In this blog, we will cover how to write a letter of explanation to mortgage underwriters. Borrowers planning on applying for home loans or are currently going through the mortgage process will encounter underwriters who will require a letter of explanation for one or more items in question. This is often the case if borrowers have previous credit issues or many credit inquiries on the credit reports. A letter of explanation (LOX) to mortgage underwriters is often requested.

The letter of explanation should be carefully thought out before it is submitted. The mortgage loan originator will most likely review the letter of explanation before submitting it to the underwriter underwriting the mortgage file. LOX (Letter of Explanations) does not need to be lengthy. Most loan officers will write the LOX on behalf of borrowers. In this article, we will cover and discuss how to write a letter of explanation to mortgage underwriters during the mortgage process.

Cases Where LOX (Letter of Explanations) Is Required

A common situation that requires a Letter of Explanation (LOX) is when borrowers have many credit inquiries on their credit reports. When a mortgage loan underwriter looks at a credit report and sees multiple inquiries, they need a letter of explanation. This LOX is especially important for credit inquiries. The letter should mention the credit inquiries but doesn’t have to be very detailed.

For example, if someone has several credit inquiries from different lenders, they can write “Shopping for a mortgage” in the letter. If there are multiple inquiries from auto finance companies, saying “Shopping for cars” is enough. Lenders usually do not like to see many credit inquiries. Each inquiry is reviewed to check if the person has received credit. If credit is given, it means the person may have new debt, which can affect their debt-to-income ratio.

Letter of Explanations For Multiple Credit Inquiries

When an individual applies for several credit cards, it can create an impression of financial urgency, suggesting the need for immediate access to funds. In instances with multiple credit card inquiries, a simple explanation like “Shopping for credit cards for the best available rates” should suffice for the required letter of explanation.

Furthermore, there are other scenarios where more detailed letters of explanation are necessary. For instance, borrowers aiming for a home loan with a history of prior credit issues might require more comprehensive letters to address their credit challenges.

Letter of Explanations For Periods of Bad Credit

For instance, individuals who previously maintained a strong credit history and consistent payment record but faced sudden financial challenges due to job loss resulting in an inability to meet monthly credit obligations and subsequent credit score decline, are advised to draft a letter of explanation about the circumstances behind their inability to pay bills. Specifically addressing the job loss is crucial in this scenario.

It’s essential to accompany the letter of explanation with supporting documents when explaining a period of job loss, such as W-2s, tax returns, and pay stubs from before and after the job loss occurred. Every aspect covered in the letter of explanation should be substantiated with documentation. Some situations might require multiple letters of explanation, especially when there are employment gaps or a prolonged period of unemployment for borrowers.

Ready to Buy a Home After Bankruptcy or Foreclosure?

Contact us today to learn about your options and how we can help you secure financing even after bankruptcy or foreclosure.

Home Loan After Bankruptcy and Foreclosure

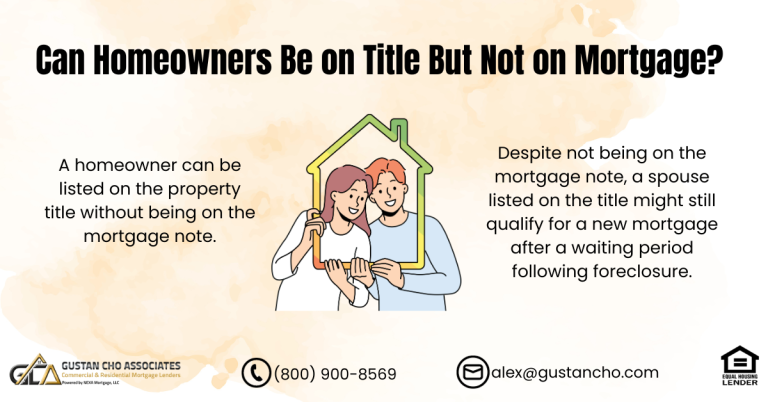

To qualify for FHA and USDA loans, a mandatory waiting period of three years is required after the recorded foreclosure date or deed-in-lieu of foreclosure. For VA loans, the waiting period following a housing event is two years. Additionally, FHA, VA, and USDA loans require a waiting period of two years after filing for Chapter 7 Bankruptcy.

It is important to note that if you have had a prior short sale, you may not be eligible for FHA or USDA loans until three years have passed from the date of the short sale, which is specified on the HUD’s settlement statement. If you are applying for VA Home Loans, there is a two-year waiting period in such scenarios. This letter of explanation aims to provide clarity regarding the waiting periods associated with different financial events in relation to FHA, VA, and USDA loan qualifications.

.Loan Officers Will Help Borrowers With Letter of Explanation

During the mortgage approval process, borrowers often receive requests from mortgage underwriters for letters of explanation. Typically, it’s the loan officers who draft these letters (LOX) on behalf of the borrowers.

It is disheartening to note that in certain cases, borrowers are compelled to draft letters of explanation themselves by some loan officers. It is not uncommon for my team and me to receive numerous calls and inquiries from borrowers who are in need of guidance on how to compose persuasive letters of explanation to present to mortgage underwriters. We strive to provide the best possible assistance to these borrowers to ensure that their letters meet the underwriters’ requirements and stand out from the rest.

Do Not Be Alarmed When Asked For LOX

Many individuals seeking a mortgage often feel uneasy when underwriters request a letter of explanation (LOX). The need for LOX is a standard component of the mortgage application process, especially for those with a history of bad credit, bankruptcy, foreclosure, deeds in lieu of foreclosure, or short sales. Mortgage underwriters routinely ask for these explanations.

Letters of Explanations For Derogatory Tradelines

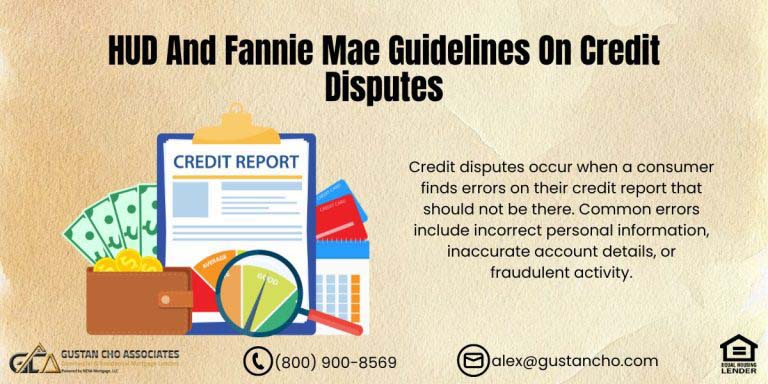

Derogatory tradelines are negative entries on a credit report that indicate a borrower’s poor payment history or financial behavior, such as late payments, defaults, or accounts in collections. These entries can hurt a person’s credit score and make it harder to get new credit.

A letter of explanation will be required for the following:

- recent credit inquiries

- late payments

- irregular or large deposits

- other questionable items a mortgage underwriter may have concerns with

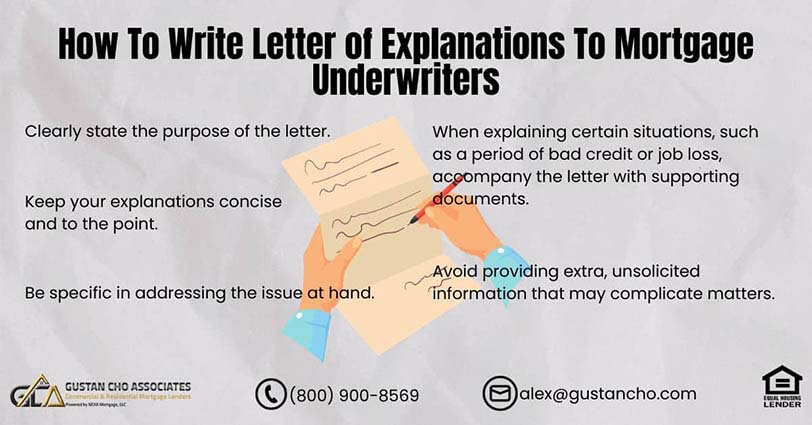

Format of Letter of Explanations To Mortgage Underwriters

Every letter of explanation needs to have the applicant’s signature and date on it. If joint bank accounts or overdrafts are involved, you need to include a letter of explanation. It’s especially important to explain anything related to economic events since those can really make a difference. The progress of the file relies on how clear and detailed your letter is. Don’t forget that all letters must come with the right supporting documents, and we’ll dive deeper into that topic later on.

Letter of Explanations To Mortgage Underwriters Needs To Be Brief

Mortgage lenders do not expect to receive detailed explanations. In certain instances, a concise letter of explanation consisting of only one or two sentences will be satisfactory.

Please avoid creating an elaborate explanation and refrain from providing extra, unsolicited information, as this may inadvertently introduce additional complexities for borrowers.

What Is The Right Answer In a Letter of Explanation For Mortgage Approval?

The mortgage underwriter doesn’t seek a specific “right” or “wrong” answer within the letter of explanation. Instead, they aim to gather factual details about any unclear information provided by the borrower. For instance, when reviewing the comprehensive credit report and credit history, any credit inquiries within the last 120 days require a letter of explanation. Additionally, if there are seven lenders listed as credit inquiries on the report, borrowers need to provide a letter of explanation indicating they were shopping for a mortgage.

Compose a concise statement, sign it, add the date, and then submit—it’s as straightforward as that. There’s no need to elaborate on whether the applications were approved, denied, or any specifics. Similarly, for multiple credit card inquiries, borrowers only need to mention that they were seeking better interest rates. The same applies to inquiries related to automobile credit—a brief statement stating that you were in the process of shopping for a car suffices for the LOX.

Letter of Explanations To Mortgage Underwriters on Recent Late Payments

If a mortgage underwriter asks for a letter of explanation regarding recent late payments, again, borrowers simply need to draft a concise one or two-sentence LOX, sign, and date it. There’s no definitive right or wrong approach to composing this letter.

In cases where consumers missed a payment, they can write a brief explanation stating they overlooked the minimum payments due to various reasons, such as illness, unemployment, or a dispute with the credit card company. There’s no universally correct response. Letters of explanation aren’t graded on a pass-or-fail basis; they serve to provide context rather than determine success or failure.

Non-QM Loans & Bank Statement Loans For Self-Employed Borrowers

Gustan Cho Associates provides non-QM (non-qualified mortgage) loans for homebuyers who may not fit traditional lending criteria. These loans have key benefits, such as no waiting period after foreclosure, deed-in-lieu of foreclosure, or short sale—qualifying just one day after experiencing any of these events.

To obtain a non-QM loan, a borrower typically needs to make a down payment, which varies with credit scores:

- 20% down for most borrowers

- 15% down if you have a minimum credit score of 640 or a score of 660.

- 10% down with a credit score of 680 or higher.

Additionally, borrowers must provide a detailed letter explaining their financial history over the past few years.

Letter of Explanation on Extenuating Circumstances

An example of an extenuating circumstance for a housing event would be:

- Being out of work was the cause of being forced into bankruptcy, foreclosure, deed-in-lieu of foreclosure, short sale.

- This economic event affected borrowers, which caused the reduction of their household income for at least six or more months and was the cause of the housing event.

- The borrower has recovered, obtained full-time employment, and can now afford a new home purchase.

- Need to show that they have re-established their credit and have no late payments after housing and economic event

Gustan Cho Associates is a full-service direct lender with no overlays on government and conventional loans. We are correspondent lenders on non-QM loans and bank statement loans for self-employed borrowers. We are available seven days a week, evenings, weekends, and holidays.

Bought a Home After Bankruptcy or Foreclosure? You Can Still Get Approved!

Reach out now to discuss your options and see how we can help you qualify for a home loan.

How do you write a letter of explanation to mortgage underwriters for credit inquiries?

Mortgage underwriters often request a letter of explanation when they identify inconsistencies between the information provided by a borrower on their application and the supporting documents.

For instance, if there’s a disparity between the borrower’s stated monthly income and the details on their W-2s, especially if the borrower had taken time off work due to medical reasons or any other cause, a comprehensive letter of explanations (LOX) becomes necessary. Similarly, borrowers with multiple credit inquiries on their credit report must furnish a letter of explanations to mortgage underwriters for each inquiry. These explanations for credit inquiries need not be extensive and can be as concise as a single line.

How To Write Letter of Explanations To Mortgage Underwriters For Credit Inquiries?

When borrowers have several credit inquiries from different sectors like automobile finance, mortgages, or credit cards, they must specify the purpose. For instance, if there are multiple inquiries from auto finance companies, the borrower should clarify they were shopping for a car. Similarly, multiple mortgage inquiries require an explanation stating the intent to shop for a mortgage. The same principle applies to credit card inquiries, where borrowers need to mention their intent to shop for credit card interest rates.

It’s important to note that providing a letter of explanations for credit inquiries is not a deal-breaker. If the underwriter finds the explanation insufficient or lacking clarity, they might request a more detailed LOX. Each credit inquiry needs validation from the underwriter to proceed with the process. In many cases, loan officers assist borrowers by drafting a Letter of Explanations for Mortgage Underwriters on their behalf.

Case Scenarios Where A Good Letter of Explanation Is Crucial

A key situation in which you need to write a clear explanation for mortgage underwriters is when people have late payments after going through bankruptcy or a tough housing situation. Many lenders might turn down an application if they see late payments after bankruptcy or foreclosure.

But don’t worry—late payments after these events don’t always mean you’re out of luck. That said, most lenders see these late payments as a red flag and can be hesitant to approve the loan. To improve your chances, it’s important to clearly explain the circumstances behind those late payments in your letter.

Sample Letter of Explanations To Mortgage Underwriters on Late Payments After Bankruptcy

Mortgage underwriters understand that individuals may face financial challenges at times. They recognize that situations leading to bankruptcy or home foreclosure can arise due to various reasons, such as financial hardship or non-payment issues. Underwriters typically seek clarity on the causes behind bankruptcy and foreclosure.

For a borrower to qualify, there should have been a history of good credit prior to the onset of bankruptcy and foreclosure. Factors like unemployment or underemployment, which led to a decrease in household income, might have contributed to these financial difficulties. However, if the borrower had a poor credit history preceding their financial hardship or if they lack an understanding of the importance of credit, they may not meet the qualifications for a loan.

How Much Will My Credit Score Drop After Bankruptcy?

Bankruptcy and foreclosure can significantly impact one’s credit score. To recover, the borrower must rebuild their credit. The letter of explanation doesn’t need extensive details; it should simply outline the facts related to the situation. Supporting documents like the termination letter, previous W-2s, and paycheck stubs should be included.

The underwriter seeks clarification that the bankruptcy and foreclosure stemmed from the applicant’s job termination, a circumstance beyond their control or due to other exceptional situations. It’s crucial to demonstrate the borrower’s recovery, current stable employment, and re-established credit since then.

He borrower then had late payments after bankruptcy due to the following reasons:

- Unemployment?

- Health?

- Divorce?

- Other solid reason

Forgetting to pay bills is not a good excuse. Discuss the reason for late payment after bankruptcy and/or housing event and have the loan officer assist in writing it in a way that is acceptable to the underwriter.

Want to Buy a Home After Bankruptcy or Foreclosure? We Can Help!

Get in touch now to learn how you can qualify for a loan and move toward homeownership.

Qualifying For A Mortgage With a Mortgage Broker With No Overlays

Prospective homebuyers or current homeowners aiming to secure a mortgage through a national direct lender without additional restrictions on government and conventional loans can reach out to us at Gustan Cho Associates. You can contact us by calling 800-900-8569, texting for a quicker response, or emailing us at alex@gustancho.com.

Lenders With No Overlays on Government and Conforming Loans

We have zero overlays on FHA, VA, USDA, and conventional loans. Gustan Cho Associates is a mortgage broker on non-QM loans and bank statement loans for self-employed borrowers.

<p”>Gustan Cho and his team of veteran mortgage professionals are ready to answer any questions home buyers or homeowners with mortgage inquiries. Gustan Cho Associates Academy is a group of real estate and mortgage industry experts, which includes the following: real estate agents, residential mortgage loan officers, and industry experts whose mission is to provide information about real estate, conforming loans, non-conforming loans, and specialty financing programs. The mortgage industry is so complex, with new regulations constantly changing. New rules and regulations are being implemented, and our goal is to express the opinions of industry experts and offer their opinions. Contact us today.

Letters of Explanation are part of the overall mortgage process. Borrowers should not be alarmed when a mortgage underwriter asks for multiple letters of explanation.

If you have any questions on how does FHA define family member or borrowers who need to qualify for FHA loans with a lender with no overlays on government or conforming loans, please contact us at Gustan Cho Associates at 800-900-8569. Text us for a faster response. Or email us at alex@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

This blog about How To Write Letter of Explanations To Mortgage Underwriters was updated on January 9th, 2024.

FAQs – Writing a Letter of Explanations to Mortgage Underwriters

Q: Why Must I Write a Letter of Explanation (LOX) to Mortgage Underwriters?

A: A Letter of Explanations is often required when applying for a mortgage, especially if you have credit issues or multiple credit inquiries. Underwriters may request a LOX to clarify specific items in your financial history.

Q: When is a Letter of Explanations Required?

A: A Letter of Explanations is commonly required in cases of multiple credit inquiries, late payments, irregular deposits, or other questionable items on credit reports. It’s crucial to provide explanations for these situations to ensure the mortgage approval process proceeds smoothly.

Q: How Detailed Should the Letter of Explanations be?

A: The Letter of Explanations doesn’t need to be overly detailed. A brief explanation like “Shopping for a mortgage” or “Looking for the best credit card rates” may suffice for credit inquiries. However, a more comprehensive explanation with supporting documents may be necessary for more significant issues, such as periods of bad credit.

Q: Who Typically Writes the Letter of Explanations?

A: In many cases, loan officers write the Letter of Explanations on behalf of borrowers. It’s essential to work closely with your loan officer to ensure the letter meets the underwriter’s requirements and effectively addresses any concerns.

Q: What Situations Might Require a Detailed Letter of Explanations?

A: Instances such as periods of bad credit, job loss leading to financial challenges, or late payments after bankruptcy may require more detailed letters of explanation. These should be accompanied by supporting documents to substantiate the explanations.

Q: Is it Common to be Asked for a Letter of Explanations During the Mortgage Application Process?

A: Yes, it’s common for mortgage underwriters to request a Letter of Explanations, especially if you have a history of bad credit, bankruptcy, foreclosure, deeds in lieu of foreclosure, or short sales. It’s a standard component of the mortgage application process.

Q: What Should be Included in the Format of the Letter of Explanations?

A: Every Letter of Explanations should include the applicant’s signature and date. In cases involving joint banking accounts or overdrafts, a LOX is mandatory. Emphasis should be on providing clear and comprehensive explanations of economic events, and relevant supporting documents should accompany all LOX.

Q: How Long should a Letter of Explanations be?

A: Mortgage lenders do not expect lengthy explanations. In many cases, a concise letter consisting of one or two sentences may be satisfactory. It’s crucial to avoid unnecessary details that may complicate the borrower’s situation.

Q: What is the Right Answer in a Letter of Explanations for Mortgage Approval?

A: There’s no specific “right” or “wrong” answer in a Letter of Explanations. The goal is to provide factual details about any unclear information in your application or supporting documents. Keep it concise and focused on addressing the underwriter’s concerns.

Q: How do I Write a Letter of Explanations for Credit Inquiries?

A: When addressing credit inquiries, specify the purpose, such as “Shopping for a mortgage” or “Seeking better interest rates.” If multiple inquiries exist, explain the intent for each. If the underwriter finds the explanation insufficient, they may request a more detailed Letter of Explanations. Loan officers often assist in drafting these letters.

Q: What should be Included in a Letter of Explanations for Late Payments After Bankruptcy?

A: Clearly explain the reasons for late payments, whether due to unemployment, health issues, divorce, or other valid reasons. Support the explanation with relevant documents like termination letters, previous W-2s, and paycheck stubs.

This blog about “How To Write Letter of Explanations To Mortgage Underwriters” was updated on April 24th, 2025.

Thinking About Buying a Home After Bankruptcy or Foreclosure?

Contact us today to discuss your unique situation and find the best loan options for your path to homeownership.

Wish I Could Double the Rating for Gustan Cho of Gustan Cho Associates.

Gustan Cho is a WONDERFUL mortgage and real estate professional with a kind heart of Gold. I contacted him after being denied a loan due to a timeshare “foreclosure” that was listed on my credit report. Gustan informed me that he was not currently licensed in my state however, he would help me. He didn’t know me at all and was willing to help me. He put me in contact with another lender and contacted him on my behalf when there was a misunderstanding of certain terms. He also stated that he would see my loan through the closing process if necessary. He is honest, upfront and extremely knowledgeable of his profession. Do not hesitate to give him a call with any questions you have regarding mortgage financing! I was in contact with two different lenders before contacting him and neither of them compared to the knowledge and customer care that Gustan provided. He never made me feel like I was bothering him or that my questions were stupid. He has definitely gained a customer for life and I would recommend him to ALL of my family and friends.

”