This manual provides information on Job Relocation Mortgage Guidelines for individuals purchasing homes in a different state. According to these guidelines, individuals are eligible for a mortgage even if they have a new out-of-state job. This remains applicable in cases of job transfers and when securing a new position with a different employer.

Job relocation mortgage guidelines can add a layer of complexity to the home-buying process, making an already stressful move even more challenging. Families often experience the need to upsize or downsize when relocating to a different part of the country.

The difficulty arises when individuals aspire to purchase a home in their new location. Qualifying for a mortgage under these circumstances can prove to be a daunting task. The challenges are compounded by the fact that each loan program comes with its criteria.

This blog aims to shed light on the nuances of conventional and FHA options for job relocation, whether it involves an internal transfer within the same company or a transition to a new job with a different employer. Both scenarios will be thoroughly examined to provide a comprehensive understanding of the intricacies involved.

Job Relocation Mortgage Guidelines With Transferring Job With Same Company

Navigating the mortgage landscape during a job relocation becomes more seamless for out-of-state homebuyers who remain with their current employer. The simplicity lies in the underwriter’s ability to validate your future income in the new position with the same employer, eliminating concerns about employment gaps.

This approach ensures a smoother transition, particularly when individuals move to a new company and location simultaneously.

The strategic alignment of job relocation mortgage guidelines with the continuity of employment allows for a more straightforward and efficient process. Homebuyers can present a compelling case to underwriters by opting for this method, showcasing a stable employment history without interruptions.

This streamlines the approval process and reflects that many individuals experience a dual transition to a new company and a different geographical location.

Moving Out of State for a New Job? We Can Help With the Mortgage

New job, new state, new home—don’t stress over the guidelinesJob Relocation Mortgage Guidelines For Out-of-State

Job relocation mortgage guidelines: Proper documentation is crucial in this process. Homebuyers should secure an accepted offer letter duly signed by their employer, adhering to Fannie Mae’s precise rules regarding this documentation.

If the lender delivers the loan to the secondary market after you start employment, you can send the lender your pay stub after closing.

To ensure compliance, the lender must collect a pay stub from you containing information that validates the income considered for your mortgage qualification. This pay stub must align with the terms outlined in the contract or offer letter. Your loan file will update this pay stub before the mortgage is presented on the secondary market.

However, a common concern arises when the lender finalizes the loan’s transition to the secondary market before the commencement of your employment.

Fannie Mae Job Relocation Mortgage Guidelines For Out-of-State Homebuyers

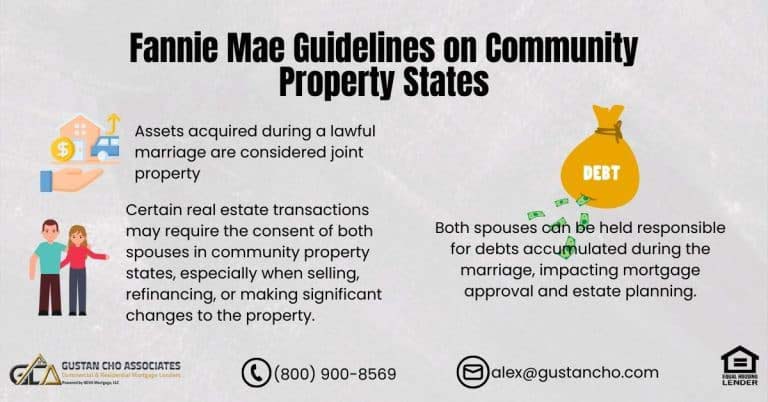

As Fannie Mae’s job relocation mortgage guidelines mandated, the prevailing method involves obtaining documentation to finalize the transaction. According to Fannie Mae, you can conclude your mortgage process before commencing your new employment.

A few conditions apply—only allowed on purchase transactions. It must be a principal primary residence. You are only allowed for one-unit properties.

It’s essential to note that employment by a family member or any entity participating in the mortgage transaction is prohibited. The borrower’s qualification is solely based on fixed income, such as salary or hourly wages. Starting your new job should happen within 90 days of the closing date for your new home.

Importance of Employment Offer Letter

If the criteria mentioned align with your job relocation, you must submit documentation demonstrating your acceptance of the offer letter or employment contract. Both you and your new employer must sign this document for clarity.

The terms of your employment, including position, pay structure, and start date must be CLEARLY OUTLINED. The offer may not have any contingencies before your start date.

If prerequisites are to be fulfilled before commencing employment, like background checks or drug screenings, these conditions must be met before the loan closes. An underwriter will need confirmation from your new employer, supported by either verbal or written documentation, verifying the fulfillment of these contingencies. These guidelines are crucial for job relocation mortgage approval.

How Reserve Funds Work During the Mortgage Process

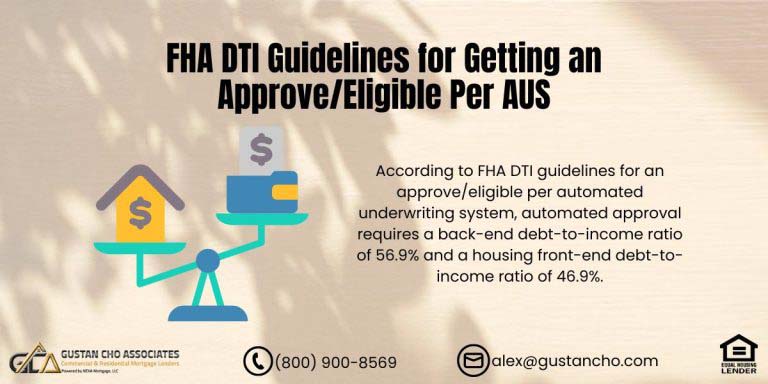

It’s important to closely review this section, as it will impact your eligibility. The job relocation mortgage guidelines require the lender to thoroughly substantiate the liquid reserves outlined in the AUS (DU) findings. These reserves should cover principal, interest, taxes, insurance, and any homeowner’s association dues (PITIA) for the subject property over six months.

OR document enough reserves to cover the timeframe between the end date of your current employment and the start date of your next employer, plus one month.

In cases where documented income is anticipated after the current employer’s end date but before the commencement with the next employer, it may be considered, provided these funds are not utilized for qualification purposes. Specifically, funds from the last paycheck received from your current employer can be utilized, although it is essential to confirm that these funds do not contribute to your qualification.

For clarification on this matter, seeking guidance from the experts at Gustan Cho Associates is recommended.

Start Your Mortgage Pre-Approval Before You Move

Don’t wait until you land in your new state to figure out financingImportance of Reserves

Reserves by borrowers show strength to lenders. Below are case scenarios for reserves by borrowers: Case Scenario I of an Example of Reserves:

- Principal and Interest: $1476

- Taxes: $375

- Insurance: $120

- HOA: $60

Total PITIA Payment: $2031: 6 Months Reserves = $12186

Case Scenario II: Example 2 illustrates a situation where Brian is concluding his employment in Chicago on July 1st and commencing a new job in Los Angeles on October 1st. The payment details mentioned earlier will be applied in this scenario. Following Fannie Mae’s guidelines, which stipulate the addition of months.

Considering the three full months between the termination of Brian’s current job and the commencement of the new one, he would require three months of reserves plus an additional month. Consequently, Brian would need four months of reserves, equivalent to $8,124, per the job relocation mortgage guidelines.

Fannie Mae HomeReady Mortgage Guidelines on Conventional Financing

The details provided pertain to traditional financing. The positive update is that a mere 3% down payment is sufficient for a conventional loan applicable to a primary residence. This information applies to Fannie Mae programs, including Home Ready.

With this program, there are many pockets available where there are no income limits: See HOMEREADY BLOG for more information.

Gustan Cho Associates is a specialist in the Fannie Mae HomeReady program. Feel free to contact us for guidance on maximizing the benefits of this program. Depending on your employment type, the documentation required may be quite comprehensive.

For instance, individuals, like union members engaged in fields with a sequence of short-term job assignments may necessitate documentation from the union indicating future contracts. Essentially, the underwriter’s task is to validate the stability of future income.

Using a Job Offer Letter to Qualify for a Mortgage?

Many buyers can qualify with an offer letter before their first paycheckHUD Job Relocation Mortgage Guidelines

Now, what about FHA lending? Unfortunately, per HUD guidelines, you must start your new employment and receive at least one paycheck stub before closing your FHA loan. You must move and start your new employment before closing on your new home. This may require you to find short-term housing as part of your relocation.

Let’s delve into the Job Relocation Mortgage Guidelines for FHA lending. According to HUD guidelines, you must begin your new job and receive at least one paycheck stub before your FHA loan can be closed. The stipulation is to ensure that you have relocated and initiated your new employment before finalizing the purchase of your new home.

It may be necessary to arrange for temporary accommodation as a part of your relocation process.

Sometimes, the seller will allow you to rent the house from them for a month or two before you purchase it. You will need to work that out with your realtor. Many loan officers do not take the time to educate themselves on this area of mortgage lending.

This scenario is uncommon for loan officers, but it highlights the expertise of Gustan Cho Associates in the mortgage field. As distinguished mortgage professionals, Gustan Cho Associates stands out as one of the very few national lenders without overlays on government and conventional loans.

If you have any questions on Out of State job Relocation Mortgage Guidelines, please contact us at Gustan Cho Associates at 800-900-8569. Text us for a faster response. Or email us at alex@gustancho.com . The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

FAQ – Out-of State Job Relocation Mortgage Guidelines

-

1. What does this manual cover? This manual provides comprehensive information on job relocation mortgage guidelines for individuals purchasing homes in a different state, addressing scenarios involving new out-of-state jobs, job transfers, and transitioning to a new position with a different employer.

-

2. Why are Job Relocation Mortgage Guidelines important? These guidelines add complexity to the home-buying process during relocations, especially when families need to upsize or downsize. Qualifying for a mortgage in a new location becomes challenging due to different criteria for each loan program.

-

3. How does the blog address conventional and FHA options for job relocation? The blog aims to explore the nuances of conventional and FHA options for job relocations, whether it’s an internal transfer within the same company or transitioning to a new job with a different employer. Both scenarios are thoroughly examined to provide a comprehensive understanding.

-

4. How does job relocation with the same company impact mortgage approval? For individuals staying with the current employer, the blog highlights that the underwriter can validate future income in the new position, streamlining the process and eliminating concerns about employment gaps.

-

5. What documentation is crucial for out-of-state job relocations? Proper documentation, including an accepted offer letter signed by the employer, is crucial. Fannie Mae’s rules regarding this documentation must be adhered to, and pay stubs may be submitted after closing if the loan is delivered to the secondary market post-employment.

-

6. What are Fannie Mae’s guidelines for job relocations? Fannie Mae allows concluding the mortgage process before starting the new job, with conditions such as it being a principal primary residence, only for one-unit properties, and employment starting within 90 days of closing.

-

7. Why is an employment offer letter important? The offer letter must clearly outline the terms of employment, including position, pay structure, and start date, with no contingencies before the start date. Any prerequisites must be fulfilled before the loan closes.

-

8. How do reserves work during the mortgage process? Reserves should cover PITIA for the subject property over six months or the timeframe between the current and next employment, plus one month. Proper documentation and guidance from experts, like Gustan Cho Associates, are recommended.

-

9. What is the significance of reserves for borrowers? Reserves demonstrate strength to lenders. Examples provided illustrate how reserves are calculated based on PITIA payments and Fannie Mae’s guidelines for different scenarios.

-

10. What are the Fannie Mae HomeReady Mortgage Guidelines on conventional financing? The blog outlines details for conventional financing, emphasizing a 3% down payment for primary residences under Fannie Mae programs like HomeReady. Specific documentation requirements may vary based on employment type.

-

11. How do HUD guidelines impact FHA lending during job relocations? HUD guidelines require starting the new job and receiving at least one paycheck stub before closing an FHA loan. The stipulation ensures relocation and new employment initiation before finalizing the home purchase, potentially requiring temporary housing.

This blog about Out of State job Relocation Mortgage Guidelines was updated on February 23, 2024.

I am Tom Brandy, currently living in Texas, USA. I am a widower at the moment with two kids and i was stuck in a financial situation and i needed to refinance and take care of my children. But as God would have it, i was introduced to Jammi Cash of Gustan Cho Associates by a friend of mine. I was given a loan at a very low interest rate (3%) to purchase my home. I would advice anyone seeking for loan to contact Jammi Cash of Gustan Cho Associates.