In this blog post, we’ll delve into Mortgage Qualifying With Part-Time Income and Other Income and explore lending guidelines regarding various income sources. One significant challenge for numerous mortgage applicants is navigating a high debt-to-income ratio during the qualification process. Many lenders enforce overlays on debt-to-income ratios, which are lending criteria more stringent than those set by HUD, the governing body of FHA loans.

What Types of Income Can Be Used To Qualify Someone For a Mortgage?

When it comes to Mortgage Qualifying With Part-Time Income, our viewers and borrowers often inquire about the types of income that lenders consider for mortgage qualification. Understanding what constitutes qualified income and why not all types are accepted is crucial.

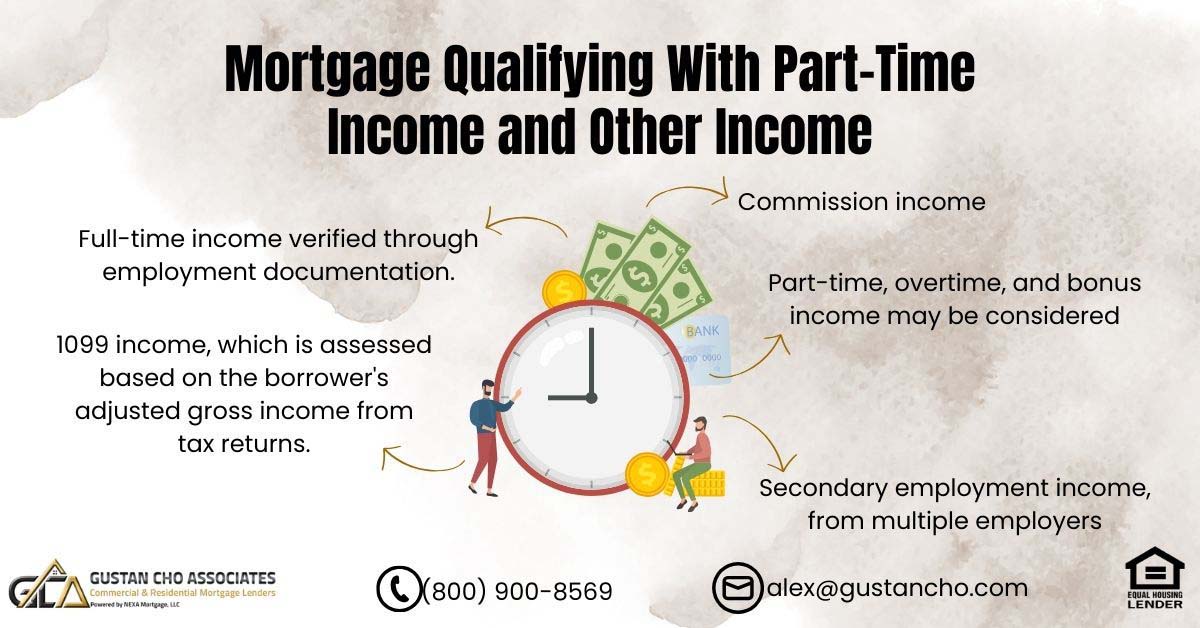

The mortgage industry operates under strict regulations, requiring thorough documentation and sourcing of all income to be deemed qualified for a mortgage application. Various income sources are recognized as qualified income by regulatory bodies like HUD, VA, USDA, Fannie Mae, and Freddie Mac:

- Full-time income, verified through employment documentation. This can include hourly wages based on a standard 40-hour work week or a fixed salary.

- 1099 income, which is assessed based on the borrower’s adjusted gross income from tax returns. However, it’s only considered qualified income if the borrower has a two-year working history with the employer.

- Commission income, eligible as qualified income if the borrower can demonstrate a two-year history of earning commissions.

- Part-time, overtime, and bonus income may be considered, but only if the borrower has a consistent two-year history of receiving such income.

- Secondary employment income, from multiple employers, can be included if the borrower has a documented two-year history of earning from these sources.

In essence, while part-time income is indeed considered for mortgage qualification, it must meet specific criteria and be supported by a consistent history to be deemed qualified.

Get a Strong Pre-Approval Using All Eligible Income

A smart pre-approval doesn’t leave money on the table—it uses every verified income source you have

How Do You Know If I Can Get Mortgage With Part-Time Income?

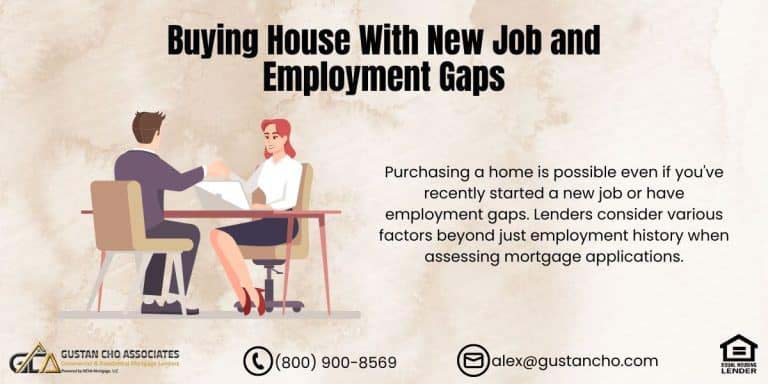

Securing a mortgage with part-time income, overtime pay, bonuses, or additional income streams is feasible, provided it adheres to the guidelines set by the mortgage underwriter. One critical stipulation is that the income must have a track record of at least two years’ seasoning to be considered valid. Without this tenure, its inclusion in the mortgage application is essentially nullified.

While evaluating part-time or other supplementary income, the primary focus revolves around meeting this two-year seasoning prerequisite. The mortgage underwriter’s scrutiny aims to ensure the sustained viability of this non-traditional income source for the foreseeable future, typically extending up to the next three years.

This article will delve into how to qualify for a mortgage with part-time income and other additional earnings. By understanding the nuances and requirements associated with these income sources, prospective homebuyers can better position themselves for success in obtaining mortgage approval.

How Do Lenders Calculate Qualified Income For Mortgage?

Leveraging part-time income can significantly impact borrowers’ eligibility and affordability in mortgage qualification. Take, for instance, a scenario where a borrower earns a $2,000 monthly gross income. To adhere to lender requirements, which often cap debt-to-income ratios at 40%, including the mortgage payment, total monthly bills must not exceed $800. These stringent guidelines highlight the importance of managing various income sources effectively to meet lender criteria.

One notable avenue for enhancing borrowers’ financial standing is incorporating part-time income and overtime earnings into the equation. However, lenders typically mandate a two-year seasoning period for these additional income streams. This prerequisite underscores the importance of stable, consistent income sources in the eyes of lenders.

By adhering to such guidelines and demonstrating a reliable track record of part-time income, borrowers can bolster their chances of securing mortgage approval.

Navigating the intricacies of mortgage qualification, particularly with part-time income considerations, requires a nuanced understanding of lender requirements and industry standards.

This article sheds light on the nuances of mortgage qualifying with part-time income and other supplementary income sources. By offering insights and guidance, borrowers can make informed decisions to optimize their financial standing and increase their chances of obtaining mortgage approval.

Mortgage Loan Denial Due To Declining Income

Qualifying for a mortgage with part-time and overtime income is an option, provided that certain criteria are met. The borrower must demonstrate a consistent track record of part-time and overtime earnings over the past two years. Any fluctuations or declines in income during this period could hinder the qualification process. Moreover, sources of income such as sporadic bonuses or irregular earnings may not be considered reliable by mortgage lenders.

In addition to past earnings, mortgage underwriters assess the likelihood of future income stability. They must be assured that the part-time, overtime or other income will continue for at least three years. Even if the borrower has maintained steady part-time or additional income for two or more years, there’s still a risk of mortgage denial if the underwriter detects a decline in income or predicts further decreases. This underscores the importance of demonstrating past consistency and future income reliability.

Ultimately, underwriter discretion plays a significant role in mortgage approval, especially when evaluating income patterns. Irregular, inconsistent, or diminishing income trends can lead to loan denial, highlighting the importance of maintaining stable and reliable earnings when applying for a mortgage. Borrowers need to provide clear documentation and evidence of their income sources to strengthen their mortgage application and increase the likelihood of approval.

Use All Your Income Sources to Get Approved

Part-time job, side hustle, second job, Social Security, or pension—many of these can count toward your approval

Mortgage Qualifying With Part-Time Income Can Be Used With 2-Year Seasoning

When it comes to mortgage qualifying with part-time income, understanding the details involved in income verification is essential. High debt-to-income ratios can present a barrier to mortgage approval, underscoring the importance of accurately documenting all sources of income. Part-time earnings, often received in cash, are common for many borrowers.

However, it’s crucial to recognize that lenders require verifiable documentation for such income to be considered in mortgage applications. Only documented part-time income with a proven history of consistency can be factored into the calculation of borrowers’ overall income, ensuring transparency and reliability in the qualification process.

When mortgage qualifying with part-time income, it’s important to be meticulous and provide thorough documentation. This process can be complex, but attention to detail will help you navigate it successfully. While part-time earnings can contribute significantly to one’s financial stability, they must be properly accounted for to meet lenders’ requirements.

By providing documented proof of part-time income with longevity, borrowers can strengthen their mortgage applications and increase their chances of approval. This approach demonstrates financial responsibility and enhances lenders’ confidence in the borrower’s ability to manage mortgage payments effectively, ultimately facilitating a smoother path to homeownership.

Mortgage Qualifying With Part-Time Income And Other Income Likelihood Of Continuation

Qualifying for a mortgage with part-time income entails meeting certain criteria to ensure financial stability and reliability. Firstly, the borrower must have a consistent part-time earnings track record for at least two years. This duration serves as a benchmark, demonstrating the borrower’s ability to sustain their income over a significant period, thus indicating financial reliability to lenders.

Similarly, overtime income can bolster the borrower’s monthly gross income. Still, like part-time income, it must also be consistent for a minimum of two years to be considered for mortgage qualification purposes. This requirement helps lenders assess the borrower’s capacity to manage their financial obligations over an extended period.

Furthermore, leveraging part-time or overtime earnings to offset high debt-to-income ratios can enhance the borrower’s mortgage eligibility. By including these additional sources of income, lenders gain a more comprehensive understanding of the borrower’s financial situation, potentially improving their debt-to-income ratio and increasing their chances of mortgage approval.

However, borrowers must provide documentation verifying their employment history and income consistency to support their mortgage application. This includes proof of part-time employment spanning at least two years, demonstrating a stable and reliable income stream.

In summary, mortgage qualifying with part-time income requires meeting specific criteria, including at least two years of consistent part-time earnings. Similarly, overtime income can be considered supplementary income to offset high debt-to-income ratios, provided it meets the same duration requirement. By demonstrating a steady income and employment history, borrowers can enhance their mortgage eligibility and improve their chances of securing financing for their home purchase.

Not Just One Job? That’s Okay—We Count It All

If you juggle multiple part-time jobs or gigs, some lenders get confused. We don’t

Part-Time Income With Less Than 2 Years

When assessing mortgage qualifying with part-time income, it’s important to consider scenarios where a borrower’s tenure in a part-time role is less than two years. Despite limited job history, their part-time income can still be considered, contingent upon obtaining a letter from their human resources department. This letter should confirm the borrower’s anticipated hours over six to twelve months, assuring income stability.

Similarly, if the borrower relies on overtime income but needs a consistent two-year history, they must furnish a letter from their personnel department. This documentation should validate the likelihood of ongoing overtime earnings for the next six to twelve months. These measures ensure that lenders accurately evaluate the borrower’s financial capacity, effectively integrating part-time and overtime income into the mortgage qualification process.

Overlays on Debt To Income Ratio

We’re here to assist those seeking to qualify for a mortgage despite having high debt-to-income ratios. You can contact us via phone at 800-900-8569, text us for a prompt response, or email us at alex@gustancho.com. As mortgage bankers and correspondent lenders, we operate without imposing additional restrictions.

While many mortgage providers limit debt-to-income ratios to 45% due to their overlays, we adhere strictly to AUS FINDINGS and the minimum federal HUD and Fannie Mae mortgage lending guidelines. This means we consider debt-to-income ratios of up to 46.9%/56.9% for FHA Loans and 50% for conventional loans.

FAQ: Mortgage Qualifying With Part-Time Income and Other Income

- 1. What types of income can be used to qualify someone for a mortgage? When considering mortgage qualification with part-time income, it’s essential to understand the various income sources accepted by lenders. Qualified income recognized by regulatory bodies includes:

- Full-time income verified through employment documentation.

- 1099 income assessed based on adjusted gross income from tax returns, requiring a two-year working history.

- Commission income, eligible if a two-year history of earning commissions is demonstrated.

- Part-time, overtime, and bonus income may be considered with a consistent two-year history.

- Secondary employment income from multiple employers can be included with a documented two-year history.

While part-time income is considered for mortgage qualification, it must meet specific criteria and be supported by a consistent history to be deemed qualified.

- 2. How do you know if I can get a mortgage with part-time income? Securing a mortgage with part-time income is possible if it meets lender guidelines. Part-time income, overtime pay, bonuses, or additional income streams must have a track record of at least two years to be considered valid. Lenders evaluate the stability and reliability of this income over the past two years and typically project its continuation for the next three years.

- 3. How do lenders calculate qualified income for a mortgage? Lenders calculate qualified income by considering various sources, including part-time income. However, to be included in mortgage applications, part-time income must have a documented history of at least two years. Meeting lender requirements for income stability and reliability is crucial for mortgage approval.

- 4. Can mortgage qualification with part-time income be used with less than two years of seasoning? Even with less than two years of part-time income history, borrowers can still qualify for a mortgage. They may need to provide additional documentation, such as a letter from their human resources department, confirming anticipated income stability over the next six to twelve months.

- 5. How do overlays on debt-to-income ratios affect mortgage qualification? Overlays imposed by some lenders restrict debt-to-income ratios, making it challenging for borrowers to qualify for mortgages. However, as mortgage bankers and correspondent lenders, we adhere strictly to AUS FINDINGS and minimum federal HUD and Fannie Mae mortgage lending guidelines, allowing for higher debt-to-income ratios of up to 46.9%/56.9% for FHA Loans and 50% for conventional loans.

Working Part-Time? You May Still Qualify for a Mortgage

Don’t assume you need a full-time job to buy a home. With enough history, part-time income and other income can help you qualify