improve future bids, and find effective strategies to secure your dream home in a tight market. Alex Carlucci says the following about home purchase offer rejected by home sellers:

Finding your dream house is exciting. You picture holidays in the living room and the kids in the backyard. You write a strong offer, then wait, and the phone call from your agent delivers the blow: the home purchase offer was rejected by the home sellers.

It stings. Why did your picture-perfect plan come undone? The good news is that each setback is a lesson wrapped in disappointment. Let’s break down the most common reasons sellers say no. We’ll list specific ways to boost your next offer and things to steer clear of so the same door doesn’t slam shut again. The goal is not just to stay in the game but to come swinging the next time you spot the home that’s a match for your dreams.

Don’t Let Rejection Stop You—Revise Your Offer

Get expert tips to strengthen your bid and win your dream home after a seller says no.

Why Sellers Say No to Home Purchase Offer by Buyers

Sellers turn down purchase offers for different reasons, and the dollar amount isn’t always the main factor. Here are the typical things that make an offer slide into the “no” pile:

- The price is too low compared to either their asking price or other offers they have.

- Some contingencies, like wanting to back out after an inspection, an appraisal clause, or tricky financing conditions, don’t sit well.

- A weak earnest money check that gives the impression the buyer isn’t fully committed.

- Financing red flags—like a shaky credit score, high debt-to-income ratio, or unverified bank funds.

- Seller’s emotions—they may have a sentimental attachment to the house or prefer the vibe of another buyer.

- The presentation looks flimsy—there is no heartfelt offer letter, proof of funds is absent, or the buyer’s agent does not communicate clearly and professionally.

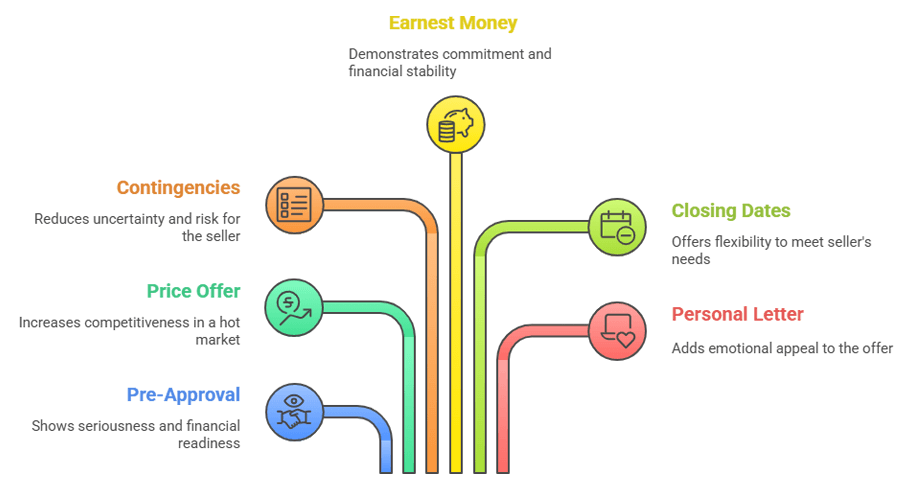

Ways to Make Your Offer Hard to Resist

If the seller turned your offer down, you can bounce back with a stronger one:

- Get fully pre-approved—not just a quick pre-qual. A full pre-approval shows the seller you mean business.

- Make a fair or slightly higher price—that may mean topping the asking price in a hot market.

- Trim the contingencies—fewer “what-ifs” make your offer stand out.

- Boost the earnest money—putting down a larger deposit makes it clear you plan to follow through.

- Stay Flexible on Closing Dates—If you can adjust your timeline to meet the seller’s needs, you might seal the deal when others can’t.

- Include a Personal Letter – Sharing a little about why the home matters to you can give your offer a heart that pure numbers lack.

Best Moves to Win After a Rejected Bid

- Ask for Feedback – Have your agent check in with the seller.

- Knowing why the first offer got turned down can help you tweak the next one.

- Keep the Channel Open – Some transactions don’t stick.

- If you stay in touch, you might get a shot at the same house again.

Be Ready to Act Fast

In fast markets, extra time can mean you lose the house. Have your finances lined up, your inspection team set, and your lender on speed dial.

- Team up with an Experienced Agent. Someone who knows the neighborhood and the numbers can craft an offer that stands out in the pile.

- Think About Escalation Clauses—These let your offer climb in set increments if another bid pops up, so you can stay competitive without guessing.

Home Seller Said No? Let’s Rework Your Offer

Step-by-step guidance on overcoming objections and presenting a winning package.

Should You Raise the Bid After a Rejection?

Bumping your offer makes sense if:

- The home’s value matches the market, and its future appraisal looks strong.

- You have space in your budget and can still cover your other financial needs.

- You can trim uncertainty, like waiving certain inspections or appraisal contingencies.

- Still, don’t let excitement lead you to overpay.

- Check numbers with your agent and ensure the decision passes the financial smell test.

Handling the Emotional Hangover of a Rejected Offer

Feeling let down when your offer on a home is turned down is human.

Try to keep this in mind:

- It happens in strong selling markets.

- It’s not a personal failure.

- Just because this one didn’t work out doesn’t mean the right house isn’t waiting for you.

- Every “no” teaches you a little about what sellers care about.

- When a seller says “no” to your offer, it can sting, but you can treat the moment like a springboard.

- Find out what the seller valued in the winning offer, tweak your bid if possible, and keep at it.

- Each bounce-back gets you closer to the offer that the seller will scoop right up.

- The perfect house is out there—and the next offer you make could be the one that locks it down.

The Biggest Reasons Home Purchase Offer Rejected by Home Sellers

Homebuyers with a prior bankruptcy, foreclosure, deed in lieu of foreclosure, and short sale can now qualify for a mortgage loan after passing the mandatory waiting period. Gustan Cho Associates Mortgage Group has launched NON-QM Loans and banks statement loans for self-employed borrowers. Dale Elenteny, a senior mortgage loan originator at Gustan Cho Associates says the following about purchase offer rejected by home sellers:

Homebuyers with prior bad credit and open collection accounts can qualify for a mortgage loan without needing to pay off or satisfy old collection accounts.

Medical collections are often ignored by mortgage lenders. Many pre-approved home buyers are facing homes they are interested in putting an offer. But many of these homes have multiple purchase offers. Many of my pre-approved home buyers are getting their purchase offer rejected and facing competition on homes they want to make offers in. It takes weeks, if not months finding the right home to purchase and getting purchase offer rejected can be a major disappointment and disheartening.

Reasons Why Purchase Offer Rejected

One of the most common reasons why a purchase offer is turned down or rejected is because the home buyer offers a low ball offer. The home seller gets insulted. Sellers does not even counter the purchase offer. Sellers often think that the home buyer is not a serious home buyer.

Nothing is wrong with writing a purchase offer lower than the asking price. However, coming in at a value that is 20% or more less than the purchase price can be the reason for the home seller to think that the home buyer is just low balling them.

Low ball offers are viewed negatively by sellers and seller do not take the purchase offer seriously and not even counter offer. If the home is just listed and fresh on the market, the seller may not even take an offer less than the asking price. Sellers are not regulated like realtors and mortgage bankers. So home sellers do not have to respond to any offers than the asking market listed price of their home.

The Importance of a Solid Pre-Approval Letter

Homebuyers should be armed with a strong pre-approval. Buyers should be represented by a professional experienced realtor who can convey to the seller’s realtor that buyer is a strong buyer and are serious in a purchase offer.

Buyers should be armed with a solid pre-approval letter that has been fully underwritten and signed off by a mortgage underwriter and not loan officer. A loan officer should never sign off on a pre-approval letter.

All of our pre-approvals at Gustan Cho Associates Mortgage Group are loan commitments that has been fully underwritten and signed off by our mortgage underwriters. With our pre-approval letters, the home will close in a short period of time.

Rejected Offer? Win the Bidding War Next Time

Access our checklist of powerful tweaks—price sweeteners, appraisal waivers, and more.

Listing Agent Want To Get His or Her Own Buyer

Home sellers need to pay a 6% real estate commission on a sales transaction. That 6% commission gets split between the buyers’ realtor and sellers realtor. Although it may seem unethical. It is not illegal, many sellers realtors, or listing agents, want to gobble up the whole 6% sales commission and can do so if they get their own buyer. John Strange, a senior mortgage loan originator at Gustan Cho Associates says the following about purchase offer rejected by sellers:

It is common sense that listing agent will want to get their own buyer so they can keep the 6% sales commission instead of splitting it with a different realtor.

By law, the listing agent needs to present all offers to the home seller. Whether it is the listing agent’s offer or an offer by another real estate agent. More so than not, the listing agent will be pushing more on his or her own buyer than another realtor’s offer.

Cash Offers and No Mortgage Contingency Buyers Will Get Preference

Cash offer homebuyers or homebuyers with no mortgage contingencies will get preference over homebuyers who request a finance contingency and home inspection contingencies. Home sellers do not necessarily go with the highest purchase offer. Lisa Marie Jones, a partner at R 247 Partners, LLC, a acquisition and development company says the following about purchase offer rejected by home sellers:

The home seller needs to feel comfortable with the homebuyers. A strong pre-approval and a call to the homebuyer’s lender where the mortgage lenders makes the sellers’ realtor feel very confident goes a long way.

The sellers’ side need to be convinced that there will be no glitches with the home buyer and the buyer’s lender. Sometimes the home seller may want to speak directly with the home buyer’s mortgage loan officer. Some home sellers do not like home buyers who are FHA borrowers. FHA loans used to be very strict in the past. FHA loans are much more lenient and easier to get qualified than conventional loans.

Ways of Avoiding Purchase Offer Rejected

Try to work with the seller where buyers can close the home early. But offer them a leaseback where they can stay and pay your rent if the subject property is hot and have multiple offers. Also, offering a larger than usual earnest money deposit. Large earnest money shows strength and seriousness. If there are minor repairs to be done after the home inspection and those repairs need to be done to have the appraisal pass inspection, offer to the sellers that you will absorb the cost of the needed necessary repairs and purchase the property as is.

Frequently Asked Questions on Home Purchase Offer Rejected by Home Sellers

Why was my offer turned down when I offered the full price?

- The seller might have been interested, liked a different buyer’s terms more, or preferred a simpler offer with fewer “if this, then that” clauses.

Will a rejected offer make it harder to land a different home?

- Not at all! A “no” for one house has zero impact on the next one you want to chase.

- You can keep on bidding.

Can I submit another offer on the same house if mine was turned down?

- Definitely.

- If the house is still on the market, you can write a new offer, making it more appealing.

How can I learn why my offer didn’t work?

- Have your real estate agent reach out to the listing agent.

- They can ask for specific reasons and give you insight to improve your next bid.

Is it smart to waive the home inspection to sweeten my offer?

- It may make your bid more attractive and raise your chances of facing costly repairs.

- Talk to your agent about safer options, like a quicker inspection timeline.

How much earnest money should I offer to boost my chances?

- Putting down 2% to 5% of the sale price usually signals a serious buyer and can make your offer stand out.

What’s an escalation clause, and is it worth using?

- This clause lets your offer increase automatically if another buyer submits a higher bid, up to a price you set.

- It can be a smart move in a bidding war.

Turn “No” Into “Yes” on Your Home Offer

Discover how to adjust price, terms, and contingencies to secure acceptance.