Starting Fresh: Mortgage After Bankruptcy in New Hampshire

Filing for bankruptcy is never easy. It can feel like the end of your financial story. But here’s the truth: bankruptcy is not the end of your dream to own a home. Many families across New Hampshire have gone through bankruptcy and later bought a house. With the right plan, you can too.

New Hampshire is one of the hottest housing markets in the country. Families from high-tax states like New York, New Jersey, and California are moving here for a better quality of life and no state income tax. Even if you had financial trouble, lenders have programs to help you qualify for a mortgage after bankruptcy in New Hampshire.

Can You Really Get a Mortgage After Bankruptcy in New Hampshire?

Yes — you can. Many homebuyers wrongly assume that bankruptcy shuts the door on homeownership forever. That’s not true. Lenders care about what you’ve done since your bankruptcy. You can get approved if you’ve rebuilt credit, managed your money wisely, and met waiting period rules.

At Gustan Cho Associates, over 75% of our clients are borrowers denied by other lenders. We specialize in helping people who have gone through bankruptcy, foreclosure, or other credit challenges. With no lender overlays and over 280 loan programs, we can often say “yes” when others say “no.”

New Hampshire Home Loans for Post-Bankruptcy Borrowers

Fast-track your mortgage approval with our expert guidance.

FHA Loan After Bankruptcy in New Hampshire

FHA is usually the best path if you’re looking to buy a home quickly after bankruptcy.

- Chapter 7 Bankruptcy → You can qualify 2 years after the discharge date.

- Chapter 13 Bankruptcy → You might qualify after making on-time payments for a year with the trustee’s approval. There’s no need to wait until everything is totally settled.

FHA loans offer a good amount of flexibility regarding credit scores. If you’ve got a score of 580 or higher, you only need to put down 3.5%. If your score is under 580, you can still get in the game, but you’ll need to put down 10%. Plus, FHA lets you go through manual underwriting, which is great for people currently in Chapter 13 bankruptcy.

This makes FHA one of the most flexible ways to get a mortgage after bankruptcy in New Hampshire.

VA Loan After Bankruptcy in New Hampshire for Veterans

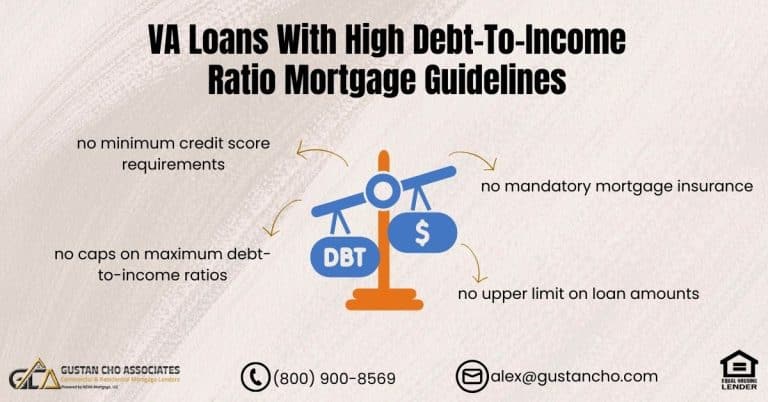

For those who have served in the military, utilizing a VA loan can be one of the most valuable benefits available after experiencing bankruptcy. If you filed for Chapter 7 bankruptcy, you become eligible for a VA loan just two years after your discharge. Meanwhile, for those who went through Chapter 13 bankruptcy, you can qualify after making 12 months of on-time payments approved by your trustee.

VA loans offer several benefits: you don’t need a down payment, there’s no mortgage insurance, and interest rates are competitive. If you’ve had a VA loan discharged in bankruptcy, you might still qualify for a new loan based on how much entitlement you have left.

If the mortgage included in Chapter 7 Bankruptcy was a VA Loan, it may affect VA Entitlement on the new VA Mortgage. This makes VA financing one of the fastest ways to regain homeownership with a mortgage after bankruptcy in New Hampshire.

USDA Loan After Bankruptcy in New Hampshire Rural Areas

Many New Hampshire residents qualify for USDA financing, which is designed for families with moderate incomes who want to live outside the bigger cities like Manchester or Nashua. These loans make it easier for families to find affordable housing in more rural areas.

If you’ve gone through bankruptcy, the waiting times to apply for loans again are different. After a Chapter 7 bankruptcy, you’ll need to wait three years from when it’s discharged to qualify again. But if you filed for Chapter 13, you could be back in the game after 12 months if you’ve followed a repayment plan approved by a trustee.

The USDA program offers 100% financing, requiring no down payment. If you’re open to relocating to a rural area, USDA financing is a fantastic option for getting a mortgage after bankruptcy in New Hampshire.

Conventional Loan After Bankruptcy in New Hampshire

Conventional loans are governed by the rules set by Fannie Mae and Freddie Mac, which means they come with stricter waiting periods. However, it is still possible to obtain these loans after experiencing bankruptcy. For those who have filed for Chapter 7 bankruptcy, the waiting period is four years from the discharge date.

In contrast, individuals who have undergone Chapter 13 bankruptcy must wait two years after their discharge or four years following a dismissal to qualify for a conventional loan.

Many banks and credit unions add overlays, requiring higher credit scores than the rules allow. At Gustan Cho Associates, we have no overlays on Conventional loans. If you meet Fannie or Freddie guidelines, we can help you qualify for a mortgage after bankruptcy in New Hampshire.

Long Waiting Periods? Non-QM Loans May Help

Not everyone wants to wait 2, 3, or 4 years to buy a home. That’s where non-QM loans come in.

Non-QM (non-qualified mortgage) loans do not follow traditional waiting period rules. Some options include:

Bank Statement Loans

These loans are for self-employed folks who want to use their monthly bank deposits as proof of income instead of dealing with the usual tax returns. It makes the whole qualification process a lot easier for people whose income can change a lot from month to month.

DSCR Loans

Debt Service Coverage Ratio (DSCR) loans are great for real estate investors. Instead of focusing on a borrower’s personal income, these loans look at the rental income the property brings to determine if the borrower can repay the loan. This makes them a solid choice for anyone wanting to grow their real estate investments without the hassle of having to verify their personal income.

No-Doc or Asset-Based Loans

These loans provide flexibility by allowing approval based on the borrower’s liquid assets or alternative documentation rather than requiring extensive credit and income verification. This option is ideal for individuals with substantial assets who may not have traditional forms of income, making the mortgage application process quicker and more accessible.

With non-QM financing, you may immediately qualify for a mortgage after bankruptcy in New Hampshire, without waiting periods.

No Overlays, No Stress—NH Bankruptcy Mortgages

Turn your past into a fresh start with homeownership.

How to Rebuild Credit After Bankruptcy in New Hampshire

Getting approved for a mortgage is about more than just waiting. You must also rebuild your credit.

Step 1: Get Secured Credit Cards

Open 2–3 secured credit cards with $300–$500 limits. Keep your balances under 10% and pay on time every month.

Step 2: Pay All Bills On Time

Even one late payment after bankruptcy can set you back years. Payment history is the single most important factor in your credit score.

Step 3: Keep Debt Low

Avoid taking on new collections or large loans. Lenders want to see stability, not more financial struggles.

Following these steps can help you prepare for a smoother approval when applying for a mortgage after bankruptcy in New Hampshire.

What If I Had a Bankruptcy and Foreclosure Together in New Hampshire?

If you filed for bankruptcy and lost a home, the waiting periods are slightly different.

- FHA/USDA: 3 years from the recorded foreclosure, short sale, or deed-in-lieu date.

- Conventional: 4 years from the bankruptcy discharge date, even if the foreclosure was recorded later.

- VA: 2 years from bankruptcy discharge.

Every case is unique. At Gustan Cho Associates, we review your full credit history and guide you toward the fastest path to approval.

Common Mistakes That Delay Mortgages After Bankruptcy in New Hampshire

Even if you’ve met waiting periods, these mistakes can still stop your mortgage:

- Late payments after bankruptcy.

- Co-signing loans for someone else.

- Making large, unexplained bank deposits.

- Running up high balances on new credit cards.

Steering clear of these errors will help ensure you maintain a quicker approval process.

Why Choose Gustan Cho Associates for Mortgage After Bankruptcy in New Hampshire

Most lenders have overlays. For example, FHA requires only a 580 score, but banks often require 640+. Gustan Cho Associates has no overlays. If FHA, VA, USDA, or Fannie Mae allows it, we can approve it.

That’s why over 75% of our borrowers come to us after being denied elsewhere. We help people qualify for a mortgage after bankruptcy in New Hampshire every day with no extra hurdles.

Final Thoughts: Your Path to a Mortgage After Bankruptcy in New Hampshire

Bankruptcy can feel like a setback, but it’s really a fresh start. With FHA, VA, USDA, Conventional, and non-QM programs, you can buy a home again.

At Gustan Cho Associates, we don’t add overlays or make it more complicated than it has to be. We help families across New Hampshire every day who thought homeownership was out of reach.

Borrowers who need a five-star national mortgage company licensed in 50 states with no overlays and who are experts on mortgage after bankruptcy in New Hampshire, please contact us at 800-900-8569, text us for a faster response, or email us at alex@gustancho.com. Or click Apply Now to see your options for a mortgage after bankruptcy in New Hampshire.

Mortgage After Bankruptcy Made Easy in NH

Learn how to get a home loan with zero lender overlays.

Frequently Asked Questions About Mortgage After Bankruptcy in New Hampshire:

Q: Can I Really Get a Mortgage After Bankruptcy in New Hampshire?

A: Yes. Many people think bankruptcy means they can never buy again, but that’s not true. You can get a mortgage after bankruptcy in New Hampshire once you meet the waiting period rules and rebuild your credit.

Q: How Long do I Wait to Get a Mortgage After Chapter 7 in New Hampshire?

A: For FHA and VA loans, the wait is 2 years. USDA loans require 3 years, and Conventional loans require 4 years. After that time, you may qualify for a mortgage after bankruptcy in New Hampshire.

Q: Can I Get a Mortgage During Chapter 13 Bankruptcy in New Hampshire?

A: Yes. FHA, VA, and USDA loans allow you to get a mortgage after bankruptcy in New Hampshire if you have made at least 12 months of on-time payments in your repayment plan and have trustee approval.

Q: What Credit Score do I Need for a Mortgage After Bankruptcy in New Hampshire?

A: FHA loans allow a score as low as 580 with 3.5% down. Some non-QM loans may not have a minimum score. A higher score will always help you get better rates on a mortgage after bankruptcy in New Hampshire.

Q: What if I had a Foreclosure and Bankruptcy Together?

A: You can still get a mortgage after bankruptcy in New Hampshire. FHA and USDA loans count from the foreclosure date, while Conventional loans count from the bankruptcy discharge date.

Q: Are There Loans with No Waiting Period After Bankruptcy in New Hampshire?

A: Yes. Non-QM loans, like bank statement or DSCR loans, may allow you to get a mortgage right away after bankruptcy in New Hampshire. However, they usually require a larger down payment.

Q: How do I Rebuild Credit to Qualify for a Mortgage After Bankruptcy in New Hampshire?

A: The best way is to open secured credit cards, pay every bill on time, and keep balances low. This will help you qualify for a mortgage faster after bankruptcy in New Hampshire.

Q: What Happens if I have Late Payments After Bankruptcy?

A: Late payments can hurt your chances of getting a mortgage after bankruptcy in New Hampshire. Lenders want to see a perfect payment history after bankruptcy.

Q: Can I Refinance My Home with a Mortgage After Bankruptcy in New Hampshire?

A: Yes. You can refinance your loan once you meet the waiting periods and credit rules. Many borrowers use refinancing to lower their payments or switch programs after getting a mortgage after bankruptcy in New Hampshire.

Q: Who is the Best Lender for a Mortgage After Bankruptcy in New Hampshire?

A: Many banks add stricter rules, but Gustan Cho Associates has no overlays. We help borrowers get a mortgage after bankruptcy in New Hampshire, even if other lenders turned them away.

This article about “Mortgage After Bankruptcy in New Hampshire with No Overlays” was updated on August 25th, 2025.

Get Back Into Homeownership After Bankruptcy

New Hampshire borrowers approved even after bankruptcy.