This guide covers mortgage for second primary residence lending guidelines. Many Americans have a current primary residence and are looking to purchase another home. There can countless reasons why homebuyers are buying and getting mortgage for second primary residence home. It can be due to needing more space due to a growing family.

Many homeowners with a condo or townhome may want to move to a single family home with a yard. Many people are fleeing the city due to high crime and recent rioting to the suburbs.

Many homebuyers move to be in a certain school district for their children. It can be due to downsizing after their children leave for college or move out of the family home. As of what they will do with the first home, it is up to the homeowner. Most people decide to sell their home and use the proceeds for the down payment on their second primary home purchase. Others want to keep it as a rental property. Regardless, buying and getting a mortgage for second primary residence owner-occupant home purchase and having the first home is more common than many think.

What Are The Lending Requirements For Mortgage For Second Primary Residence

Lending guidelines for obtaining a mortgage for a second primary residence can vary depending on the lender and your financial situation. However, there are some common factors and guidelines that are typically considered when applying for a mortgage on a second primary residence. A good credit score will help you qualify for a mortgage and get a good rate when applying for any mortgage. Lenders look for a credit score of at least 580 to 680 or higher. Higher credit scores often lead to more favorable loan terms and interest rates.

Speak With Our Loan Officer For Mortgage For Second Primary Residence

Debt-to-Income Ratio (DTI) Guidelines For Mortgage For Second Primary Residence

Lenders will assess your DTI, the ratio of monthly debt payments to your monthly income. Lenders like to see a DTI of 50% or lower, but some lenders may accept higher ratios with compensating factors. The down payment requirement for a second primary residence can vary but is often higher than for a primary residence.

Lenders may require a down payment of 3% to 20% of the home’s purchase price. Some lenders may require more depending on factors like your credit score and the loan program.

Working closely with a mortgage lender or broker who can guide you through the specific requirements and options available based on your financial situation and the property you intend to purchase is essential. Keep in mind that lending guidelines can change, so staying updated and getting personalized advice from a qualified mortgage professional is essential.

Income Documentation Guidelines For a Mortgage For a Second Primary Residence

You’ll need to provide proof of income through pay stubs, W-2 forms, or tax returns. Lenders verify your ability to make mortgage payments. You must confirm that the second property will be your primary residence. Lenders typically won’t finance vacation homes or investment properties as second primary residences. If your down payment is less than 20%, you may be required to pay for private mortgage insurance (PMI) or mortgage insurance premiums (MIP) if you use an FHA loan.

Home Appraisal

The lender will typically require an appraisal of the property to determine its value and ensure it meets their lending guidelines. Mortgage programs, especially government-backed ones like FHA and VA loans, may have loan limits restricting the amount you can borrow for a second primary residence. I

nterest rates for second primary residence mortgages are usually slightly higher than those for primary residences but lower than rates for investment properties.

Lending guidelines for obtaining a mortgage for a second primary residence can vary depending on the lender and your individual financial situation. However, there are some common factors and guidelines that are typically considered when applying for a mortgage for second primary residence. Property Use: You must confirm that the second property will be used as your primary residence. Lenders typically won’t finance vacation homes or investment properties as second primary residences.

FAQ on Buying Second Primary Owner-Occupant Home

Gustan Cho Associates get countless calls daily about homebuyers needing to qualify for a second primary owner-occupant home and deciding on what to do with their first home. Primary owner-occupant home mortgage loans are the home loan of choice. This is because primary owner-occupant home loans have the lowest down payment requirements and lowest mortgage rates out of any other loan programs. Below is a list of common FAQ on buying a second primary owner-occupant home by homebuyers:

- A few questions will come up such as am I going to sell my current house?

- Or am I going to rent it out?

- What if my first house does not sell?

- Can I qualify for two mortgages at the same time?

- What are the agency mortgage guidelines in having two primary owner-occupant homes at the same time?

- A lot of those decisions depend on if home buyers need the funds from their sale to buy their next home

In this article, we will discuss and cover mortgage for second primary residence lending guidelines. Buying a second primary residence without selling the first house is more common than you think. Gustan Cho Associates are experts in helping homebuyers purchase a second primary owner-occupant home and selling their first home. Sometimes the second primary homebuyer may sell the first home. Other times the second home does not sell prior to closing on the second primary home.

How Lenders View Mortgage For Second Primary Residence

Primary owner occupant home loans are the mortgage of choice. This is because owner occupant primary mortgage loans require the lowest down payment. Primary residence loans also have the lowest mortgage rates. Lenders consider primary owner occupant homes the less riskiest investments. This is because if a financial crisis happens in a household, most people do not bail on their home loans. Homeowners will more likely default on their investment properties before they will be bailing on their primary residence homes if they go through a financial crisis.

Qualifying For Mortgage For Second Primary Residence Homes

How much equity do you have in your current home, of if there is not equity, can you afford two mortgages? Buying next home can be incredibly confusing but it does not have to be. Buyers need to deal with a loan officer who is up-to-date on current guidelines. At Gustan Cho Associates, we hold our loan officers to a very high standard. They should be up to all mortgage guidelines. If for any reason the loan officer does not know an answer, we have access to underwriters who will know the answer. So, you have decided you want to buy a new primary residence.

Speak With Our Loan Officer For Mortgage For Second Primary Residence

Steps Getting Approved For a Mortgage For Second Primary Residence Home Purchase

What Are Next Steps In Qualifying For Mortgage For Second Primary Residence Home Purchases. Homeowners will want to speak with family and determine if they will be selling their current home or renting it out. There are certain requirements to rent it out before the income can be counted in borrowers debt to income ratio. We will go over this later in the blog.

Homeowners planning on selling exiting primary home and using those funds for the down payment on next home, that process is very simple. In fact, homebuyers can start the mortgage pre-approval process for next home today.

They do not need to wait for their home to sell. We will simply input proceeds from the sale of the home as their down payment in our system. Home buyers can sign a contract to purchase a new home contingent on the sale of their current home. This process is very simple. It only gets complicated when IF buyers of their current home run into mortgage issues.

Renting Exiting Home When Qualifying For Mortgage For Second Primary Residence

What are the options if homeowners want to rent a house out. There have a few options. The easiest way if you make enough money where the debt-to-income ratio can absorb both mortgage payments this home is really a non-issue.

An underwriter can justify their ability to repay both loans. They will be able to proceed with the purchase of the next primary residence.

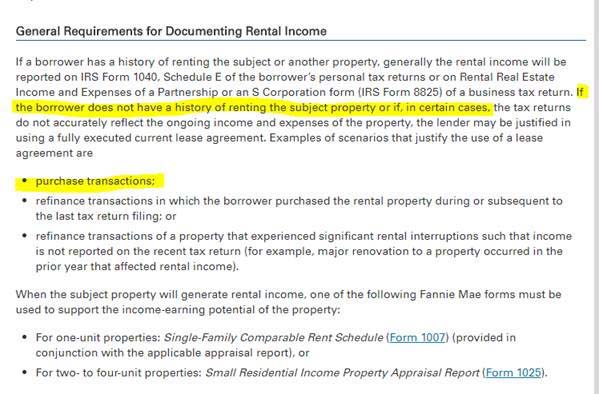

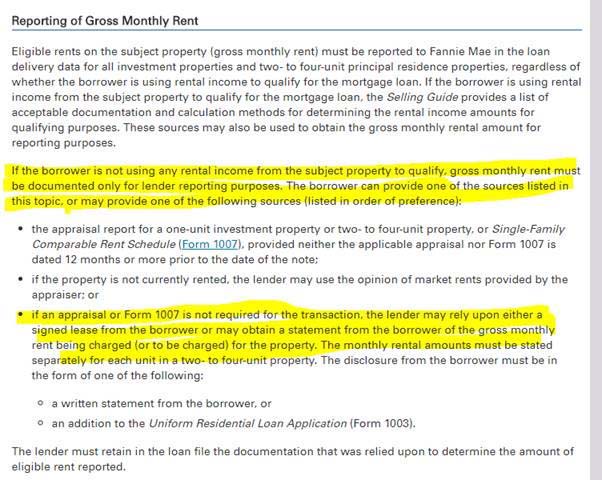

Fannie Mae has very specific documentation required for this situation when rental income is not being used from exiting property. May order an appraisal report with comparable run schedules (form 1007). Must be dated within the past 12 months. If the house is not currently rented the lender may use the opinion of market rents as stated by the appraiser. If an appraisal is not required, the lender may rely on a signed lease agreement for the exiting property showing the rent being charged monthly.

Using Rental Income From Exiting Home

If you need to use the rental income from the exiting property, the documentation is slightly different: Borrowers MUST have an appraisal completed along with comparable rent schedule (form 1007) to document the income allowed on this property. In order for this income to be counted borrowers must have lived in the subject property for at least 12 months or have 25% equity in the exiting property. At that point, you can use 75% of the fair market rent added back into the overall debt to income ratio.

Documents Required To Start Mortgage Process

What is needed to start the process? First, you will need to gather some up-front documentation:

- Last 60 Days Bank Statements – to source down payment

- Last 30 Days Pay Stubs

- Last Two Years W2’S

- Last Two Years Tax Returns

- Current Mortgage Statement

- Homeowners Insurance Information

- Driver’s License

Contact us at Gustan Cho Associates at 800-900-8569 or text for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week. He will go over the mortgage process and send you an application link to get started.

Qualify For Mortgage Loan, Click Here

What Determines Mortgage Qualification?

Borrowers can see from reading above this is a very confusing topic. It is our job to provide you with the information necessary to make an educated decision on what to do with your current primary residence. Depending on your equity position and the amount of rent you may be able to get, this can be a great way to become a real estate investor. There are many areas in our country where you can make a pretty penny renting out your property. Hopefully, you are in one of these areas. we are experts in many areas of the mortgage industry, please contact us to get you into your next primary residence.

FAQs: Mortgage For Second Primary Residence Lending Guidelines

- 1. What is a “Second Primary Residence”? Second home is another or a different dwelling in which the buyer lives while still owning his/her first house, which may be due to space constraints, changes in schools or a different environment of living.

- 2. Can I get a mortgage for a second primary residence? You can do so. Many lenders will provide this type of mortgage but there are different criteria applied with respect to each one of them depending on the deal. Good credit rating, stable earnings and reasonable debt-to-income ratio play an important role.

- 3. What credit score do I need to qualify? In general, it’s about 580-680 points and upwards that most creditors consider when assessing loan applications. A higher score will give you better interest rates and loan terms.

- 4. What is a Debt-to-Income Ratio (DTI), and why is it important? DTI stands for your monthly debts payments’ proportion to your monthly income; some lenders are only contented if DTI does not exceed 50%, although others may allow high ratios along with compensating factors.

- 5. How much down payment is required? It usually ranges from as low as 3% to around 20% of the purchase price for second homes.The specific amount could vary depending on your credit rating and choice of lending program.

- 6. What income documentation do I need to provide? To confirm that you can afford repaying the mortgage, you must produce evidence of your income by presenting pay stubs from work place(s), W-2 forms or tax returns at some point.

- 7. Will I need to sell my first home to buy a second primary residence? No. Not necessarily. For instance, you might choose either sell or let out your previous residence.If you retain it then show ability for double mortgage payments.

- 8. Do I need a home appraisal for the second property? Definitely! In addition, most banks will require some valuation to determine whether the property is worth lending against.

- 9. Are there loan limits for second primary residences? Indeed, most notably in case of FHA and VA loans which are backed by government.Those options have set amounts that define maximum borrowings.

- 10. How are interest rates for second primary residence mortgages? Second home owners usually get slightly higher APRs than their main home counterparts but lower figures than those owning structures as investments only.

- 11. What if my down payment is less than 20%? If your initial investment sums up to less than 20%, you may need to pay for private mortgage insurance (PMI) or mortgage insurance premiums (MIP), especially in relation to FHA.

- 12. How do I start the mortgage process for a second primary residence? To get advice based on your situation and explore alternative financing opportunities, reach out to one of these professionals right now. Gather your ID/drivers license, bank statements, pay stubs, W2s and tax returns from previous years, current mortgage statement(s).

- 13. Can I use rental income from my first home to qualify for the new mortgage? Yes so long as you provide a supporting document like an appraisal with rent schedule or lease agreement that shows earning potential. You must have resided there for at least twelve months or possess 25% equity in this dwelling.

- 14. Is it possible to go ahead and purchase the second house without selling the first one? Assuming you have sufficient funds to pay both loans, you can still obtain a home loan. An underwriter will evaluate your capacity to recompense the two advances.

- 15. Which contact should I reach for more information? For further inquiries, simply dial 800-900-8569 or send an email to gcho@gustancho.com. Their staff is always available in the entire week and they assist anyone who wants a mortgage.