This Article On Mortgage After Short Sale Guidelines For Home Purchase

Previous homeowners who had a prior short sale can now qualify for a mortgage after a short sale as long as they have met the mandatory waiting period after a short sale.

- Many homeowners have requested a short sale from their current lender as an option to avoid foreclosure

- A short sale is when a homeowner gets the blessing of their lender to sell their home below the amount of their mortgage balance

- Short sales are selling a home that is worth less than the balance of their loan balance

- Most lenders grant and approve short sales to homeowners who cannot afford their mortgage payments

- This because it saves time and money of taking the homeowner through the foreclosure process

Plus with short sale homes, lenders will get much more money from the sale of their assets than it would for paying for the expenses of the foreclosure process.

Housing Market After The 2008 Housing Meltdown

The real estate collapse of 2008 has left millions of homeowners with underwater mortgages where:

- Many homeowners were stuck in homes are worth significantly less than the balance of their home loan

- Every year, there are approximately 400,000 short sale homes closed

- Each year, there are tens of thousands of previous short sale homeowners re-entering the housing market as new home buyers

- Homebuyers can qualify to purchase a new home after a short sale

- However, it depends on several factors

In this article, we will discuss and cover Mortgage After Short Sale Guidelines For Home Purchase.

Waiting Period For Mortgage After Short Sale Guidelines

All mortgage programs have different waiting period requirements to qualify for a mortgage after a short sale.

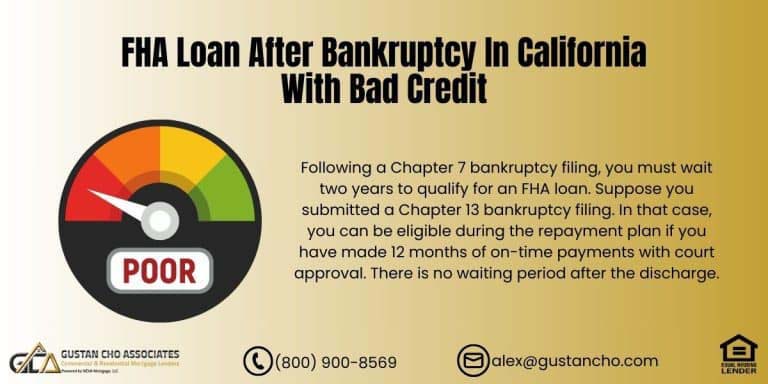

- For FHA and USDA Loans there is a three-year mandatory waiting period to qualify for a mortgage after a short sale

- The waiting period clock starts from the date of the short sale that is reflected on the HUD Settlement Statement

- Homeowners who have been current on a mortgage payment for 12 months up to the date of the short sale, there is no waiting period to qualify for a mortgage

- Unfortunately, most lenders will not approve a short sale unless homeowners have skipped that last mortgage payment

- To this date, I have never ever seen a short sale homeowner who has been timely on their mortgage payment up to the date of the short sale

- This is not because they did not or could not pay but was instructed by their lender that they needed to miss that last mortgage payment in order for them to do a final approval on the short sale

The 12 months on-time mortgage payments and all other payments of the short sale homeowner needed to have been current for 12 months up to the date of the short sale in order for the no waiting period after a short sale to be effective.

Waiting Period After Short Sale On VA Loans

For VA Loans, there is a mandatory period of 2 years to qualify for mortgage after short sale.

- Like FHA loans, there is no mandatory waiting period to qualify for mortgage after short sale if the homeowner has been timely on their mortgage payments

- To qualify for this exemption, veteran borrowers need to have been timely on all other payments for 12 months until the date of the short sale

The U.S. Department Of Veteran Affairs (VA) has a two year waiting period after foreclosure, deed in lieu of foreclosure, and Chapter 7 Bankruptcy.

Fannie Mae Waiting Period For Mortgage After Short Sale

Fannie Mae has announced new FANNIE MAE implemented and new MORTGAGE AFTER SHORT SALE Guidelines.

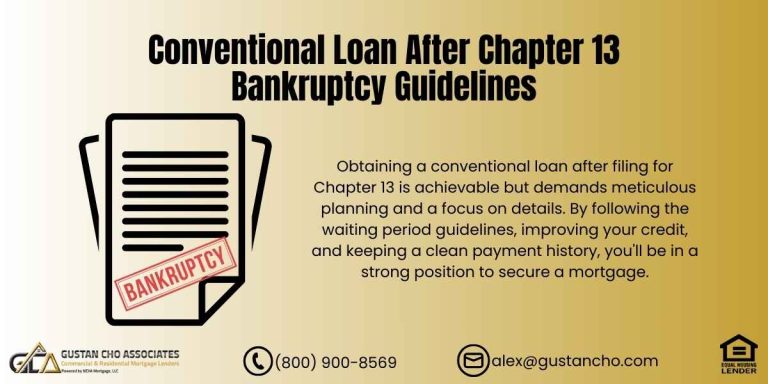

- New Fannie Mae mortgage after short sale guidelines and deed in lieu of foreclosure is 4 years with 5% down payment

- The old Fannie Mae Guidelines with regards to a waiting period to qualify for a mortgage after short sale guidelines and/or deed in lieu of foreclosure was 2 years with 20% down payment

- The mortgage after short sale guidelines and deed in lieu of foreclosure 2-year waiting period program is no longer in effect

Fannie Mae’s waiting period requirements to qualify for a conventional loan after a foreclosure is 7 years from the date of the foreclosure.

Government And Conforming Guidelines On Mortgage Included In Bankruptcy

Government and Conforming Guidelines for homebuyers to qualify with a prior mortgage included in Chapter 7 Bankruptcy is as follows:

- For FHA, VA, USDA Loans (Government Loans), if prior homeowners had mortgage included in Chapter 7 bankruptcy, the waiting period start clock begins from the date the housing event has been finalized.

Here is an example on waiting period start date on government loans if the homeowner had mortgage included in Chapter 7 Bankruptcy:

- Mortgage included in Chapter 7 Bankruptcy and discharged date was 1/10/2012

- A mortgage that was included in Chapter 7 Bankruptcy had finalized with foreclosure on 1/10/2018

- This particular borrowers waiting period started on 1/10/2018

- Would not qualify for FHA and/or USDA Loan until 1/10/2021 and would not qualify for VA Loan until 1/10/2010

For conventional loans, borrowers with mortgage included in chapter 7 bankruptcy, the waiting period is 4 years from the discharge date of Chapter 7 bankruptcy discharged date and the minimum down payment required is 5%:

- The housing event date does not matter

Here is an example on waiting period start date on conventional loans if the homeowner had mortgage included in Chapter 7 Bankruptcy:

- Mortgage included in Chapter 7 Bankruptcy and discharged date was 1/10/2014

- A mortgage that was included in Chapter 7 Bankruptcy had finalized with foreclosure on 1/08/2018

- This particular borrowers waiting period started on 1/10/2012

- This borrower would qualify for Conventional Loan as of 1/10/2018 because that would be the four-year anniversary date of their Chapter 7 Bankruptcy discharged date

- The finalized housing event date of the foreclosure does not matter since the mortgage was included in the Chapter 7 Bankruptcy

- The mortgage cannot be reaffirmed

No Waiting Period After Housing Event

Gustan Cho Associates Mortgage Group has an alternative financing loan program called non-QM loans where there is no waiting period after the following:

- Short Sale

- Foreclosure

- Deed In Lieu Of Foreclosure

- Bankruptcy discharged date

10% to 20% down payment is required. There are no maximum loan limits. There is no private mortgage insurance required. Contact us at 800-900-8569 for more information or text us for a faster response. Or email us at gcho@gustancho.com.

Re-Established Credit Required Besides Waiting Period

Besides meeting the mandatory waiting period, both all government loan and Fannie Mae/Freddie require no late payments after a bankruptcy, deed in lieu of foreclosure, short sale, or foreclosure. Mortgage lenders want to see re-established credit and perfect payment history.

- Overdrafts in the past 12 months are not allowed

- Verification of Rent, VOR, is required on all FHA and VA manual underwriting

- Rental Verification with less than 5% payment shock is considered a great compensating factor

Borrowers with prior short sale and need to qualify for a mortgage loan with a five-star national mortgage company with no overlays on government and conventional loans, please contact us at Gustan Cho Associates Mortgage Group at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com.